Total Claim Amount for Multiple TRU Scenarios

For employees that are paid in more than one TRU at the same time, the Total Claim amount should only be applied for their primary TRU tax calculation. This is to avoid applying the Total Claim Amount more than once for the same employee, therefore under-deducting Federal Tax. To accomplish this, a new checkbox called “Apply Zero Total Claim Amount” was added to the employee’s Tax Credit Information page for professional users.

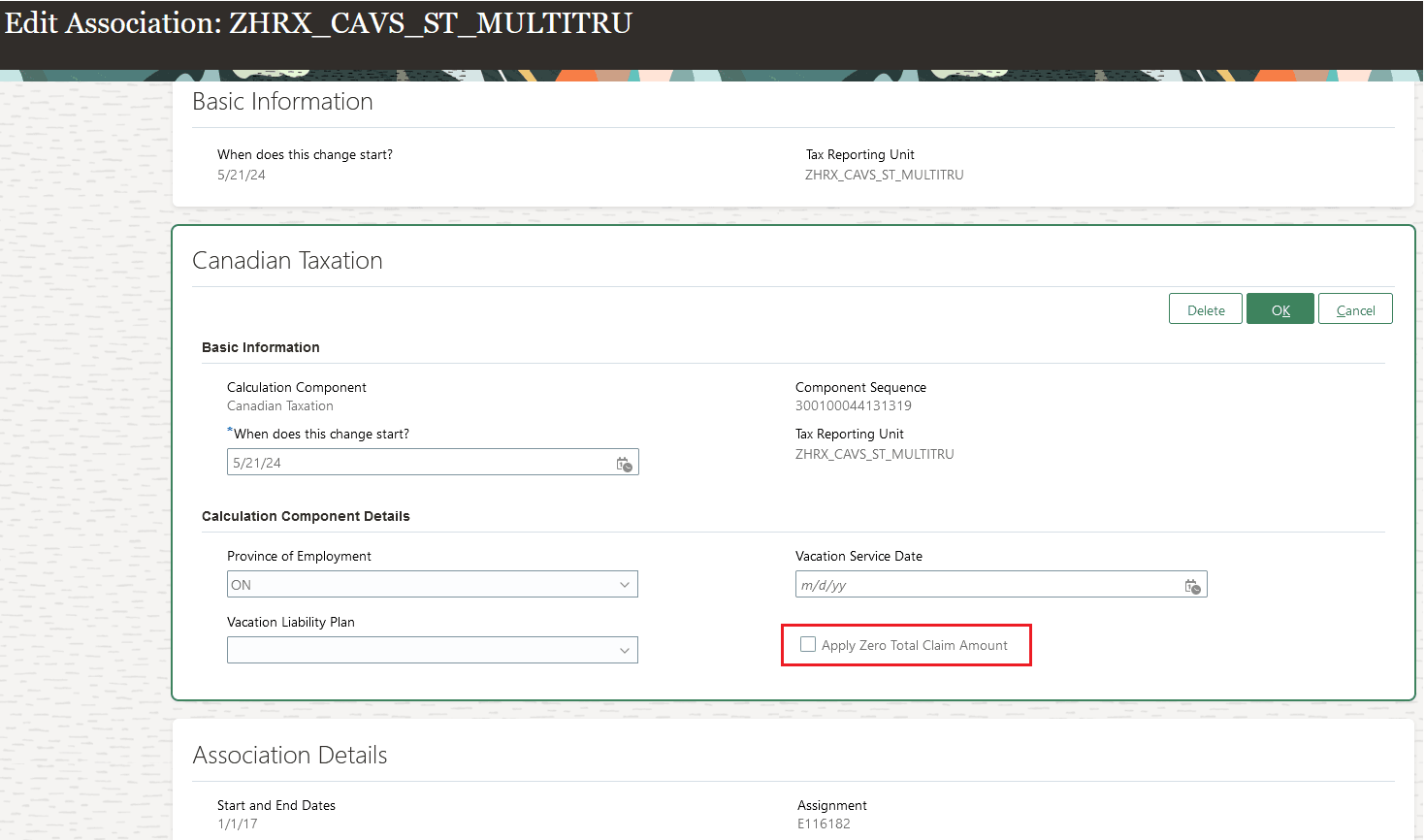

This attribute is located on the Canadian Taxation component, under the TRU Associations. This field is unchecked by default. If it is checked, the tax calculation uses zero for both the Federal and Provincial Claim amounts. The illustration below highlights the checkbox on the employee’s Tax Credit Information card.

This feature supports more accurate Federal Tax calculations.

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

In multiple TRU scenarios, you should check this field for all TRUs, other than the primary TRU. This ensures that the Total Claim Amount is only applied once for the tax calculation of the primary TRU.

Key Resources

Refer to these documents on the Canada Information Center for additional information.

Canada Information Center: https://support.oracle.com/rs?type=doc&id=2102586.2

- CA – Payroll tab > Product Documentation > Payroll Guides > Implementing Payroll for Canada

- CA – Payroll tab > Product Documentation > Payroll Guides > Administering Payroll for Canada

Hot Topics Email (To Receive Critical Statutory Legislative Product News)

To receive important Fusion Canada Legislative Product News, you must subscribe to the Hot Topics Email feature available in My Oracle Support. Refer to the document below on the Canada Information Center for additional information.

https://support.oracle.com/rs?type=doc&id=2102586.2

- Welcome tab > Other Documents > How To Use My Oracle Support Hot Topics Email Subscription Feature