Periodic Compound Interest Calculations

Periodic Compound Interest Calculations

Calculate lease balances and accruals using the periodic compound interest method. Along with the existing daily compound interest method, the periodic compound interest method calculates the liability and right-of-use balances and accrued interest using periodic simple interest calculations.

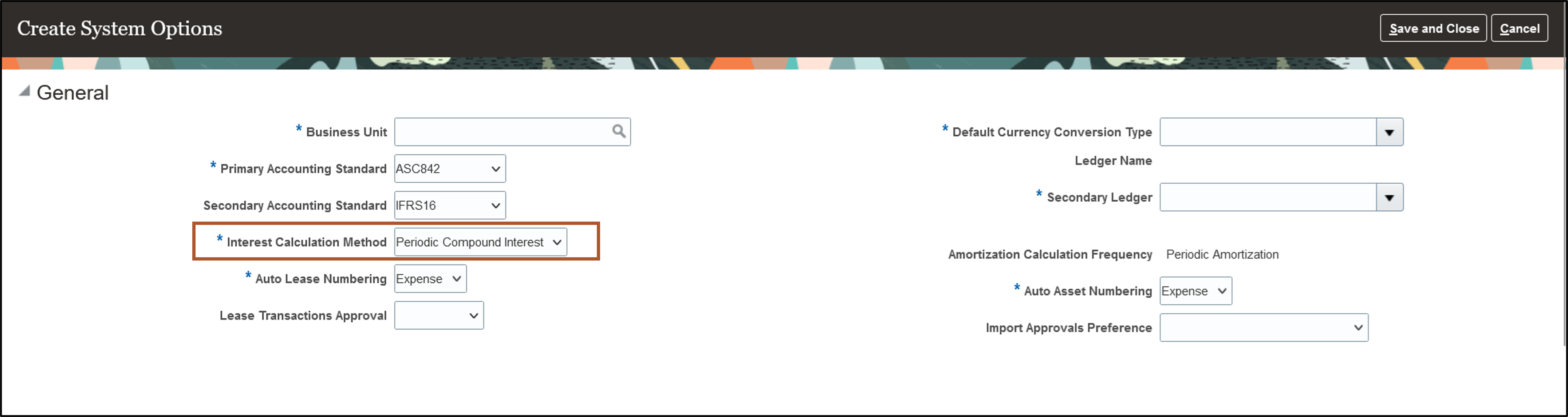

Configure the Lease System Options to use the Periodic Compound Interest method.

Configure System Options

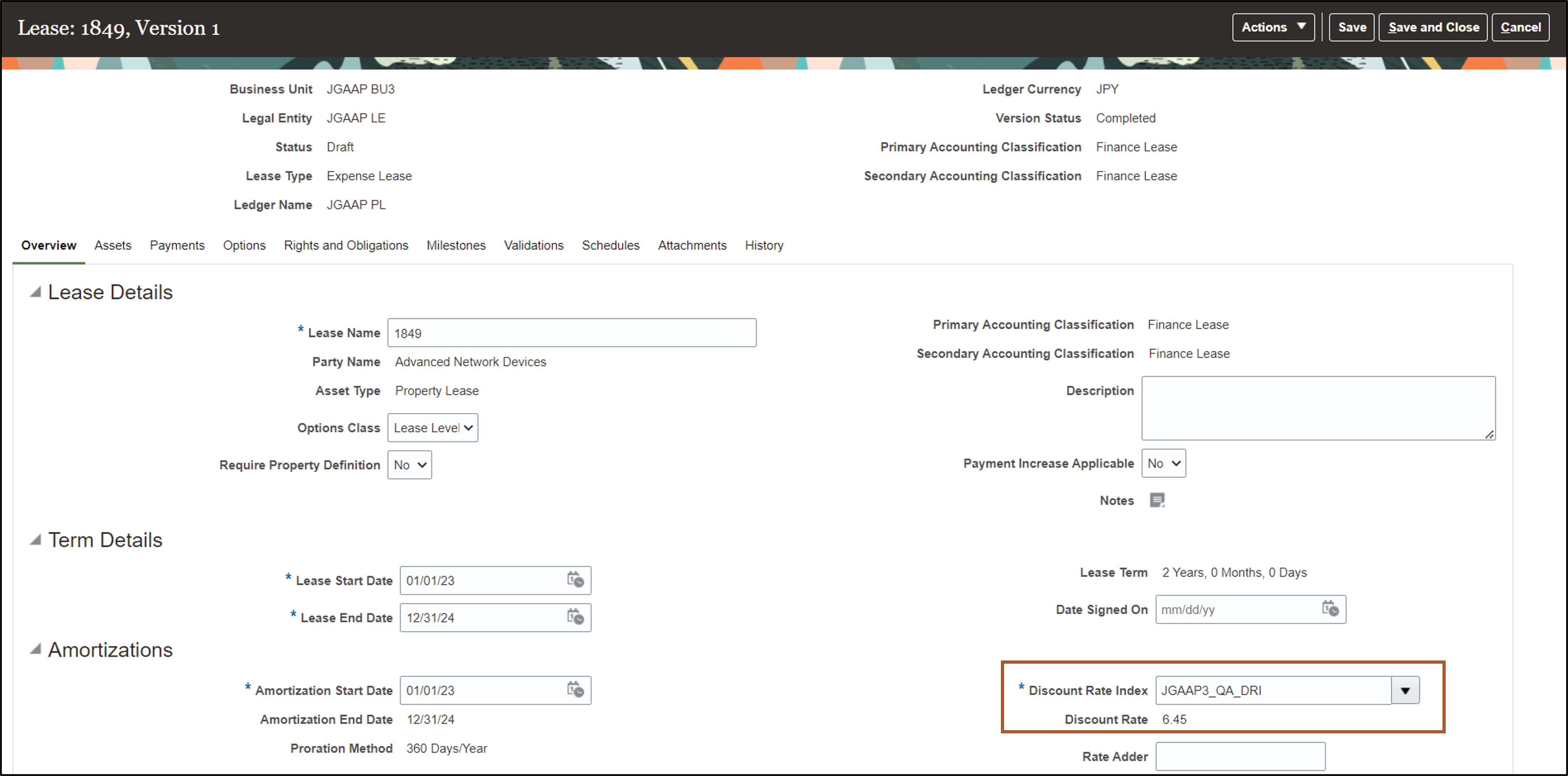

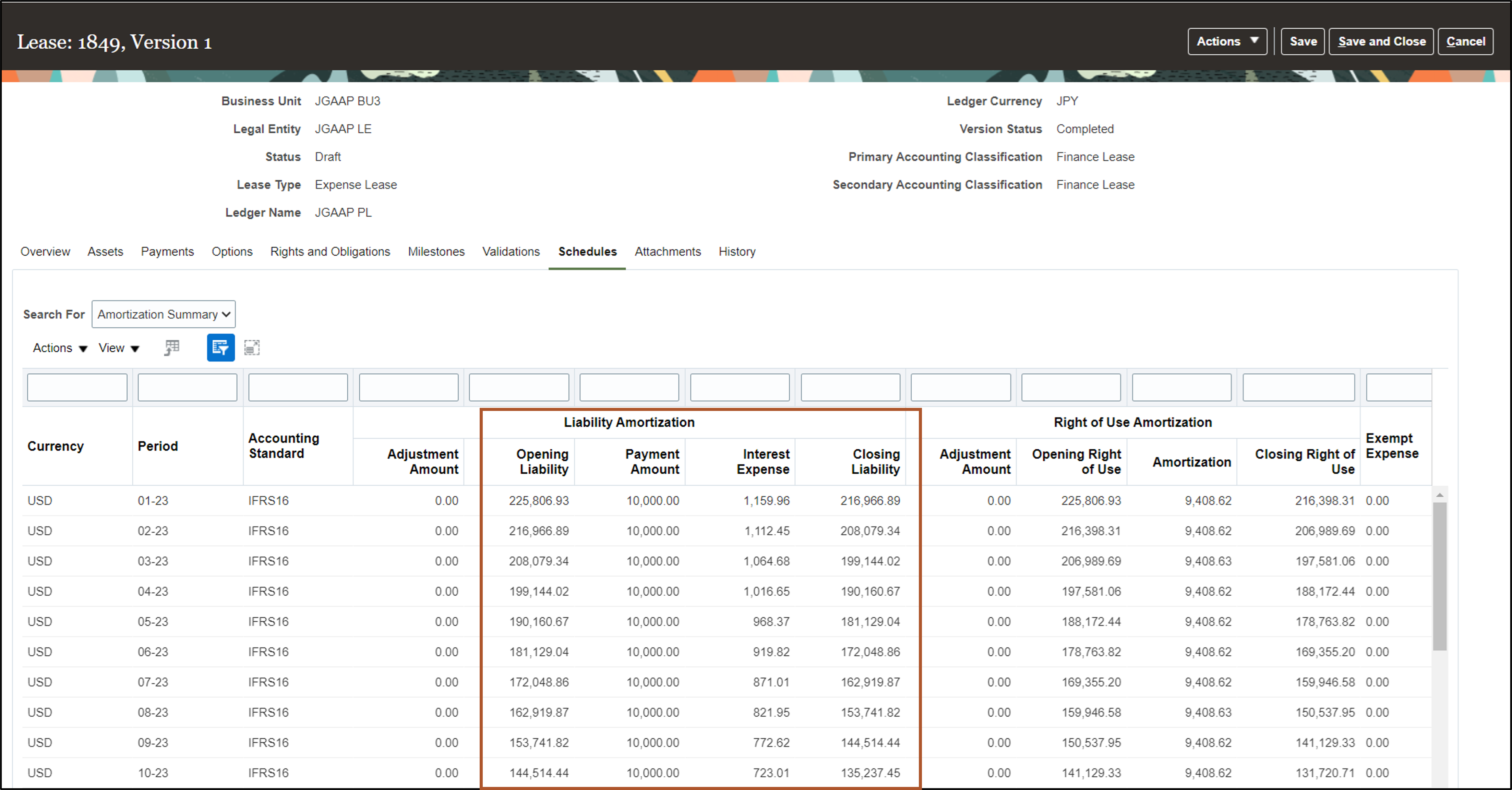

Create lease and enter lease details including terms of lease, discount rate, asset details, parties, payment schedules, and lease-related options, rights, and obligations. Validate the lease and generate schedules. Lease Accounting converts the annual discount rate to a periodic rate using frequency of payments and applies this periodic rate to calculate the initial lease liability and right-of-use balances and interest. Interest is then amortized over the term using the interest method.

Lease Details Page

Amortization Schedules

Business benefits include:

- Simplify compliance with IFRS 16, ASC 842, and Japanese GAAP lease accounting.

- Streamline business processes with flexible interest calculation options for lease balances and interest accruals.

Steps to Enable

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials No Longer Optional From: Update 25B

Key Resources

- This feature originated from the Idea Labs on Oracle Cloud Customer Connect: Idea 757459

Access Requirements

You do not need any new role or privilege access to set up and use this feature.