JPK Accounting File Format Update for Poland

JPK Accounting File Format Update for Poland

Generate the JPK Accounting file for Poland using the revised format called JPK_CIT. The Polish Ministry of Finance has mandated the use of JPK_CIT format to report accounting transactions taking place in 2025 and beyond. This release will not include the Asset Register section of the new report as it has been postponed for a year.

The Polish Ministry of Finance has mandated the use of JPK_CIT format to report accounting transactions from 2025 forward.

Requested changes to the new report format include:

- Elimination of all the current XML tags based in Polish descriptions, with a coding system (such as S1, S2, and T1, T2)

- Elimination of the current sections of Trial Balance, Detailed Journals and Account Analysis with the introduction of a new merged structure.

- Addition of a third party information section.

- The Detailed Journals and Account Analysis sections are joined into one section and the Trial Balance as mentioned now includes all the natural account levels.

- Control entries of the previous account analysis and detailed journals sections are now joined into a single control section.

- Addition of a tax information section.

Most of these changes have no effect on your operations and there are no extra setup requirements for them to be presented in the report. However, there are a few elements that do require new setups and these are listed below:

Third Party Information: This includes information about the Customer and Supplier ID, their country codes and their Tax registration numbers (TRN). All elements are available in the system and are included in the new XML format.

Account Classification: This includes new lookups that handle new elements that are not included in the current Account Hierarchy structure for JPK. These lookups map the actual accounts to the standard values given by the tax authorities (S_12_1 to S_12_3). The natural accounts were listed only at the child level previously. The report with the new format lists all levels (parent and child) of the accounts. The account lookup for the mandatory S_12_1 classification also includes the required Legal Entity classification of a given industry type based on the values of ZOiS1 to ZOiS8 provided by the Tax authorities. The steps required for the setup are listed below.

Tax Block: This node collectively displays differences between the balance sheet and tax results, listed under these categories:

- K_1: Tax-exempt income.

- K_2: Non-taxable income in the current year.

- K_3: Revenues subject to taxation in the current year, recorded in the accounts of previous years.

- K_4: Costs that are not deductible for tax.

- K_5: Costs not recognized as tax deductible costs of obtaining income in the current year.

- K_6: Costs recognized as costs of obtaining income in the current year, recorded in the books of previous years.

- K_7: Taxable income not recognized in the accounting books.

- K_8: Costs considered as PURCHASES not included in the accounting books.

The values for these tags are provided by another lookup where you can define the exact amount for each tax element, based on your internal or external calculations to identify the exact tax liabilities. The format and steps required to set up of this lookup are also listed below.

Compliance with the new legal requirements for the JPK Accounting Report for Poland begins January 1st, 2026 for reporting accounting data in fiscal year 2025.

Steps to Enable and Configure

You don't need to do anything to enable this feature.

Tips And Considerations

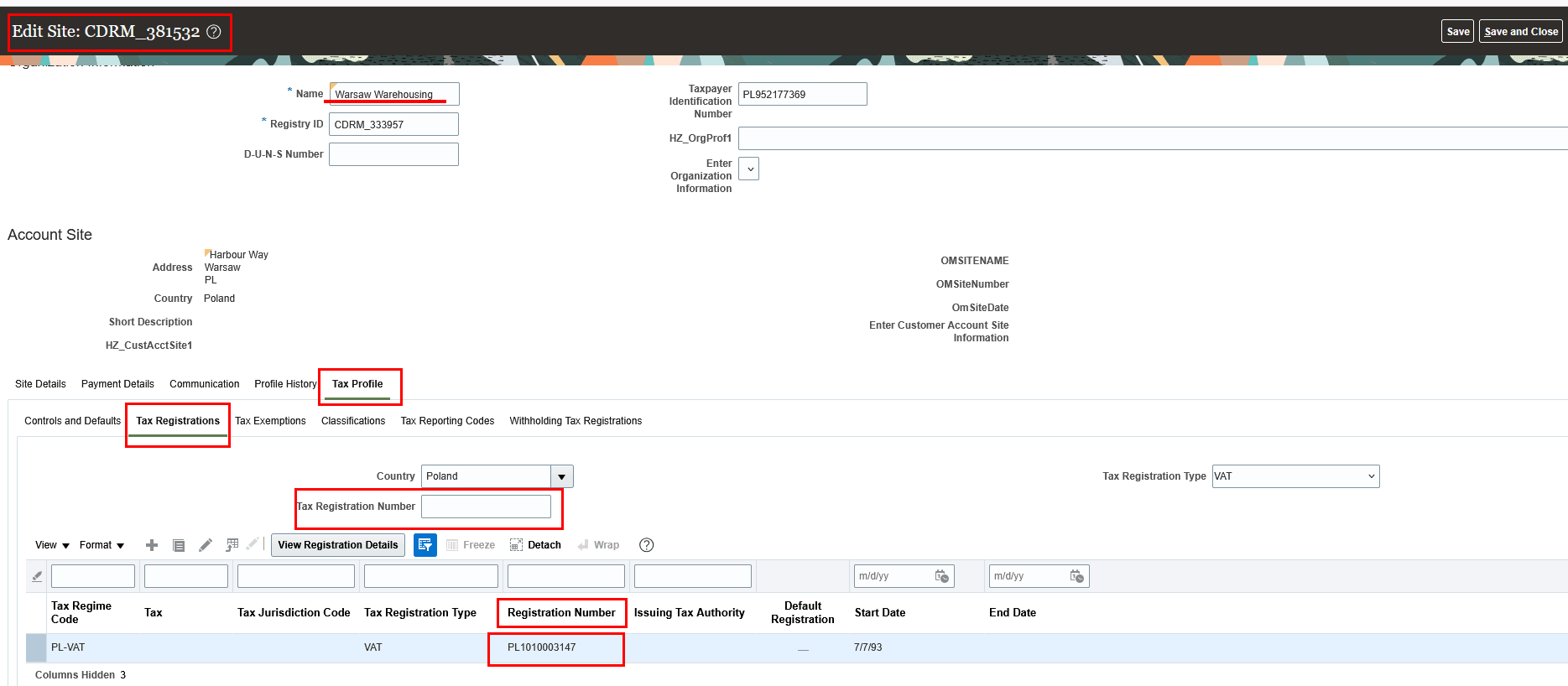

For the third party information required, make sure you define the Tax registration number at the Customer site level, including the 2-letter country prefix. The application uses the first 2 letters for the country code and the rest of the TRN for the TRN xml tag.

Navigate to Receivables > Billing > Manage Customers > Customer > Customer Account > Site > Tax Profile > Tax Registration.

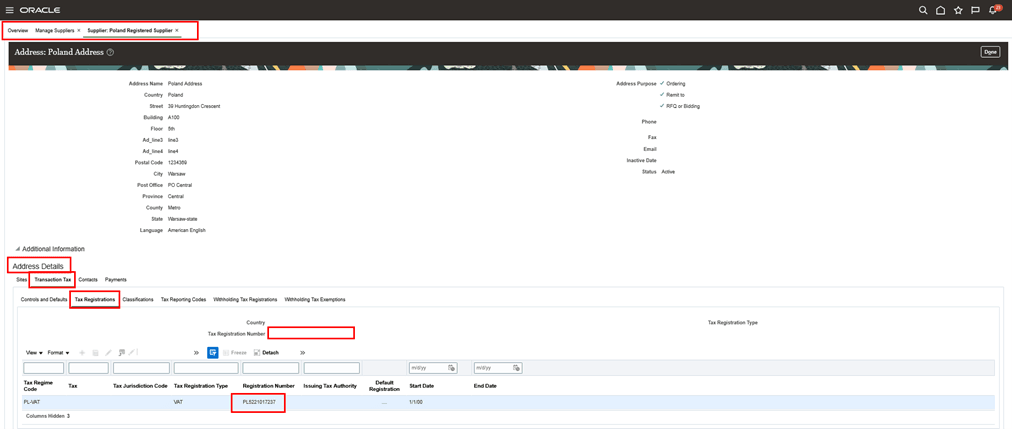

For the Supplier, you must enter the Tax Registration Number at the Address level, so that the report can extract the Country code and the TRN.

Navigate to Procurement > Suppliers > Manage Suppliers > Supplier > Addresses > Address > Transaction Tax > Tax Registration.

Supplier country and TRN setup

For the Account classification requirements, you must create the Standard lookups indicated below. The values for these lookups are not inherited during transaction and journal creation, and they do not need to be created at the beginning of 2025 operations. They must be in place by the end of December 2025, when the new reporting format extracts 2025 data in January 2026.

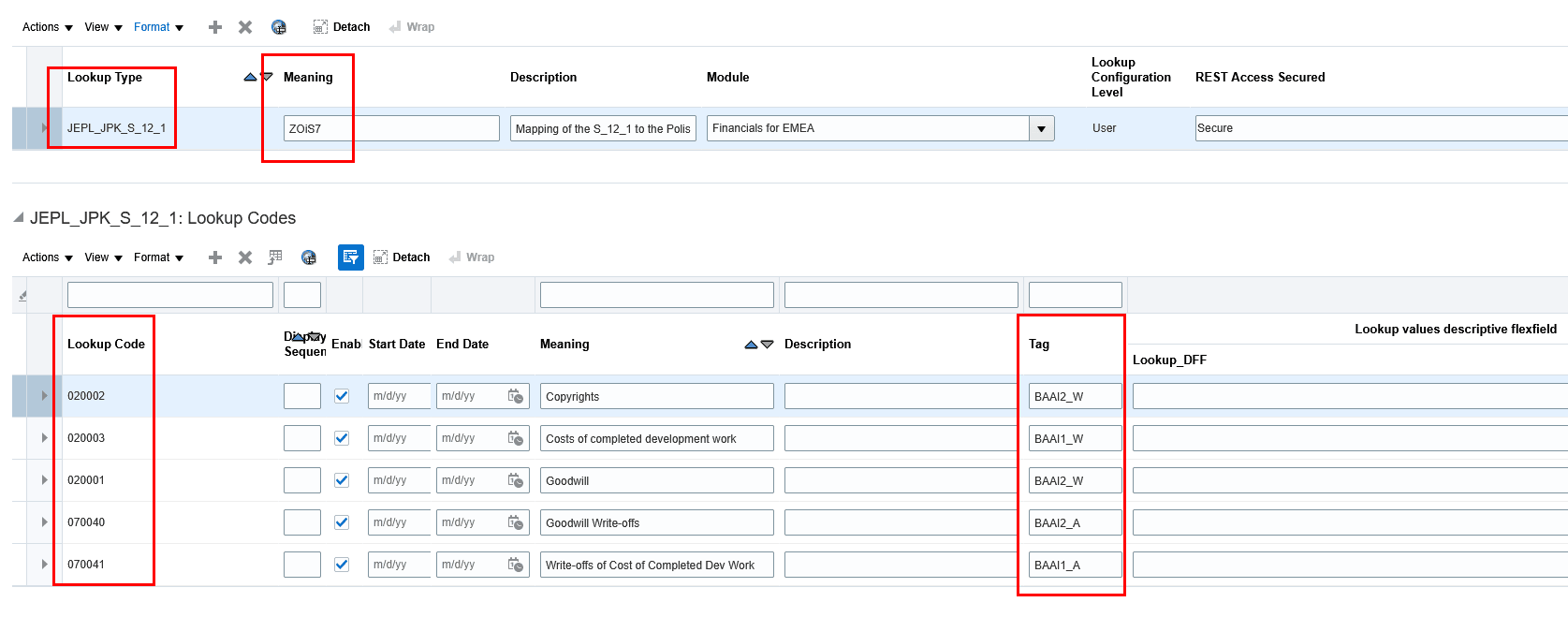

The ZOiS classification will be identified by the Description field of the lookup used for the S_12_1 classification. In this example, you must define lookup as JEPL_JPK_S_12_1 and the Meaning column value as ZOiS7 – for other entities. Similarly you must create Standard lookups: JEPL_JPK_S_12_2 and JEPL_JPK_S_12_3, which are not mandatory but depend on the implementation. These standard lookups have similar logic but you should not enter a ZOiS value under the meaning column.

Navigate to Setup and Maintenance > Manage Standard Lookups. Create new lookup type:

- Lookup_Type to be created: JEPL_JPK_S_12_1

- Form of Lookup code: The Natural account you are using.

- Meaning: is the description of the natural account

- Tag: the code given by the Polish tax authorities for this ZoiS type of industry, corresponding to the natural account in the lookup code.

JE_JPK_S_12_1

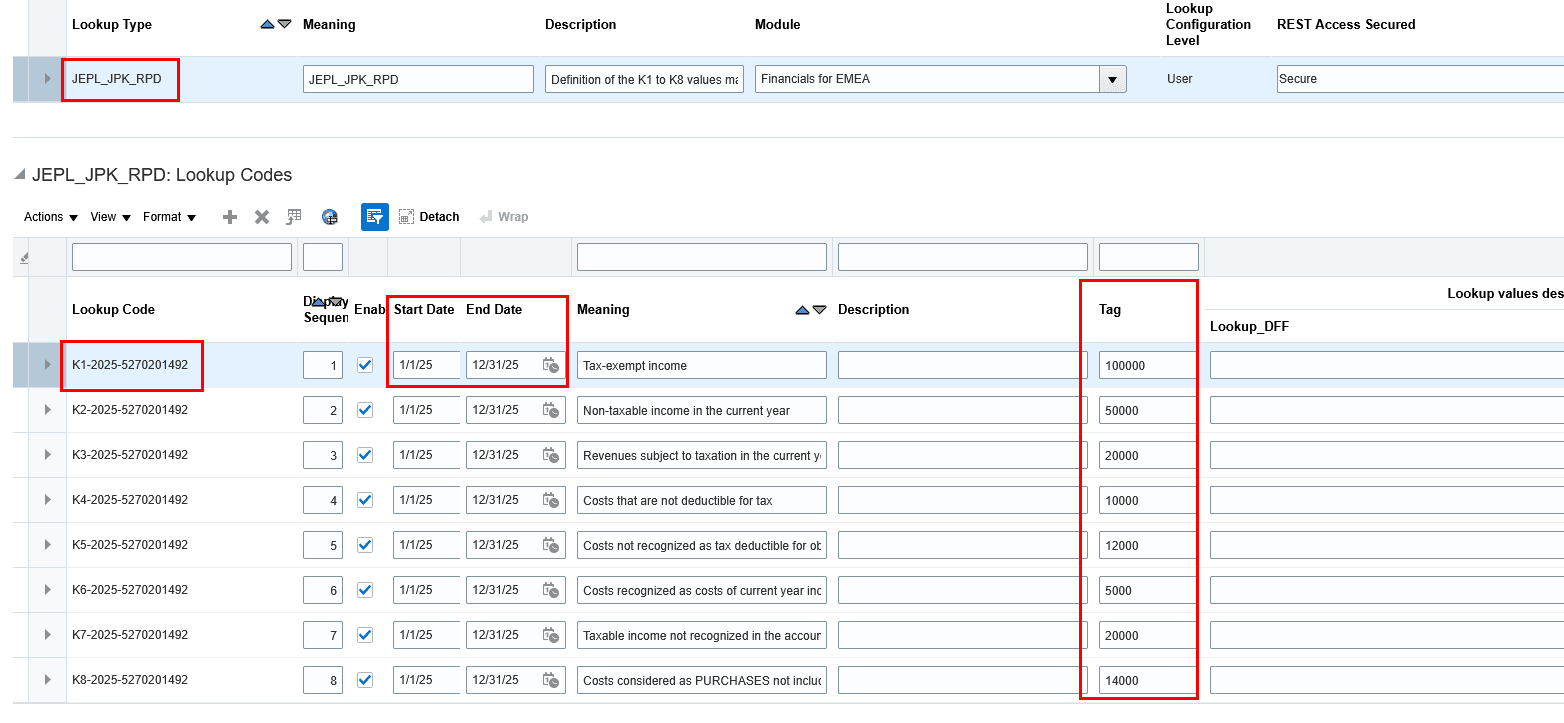

For the Tax block to be present in the report, create the JEPL_JPK_RPD standard lookup type and enter the tax-related values that were defined externally in the Tag column of the lookup. The details will be included in the Topical Essay for JPK_CIT.

Navigate to Setup and Maintenance > Manage Standard Lookups. Create new lookup type:

- Lookup_Type to be created: JEPL_JPK_RPD

- Form of Lookup code: K1-2025-5270201492, where K1 is the JPK xml tag, 2025 is the fiscal year of reference and 5270201492 is the TRN of the LRU you are running the JPK_CIT for.

- The Start-Date , End-Date columns also define the period of reference of the lookup codes. Example of the standard lookup for the tax elements:

JEPL_JPK_RPD

JEPL_JPK_RPD

You must adjust the Chart of Accounts and most importantly the current Hierarchy in order to accommodate the new directions in regard to the grouping category and category accounts. The older JPK Account Hierarchy with the JPK grouping accounts will be set as disabled for now but will be available in case a JPK Accounting report for an audit for years before 2025 has to be extracted.

Key Resources

- Details of the changes required for the new JPK_CIT and all the detailed steps for setting up the required lookups and natural account hierarchy will be available in the VAT Registers and JPK Extracts for Poland Topical Essay on My Oracle Support: EMEA Implementation Resources (Doc ID 2576459.1).

- VAT Registers and JPK Extracts for Poland Topical Essay

- JPK Accounting File Format Update for Poland

- This feature originated from the Idea Labs on Oracle Cloud Customer Connect: Idea 830005

Access Requirements

Same as the ones used for the current release.