Integrated Banking and Payments with Bank of America

Embedded banking services with BOFA provide businesses with a comprehensive view of their cash position, payments, and receipts. The solution includes ready to use connectivity between Oracle and BOFA for U.S. and Canada customers. It includes rapid bank account onboarding, seeded ISO payment templates, automated funds capture and disbursement transmission, and continuous bank statement retrieval, processing, and reconciliation. The Banking Configurations functional area supports enablement of the following business flows:

- Connectivity, Bank and Bank Accounts

- Funds Disbursement

- Funds Capture

- Bank Statement Processing

Connectivity, Bank and Bank Accounts

Oracle B2B generates PGP and SSH key pairs for the customer, stores the private keys securely, and emails the public keys to the customer with instructions to share them with Bank of America (BOFA). The customer downloads and forwards the keys to BOFA, which loads and configures them, then notifies the customer upon setup completion.

Manage banks, bank branches, and bank accounts using the integration with BOFA. The turnkey bank onboarding uses a BOFA-specific template to create the banks, bank branches, and bank accounts.

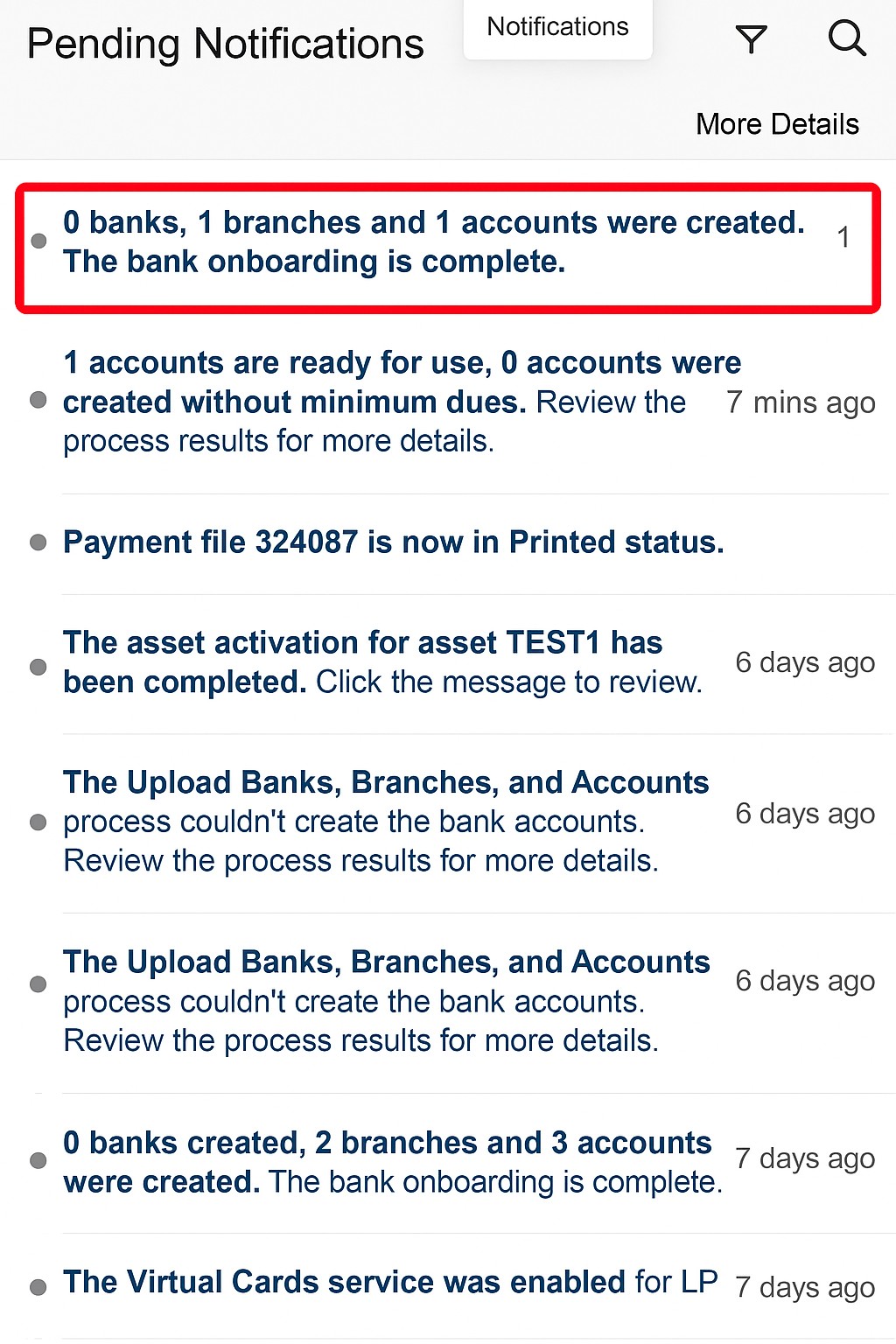

Through the integration, you can upload the BOFA-specific template and create the banks, bank branches, and bank accounts. Once the bank accounts are created, the process automatically attaches the business functions and business units, reconciliation configurations, and bank statement transaction creation rules needed for payables and receivables processing. Users can review the onboarded bank accounts from the bell notifications. The Banks and Bank Accounts flow reduces setup steps by creating bank account master data that has been identified with BOFA. This flow can be used for initial and ongoing bank account creation.

Funds Disbursement

Process payment and acknowledgment files for funds disbursement using the integration with BOFA. Customers can generate and transmit payment files in the standard ISO template configured with BOFA and retrieve and process disbursement acknowledgment files. Bank transfers and ad hoc payments can also be processed as part of this integration.

The integration uses the BOFA message format based on ISO 20022 CGI standards. This format includes payments by ACH, Wire, and check for the US and Canada. The integration provides the acknowledgment processing feature with complete automation for file retrieval and processing. It processes file-level and transaction-level acknowledgment files generated by BOFA at various points in the clearing flow. The invoice status changes from Paid to Unpaid for rejected payments, allowing users to take corrective action.

Funds Capture - Lockbox

Process intraday lockbox using the integration with BOFA to enable near real-time customer balances. Payment advice and remittance information are collated and combined with the lockbox file, eliminating the need for manual entry and application.

Bank Statement Processing

Process and reconcile bank statements using the automated integration with BOFA. This maximizes efficiency and eliminates time-consuming activities through automatic bank statement processing and reconciliation.

The integration uses the BOFA CAMT053 bank statement template, based on ISO20022 standards. The use of this template enables seamless bank statement file retrieval and processing. Features include:

- Regular retrieval and processing of prior day bank statements.

- Automatic creation of new bank statement transaction codes reported on bank statement lines.

- Automatic creation of bank statement transaction creation rules and reconciliation of bank statement lines.

- Automatic unreconciliation and voiding of rejected payments, and reconciliation of the original and rejected bank statement lines.

- Automatic reversal of rejected direct debit transactions and reconciliation of reversal bank statement lines.

The integration between Oracle and BOFA eliminates weeks of technical integration work during implementation and enables transactional processing in Cloud ERP by directly connecting with BOFA. Users have the flexibility to enable one or more flows.

These are the business benefits:

Connectivity, Bank and Bank Accounts

- Reduced effort involved in initial connectivity, security keys configuration and future renewal of expired keys using the BOFA preconfigured connectivity.

- Reduced effort in troubleshooting connectivity issues related to outbound and inbound file transmissions.

- Improves the customer experience with a unified and simplified UI, along with guided navigation.

- Maximizes efficiency and eliminates time-consuming activities through enabling the business functions, reconciliation configurations for these bank accounts.

Funds Disbursement

- Simplify the entire setup process with predefined setups needed to generate the payment files in accordance with BOFA's specifications.

- Reduce effort and increase productivity through automated retrieval and processing of multiple acknowledgment files generated at different intervals for payment files.

- Improve efficiency by reducing manual steps and enabling immediate corrective actions for rejected payments.

- Reduce effort related to payment file testing by using the BOFA preferred format.

Funds Capture - Lockbox

- Improve efficiency by eliminating a material amount of manual processing.

- Reduce effort related to testing lockbox processing by using the BOFA preferred format.

Bank Statement Processing

- Eliminate manual configuration of BOFA-specific bank statement formats and other bank statement processing configurations through seamless integration.

- Automate retrieval and processing of bank statement files.

- Provide automatic reconciliation of bank statement lines and notification of exceptions, if any.

Steps to Enable and Configure

To enable this feature you need to log a Service Request (SR).

Connectivity

Prerequisite Steps

- Before embedding banking services with BOFA in Cloud ERP, you must first work with a BOFA implementation team to establish the bank accounts and the related scope of the services you want to include. Please contact your BOFA Sales/Relationship manager.

- If your enterprise is new to Oracle Fusion Cloud ERP and has not completed the implementation process, please review Getting Started with Your Financials Implementation before enabling the banking integration with BOFA.

- Embedded banking services with BOFA is currently in controlled availability and requires a promotion code.

To enable this feature, you need to log a Service Request (SR) using Product: Oracle Fusion Payments Cloud Service and Problem Type: Setup and Configuration - Payables. You will need to provide the production and test environment names. Once the above is completed, follow the steps in the Service Request to enable embedded banking services with BOFA, including the following setup steps to enable the connectivity between BOFA and Cloud ERP.

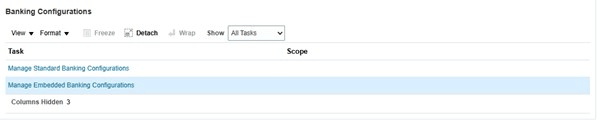

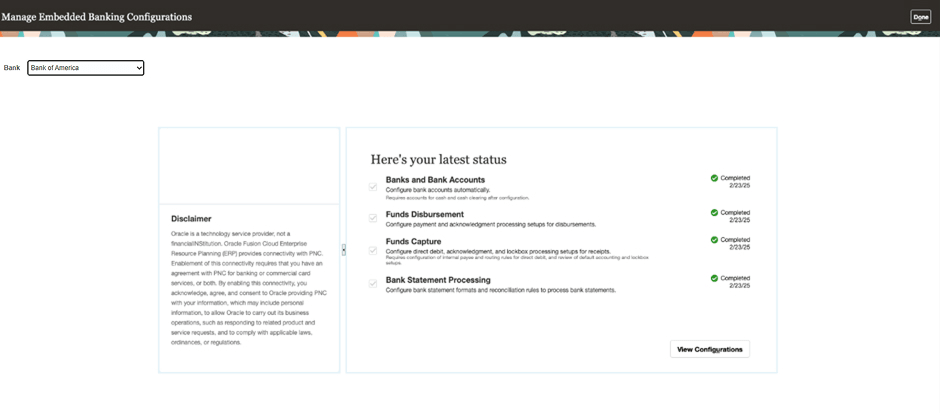

- In the Banking Configurations functional area, click Manage Embedded Banking Configurations.

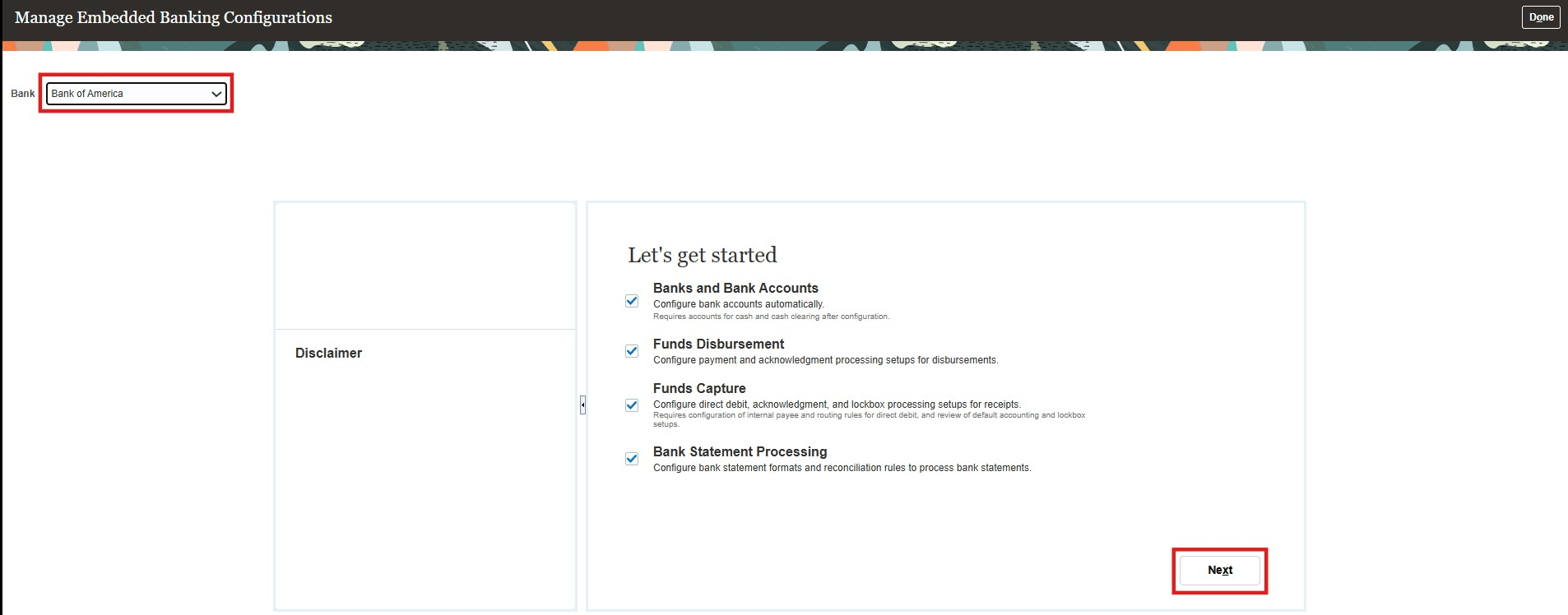

- Select BOFA from the list and select the business flows that you want to enable. Click Next.

- After clicking ‘Next’ on the page, below steps are executed by B2B.

- Key Generation: Oracle initiates the process of generating PGP and SSH key pair exclusively for the customer.

- Key Sharing: Oracle shares the public keys with the customer via email during enablement, and the customer then forwards them to the partner through secure email. The private keys are securely stored within Oracle B2B vault.

- Key Naming: The SSH and PGP files are named with a suffix that matches the Oracle customer’s environment name.

- An email is sent to the customer with instructions to share the keys with BOFA.

- Status changes to In Progress, indicating that key sharing has been requested.

- Customer downloads the SSH and PGP keys.

- Shares them with Bank of America via secure email.

- BOFA loads the keys, configures them.

- BOFA notifies the customer once the setup is complete.

Banks and Bank Accounts

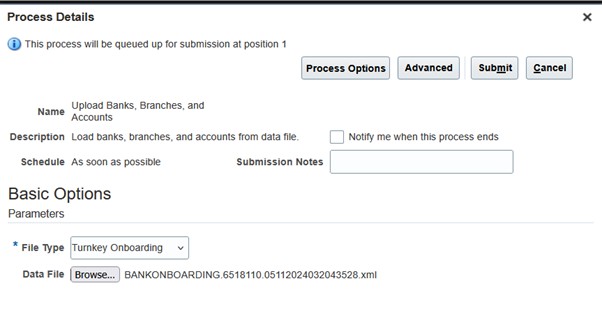

The banks, bank branches and bank accounts are configured using the BOFA specific bank account template. Once the bank accounts are configured, the reconciliation configurations are automatically attached to these bank accounts.

- Upload Banks, Branches and Accounts

- Review Bell Notification

Funds Disbursement

This feature is automatically enabled after you onboard using the Manage Embedded Banking Configurations task. This feature lets you use the following preconfigured setups:

- Payment System Account: BOFA_PSA

- Payment Process Profile: BOFA ISO20022 CGI

- Payment Method: BOFA EFT Payment Method (for ACH and Wire payments)

- Payment Method: BOFA Check Payment Method (for check payments)

As part of the integration with BOFA you can also create payment files using the predefined BIP template BOFA ISO20022 CGI in the BOFA CGI format.

Ensure that supplier who are planning to be paid through BOFA bank account are updated with BOFA payment method, delivery channel and service level.

Before you can use the acknowledgment flow, you must review the following settings at the payment system account level.

- Disbursement Acknowledgment Automatic Voiding Option

- Disbursement Acknowledgment Voiding Invoice Action

Funds Capture – Lockbox

This feature is automatically enabled after you onboard using the Manage Embedded Banking Configurations task. This feature includes the following preconfigured setups:

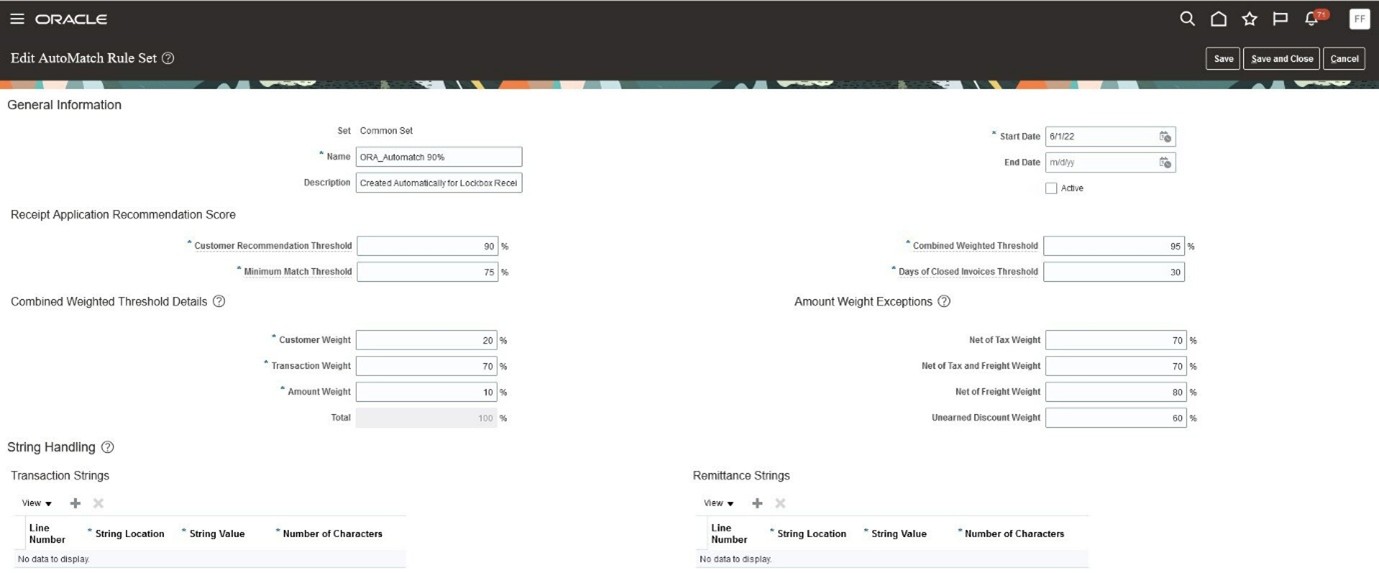

- AutoMatch Rule Set: ORA_Automatch 90%

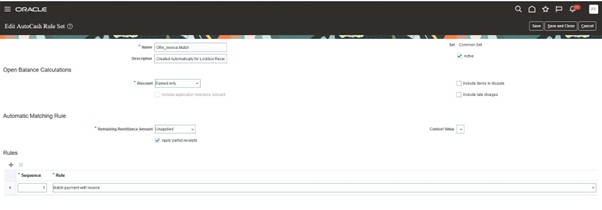

- AutoCash Rule Set: ORA_Invoice Match

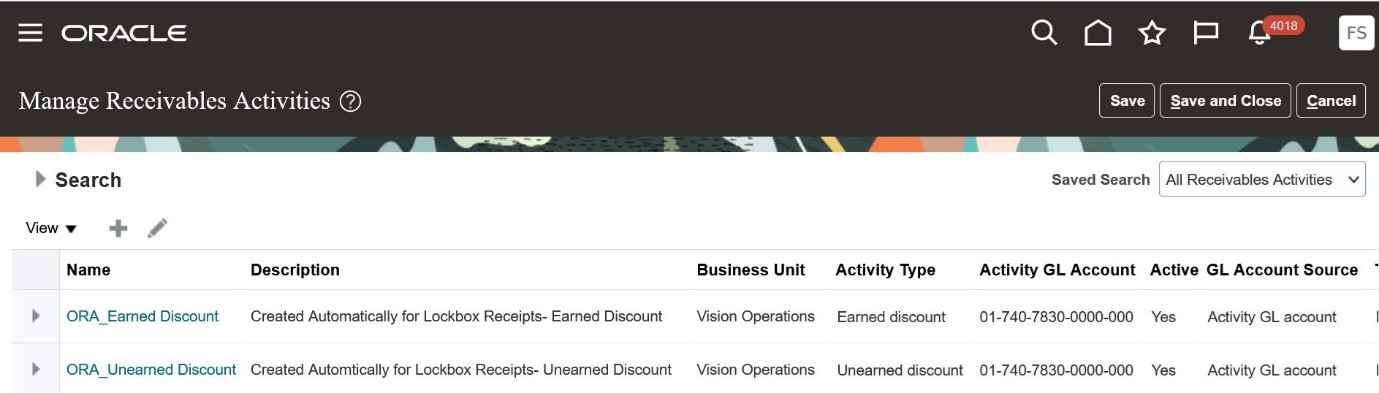

- Receivables Activities: ORA_Unearned Discount and ORA_Earned Discount

- Receipt Class and Method: ORA_LOCKBOX

- Receipt Sources

Use the following setup steps to enable Lockbox processing:

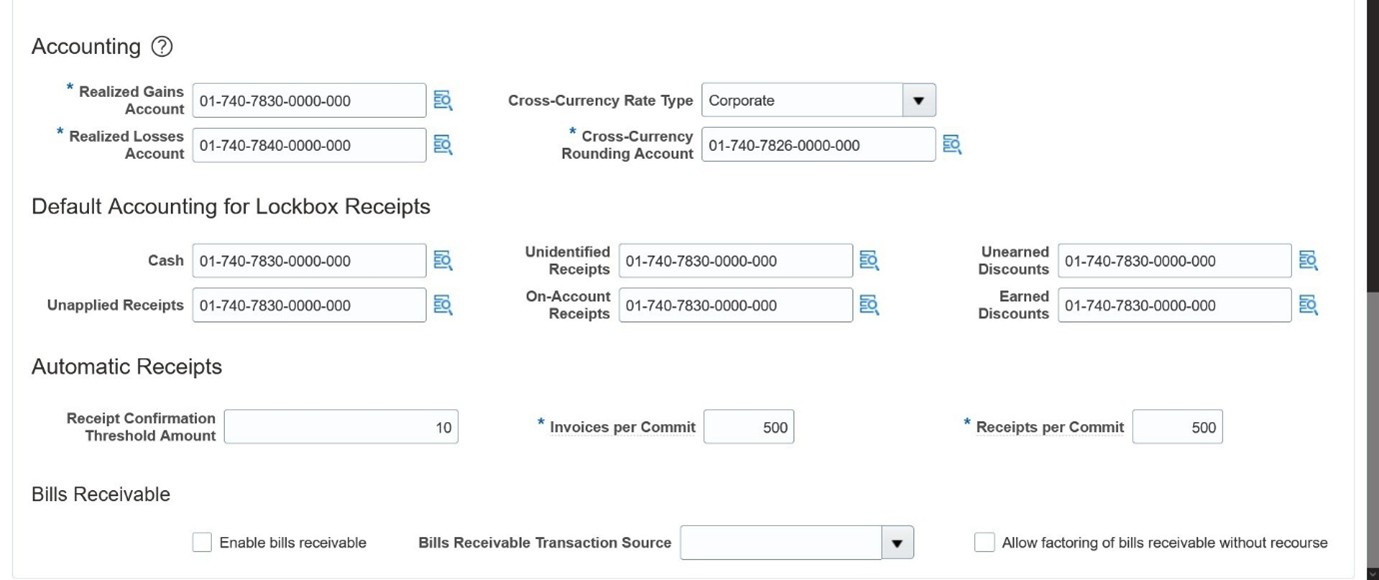

- If lockbox processing is in scope for your funds capture flow, you must enter the required account code combinations in the specified fields of the Default Accounting for Lockbox Receipts section in the Cash Processing tabbed region of the Receivables System Options page for each applicable business unit. Entering this account information will automate the related lockbox setup during bank account onboarding. This is only required for a new lockbox setup.

- The lockbox feature includes a predefined AutoMatch Rule Set and AutoCash Rule Set. Enter these predefined rule sets either in the lockbox transmission or your Receivables System Options definition, as required. You also need to enable AutoApply in Receivables System Options and lockbox. See Tips and Considerations for more information about the predefined AutoMatch Rule Set and AutoCash Rule Set.

Task - Manage Receivables System Options

- After your bank accounts are onboarded, use the Manage Receivables Activities page to review the two Receivables Activities that were created for each business unit: Unearned Discounts (ORA_Unearned Discount) and Earned Discounts (ORA_Earned Discount).

Task - Manage Receivables Activities

- Use the Edit Receipt Classes and Methods page to review the receipt method, ORA_Lockbox, created for lockbox processing. Remittance bank accounts are added to this receipt method according to your setup and the bank accounts onboarded.

- Use the Manage Receipt Sources page to review the receipt sources created for lockbox processing. Receipt sources are created using the remittance bank account assignments in the ORA_Lockbox receipt method.

- After reviewing all the related lockbox setup as indicated in the previous steps, use the Create/Edit Lockbox page to manually configure a lockbox for your bank account using the receipt source, receipt method, and AutoMatch rule set provided.

NOTE: If document sequencing is enabled for the applicable Ledger or Legal Entity, the related receipt processing document sequencing is set up automatically.

Bank Statement Processing

This feature is automatically enabled after you onboard using the Manage Embedded Banking Configurations for task for BOFA. This feature lets you use the following preconfigured setups:

- Manage Bank Statement Transaction Codes

- Manage Bank Statement Transaction Creation Rules

- Manage Bank Statement Reconciliation Tolerance Rules

- Manage Bank Statement Reconciliation Matching Rules

- Manage Bank Statement Reconciliation Rule Sets

- Manage Formats

- Manage Payment Systems

Tips And Considerations

Connectivity

- Read the descriptions mentioned under the business flows to understand any pending setups to be reviewed and completed for the flow to be enabled.

- The Banks and Bank Accounts business flow will be automatically selected for enablement when you enable the Funds Disbursement, Funds Capture, or Bank Statement Processing flows.

- In order to see Business Intelligence reports related to this integration, assign the BI Administrator role to any user who needs to view them.

- Bell notifications with detailed messages are generated as processing occurs. If the enablement of a business flow doesn't complete, you receive a bell notification. Revisit the Manage Embedded Banking Configuration task to retry the process after 24 hours. If the issue still persists, reach out to Oracle Support for assistance.

Banks and Bank Accounts

- If you notice any issues with the bank account onboarding process, review the related setups in your Cloud ERP instance for possible mismatched or missing legal entity names, legal entities, business units, or other enterprise structures.

Funds Disbursement

- Use NURG as the service level code and delivery channel code as CCD, CCP, CTX, PPD, PPP and IAT for ACH transactions.

- Use URGP as the service level code for wire and cross-border transactions.

- Use CHK as the payment method alias for check payments.

- In the payment file, the Service Level Alias Value is sent as SvcLvl. The service levels are predefined with codes NURG, URGP, and so on. Use NURG for ACH and URGP for wire payments.

- Users can create their own payment process profile, but must use the preconfigured transmission setup related to this integration.

- For any transmission issues with outbound or inbound files, log a service request.

The bank generates up to three payment acknowledgment files during the clearing process:

- File Level Acknowledgment: This is generated by the bank within a few minutes of receiving the payment file. It only provides file level acknowledgment to confirm that the file schema or syntax is correct.

- Transaction Level Acknowledgment: This is generated by the bank within a few minutes of receiving the payment file. This acknowledgment provides the status at both the file and payment levels.

Once payment file processing is completed, the status of the payment file changes to "Completed and pending acknowledgment".

Acknowledgment file is automatically processed, and the payment file status changes to "Acknowledged" or "Rejected" depending on whether the bank accepts all, some, or none of the payments. At the same time, the payment status changes to "Acknowledged" or "Rejected" depending on whether the bank accepts or rejects the payment.

Users can configure the system to automatically void payments that have been rejected by the bank. Users can also configure the system to take automated action on the invoice to cancel or hold it when the payment is voided due to bank rejections.

This table summarizes the payment file and payment status after each step in acknowledgment processing:

|

Payment File Status |

Payment Status (IBY_PAYMENTS_ALL) |

Payment Status (AP_CHECKS_ALL) |

|

|

File Level – File accepted |

Acknowledged |

Acknowledged |

Negotiable |

|

File Level – Rejected |

Rejected |

Rejected / Voided |

Negotiable/Voided |

|

Transaction Level – All payments accepted |

Acknowledged |

Acknowledged |

Negotiable |

|

Transaction Level – Some payments rejected |

Acknowledged |

Respective payments are changed to rejected / voided status |

Negotiable/Voided |

Funds Capture – Lockbox

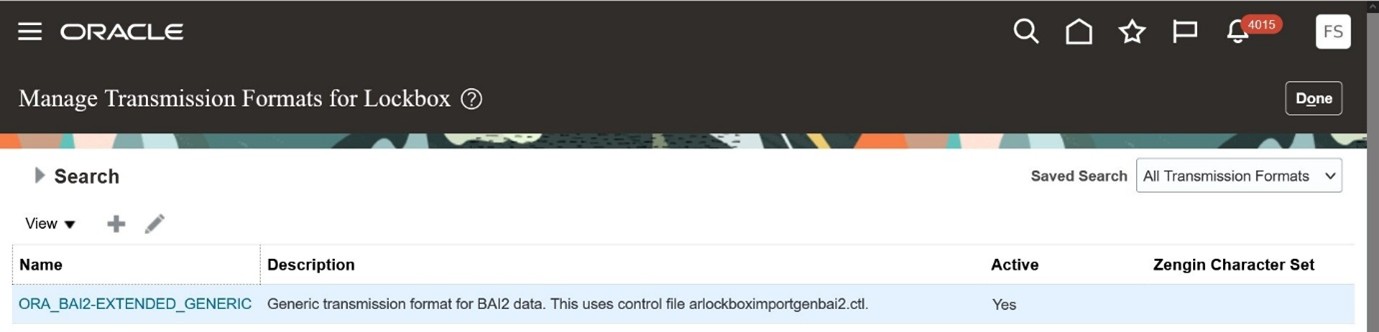

- The ORA_BAI2-EXTENDED_GENERIC/arlockboximportgenbai2 is the only supported lockbox transmission format for BOFA integration. This format uses the control file arlockboximportgenbai2.ctl.

- Before you initiate bank account onboarding for lockbox, verify that the fields in the Default Accounting for Lockbox Receipts section of the Cash Processing tab in Receivables System Options are completed for the applicable business unit. This is a required step for the bank account onboarding process to create the related lockbox setups.

- Review and test the predefined setups generated during the onboarding process. You can also create new ones according to your business requirements.

- AutoMatch Rule Set – ORA_Automatch 90% (AutoMatch above 90% threshold)

Task - Manage AutoMatch Rule Sets

- AutoCash Rule Set – ORA_Invoice Match (Directly match receipt to invoice)

Task - Manage AutoCash Rule Sets

- Transmission Format – ORA_BAI2-EXTENDED_GENERIC

NOTE: This setup is for informational purposes only and should not be changed.

Task - Manage Transmission Format for Lockbox

Bank Statement Processing

- For foreign currency transactions, create tolerance rules and attach to the matching rule set for processing the automatic reconciliation of foreign transactions.

- Attach the cash and cash clearing accounts on the bank accounts to create accounting for the cleared events of payments and receipts.

- Attach the charge and cash account code combinations on the bank statement transaction creation rules to create the accounting for the external transactions generated for the bank charges or fees.

- Update Void Rejected Payments option at the bank account level to automatically void the original payments that are unreconciled after reconciling the reversal bank statement lines,

- Enable the reversal processing method for the receipt action after reconciling the direct debit return bank statement lines.

Key Resources

- Refer to the resources to Use Promotion Codes

Access Requirements

You must have the Financial Application Administrator job role to establish connectivity with BOFA and to review all related predefined and automatically configured Functional Setup Manager tasks.