Payroll Cost Distribution to Projects Using Time Cards

Payroll Cost Distribution to Projects Using Time Cards

Distribute payroll costs to projects using existing time card hours in Project Costing as the distribution basis. Record time on projects using Oracle Fusion Time and Labor, Oracle Fusion Projects, or third-party sources, and calculate the cost of the time transactions using distributed actual payroll costs. This payroll cost distribution method provides the most accurate costing of the labor effort on a project, allowing for efficient cost control and enhanced financial analysis. This new method extends the labor cost distribution capabilities in Project Costing, providing a time card based distribution option in addition to the existing person assignment and payroll cost configuration methods.

The following steps describe how to use the new time card distribution method for allocating payroll costs to projects:

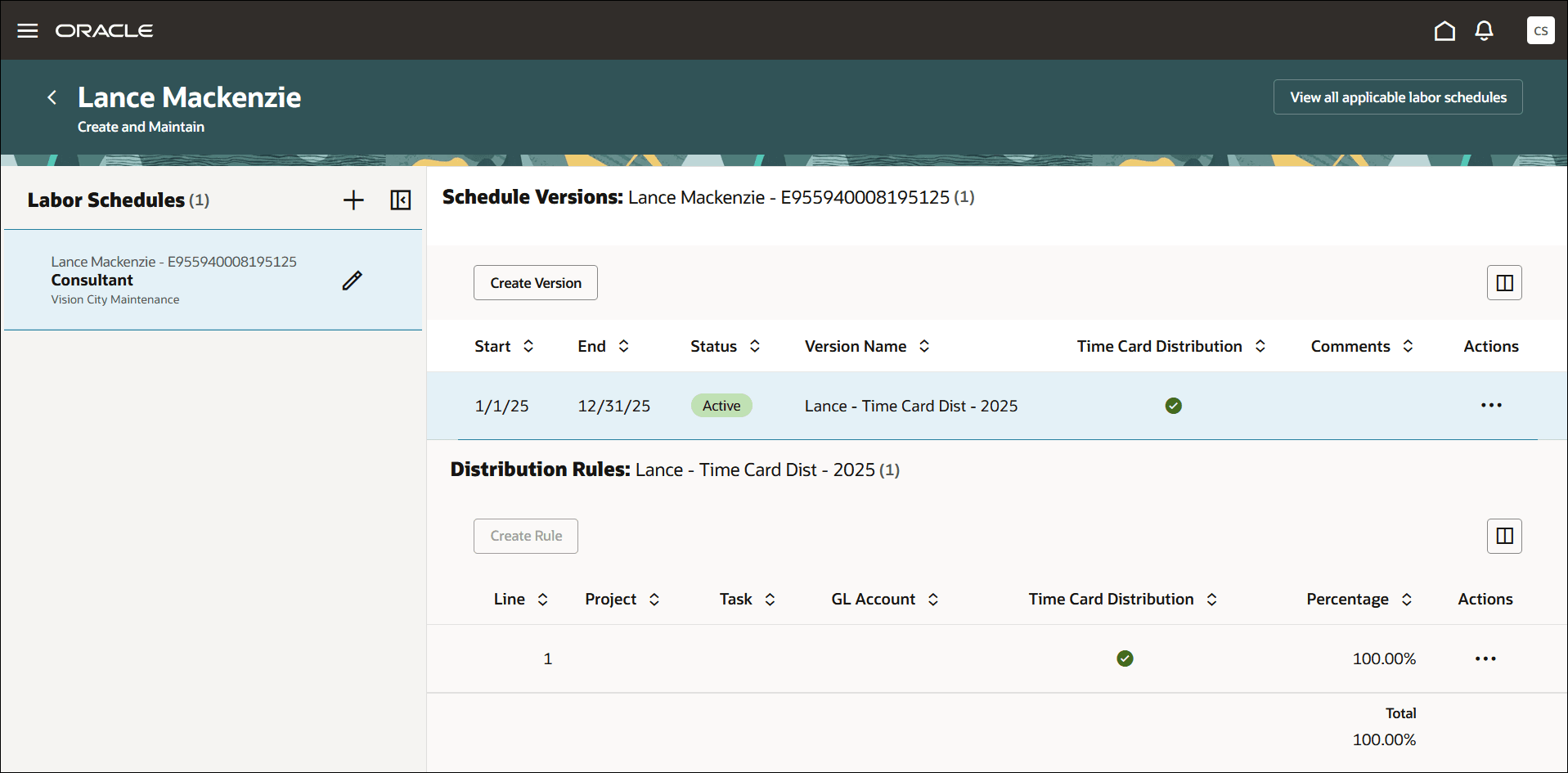

- Enable the Distribute Using Time Cards option when creating a new person assignment labor schedule version. A distribution rule specifying time card distribution as the basis is automatically created.

Labor Schedule Version Enabled For Time Card Distribution

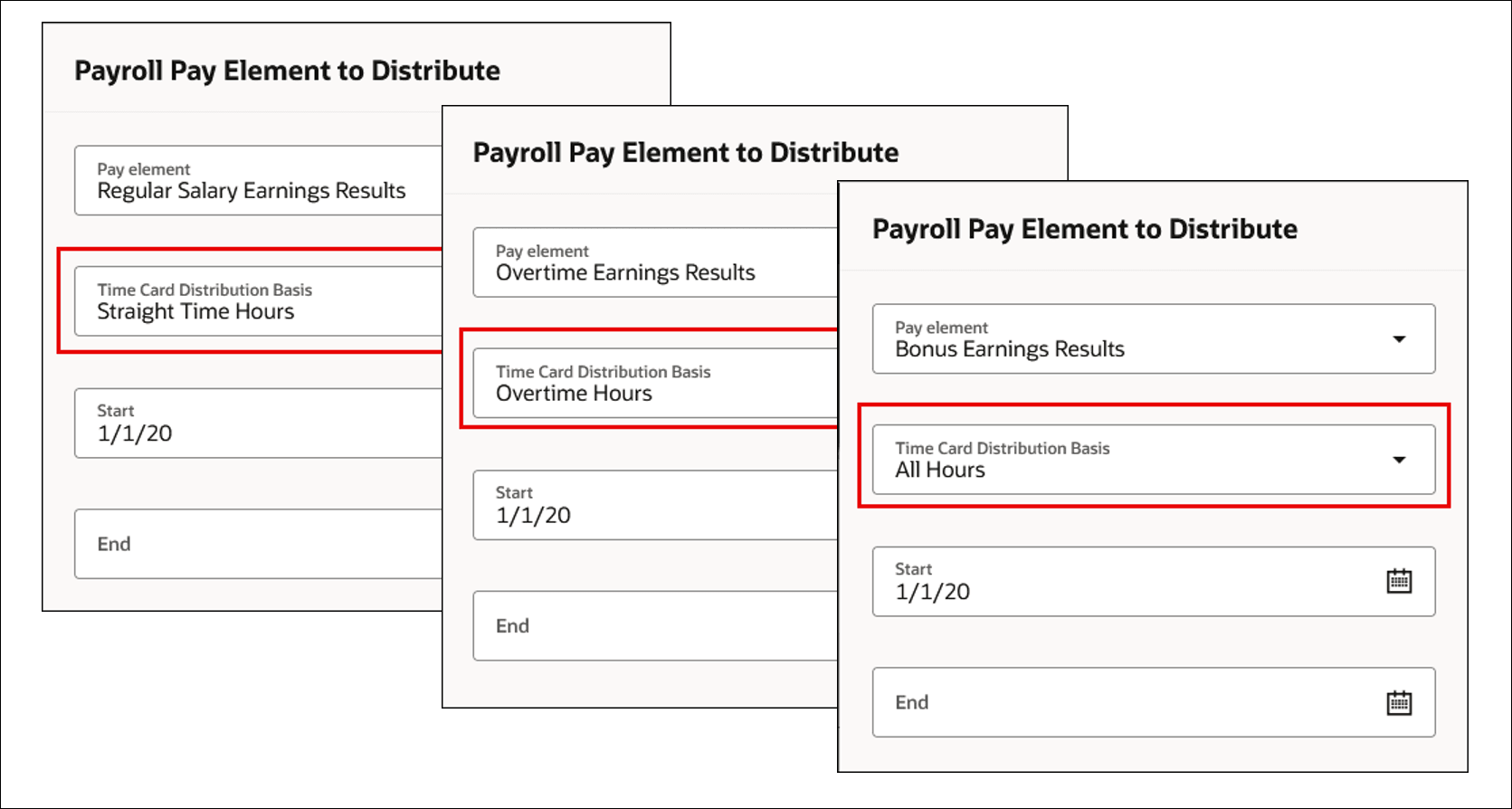

- Define the pay elements that you want to use when distributing costs from Oracle Fusion Payroll to projects and specify the new Time Card Distribution Basis for each. If you are importing payroll costs from third-party sources, you must specify the Time Card Distribution Basis for each payroll cost when loading into the interface table if these costs will be distributed to projects using the time card distribution method.

Specify Which Target Time Cards Are Eligible For Each Pay Element Based on Expenditure Type Class

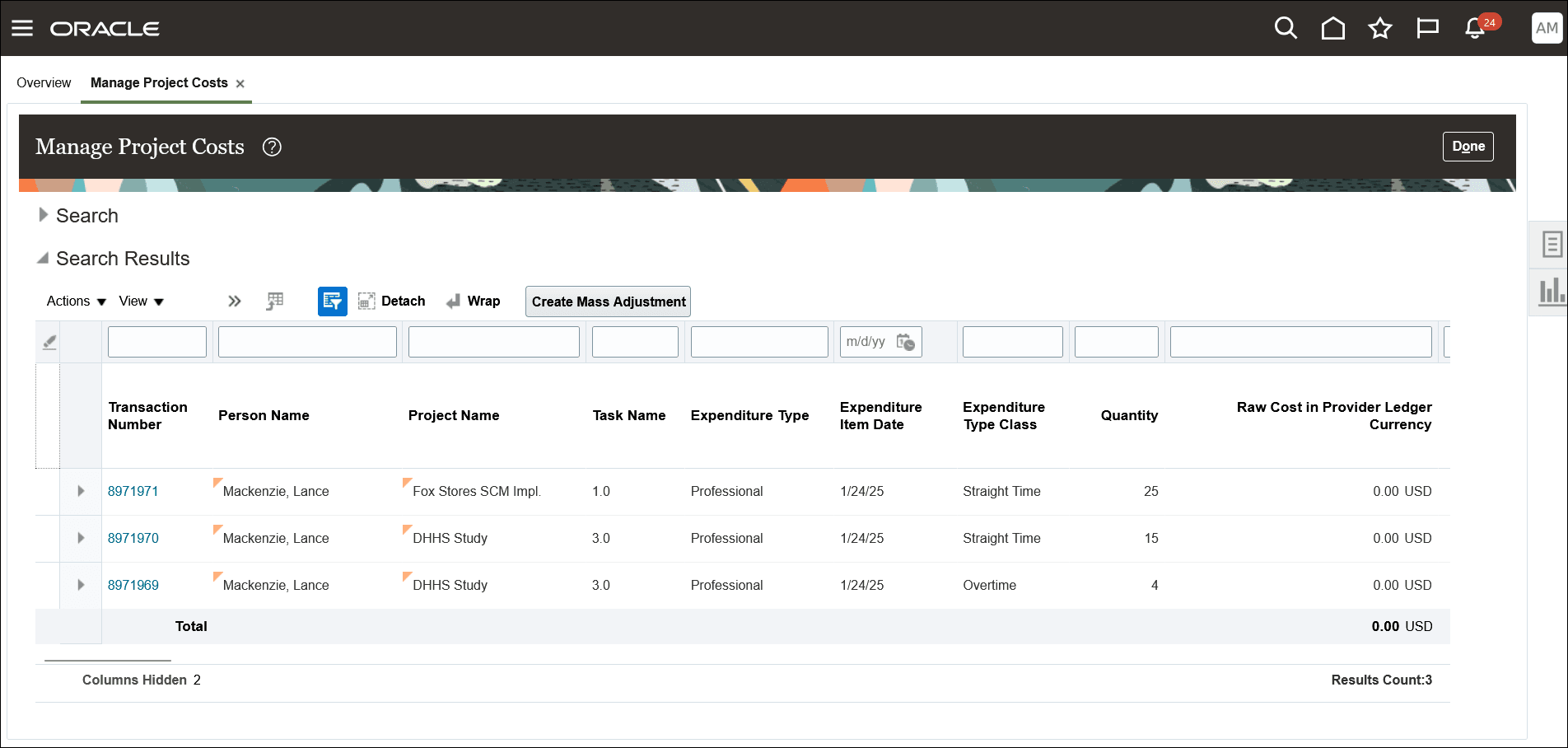

- Import time cards into Project Costing from either Oracle Fusion Time and Labor, Oracle Fusion Projects, or a third-party time reporting source. The Import Costs process determines whether a time card transaction being imported is eligible to be recosted using distributed payroll actual costs. If it is, then the time card transaction is imported into Project Costing with a 0 cost rate, and its payroll costed status is Pending.

Time Cards Pending Payroll Costing Have a Cost of 0

NOTE: For a billable time card transaction, if the pricing method is based on cost, such as the case for the cost reimbursable method, then "The transaction isn't billed because billing is based on raw or burdened cost that's zero. (PJB_ZERO_COST)" billing exceptions will be raised for time cards that are pending payroll distribution when bill or revenue transactions are created. Consider setting these transactions to Nonbillable or placing a billing or revenue hold on them until they are successfully costed using distributed payroll actual costs in order to prevent or remove the undesired PJB_ZERO_COST billing exceptions.

- Run payroll and account for the payroll costs if the source of your payroll is Oracle Fusion Payroll. Otherwise, load externally-sourced payroll costs into the interface table.

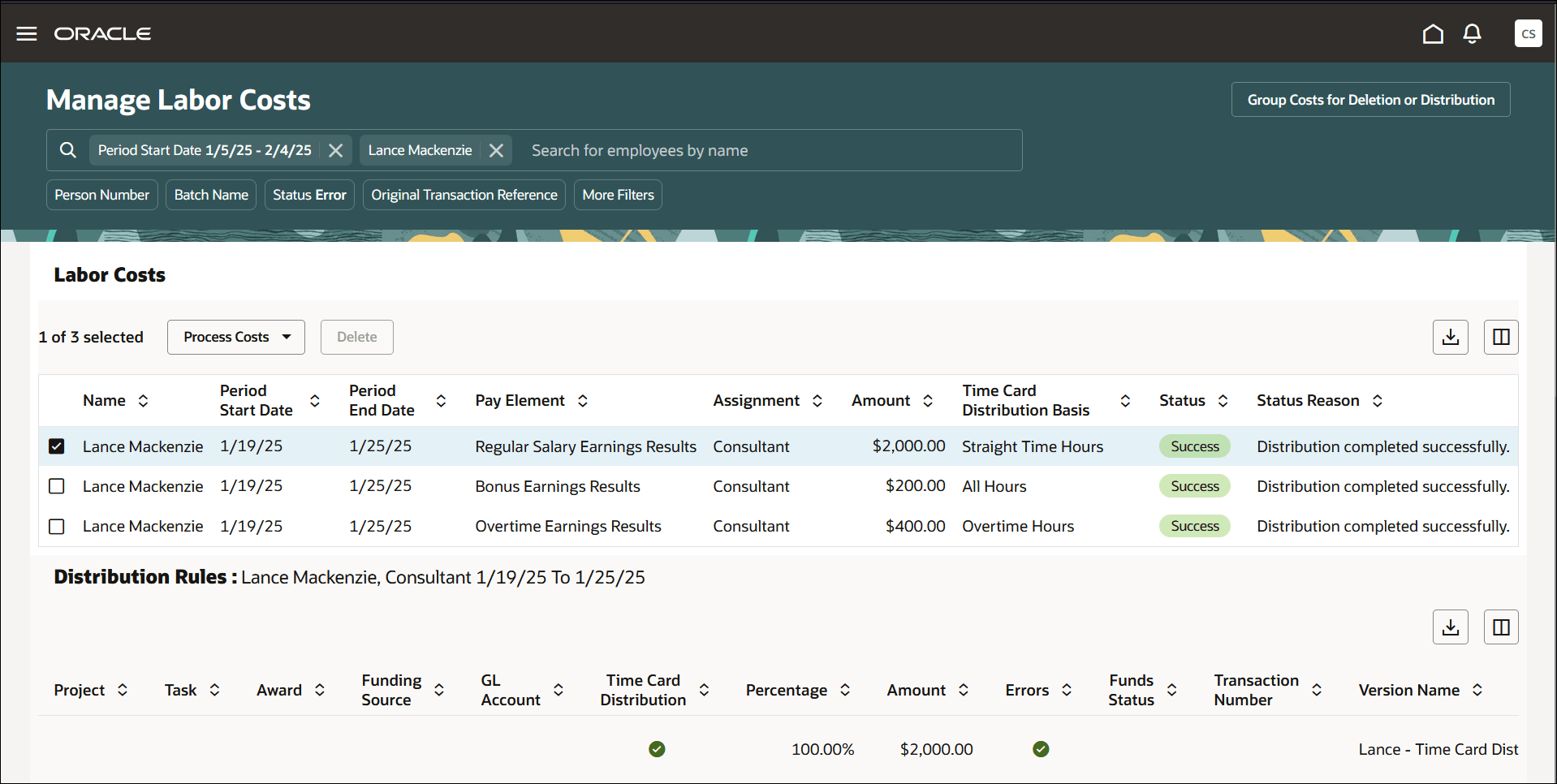

- Schedule the Import Payroll Costs process to distribute the payroll as defined. For time card distribution, all payroll costs for a specific person assignment in the payroll period are summarized by time card distribution basis. The target time cards in Project Costing are identified, and the total amount that each target transaction should receive is calculated, and each transaction is then recosted using a new Distribute payroll costs adjustment type.

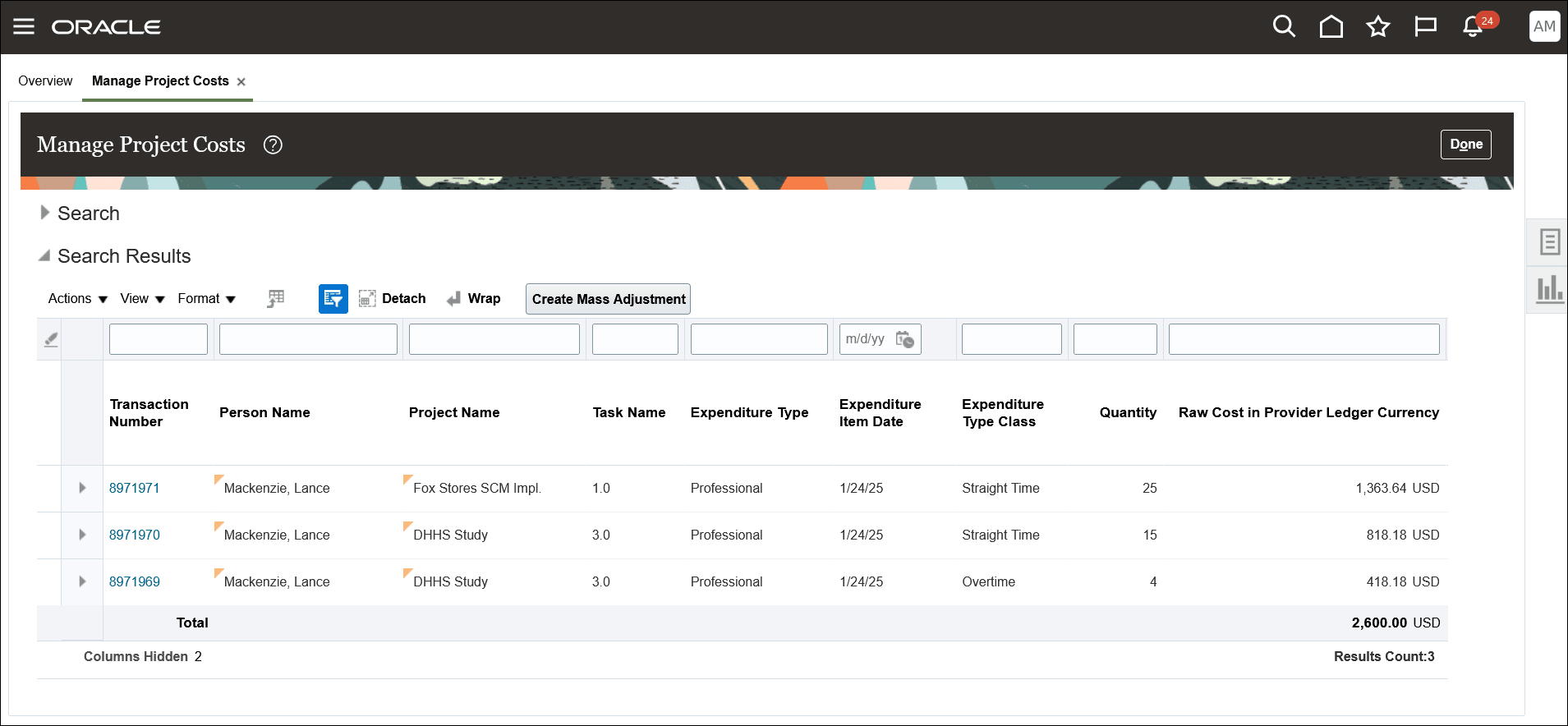

Imported Payroll Costs Successfully Distributed to Time Cards

Target Time Cards After Payroll Cost Distribution

Further planned enhancements for this feature include:

- Option to exclude time cards that are pending payroll cost distribution from the invoicing and revenue recognition processes when the pricing method of the transaction is based on cost.

- Displayed time card distribution results for a processed labor cost in the Manage Labor Costs user interface and in an API.

- Option to calculate a provisional cost for a time card transaction using standard costing prior to the distribution of actual payroll costs.

- Ability to define time card distribution schedules at a higher level than person assignment, such as by department or business unit.

This feature offers the following business benefits:

- Increased profitability through enhanced financial analysis provided by the most accurate costing of the labor effort expended on a project.

- Ability to make better-informed decisions based on the more accurate labor costs recorded on a project.

- Elimination of labor schedule distribution rule maintenance, leading to time and cost savings. Using time card distribution, payroll costs are dynamically allocated to the projects on which a person worked using the person's reported time.

Here's the demo of these capabilities:

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

- The time card distribution method can be configured only for person assignment labor shedules.

- Update your existing pay elements in Labor Distribution with a Time Card Distribution Basis value if these pay elements will be used to distribute payroll costs to projects using time cards.

- Payroll costs are distributed to the time cards that exist in Project Costing when the Import Payroll Costs process is executed. Therefore, ensure that all time cards within the payroll period date range have been imported into Project Costing prior to running the Import Payroll Costs process.

- Use the Cost Distribution Payroll Costed Indicator subledger accounting source in your rules for the Labor Cost and Labor Cost Adjustment event classes if you need to account for labor costs differently based on costs calculated using standard costing or payroll costing.

- All payroll costs to be distributed to a time card transaction must have the same currency.

- The payroll cost distribution to time cards is tracked using a new Distribute payroll costs project cost adjustment type. The Allow Adjustments configuration setting on the document entry of a third-party transaction source is not considered when distributing payroll costs to time cards. The Adjust transactions setting on a project status action control, however, is considered when distributing payroll costs to time cards. If a project's current status is configured to not allow transaction adjustments, then the payroll cost distribution adjustments to target time card transactions on that project will fail.

- The method for distributing payroll costs to time cards involves calculating an overall cost rate across all payroll pay element costs targeting a particular time card transaction, and then multiplying that rate by the transaction's quantity to calculate the raw cost amount. Raw cost amounts are not rounded on the transaction records in the database, however, the raw cost amounts are rounded to the precision of the transaction's currency when displayed in the Manage Project Costs page or when generating accounting for the time card transaction.

- If the time card quantities change in Project Costing after a successful distribution of payroll costs, such as by importing a new time card transaction that meets the payroll distribution eligibility criteria, then the status of the relevant labor cost records in Labor Distribution is updated to Needs Reprocesing. You can redistribute payroll costs to the revised set of target time cards using one of the Process Costs options in the Manage Labor Costs page.

Key Resources

- To understand how this new feature fits into the overall scope of payroll cost distribution, review the related help:

- Labor Distribution section of the Using Project Costing guide.

- Based on Idea 763509 from the Project Management Idea Lab and Idea 673210 from the Payroll, Compensation and Benefits Idea Lab on Oracle Cloud Customer Connect.

Access Requirements

No new access requirements.