Support for Monthly and Annual Tax Adjustments in Quickpay

You can now use the Monthly Tax Adjustment(MTA) and Annual Tax Adjustment(ATA) run types for Mexico along with the regular payroll run types for Quickpay. With these run types, you have the option to adjust the tax, deduct or reimburse automatically in the run based on Monthly Tax to Date (MTD) or Yearly Tax to Date (YTD) values as part of the payroll run.

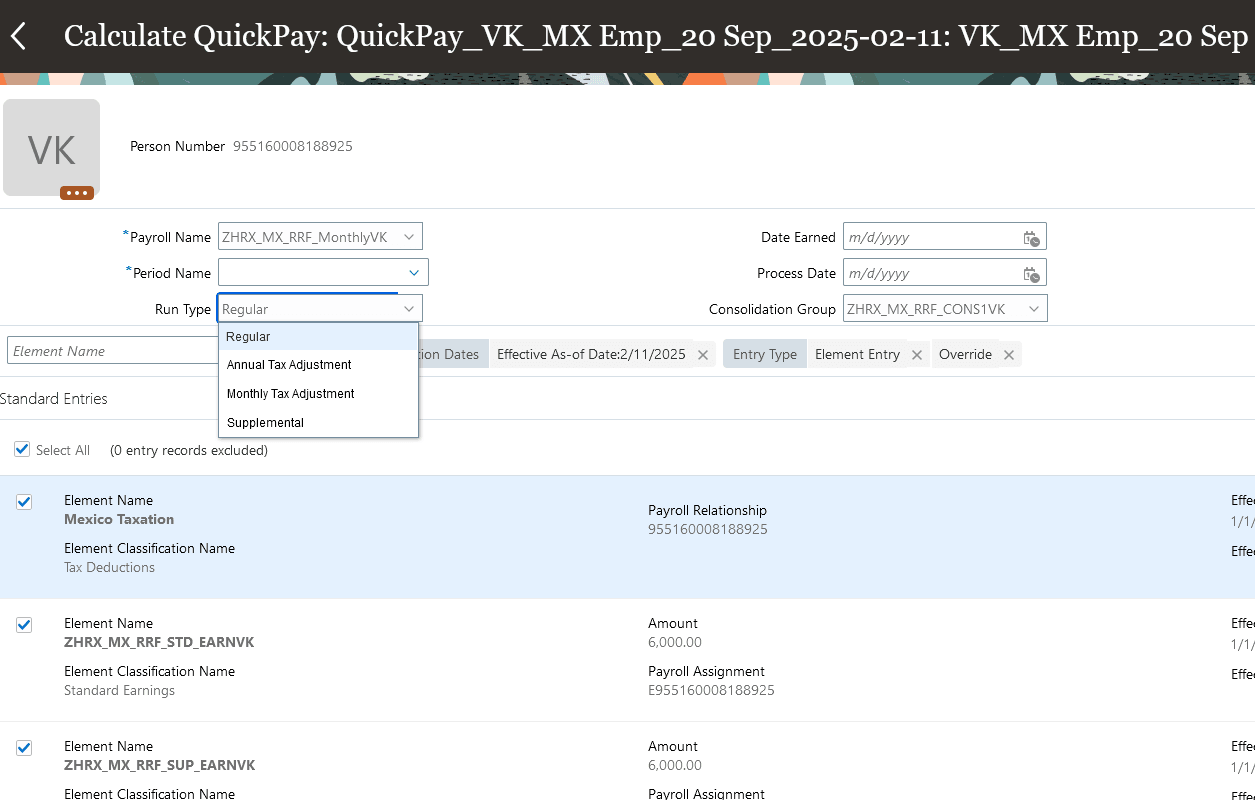

Run Types for Monthly and Annual Tax Adjustment

Supports automatic tax adjustments based on the Monthly Tax to Date(MTD) or Yearly Tax to Date(YTD) values for Quickpay.

Steps to Enable and Configure

Here's how you can include the run types for MTA and ATA when you calculate Quickpay:

- From the home page, navigate to My Client Groups > Person Management > Search employee > Calculate Quickpay.

- Select the payroll name, period name, date earned, process date, and consolidation group.

- Select the run type from the list.

- Submit the details.