Receivables Receipt Processing with Withholding Tax Amounts for India

Record and apply receipts that have been reduced by withholding tax amount as determined and calculated by the customer. Close the remaining receivables balance, and reconcile the withheld tax as an advance payment to the tax authorities in India.

Use the Create Receipt and Manage Receipt pages to manually create withholding activities. This process increases the unapplied cash on the receipt and allows you to apply the outstanding withholding balance against sales invoices, thereby reducing the outstanding amount and receivables balance.

Use the Withholding Reconciliation page or the Reconcile Withheld Amounts for Receipts process to reconcile withholding receipts with periodic Form 26AS statements in India.

Record, apply, and account for receipt withholding activities using different solution options, depending on internal business processes or customer communication scenarios for withholding confirmation.

Receipt Withholding - Header Level

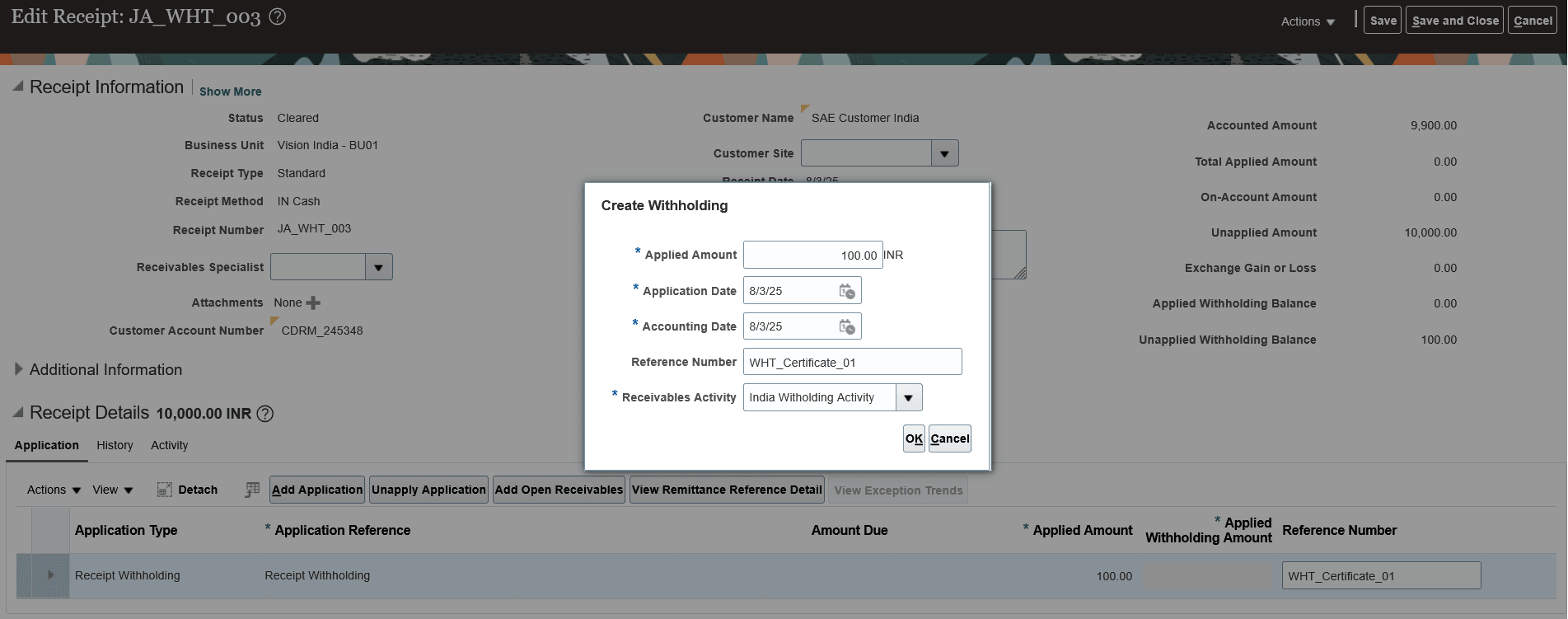

Manually create a separate withholding activity for Receipt Withholding type to track amounts withheld on the receipt when there is no customer confirmation of the specific transactions to which the withholding balance should be applied.

The withheld amount is recorded for accounting and reconciliation purposes. Both the unapplied withholding balance and the total unapplied balance of the receipt are increased accordingly.

Manually create withholding activity for Receivables receipt using Edit Receipt page

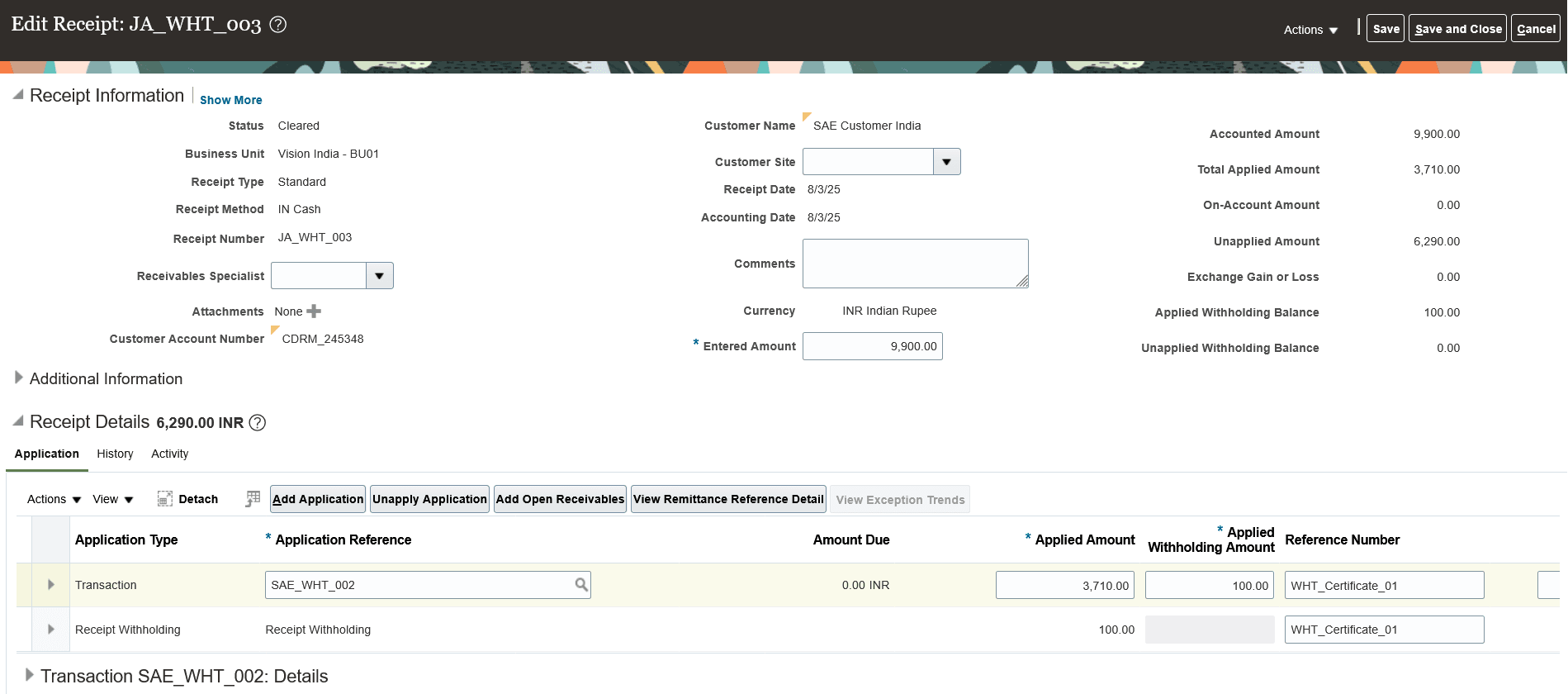

Apply the receipt balance to specific open receivable transactions when confirmed by the customer. In addition to the applied amount, enter the applied withholding amount on the transaction application line and ensure that the applied amount includes the applied withholding amount.

Manually apply withholding activity to Receivables transaction using Edit Receipt page

The outstanding withholding balance for the receipt and the amount due on the receivables transaction will be decreased accordingly.

Sample Scenario: Use the Receipt Withholding Header Level option to account for and reconcile receipts in India that have only a withholding balance.

Receipt Withholding - Transaction Level

Create withholding activity for receipts when both the withheld amounts and the specific open receivable transactions to which the withholding balance must be applied are confirmed by the customer.

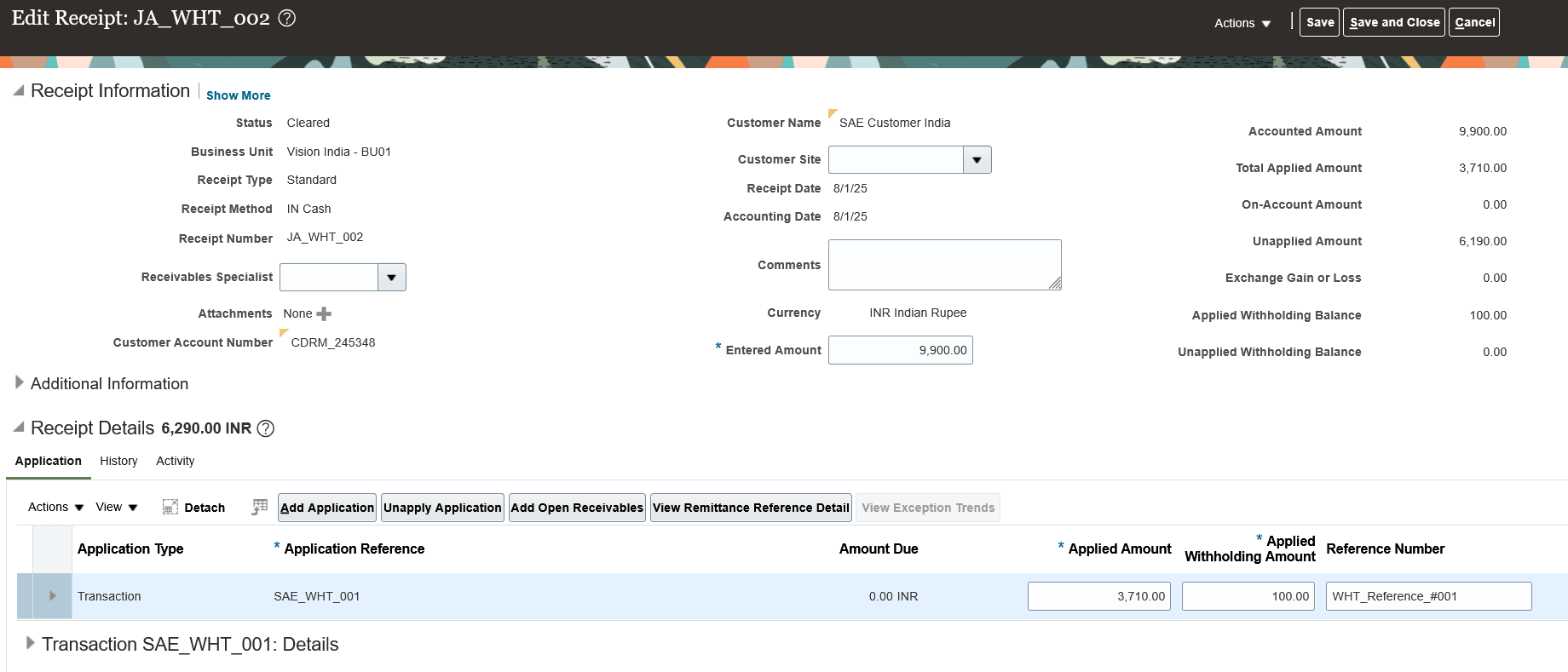

Use the standard open receivable transaction application process, and in addition to entering the applied amount on the application line, also enter the applied withholding amount. Ensure that the applied amount includes the applied withholding amount.

Enter applied withholding amount for a transaction application line using the Edit Receipt page.

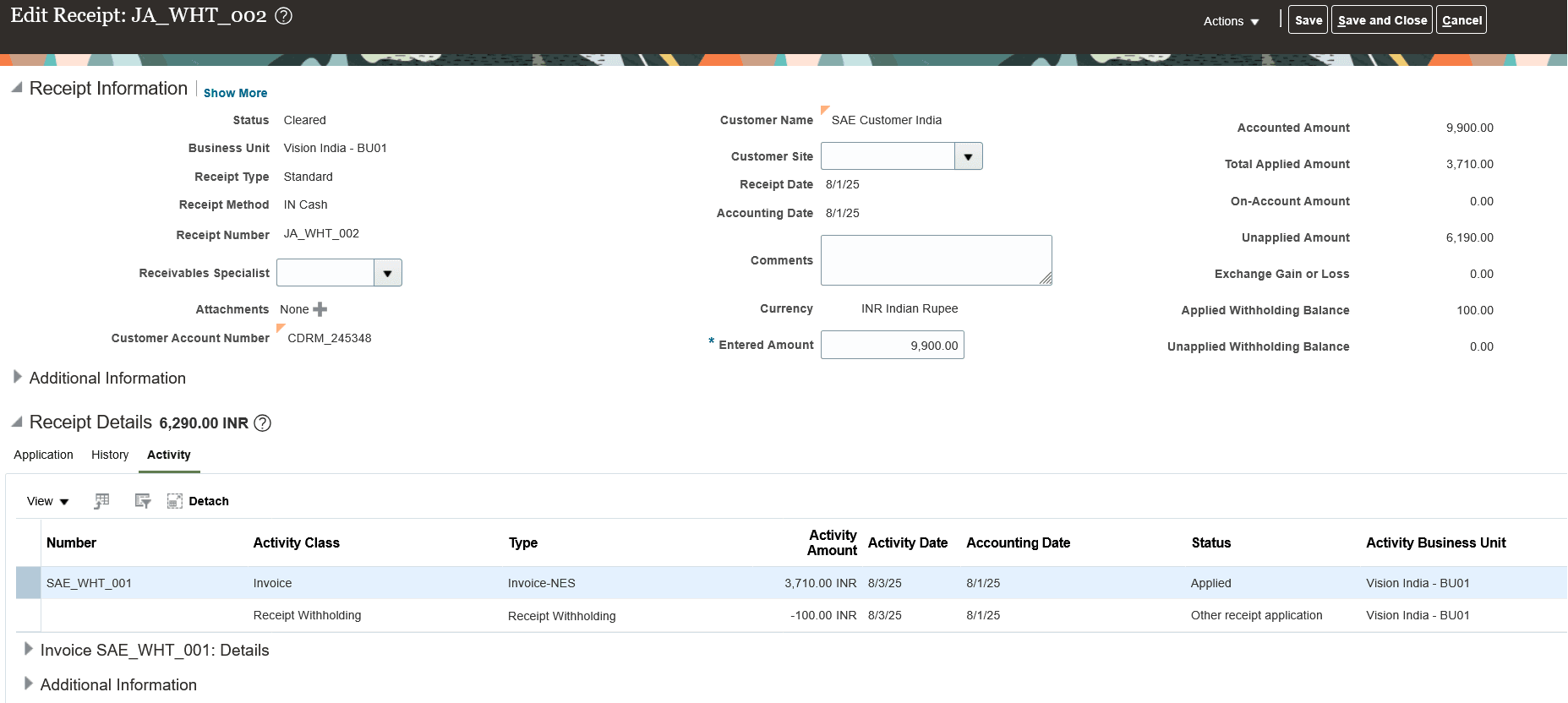

The withholding activity for the receipt is created automatically, linked to the transaction application line, and the receipt’s applied withholding balance is increased.

Review automatically created withholding activity for transaction application line.

Sample scenario: Use the Receipt Withholding Transaction Level option for receipts that were applied to transactions before the withholding balance was confirmed by customer.

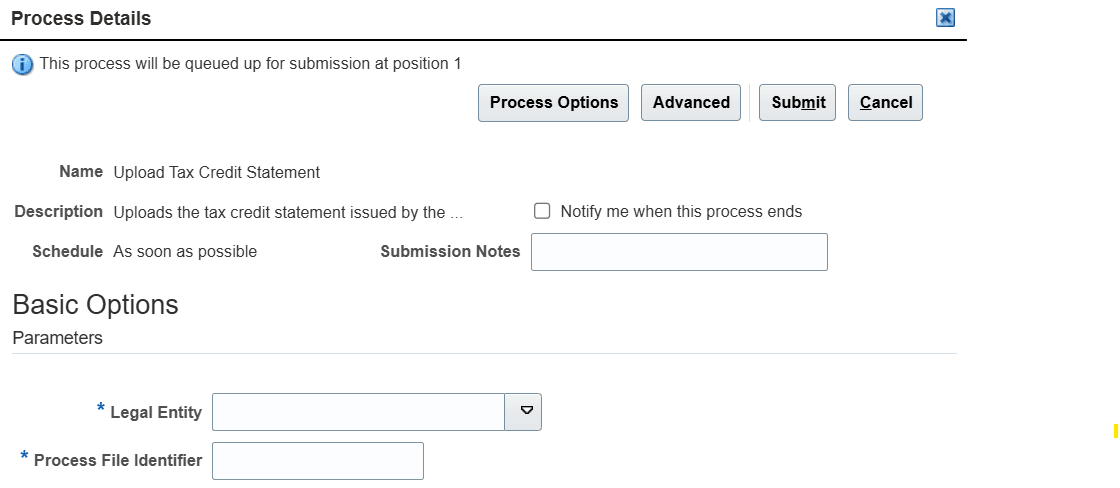

Upload of Form 26AS

Use the Upload Tax Credit Statement process to upload Form 26AS entries. Download Form 26AS from the income tax portal and save it in CSV format without password protection before uploading it to UCM. The process will select only entries marked as Status ‘F’ and store the summary amounts of TDS deposited for each customer for the respective financial year.

Upload Tax Credit Statement Process

The Process File Identifier is the Content ID generated when the Form 26AS CSV file is uploaded to UCM.

Receipt Withholding Reconciliation with Form 26AS

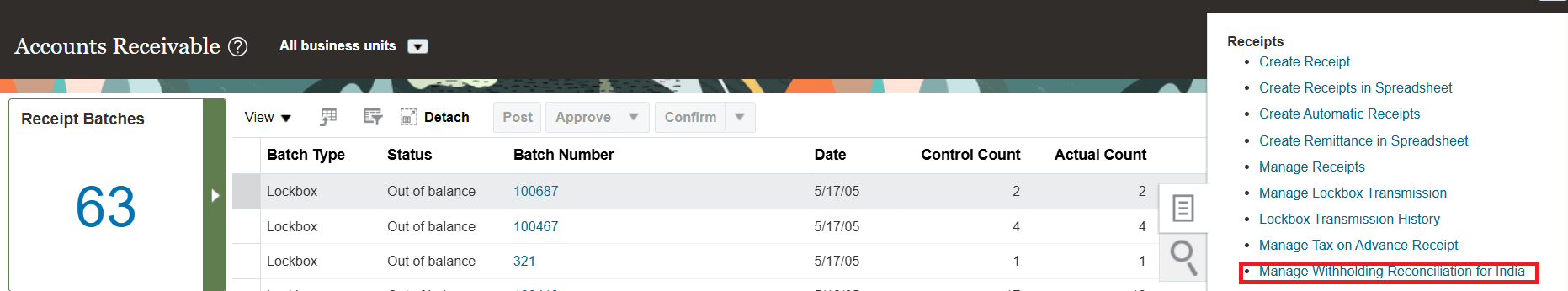

Use the Withholding Reconciliation page or the Reconcile Withheld Amounts for Receipts process to reconcile withholding receipts with periodic Form 26AS statements in India.

You can access the page by selecting Manage Withholding Reconciliation for India from the Receipts task list.

Manage Withholding Reconciliation for India Task List Menu Item

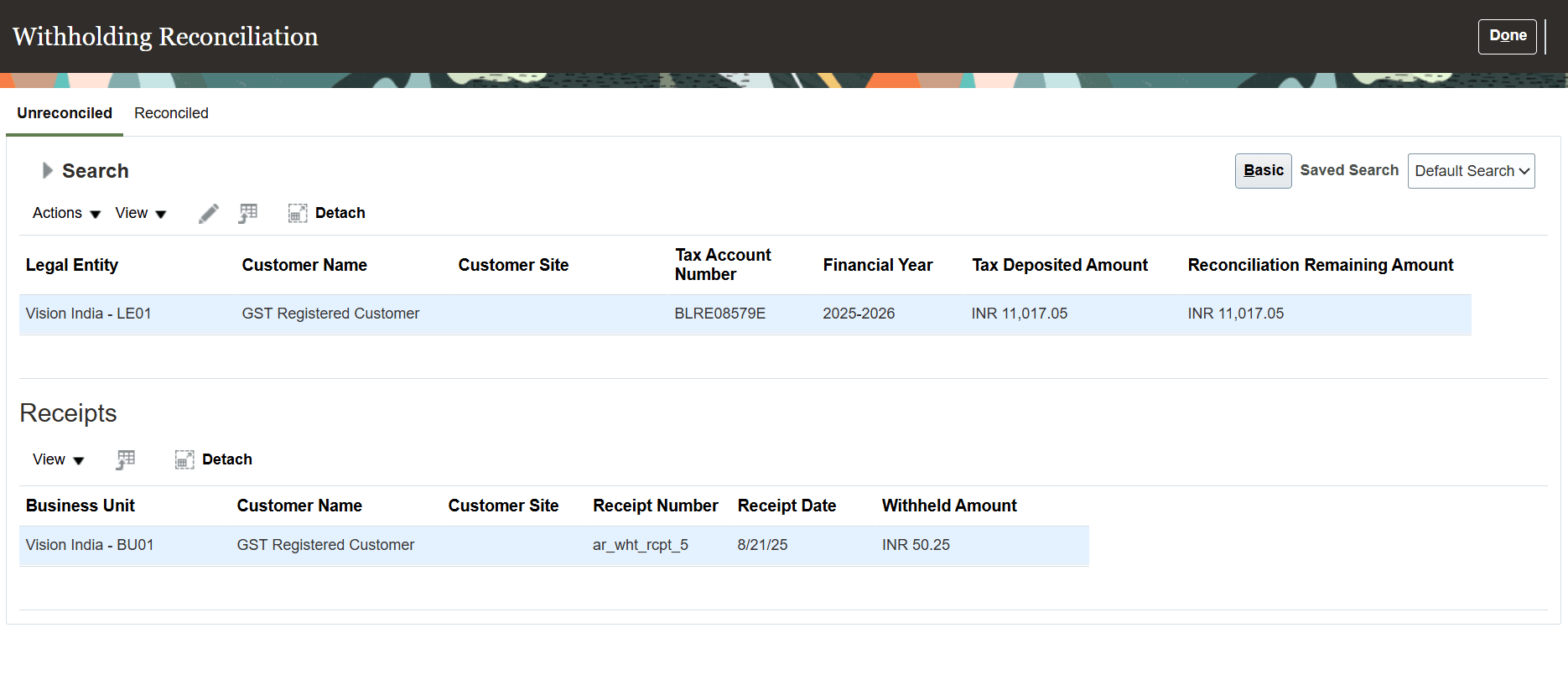

The page displays the TDS amounts for a customer for a given financial year, along with receipts that have withheld activities and are available for reconciliation.

Withholding Reconciliation Page

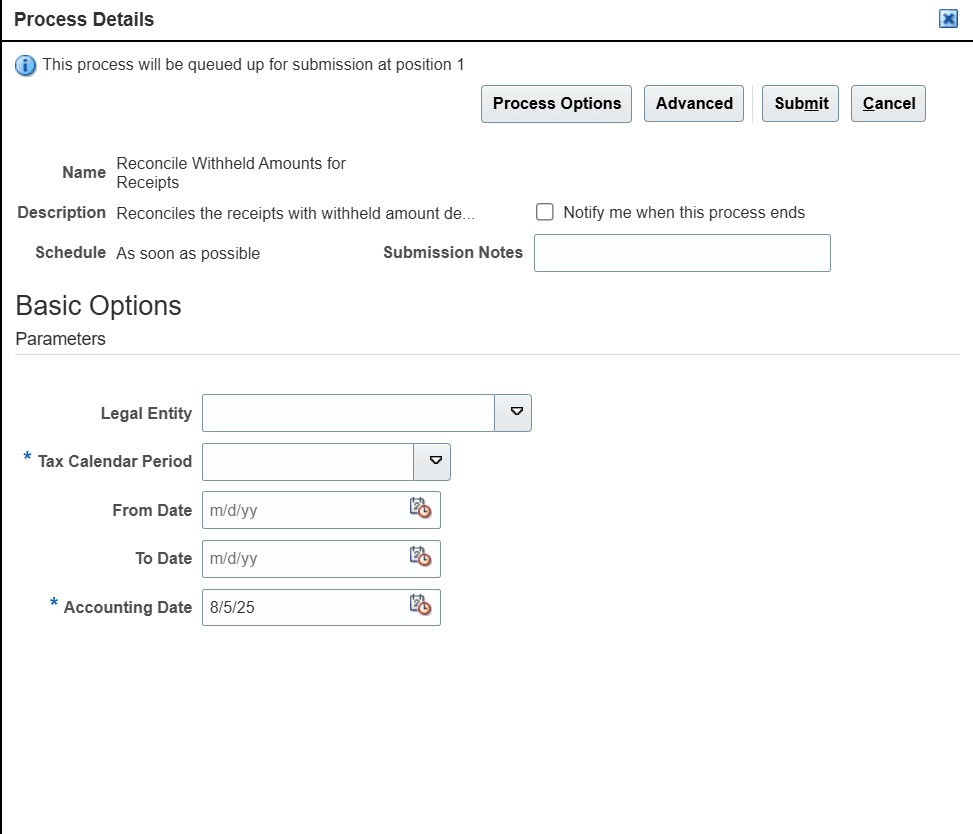

Use the Reconcile Withheld Amounts for Receipts process to reconcile a large number of receipts simultaneously.

Reconcile Withheld Amounts for Receipts Process

These are the business benefits for customers when using this feature:

- Comply with tax regulations for customer-deducted withholding tax (TDS) in India.

- Streamline your collections and reconciliation processes for receipts with withheld amounts.

- Optimize the monitoring and control of applied and unapplied withholding balances for receipts.

Steps to Enable and Configure

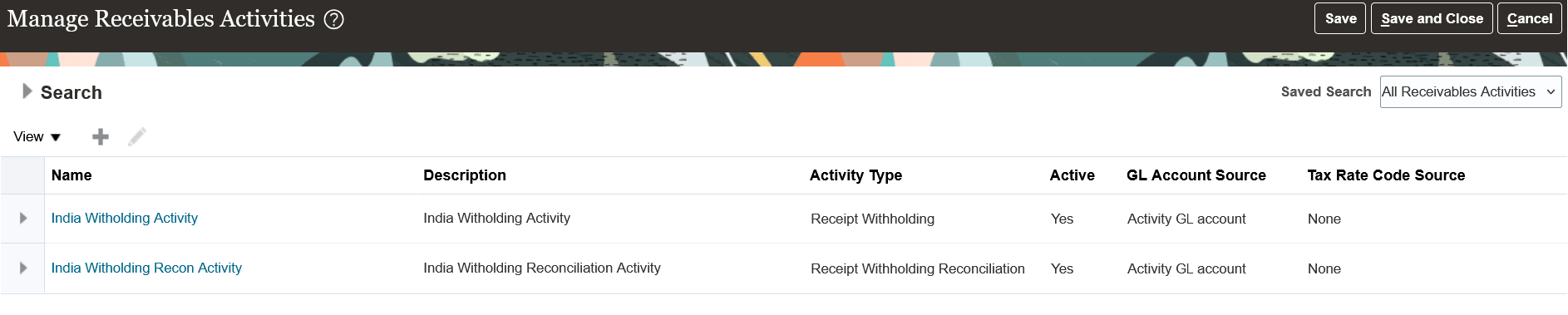

To enable this feature, you need to create two Receivables Activities: Receipt Withholding and Receipt Withholding Reconciliation.

Create Receivables Withholding Activities

Use the Manage Receivables Activities page to create withholding receivables activities for each business unit, which facilitates the creation and reconciliation of withholding balances on receivables receipts.

Steps to Create Withholding Receivables Activities:

- Open the Create Receivables Activity or Manage Receivables Activities page to create new activities.

- Set the Activity Type to:

- Receipt Withholding for withholding creation activity.

- Receipt Withholding Reconciliation for withholding reconciliation with certificate activity.

- Set the GL Account Source field to Activity GL Account.

- In the Activity GL Account field, enter the appropriate general ledger (GL) account for withholding distributions:

- Withheld Amount Clearing GL Account for Receipt Withholding activity

A dedicated GL account used to record withholding balances associated with receipts that have not yet been reconciled with Form 26AS certificates. - Withheld Amount Prepaid GL Account for Receipt Withholding Reconciliation activity

A dedicated GL account used to record withholding balances associated with receipts that have been reconciled with Form 26AS certificates.

- Withheld Amount Clearing GL Account for Receipt Withholding activity

- Set the Tax Rate Code Source field to None.

- Mark the activity as Active.

Create Receivables Activities for Receipt Withholding and Receipt Withholding Reconciliation

Setup for Withholding Reconciliation

Legal entity setup

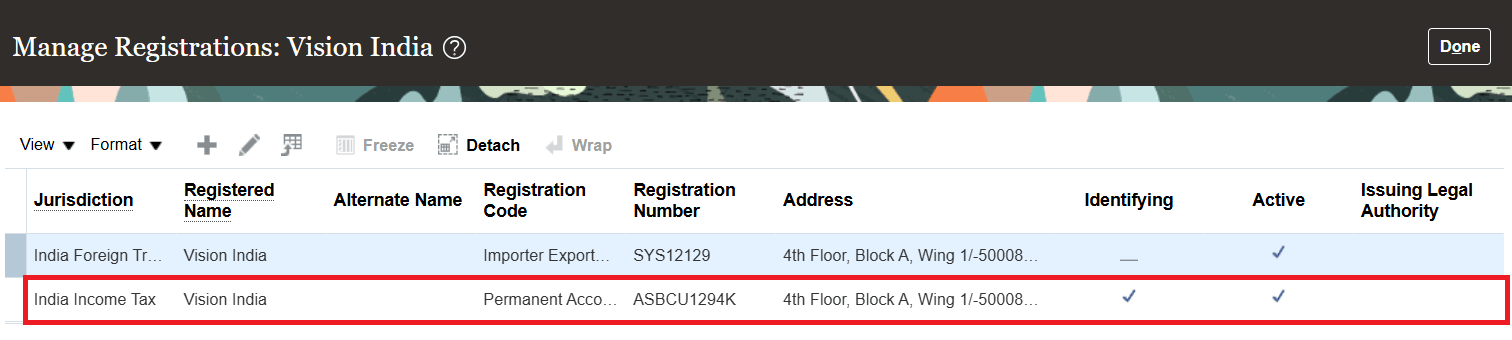

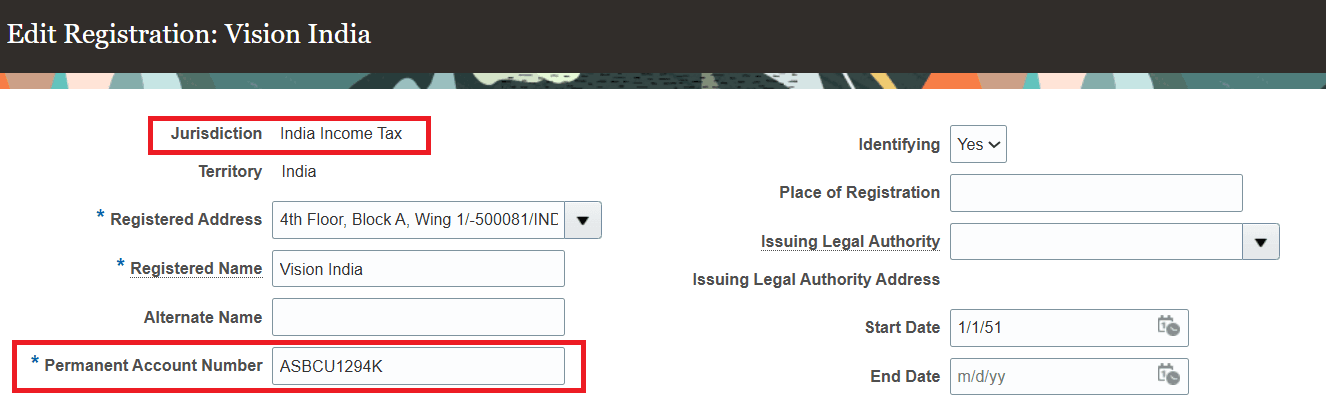

Define a Permanent Account Number (PAN) for the legal entity using the FSM task Manage Legal Entity Registrations. The PAN will be used by the process that loads Form 26AS entries to match the legal entity. Ensure the registration is defined for the jurisdiction "India Income Tax".

PAN Setup for Legal Entity

PAN Setup Registration Details for Legal Entity

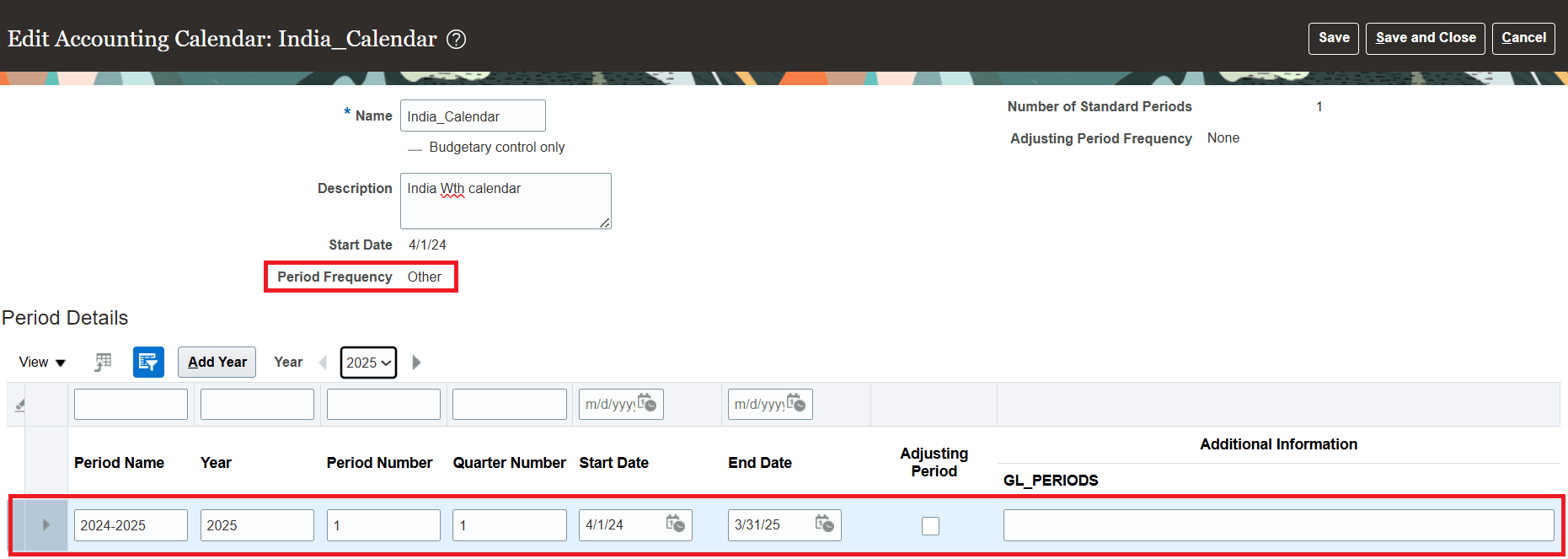

Define accounting calendar

Use the FSM task Manage Accounting Calendars to define an accounting calendar that aligns with the financial year in India, which starts on April 1 and ends on March 31 of the following year.

Period names should follow the format YYYY-YYYY+1 (e.g., 2024-2025). to align with the Form 26AS format.

Accounting Calendar Setup

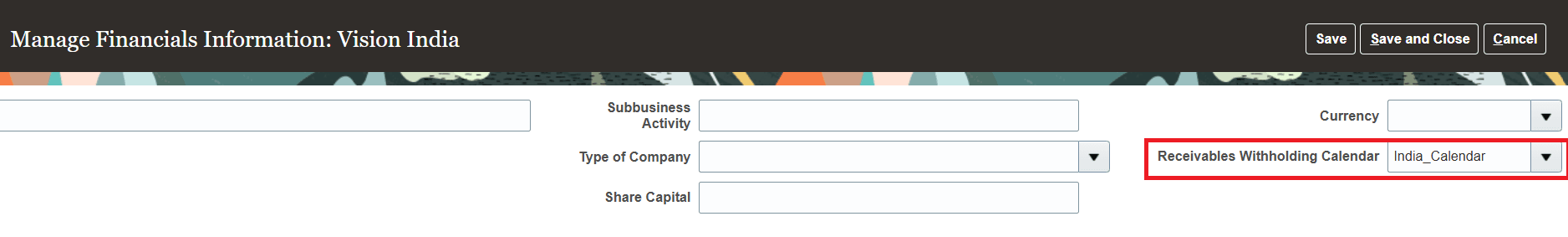

Associate the calendar with the legal entity using the FSM task Manage Legal Entity Financial Information.

Association of Calendar with Legal Entity

Customer TAN setup

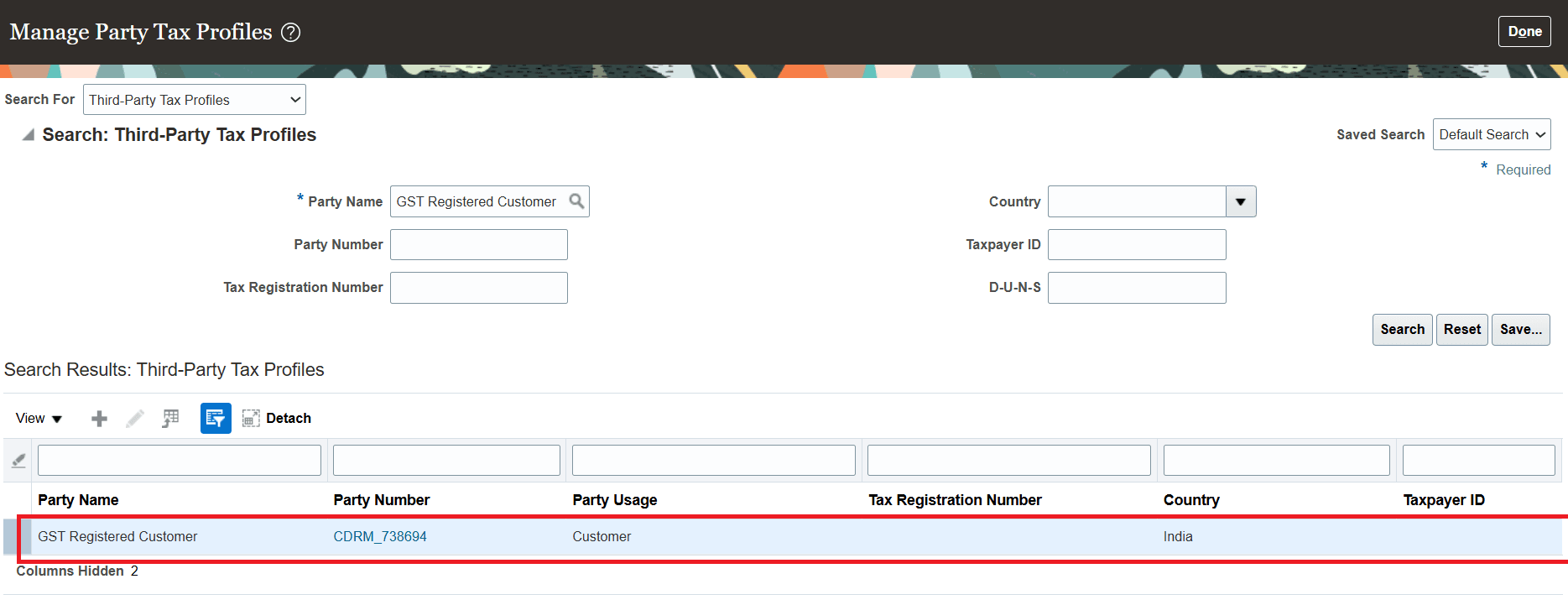

Create a party tax profile for the customer using the FSM task Manage Party Tax Profiles.

Third-Party Tax Profile Setup for Customer

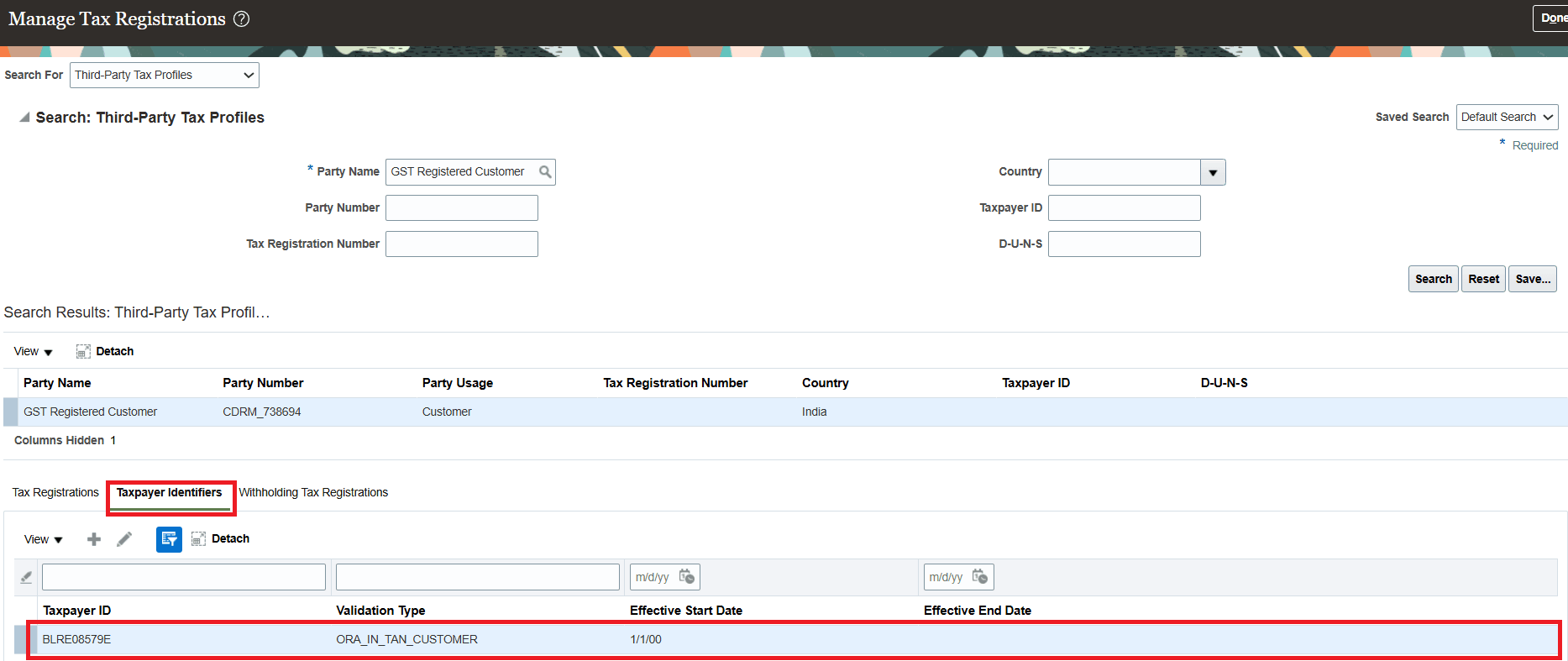

Define the TAN using the FSM task Manage Tax Registrations on the Taxpayer Identifiers tab.

TAN Setup for Customer

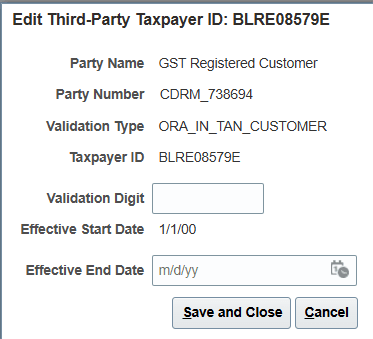

TAN Setup Details for Customer

TAN can be defined either at the customer (party) or customer site level.

Tips And Considerations

- A single receipt may have multiple withholding activities, each representing a different withholding type.

- In the Receipt Withholding Transaction Level scenario, withholding activities are created automatically for the applied withholding amount. To unapply the withholding, set the applied withholding amount to zero.

- You cannot use both the Receipt Withholding Transaction Level and the Header Level options on the same receipt.

- You can create and apply receipts with a withholding balance across multiple transactions only within the same customer Business Unit.

- The applied amount on a transaction application line includes the applied withholding amount for that line and cannot be less than the applied withholding amount.

- In the Receipt Header Level Withholding scenario, even if a transaction application line includes an applied withholding amount, there is no link between the withholding activity line and the transaction application line.

- Ensure that withholding activity is created and applied based solely on customer confirmation, which in India is typically not formalized and may be provided via email, phone call, PDF remittance, or similar methods.

- Unapply the withholding activity before making any changes to the receipt (such as reversing, adjusting, or refunding), and ensure that any changes are communicated to the customer who previously confirmed the withholding for the receipt.

- You cannot change a receipt that contains withholding activities that are partially or fully reconciled with a Form 26AS certificate. Unreconcile the receipt on the Withholding Reconciliation page to proceed with any required changes, such as reversing, adjusting, or refunding the receipt.

- Foreign currency withholding receipts are not supported in the current release.

Access Requirements

-

No new access requirements required to manually create and apply withholding activity on Receivables Receipts.

-

Access to Withholding Reconciliation (India):

- To enable user access to the Withholding Reconciliation page, create a custom role that includes the JA_MANAGE_ADVANCE_RECEIPT_TAX_FOR_INDIA_PRIV

privilege and assign this role to the relevant user.

- To enable user access to the Withholding Reconciliation page, create a custom role that includes the JA_MANAGE_ADVANCE_RECEIPT_TAX_FOR_INDIA_PRIV

- Access to Reconcile Withheld Amounts for Receipts and Upload Tax Credit Statement Process (India):

- For users requiring access to the Reconcile Withheld Amounts for Receipts process and the Upload Tax Credit Statement process, create a custom role that includes the JA_REPORT_GOODS_SERVICES_TAX_LIABILITY_FOR_INDIA_PRIV privilege and assign it to the user. If the reports can’t be accessed, add the JE_CREATE_TURNOVER_REPORTING_FOR_ITALY_PRIV to the custom role.