Lease Migration with Gross Right-of-Use Asset and Accumulated Amortization

Lease Migration with Gross Right-of-Use Asset and Accumulated Amortization

Capture the right-of-use accumulated amortization balance when importing midlife leases. Account for the gross right-of-use asset balance and the accumulated amortization separately when booking migrated leases.

To create expense leases with the gross right-of-use asset and accumulated amortization balances:

- Create an expense lease for property or equipment.

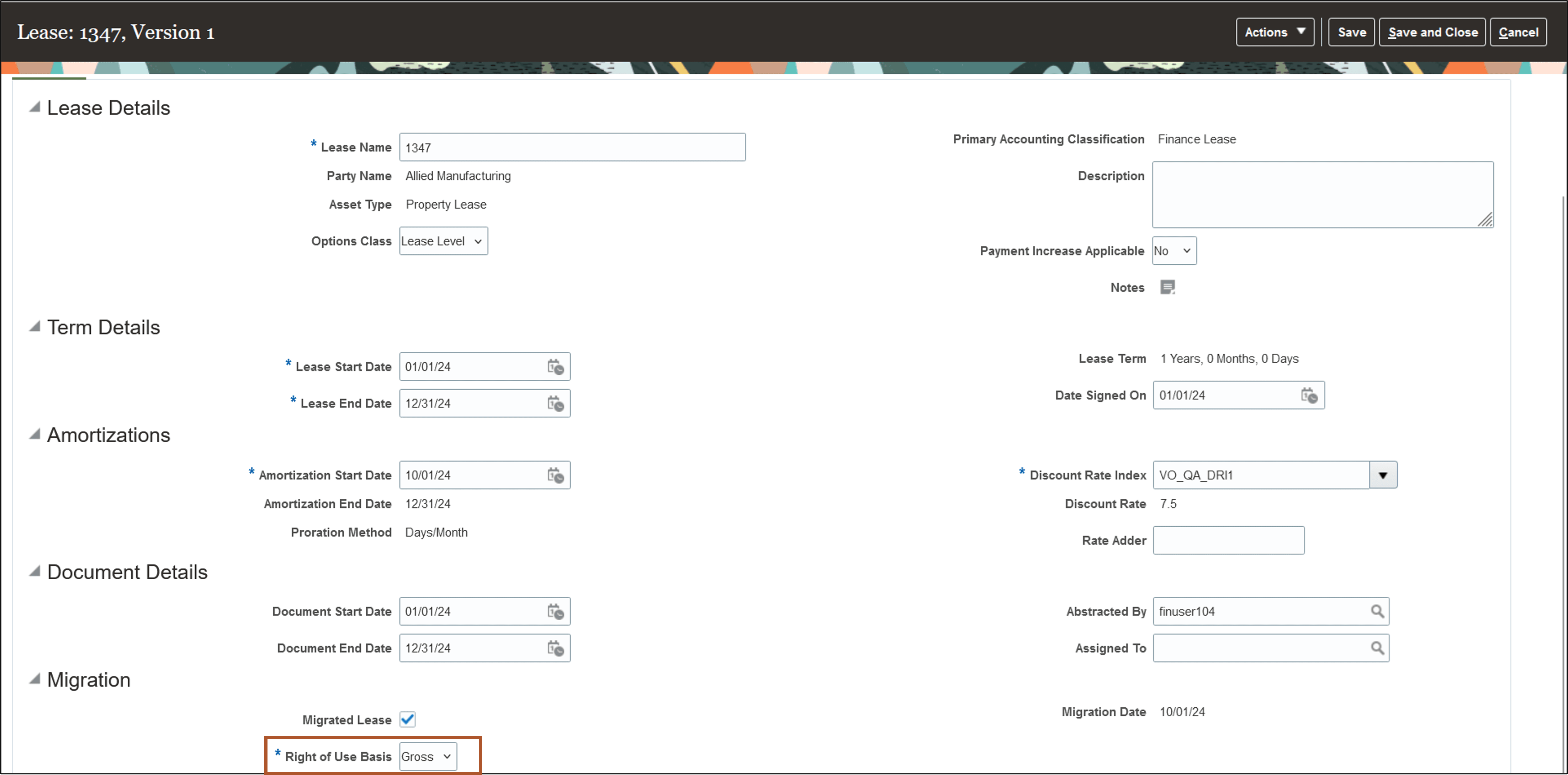

- Update lease details to check the Migrated Lease flag and input the Right-of-Use Basis as Gross.

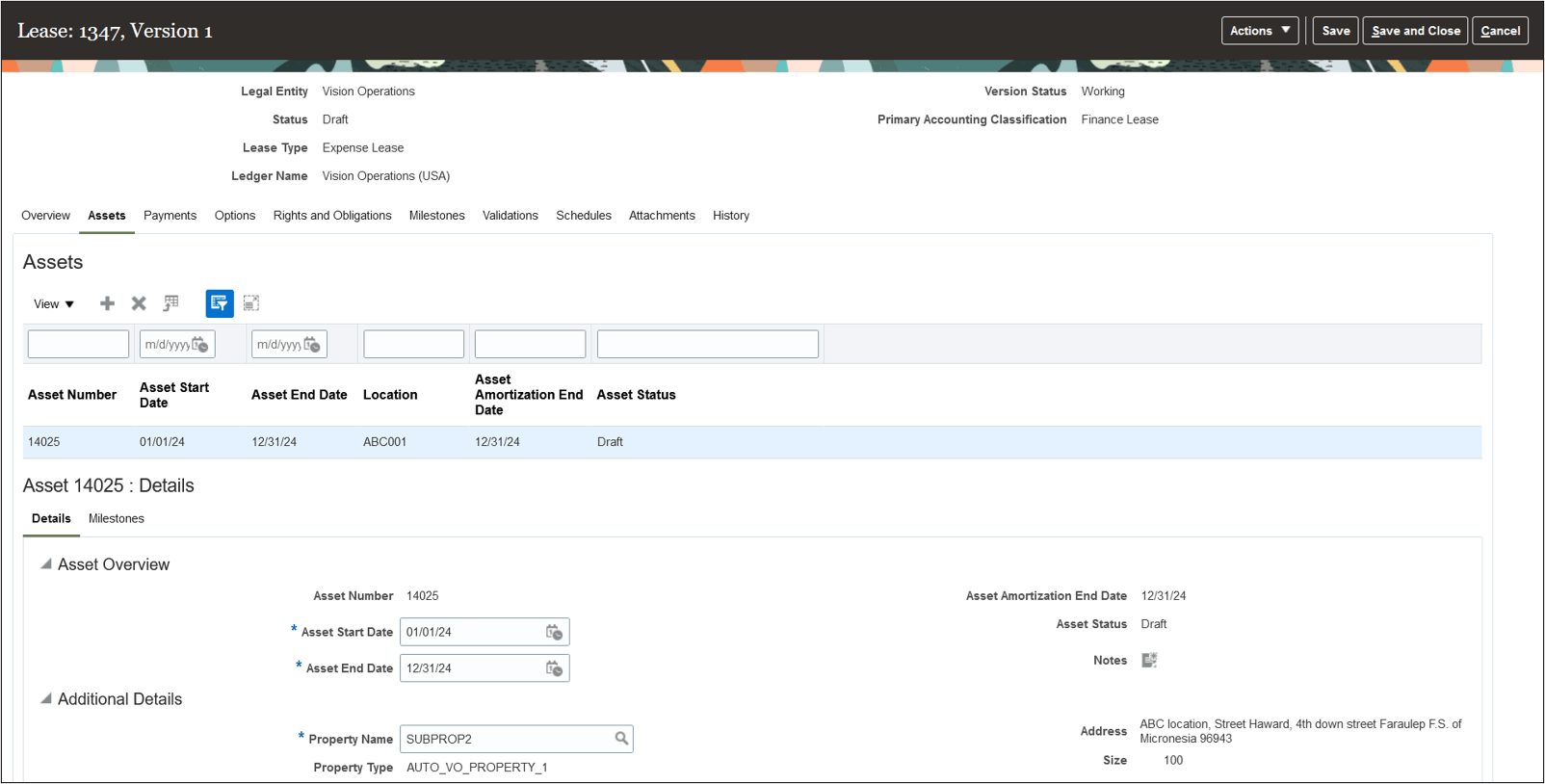

- Create an asset and add a payment.

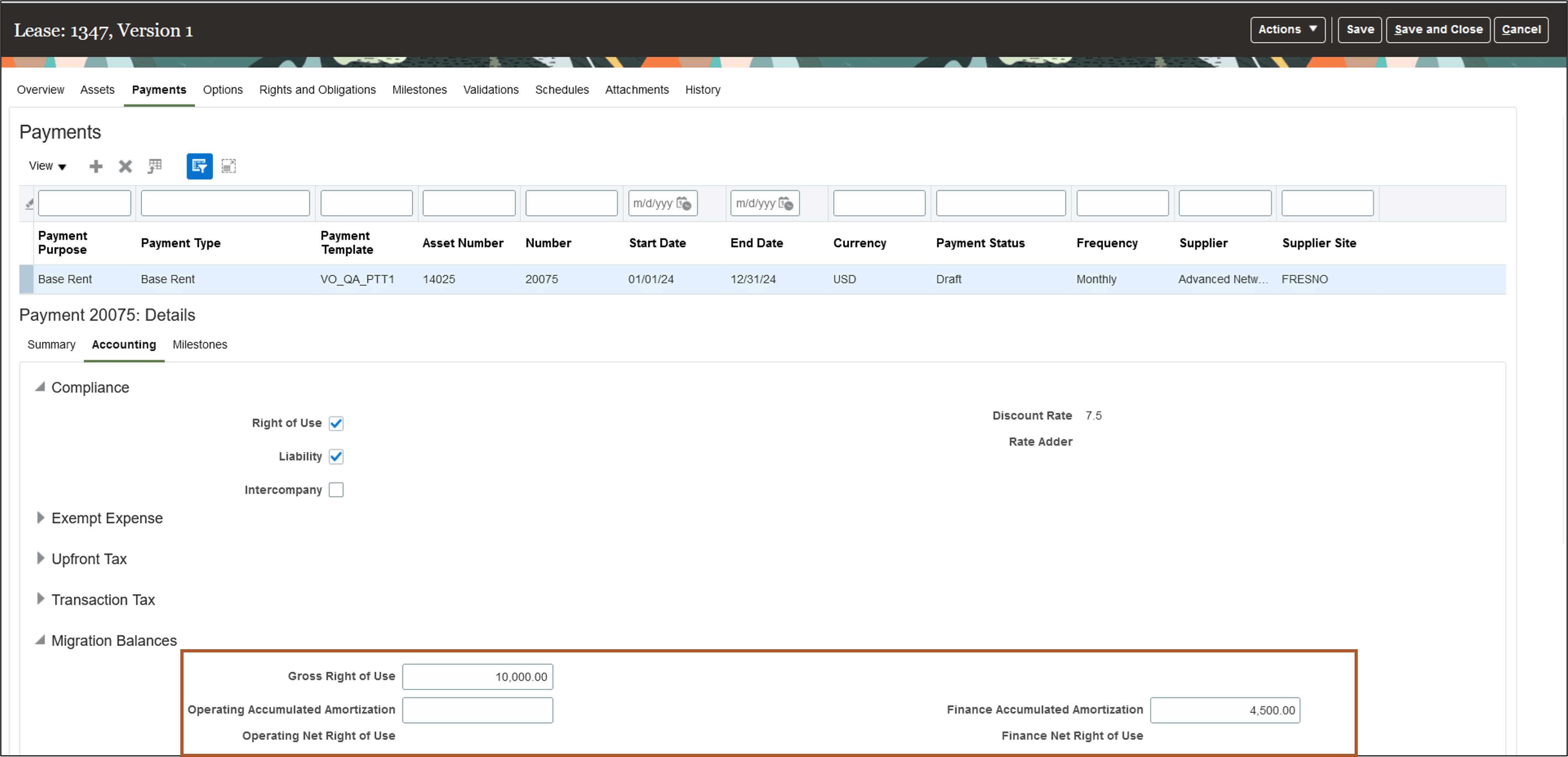

- Update the accounting details on the payment to input the Gross Right-of-Use and Accumulated Amortization amounts.

The following screenshots describe the process of creating a migrated lease with gross right-of-use asset and accumulated amortization balances:

Lease Details page

Asset Details page

Payment Details - Accounting tab

Business benefits include:

- Simplify compliance with lease accounting standards to record and report the gross right-of-use asset balance and accumulated amortization separately.

- Improve operational efficiency with streamlined accounting when migrating existing portfolios.

Here's the demo of these capabilities:

Steps to Enable and Configure

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials No Longer Optional From: Update 25C

- Configure the following new Journal Line Rules when using the Right-of-Use Basis: Net

Journal Line Rules

| Event Class | Journal Line Rule | Accounting Class | Line Type |

|---|---|---|---|

| Lease Booking | Lease Booking Migration Liability Reserve | Liability | Debit |

| Lease Booking | Lease Booking Migration Liability | Liability | Credit |

| Lease Booking | Lease Booking Migration Right-of-Use | Asset | Debit |

| Lease Booking | Lease Booking Migration Right-of-Use Reserve | Liability | Credit |

- Configure the following new Journal Line Rules when using the Right-of-Use Basis: Gross

Journal Line Rules

| Event Class | Journal Line Rule | Accounting Class | Line Type |

|---|---|---|---|

| Lease Booking | Lease Booking Migration Liability Reserve | Liability | Debit |

| Lease Booking | Lease Booking Migration Liability | Liability | Credit |

| Lease Booking | Lease Booking Migration Right-of-Use | Asset | Debit |

| Lease Booking | Lease Booking Migration Right-of-Use Reserve | Liability | Credit |

| Lease Booking | Lease Booking Migration Accumulated Right-of-Use | Asset | Debit |

| Lease Booking | Lease Booking Migration Accumulated Amortization | Accumulated Depreciation | Credit |

Key Resources

- This feature originated from the Idea Labs on Oracle Cloud Customer Connect: Idea 649599

Access Requirements

You do not need any new role or privilege access to set up and use this feature.