Compute Professional Tax for New Hires, Terminated Employees, and Employees Transferred Midyear

You can now easily handle the professional tax (PT) calculation for new hires, terminated employees and the employees who get transferred midyear. The professional tax calculation for the different scenarios is now automated eliminating the need for any manual PT adjustments.

PT deduction is handled automatically in these scenarios:

- New hires joining after the PT deduction month in the half yearly or yearly cycle.

- Employees resigning before the PT deduction month in the half yearly or yearly cycle.

- When employees transfer to a different tax reporting unit midyear.

Ensures accurate PT deductions aligned with statutory requirements, minimizing the risk of non-compliance and related penalties.

Steps to Enable and Configure

Set up the TRU

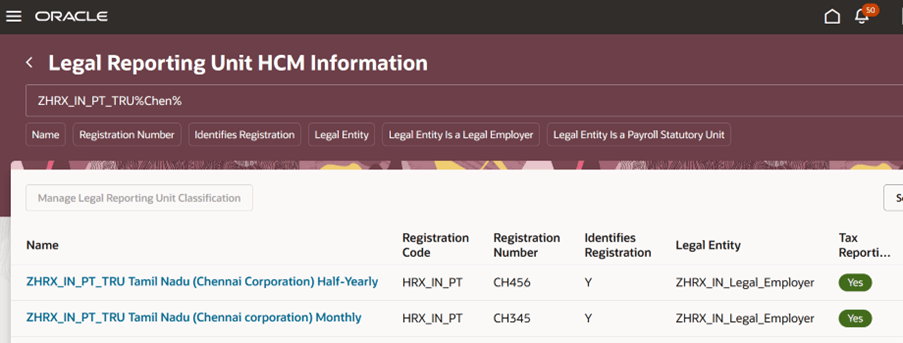

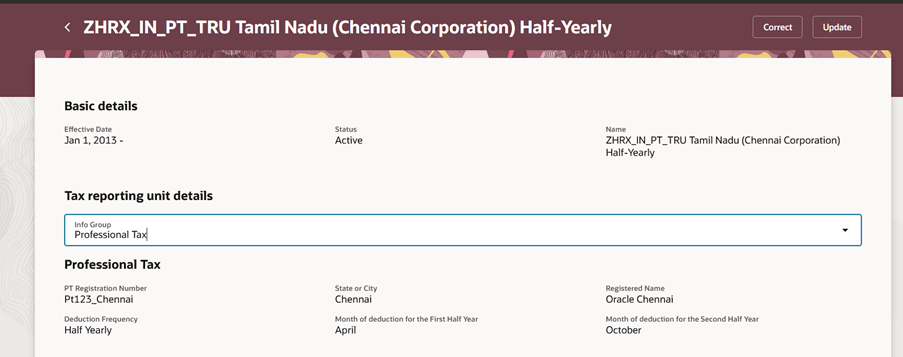

Professional Tax information in PT Tax Reporting Unit

Verify Professional Tax data in the PT Tax Reporting Unit

- From the home page, navigate to My Client Group > Show More > Legal Reporting Unit HCM Information.

- Verify if the State or Panchayat for which PT amount needs to be deducted is added in the tax reporting unit.

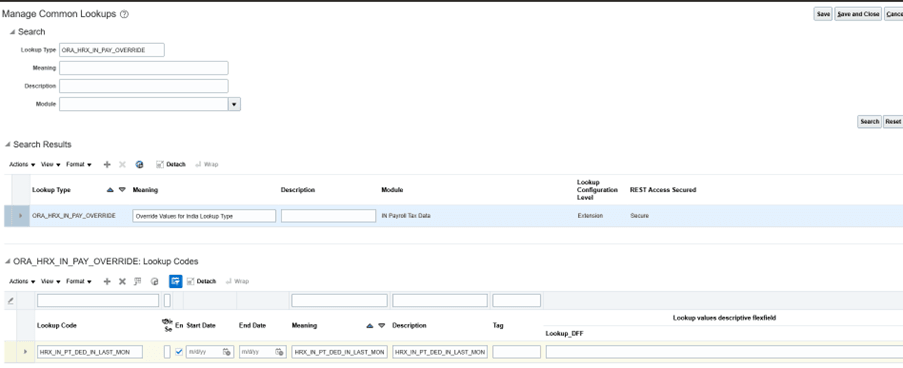

Set Up the Override Element :

Setup the Override Element for Professional Tax

If you don’t want to deduct the Professional tax amount in the hiring month and deduct PT in the last month of the half year cycle or last month of yearly cycle, here are the steps to set up the override element:

- From the home page, navigate to My Client Group > Settings and Actions > Set up and Maintenance > Search > Manage Common Lookups > Lookup Type: ORA_HRX_IN_PAY_OVERRIDE

- Add new row with the value: HRX_IN_PT_DED_IN_LAST_MON.

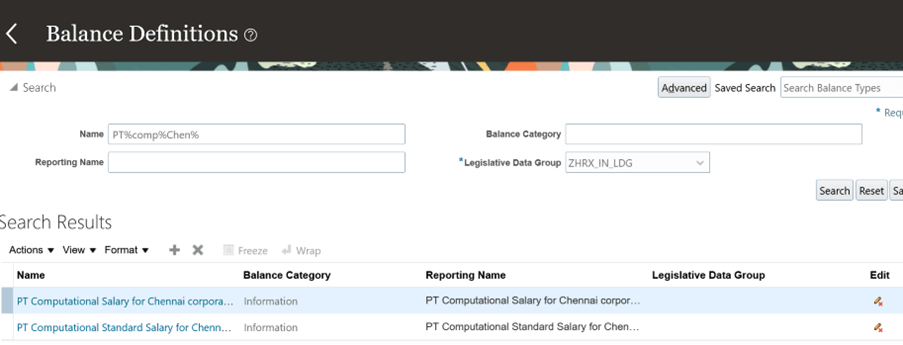

Set up the Balance:

Setup the Balance for Professional Tax

- Check if the element for the State specific balances and respective input values are present. Otherwise you need to add them.

- From the home page navigate to My Client Groups > More > Balance Definition.