Spot Taxation for Employee Stock Options Perquisite

You can now enable the spot taxation for the Employee Stock Options (ESOP) perquisite. This helps in deducting the taxable amount for the ESOP perquisite in the same period in which the ESOP perquisite is paid to the employee, instead of distributing the taxable amount across pay periods in the financial year.

When you create the ESOP perquisite element, set it as a nonrecurring element and also specify the spot taxation by choosing Lump Sum Tax Deduction.

Supports accurate withholdings, fewer retroactive adjustments, reduced compliance risks, and penalties.

Steps to Enable and Configure

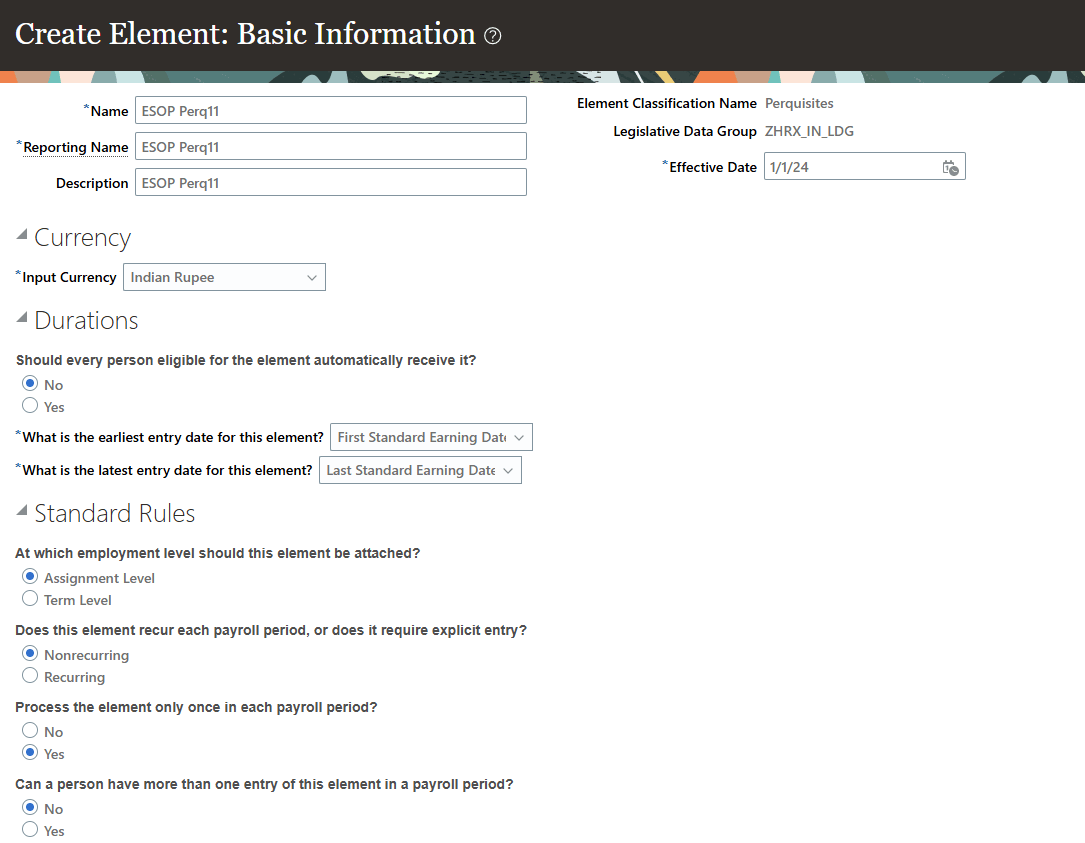

To create the ESOP Perquisite element:

- From the home page, navigate to My Client Groups > Payroll > Elements.

- Create the element with the Primary Classification as Perquisites for the selected Legal Definition Group.

ESOP Perquisite Element - Standard Rules questionnaire

- Select Nonrecurring option.

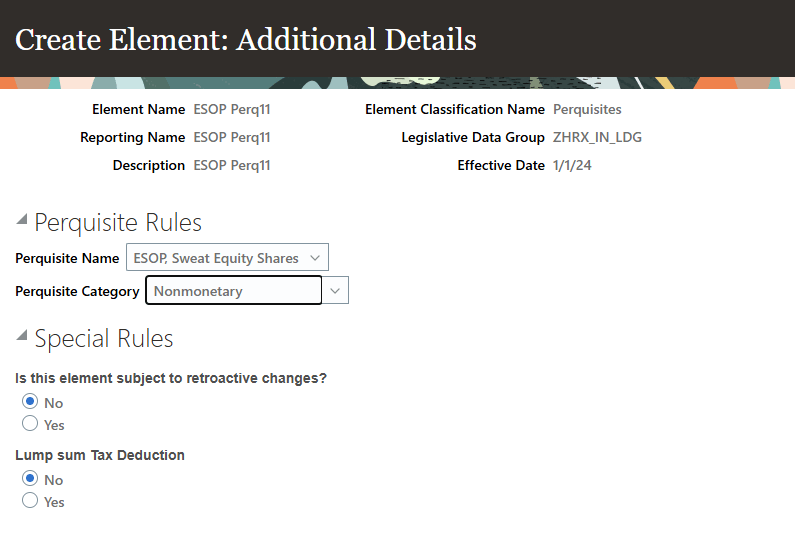

ESOP Perquisite Element: Lumpsum Tax Deduction

- Set the Lump Sum Tax Deduction as Yes.