Embedded Banking Services with PNC Bank: Positive Pay File Enhancements

Oracle B2B is a component of the Cloud ERP solution. The Embedded Banking Services with PNC Bank deliver turnkey banking and payment services directly within Cloud ERP for mutual customers worldwide. This solution includes bank account master data synchronization, simplified setup and processing of funds capture, disbursement with related acknowledgments, and automated bank statement processing and reconciliation.

As part of the 25D update, PNC Bank Positive Pay file for in-house check printing is included.

Positive Pay is a fraud prevention service that requires sending a file containing details of issued checks to the bank on a regular basis. This allows the bank to validate checks presented for payment against those issued, ensuring that only authorized checks are processed.

With this update, customers who print checks in-house can strengthen their fraud prevention efforts using the newly available, preconfigured Positive Pay template for PNC Bank, combined with automated file transmission.

The key benefits include:

- Strengthened fraud prevention by ensuring that only authorized checks are processed by the bank.

- Automated transmission of issued check details to PNC Bank, reducing manual intervention and minimizing human error.

- Streamlined implementation through a preconfigured Positive Pay template tailored for PNC Bank.

- Enhanced efficiency in in-house check processing with integrated fraud prevention controls.

- Improved compliance with bank fraud prevention protocols via system-driven, automated processes.

- Greater financial control and payment security for organizations managing their own check issuance.

Steps to Enable and Configure

To enable this feature you need to log a Service Request (SR).

This new feature allows the generation of the positive pay file in XML format for the checks printed in-house by customers.

Predefined Values:

- Format – PNC Positive Pay File Format

- Transmission configuration - PNC Positive Pay File Outbound

The in-house check printing setup needs to be done manually. To set up in-house check printing:

- Create a check template:

- Create a template as per PNC-specific format for in-house check printing.

- Upload the template in the BI Publisher.

- Create a check format:

- Create a format by attaching the check template created in the previous step.

- Attach the following predefined validations:

- Payment Method Alias: CHK.

- Enable either Payer BIC or Branch Number.

- Enter a Logical Group Reference Number. (PNC follows the ISO20022 format for positive pay files and requires the logical group reference value.

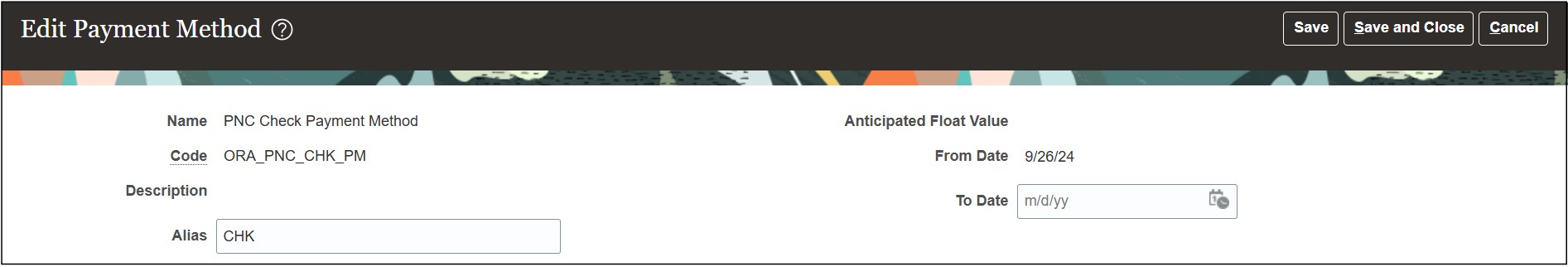

- Create a payment method:

Create or update payment methods used for PNC in-house check printing by setting the alias value to CHK.

Payment Method

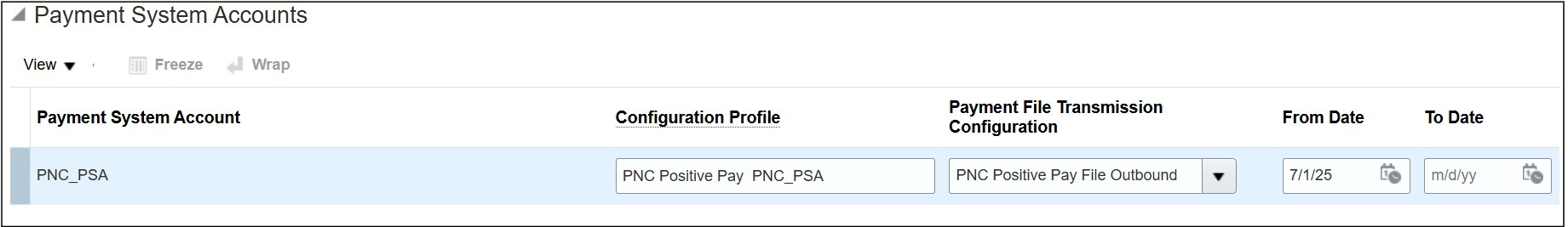

Setup Payment Process Profile used for PNC in-house check printing:

- Payment system tab:

- Select the payment system as PNC_PSA.

- Select the payment system account as PNC Positive Pay PNC_PSA.

- Select the Payment Transmission configuration as PNC Positive Pay File Outbound.

Payment System Tab

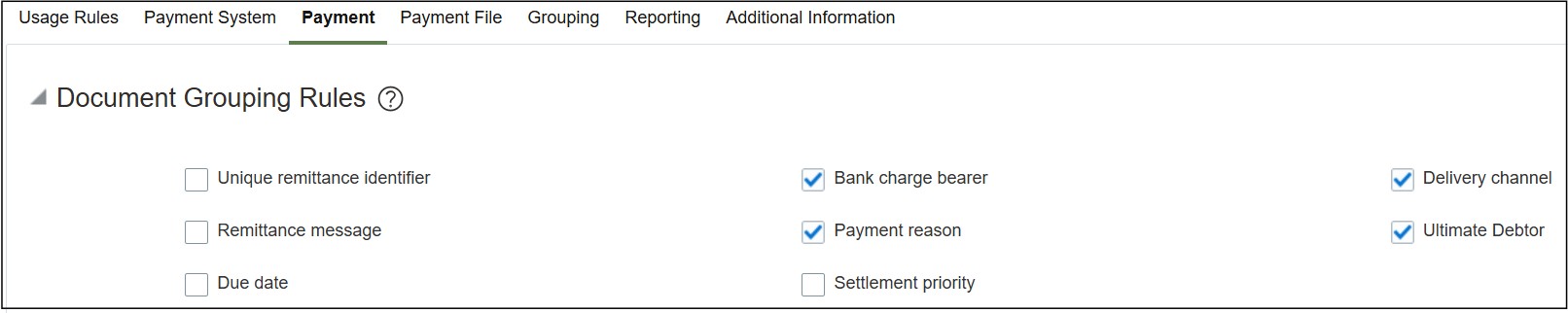

- Payment tab - Enable the 'Document grouping rules' - Ultimate Debtor, Bank Charge Bearer, Payment reason, and Delivery channel.

Payment Tab

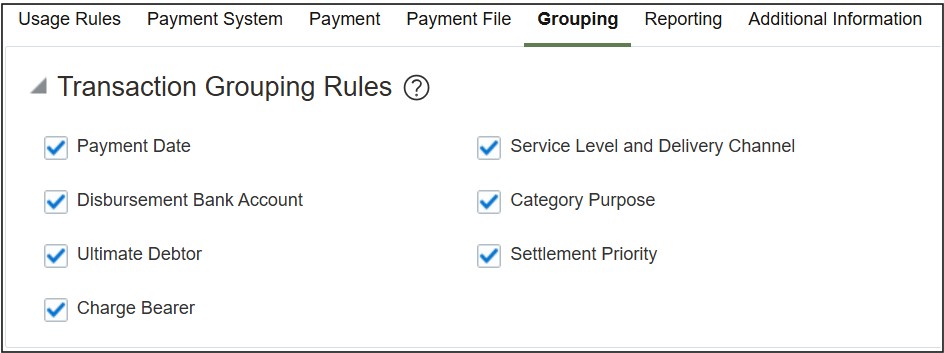

- Grouping tab:

Enable all of the Transaction Grouping Rules options.

Grouping Tab

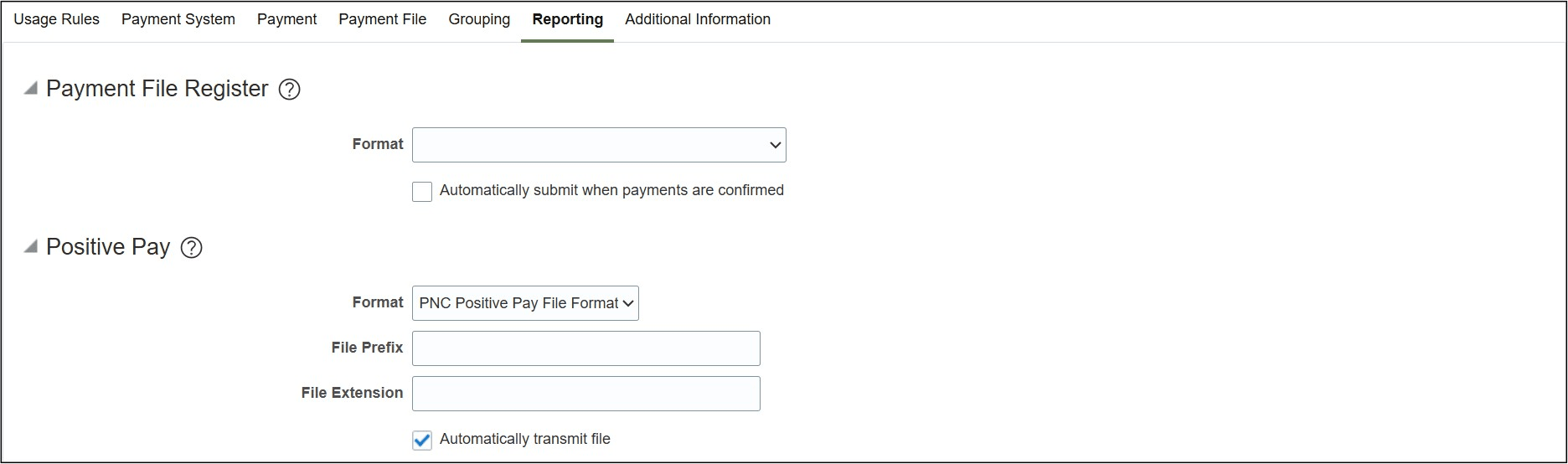

- Reporting tab:

In the Positive Pay section:

- In the Format field, Select PNC Positive Pay File Format.

- Enable the Automatically transmit file option.

Reporting Tab

Based on the number of invoices that can be included in the physical check, perform the setup for the remittance stub in the payment document setup.

Tips And Considerations

- Check printing by third parties isn’t supported for positive pay through Oracle B2B. The steps outlined in this document apply to first-party check printing only.

- PNC supports the ISO20022 format for the positive pay file.

- The Positive pay file needs to be transmitted automatically after the payment file is confirmed.

- Exception in Positive Pay File Generation: If the Create Positive Pay File process ends in error, the process must be repeated. Positive pay file cannot be submitted manually. In this case, all payments in the file must be voided, and a new Payment Process Request (PPR) submitted to regenerate the payments.

- You can't generate a positive pay file for single or pay-in-full payments.

- PNC supports acknowledgment processing against the positive pay file. Oracle does not currently support acknowledgment processing.

- PNC positive pay file is supported for generating checks with Negotiable status only.

Key Resources

Access Requirements

You must have the Financial Application Administrator job role to establish connectivity with PNC Bank and to review all related predefined and automatically configured Functional Setup Manager tasks.