Accounting Event Exclusion for Adjustment-Only Accounting Method Representation

Exclude specific event types from accounting in external and Oracle subledgers within an accounting method. This allows flexible accounting definitions for specialized accounting treatments and delta processing between primary and secondary ledgers, ensuring complete financial statements.

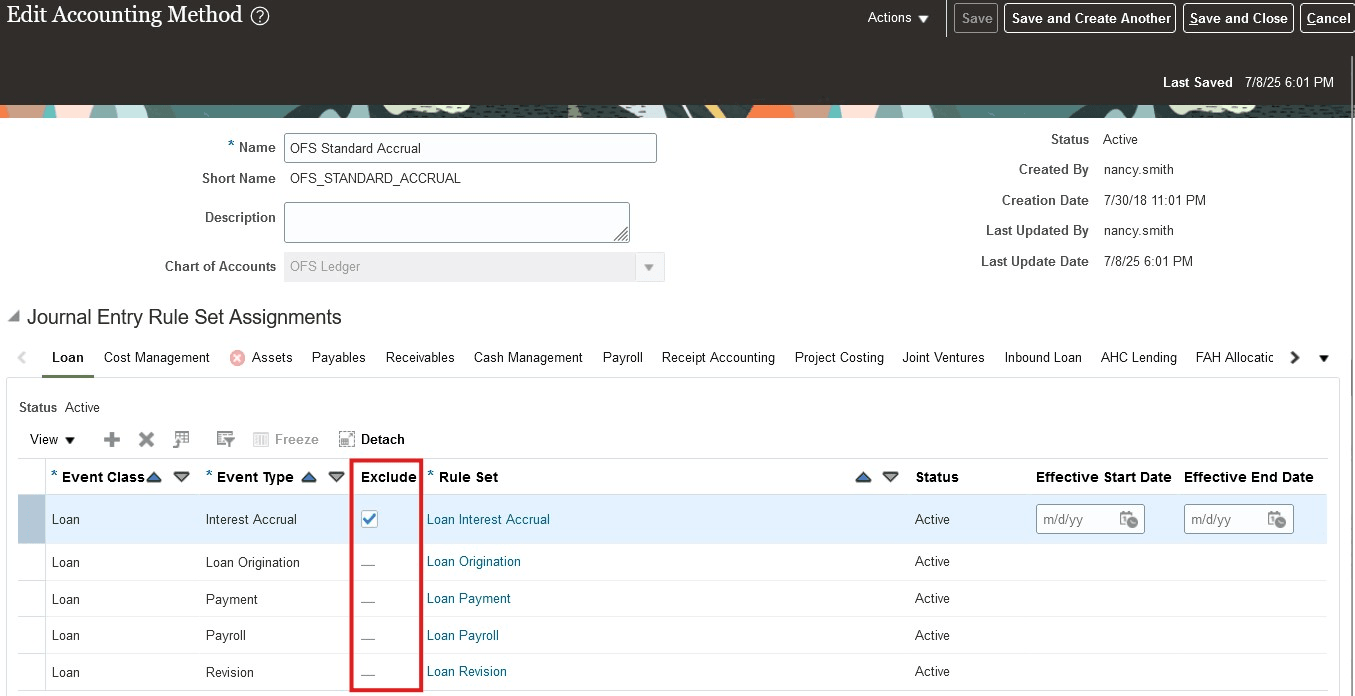

To meet the need for real-time insights and accommodate specific conventions, organizations need flexibility in accounting event processing. Use the new Exclude column in the Journal Entry Rule Set Assignments section of the Accounting Method page to customize accounting preferences. This column facilitates the enabling or disabling of accounting for individual journal entry rule set assignments within a user-defined accounting method. The default configuration ensures that for existing and newly created accounting methods, the Exclude value is set to unchecked for all journal entry rule set assignments, thereby ensuring that accounting entries are generated for all event types unless specified otherwise.

Upon updating the Exclude value to checked for a particular journal entry rule set assignment, the Create Accounting process is designed to omit the generation of accounting entries for the associated event types.

NOTE: The Rule Set value must be entered for an assignment in the Journal Entry Rule Set section of Accounting Method page even if the assignment is excluded from accounting.

Exclude column in Journal Entry Rule Set Assignments section

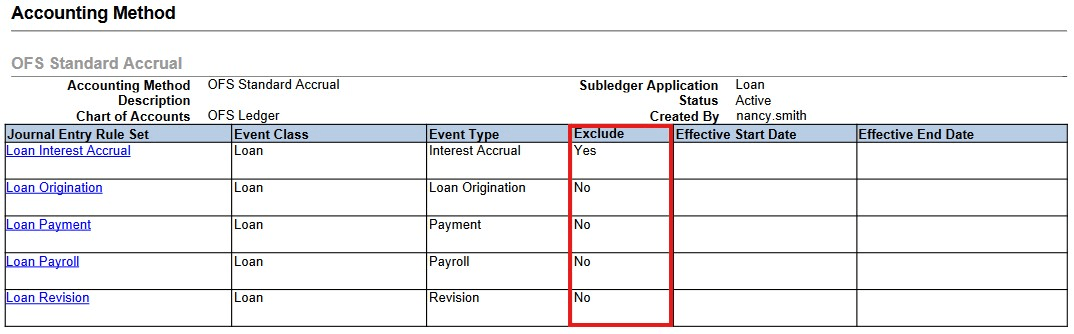

The Subledger Accounting Method Setups Report is also updated to report the value entered for the Exclude column in the Accounting Method section.

Exclude column in Subledger Accounting Methods Setup Report

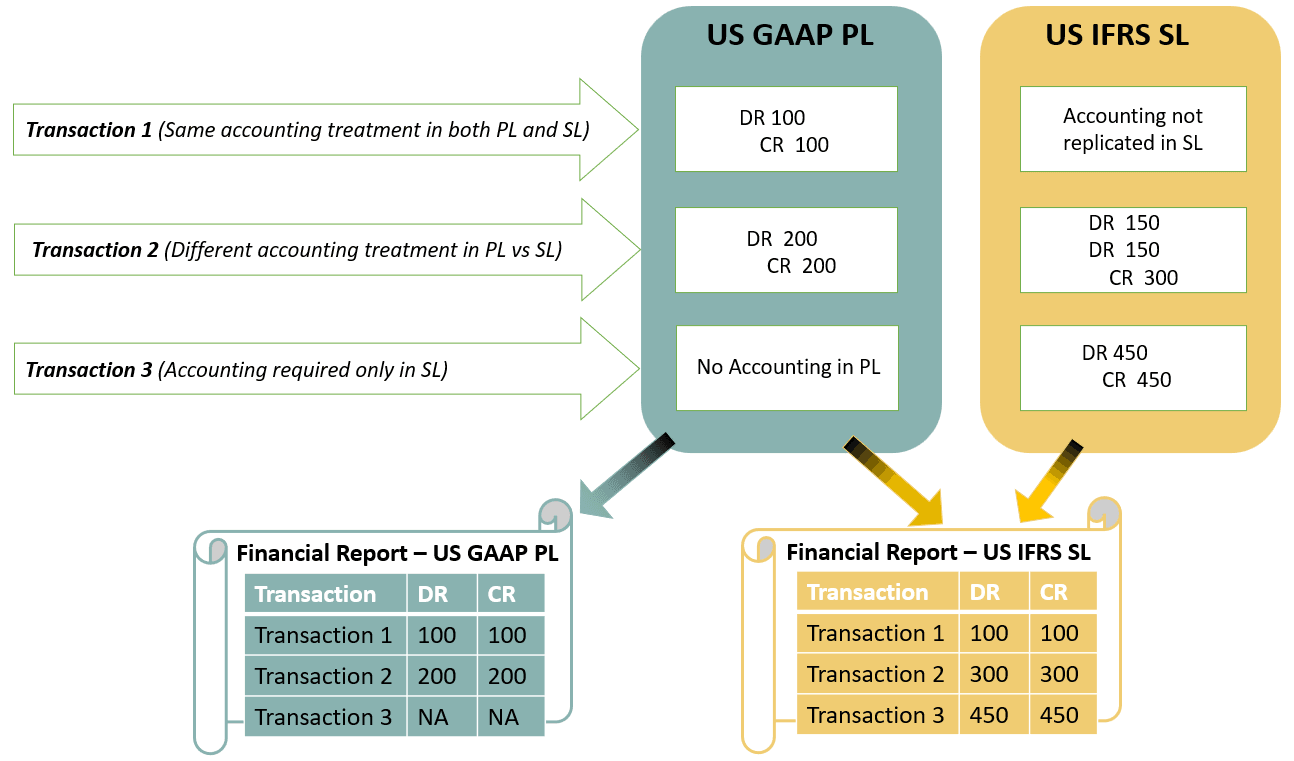

This feature can be used to optimize accounting data volume by transitioning to a Delta Ledger configuration. In this approach, all common accounting entries are stored solely in the primary ledger and only the differential entries are captured in secondary ledgers, significantly reducing redundant data replication and improving efficiency.

For example -

- If a transaction’s accounting treatment is the same across all ledgers, it is recorded only in the primary ledger. See Transaction 1 in illustration below.

- If differences exist (e.g., between primary and a specific secondary ledger like US IFRS), those differences are stored only in the relevant secondary ledger. See Transaction 2 in illustration below.

- Transactions unique to secondary ledgers which were earlier captured only using Valuation Method enabled secondary ledgers can now be captured directly through the primary ledger and the exclude option can be used to exclude accounting in primary ledger while accounting them in Non-Valuation Method secondary ledgers. See Transaction 3 in illustration below.

Delta Ledger Configuration Illustration

Business Benefit:

Ensures accuracy and compliance in accounting of subledger transactions with minimal overhead.

Steps to Enable and Configure

Use the Opt In UI to enable this feature. For instructions, refer to the Optional Uptake of New Features section of this document.

Offering: Financials No Longer Optional From: Update 26C

Tips And Considerations

- Caution should be exercised when updating the Exclude value for accounting events which have a downstream impact.

- In certain cases where business flow is used to link journal line rules and derive specific accounting attributes from the upstream event accounting entries (such as Payables Invoice Validation and Payment Creation events), the journal line rules will have to be modified accordingly for the downstream event to generate the accounting entries independent of the upstream event.

- It is also important to note that using this feature to meet cash basis accounting requirements in a primary ledger may result in incompatibility with certain subledgers, such as Project Management, especially when Payables Invoice or Cost/Receipt accounting events are excluded from accounting.

- In a Primary and Secondary Ledger configuration, manual adjustments may be required for downstream events if the upstream event is excluded from accounting in secondary ledger.

- Setup changes after updating the Exclude value may take up to an hour to reflect in the Online Accounting process, and the Create Accounting batch process can be utilized during this period.

- Alternatively, the Provide Online Transaction Engine Functionality processes may be canceled, and online accounting can be resubmitted to apply the setup changes.

- The Create Multiperiod Accounting process is unaffected by the Exclude value. This ensures that multiperiod recognition accounting entries can be generated if accounting was generated for the accrual event, regardless of any subsequent changes to the exclusion status of that event.

- If audit is enabled, updates made to the Exclude value for journal entry rule set assignments are audited.

Access Requirements

No new access requirements