Manual Creation and Application of Prepayment Invoices

Use the Create and Edit Transaction pages to manually create and apply prepayment invoices against sales invoices. The addition of manual creation and application of prepayment invoices enhances the existing Prepayment Invoicing process that uses the Import AutoInvoice process.

When a prepayment invoice is applied to a sales invoice, the outstanding balance of the sales invoice is either reduced or settled by the applied amount. The original accounting and tax entries of the prepayment invoice are reversed.

Business benefit:

- Manual creation and application of prepayment lines to sales invoices would enhance user productivity and efficiency while handling a small number of prepayments.

Steps to Enable and Configure

Before you create and apply prepayment invoices manually, complete these steps:

- Create prepayment receivables activities.

- Set up prepayment transaction types.

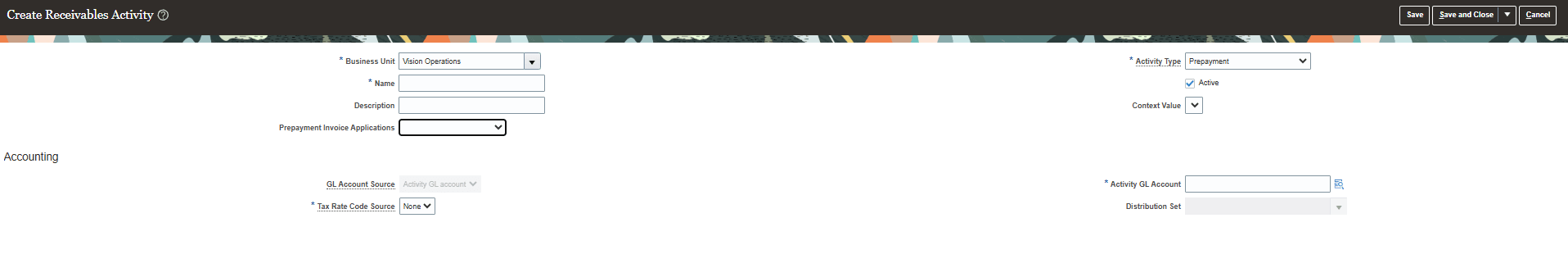

1. Create Prepayment Receivables Activities.

Use the Manage Receivables Activities page to create a Prepayment Receivables activity for each business unit that will create and use prepayment invoices.

- Open a Create Receivables Activity page

- Set the Activity Type to Prepayment

- Set the GL Account Source field to Activity GL Account.

- In the Activity GL Account Source field, enter the account where prepayment invoice distributions will be created.

- Set the Tax Rate Code Source field to None.

- Select the Prepayment Invoice Applications value for this Receivables activity:

- Use any prepayment: Allows application of eligible prepayment invoice lines against sales invoice.

- Use paid prepayments only: Allows application of only fully paid prepayment invoice lines against sales invoice.

Prepayment Receivable activity

2. Create Prepayment Transaction Types.

Create one or more prepayment transaction types with the Transaction Class of Invoice and the Transaction Subclass of Prepayment.

- Open a Create Transaction Type page

- Use a name that identifies the transaction type as a prepayment transaction type.

- In the Transaction Class field, select Invoice.

- In the Transaction Subclass field, select Prepayment.

Create and Apply Prepayment Invoices Manually

Create Prepayment Invoices

- Navigate to Billing - Create Transaction.

- Assign the transaction a Prepayment transaction type created in previous step.

- Enter prepayment invoice line information.

A prepayment invoice can have only one line. - Click Save.

- Review and Complete the prepayment invoice.

Apply a Prepayment Invoice to a Sales Invoice

Applying a prepayment invoice to a sales invoice reverses the original accounting and tax entries of the prepayment invoice. The outstanding balance of the sales invoice is reduced or settled by the amount applied.

- Navigate to Billing - Create Transaction.

- Enter Sales invoice line information.

- Click the Apply Prepayments button. The Apply Prepayments window opens.

- In the Apply Prepayments window, search for the prepayment invoice, enter the application amount, and click the Done button to apply the prepayment invoice to the transaction.

- Review the prepayment application line created with a negative line amount.

- Complete the sales invoice.

NOTE:

-

Prepayment invoices hold the outstanding Prepayment balance that can be applied to other sales invoices.

-

Prepayment accounting entries of the sales invoice with applied prepayment lines are reversed and the actual revenue booked.

-

As with imported prepayment invoices, the manual prepayment accounting activity is maintained in a separate Prepayment account assigned to the Prepayment Receivables activity for a business unit. Prepayment accounting doesn’t affect your Revenue account.

Tips And Considerations

- Prepayment invoice can have only one line.

- Prepayment and sales invoice creation and application is only supported in the ledger currency. Foreign currency transactions are not supported.

- Manually created prepayment invoices can only be applied to sales invoices of the same customer, transaction source, business unit, and currency.

- Manually created prepayment invoices cannot be applied to sales invoices sourced from upstream systems.

- Sum of Prepayment application amount cannot exceed sales invoice line amounts.

- Prepayment application amount entered in Apply Prepayments window must be more than 0 and less than or the same as the prepayment balance amount.

- Other transaction activities, including disputes and adjustments, on prepayment invoices and sales invoices with prepayment lines are not supported using SOAP or REST API services.

- You can only credit the full prepayment invoice or sales invoice with prepayment application lines. Partial credits are not supported.

- You must credit a sales invoice with prepayment applications before crediting the prepayment invoice.

- Overapplication on prepayment lines or prepayment application lines (sales invoice) is not supported.

- Deferring revenue recognition using revenue contingencies and invoicing rules is not supported.

- Manually created prepayment invoices can only be applied during creation of sales invoices. After a sales invoice is saved or completed, Apply Prepayments option becomes unavailable.

Key Resources

- Automation of Invoicing and Receipt Applications for Advance Payments: https://docs.oracle.com/en/cloud/saas/readiness/erp/24b/fins24b/24B-financials-wn-f32330.htm

- Create and Apply Manual Prepayments to Transactions

- Manually Create Prepayment Invoices

- Manually Apply Prepayment Invoices to Sales Invoices

Access Requirements

- Accounts Receivable Manager

- Accounts Receivable Specialist

- Billing Manager Segregated Role

- Billing Specialist Segregated Role