Predictive Cash Forecasting

Predict short and medium-term cash forecasts using real-time data to manage liquidity. Use Oracle Cloud ERP financial information to make cash predictions in Cloud EPM using multiple forecast methods, including Machine Learning Model, Statistical, Driver, and Trend based methods. Continuously plan cash inflows and outflows for daily, weekly, or monthly rolling forecasts. Use advanced Machine Learning models to predict the best cash forecasts for Receivables cash inflows based on customer payment behaviors. Benefit from interactive data visualization on the forecast, using planning tools to create what-if scenarios to drive key decisions. Review insights, key performance indicators and conduct variance analysis to measure the forecasting outcomes. Drill down on forecast outcomes to gain a granular view, to collaborate more easily and to acquire actionable insight to optimize cash flows.

Feature highlights:

- Analytical and multidimensional forecast model, with different business context for planning and reporting purposes.

- Daily and periodic short-term and mid-term cash forecasting.

- Automated ready-to-use integration with Fusion Cloud ERP sources for accounts receivable, accounts Payable, and cash management cash flows.

- Integrate external sources into Predictive Cash Forecasting.

- Inclusion of all cash flow line items to cover Operating Cash Flows, Investing Cash Flows, and Financing Cash Flows.

- Supports multiple forecast methods for each line item based on the data source available, the maturity of planning and forecasting, and the forecast period range.

- Built-in advanced statistical and machine learning prediction for high accuracy predictions.

- Role-based navigation flows for Cash Managers, Controllers, and Administrator, to guide users through their process.

- Utilizes the best of Cloud EPM capabilities for smart view-based drill downs, what-if planning, manual adjustments to the forecast, flexible views by Region, Legal Entity, Bank, and Bank Account on a daily, weekly, or monthly basis, and insights for analysis.

- Drill down to Cloud ERP aggregate and detailed transactions to understand the forecast in detail and for deeper analysis.

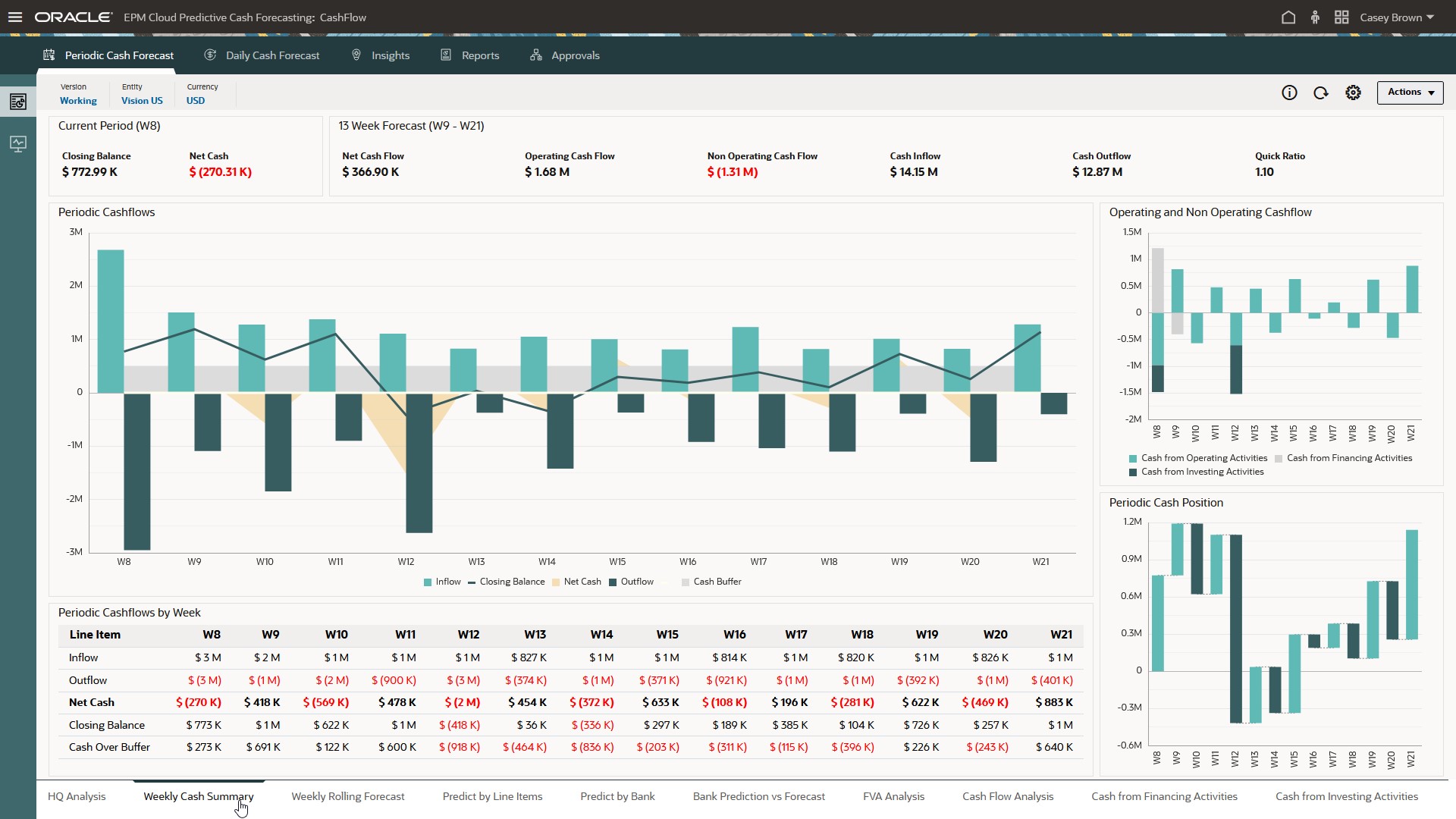

Cash Managers use the Summary dashboard to review the continuous rolling cash forecast, operating and non-operating cashflow, and daily or periodic cash position by entity, along with KPIs.

Summary Dashboard

Predictive Cash Forecasting allows for daily, weekly, or monthly rolling forecasts. Cash line items drive the various cash inflows, cash outflows, and the balances for a cash forecast. Line items are organized under the structure of Operating Cash Flows, Investing Cash Flows, and Financing Cash Flows.

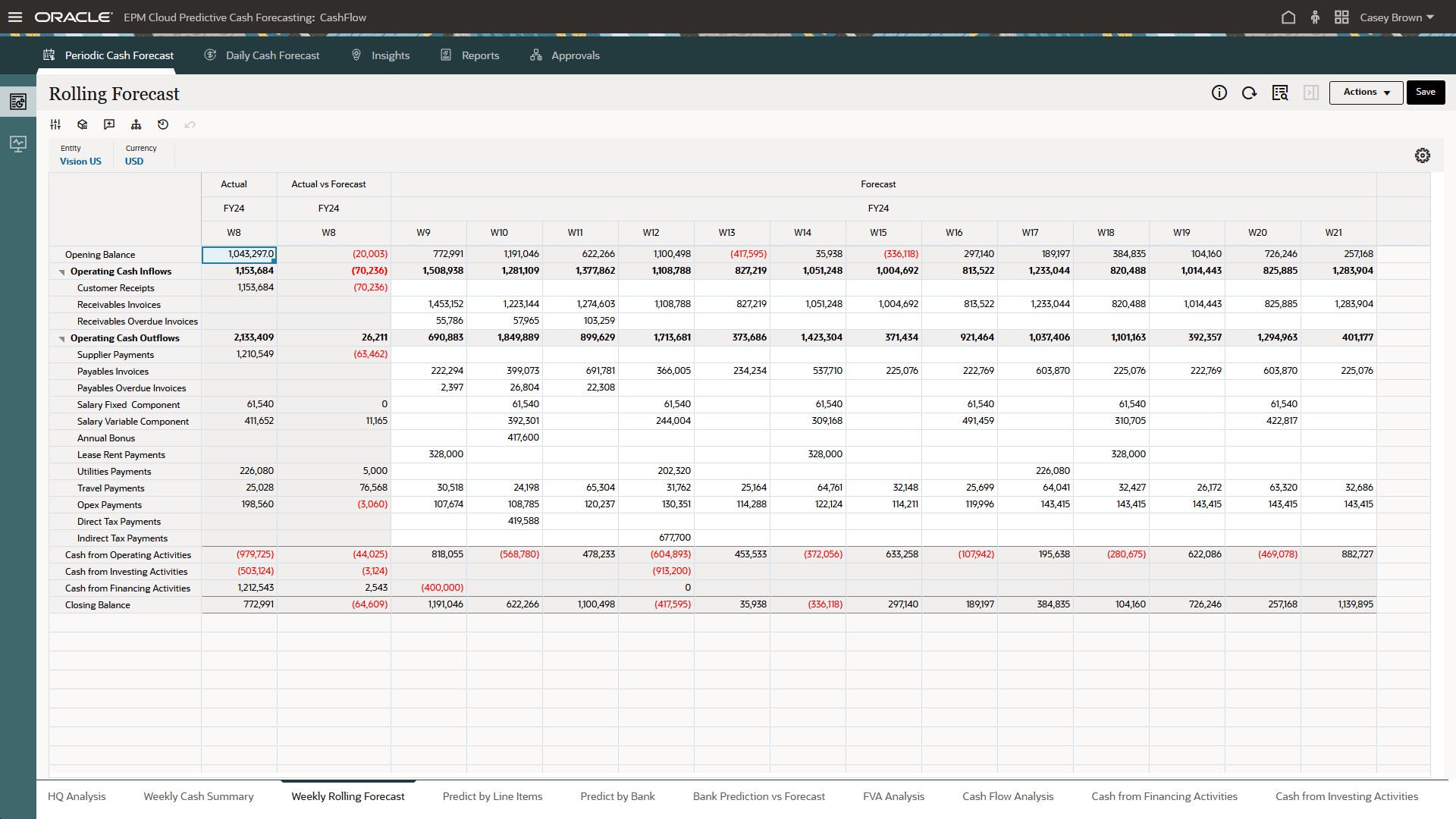

Cash Managers use the Rolling Forecast form to review and modify the forecast for cash inflows and cash outflows for their entity. They can review actuals, the rolling forecast, and actuals versus daily/periodic forecast. Controllers can see an overview of the organization's overall cash position at each level of the legal hierarchy.

Rolling Forecast

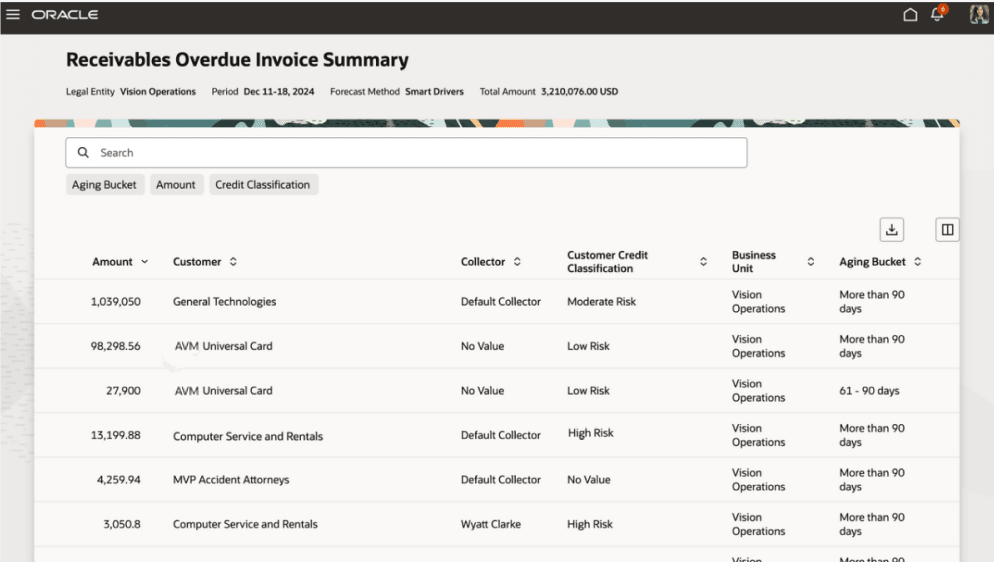

The drill-down capability allows cash and treasury users to understand the forecast amount in detail in the context of additional business attributes. Users can drill to web-based aggregate and transactional views for Receivables, Payables, and Cash Management cash flow sources. These transaction listings and their business attributes will help users understand, analyze to make decisions for actions, and gain confidence of the forecast outcomes.

Drill down to Receivables Overdue Invoice Summary

Overall, Predictive Cash Forecasting offers a comprehensive solution for cash forecasting that can help businesses make better decisions for their liquidity planning and working capital management strategies. Automated integration of Fusion Cloud ERP provides the power to use real-time transactional data from Receivables, Payables and Cash Management sources for the most detailed forecasts. Users can gain actionable insight in advance, make informed decisions, and take appropriate actions to better manage working capital. With its advanced features and flexibility, it is a valuable tool for any organization looking to improve its cash forecasting capabilities.

These are the business benefits:

- Optimize cash by finding problems and opportunities earlier with increased automation and more frequent cash forecast updates.

- Act faster by aligning stakeholders and unifying scenario planning with corrective actions.

- Enable deeper insights to improve liquidity.

Steps to Enable and Configure

To enable this feature you need to log a Service Request (SR).

NOTE: Predictive Cash Forecasting is currently available as a controlled release for eligible early adopter customers. Create a service request or reach out to an Oracle sales representative to get started.

To enable Predictive Cash Forecasting, there are setups to be performed in Cloud EPM and in Cloud ERP.

The following setup tasks are to be performed in Cloud ERP:

- Enable the Predictive Cash Forecasting feature using the Change Feature Opt In option for Financials offering in Cloud ERP Setup and Maintenance.

- Configure the data management and data integration users from the security console.

- Use the Manage Accounting Calendars task in the Financials functional area to set up the weekly forecast calendar, if required.

- Use the Review Predictive Cash Forecasting Data Extraction Options task in the Predictive Cash Forecasting functional area to complete the data extraction options.

- Use the Review Predictive Cash Forecasting Data Extraction Options task in the Predictive Cash Forecasting functional area to enable the integration between Oracle AI and Cloud ERP to initiate machine learning model training.

- Use the Manage Transaction Sources and Manage Transaction Types tasks in the Financials functional area to exclude Receivables transaction sources and transaction types that do not align to a due date-based customer payment process, from ML training and prediction.

- Complete the security related setup tasks for data access.

The following setup tasks are to be performed in Cloud EPM:

- Create a new Planning application of type Cash Forecasting in Cloud EPM.

- At the end of the Application Creation wizard, click Configure. Or, from the Home page, click Application and then click Configure.

- Click Enable Features.

- Select the features you want to enable, and then click Enable. When you click Enable, the Predictive Cash Forecasting artifacts are populated, including dimensions, forms, line items, rules, navigation flows, and so on.

Tips And Considerations

This release provides integration between the existing Predictive Cash Forecasting capabilities and Fusion Cloud ERP (Receivable, Payables, and Cash Management).

- Prepare for operational readiness the ERP business processes that have a data impact on cash flows, and make them available in the most current and complete state possible for cash forecasting.

- To maximize machine learning model training, it is recommended to have available a minimum of 18 months of historical Receivables transactions, along with a complete record of the related transactional activities.

- Requires an EPM Enterprise subscription to enable the Predictive Cash Forecasting application in Cloud EPM.

- Requires a separate instance to enable the Predictive Cash Forecasting application in Cloud EPM.

- Available in all languages supported in EPM Planning.

- Predictive Cash Forecasting Application is multi-currency only.

- Predictive Cash Forecasting Application is Hybrid Essbase enabled in EPM.

- Predictive Cash Forecasting Application provides Redwood Experience.

NOTE: Capabilities listed in this document will be made available incrementally over the next several releases. This release introduces the smart driver-based forecasting. Future releases will introduce: Machine learning model-based forecast method; Drill down capabilities to aggregate and detailed views; and Smart view capabilities.

Key Resources

- Administering Predictive Cash Forecasting

- Working with Predictive Cash Forecasting

- Implementation Checklist for Oracle Fusion Cloud ERP Administrators

Access Requirements

- Define a single sign on to access both Cloud ERP and Cloud EPM applications using one set of credentials, for seamless access to both applications with a single login.

- Set up Cloud EPM connections to Cloud ERP using the Manage Enterprise Application option in the topology definition.

- Use the Cloud ERP Manage Job Roles task in the Users and Security functional area to create user-defined roles, in addition to the predefined roles with the required roles and privileges for assignment to users.

- Use the Cloud ERP Manage Data Access for Users task in the Users and Security functional area to assign users access to appropriate data based on their job roles.