Budgetary Control for Project-Specific Procurement to an Inventory or Work Order Destination

Check for funds availability, reserve funds against control budgets, and account for encumbrances, if applicable, when procuring material to an inventory destination for sponsored or non-sponsored projects. This capability is also available when procuring material directly to a work order destination from a project-specific manufacturing or maintenance work order.

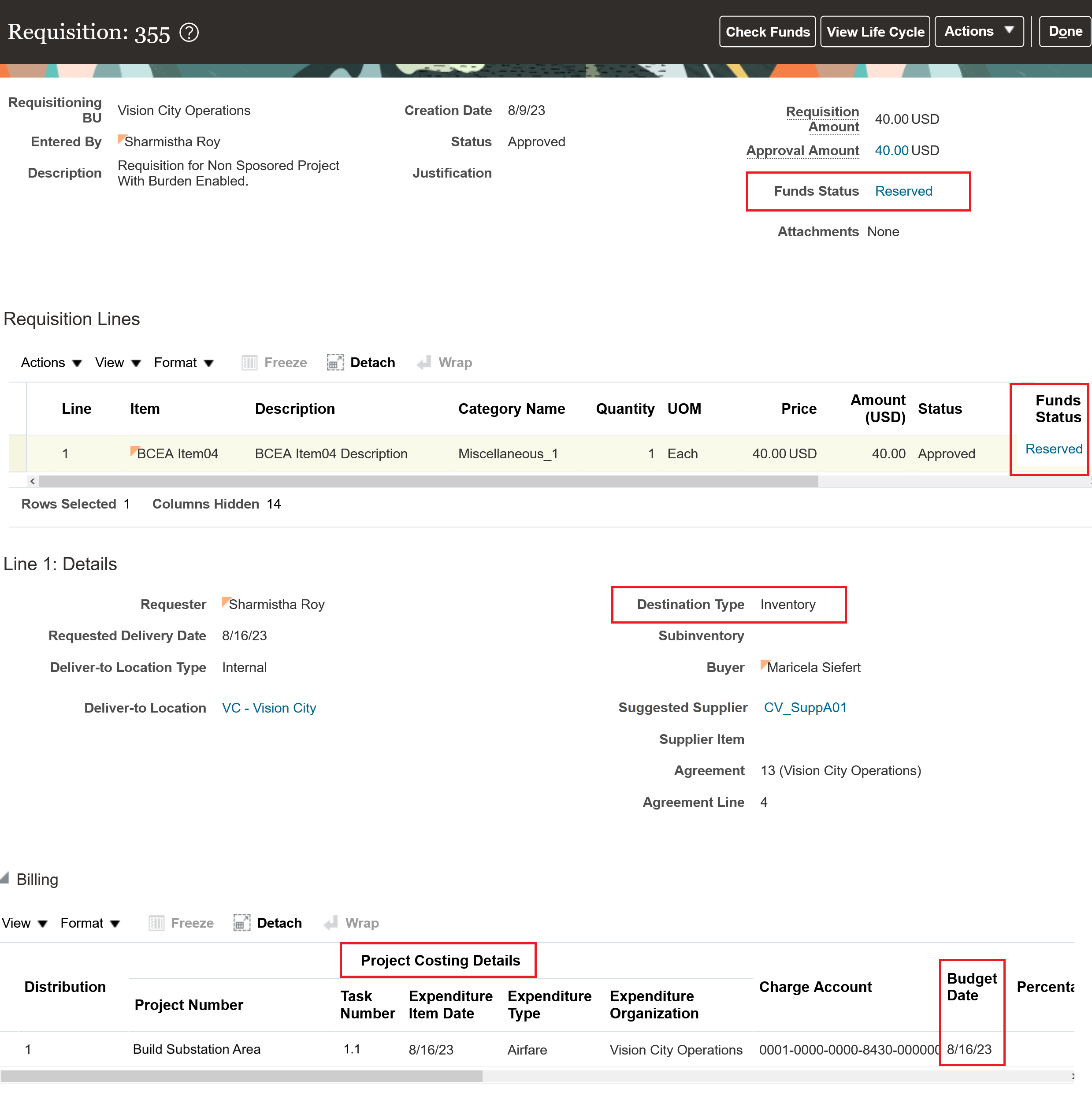

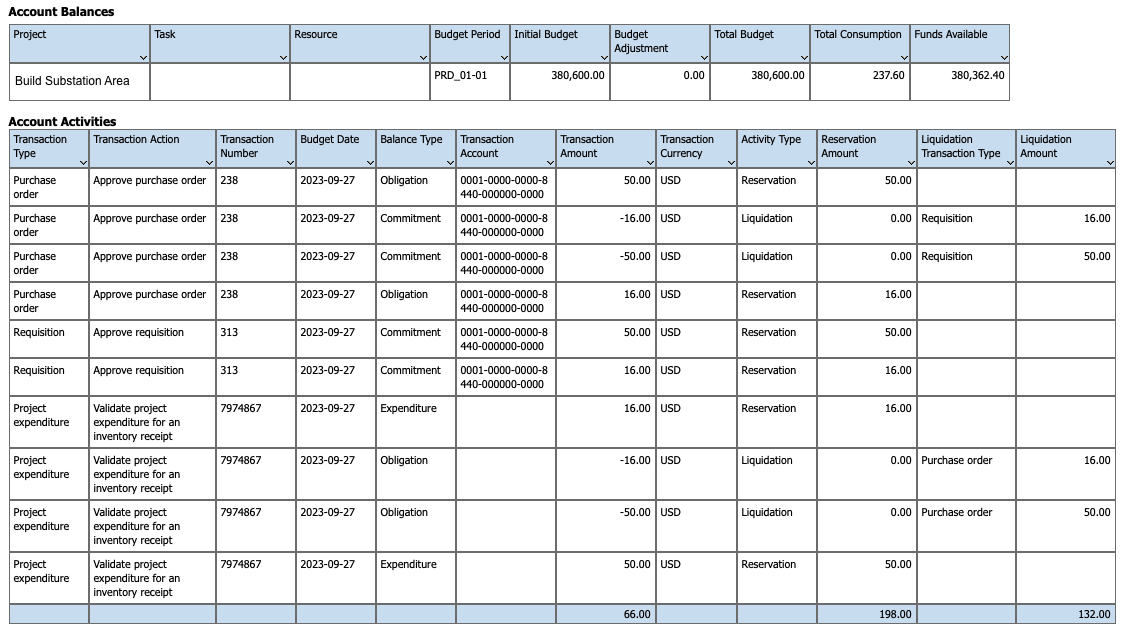

Project-specific requisitions created with an inventory or work order destination, as well as back-to-back requisitions, can have funds reserved as a commitment against the project or chart of account-based control budgets or both, when budgetary control is enabled for these transaction types. Funds reserved will include both the raw (requisition cost) and related burden costs.

Requisition for Inventory Destination with Project Details

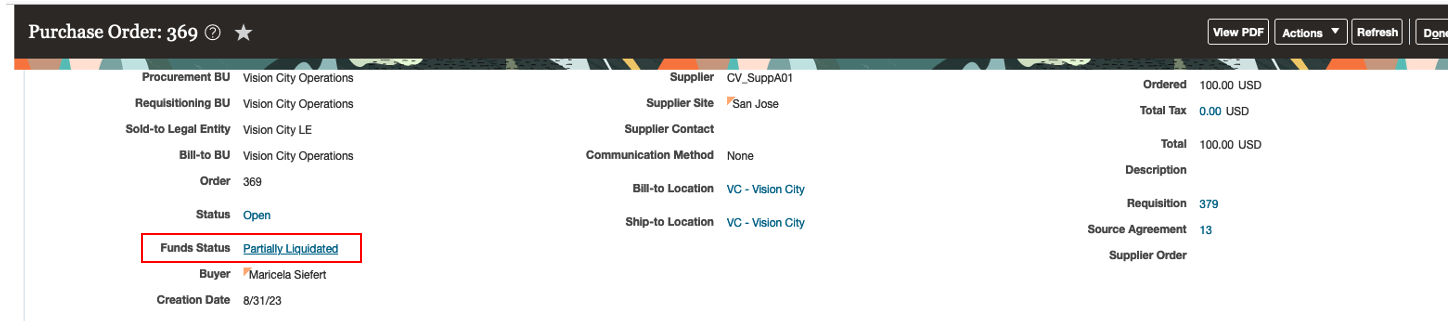

When budgetary controlled validation is performed on purchase orders created independently or from such requisitions, funds are reserved as an obligation. Also, commitments for requisitions, if applicable, are liquidated. The funds status on the purchase order is updated throughout the procurement lifecycle, until the costs have been imported into Project Costing.

Purchase Order with Funds Status showing Partially Liquidated for a Partial PO Receipt imported into Project Costing

The inventory receipt and costing of items for such purchase orders are not budgetary controlled in Receipt Accounting or Cost Management. It is at the time of importing the purchase order related inventory costs from Supply Chain Cost Management into Project Costing that the purchase order obligation is liquidated, and the inventory costs reserved as project expenditures. This includes raw (inventory) costs and related burden costs. If the burden schedule associated with the project has been updated with new rates between purchase order creation and the import of inventory costs into Projects, then the revised burden rates will be used to reserve the funds. Project Costing will also liquidate the raw and burden costs originally reserved against the purchase order.

Use the Budgetary Control Analysis Report to view control budget balances for non-sponsored projects, and the Manage Awards page to view control budget balances for sponsored projects.

Budgetary Control Analysis Report Showing the Funds Reservation and Liquidation Happening at Requisition, Purchase Order and Project Costing

Payables invoices associated to project-specific purchase orders with inventory and work order destinations are not applicable for budgetary control validation. Invoice variances, if any, will be budgetary controlled by the Import Costs process in Project Costing when the acquisition adjustment costs are imported from Supply Chain Cost Management. Payables Invoices now display project attributes at the invoice line and distribution levels for invoices matched to project-specific purchase orders.

If encumbrance accounting is enabled for the relevant business function and transaction subtypes, then accounting and liquidation of the encumbered raw and burden costs is done when creating accounting for the requisition, purchase order, receipt accounting, and project costs.

Returns, cancellations, and other adjustments on project-specific purchase orders to an inventory or work order destination and back-to-back orders are budgetary controlled. Applicable encumbrances are also accounted.

Funds that the Project Costing subledger reserved at the time of importing purchase order costs from the Supply Chain Cost Management application might differ from the accounted encumbrances on the same transaction. This is because the Supply Chain Cost Management application could have imposed item cost overheads, resulting in additional costs to the originally encumbered purchase order costs. Funds reservation in Project Costing will be based on these actual costs received from the Supply Chain Cost Management application.

These are the business benefits of this feature:

- Efficient fund management and monitoring of budgetary controlled projects for project-specific procurement to an inventory or work order destination.

- Control your project budgets effectively for project-specific procurement to an inventory or work order destination.

- Improved review of payables invoices matched to project-specific purchase orders.

Steps to Enable

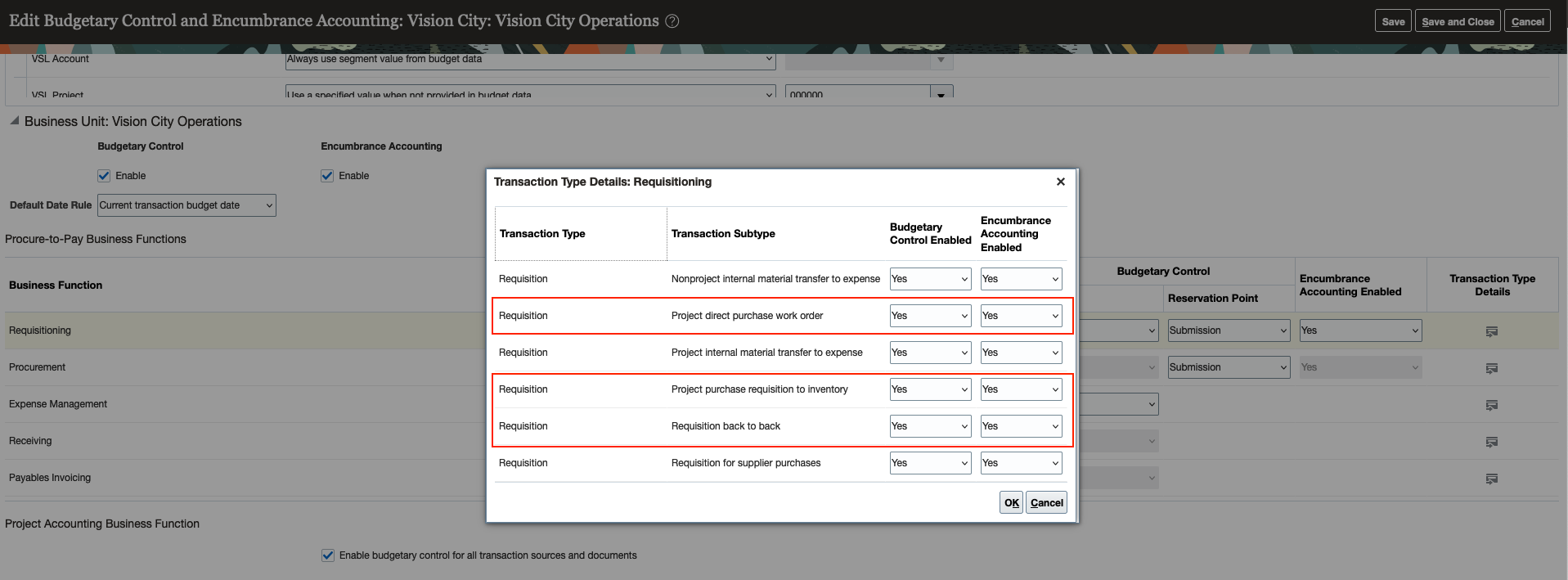

- Navigate to the Manage Budgetary Control task in the Functional Setup Manager. For your concerned ledger and business unit, edit the Budgetary Control and Encumbrance Accounting options. In the Edit Budgetary Control and Encumbrance Accounting page:

- Enable budgetary control for the ledger, business units assigned to the ledger, and the project accounting business function.

- Enable budgetary control and encumbrance accounting for these Requisitioning business function transaction subtypes:

- Project purchase requisition to inventory for project-referenced requisition with an inventory destination.

- Requisition back to back for back-to-back orders

- Project direct purchase work order for direct procurements made to a work order destination from a project-referenced manufacturing or maintenance work order.

Budgetary Control and Encumbrance Accounting Enablement for Business Function Requisitioning

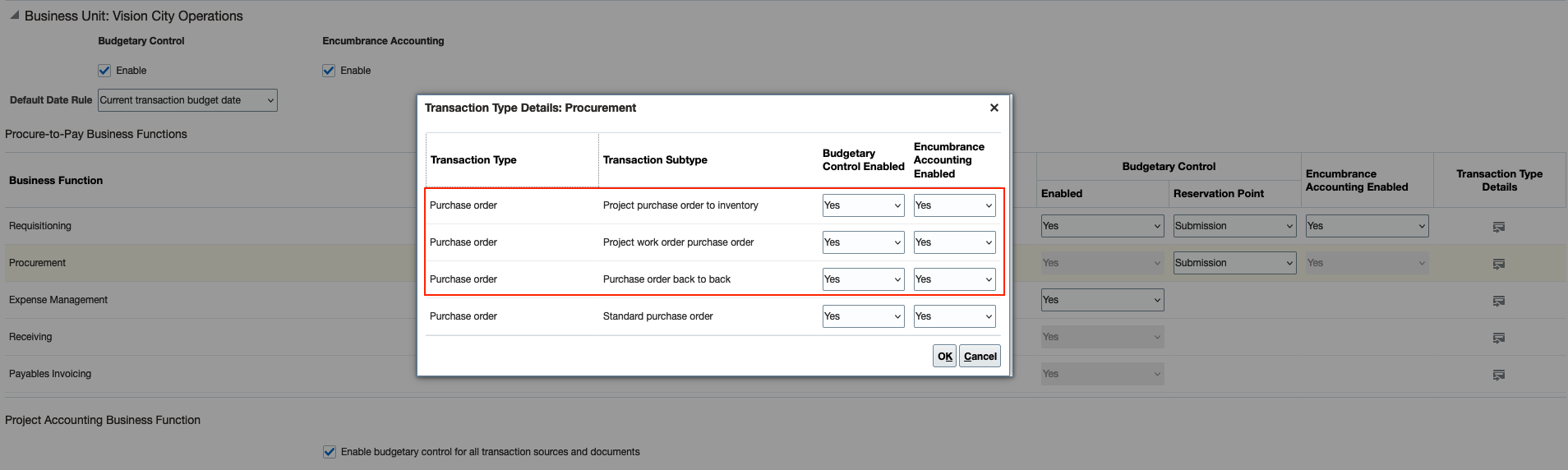

- Enable budgetary control and encumbrance accounting for these Procurement business function transaction subtypes:

- Project purchase order to inventory for project-referenced purchase orders with an inventory destination.

- Project order back to back for back-to-back orders

- Project work order purchase order for direct procurements made to a work order destination from a project-referenced manufacturing or maintenance work order.

Budgetary Control and Encumbrance Accounting Enablement for Business Function Procurement

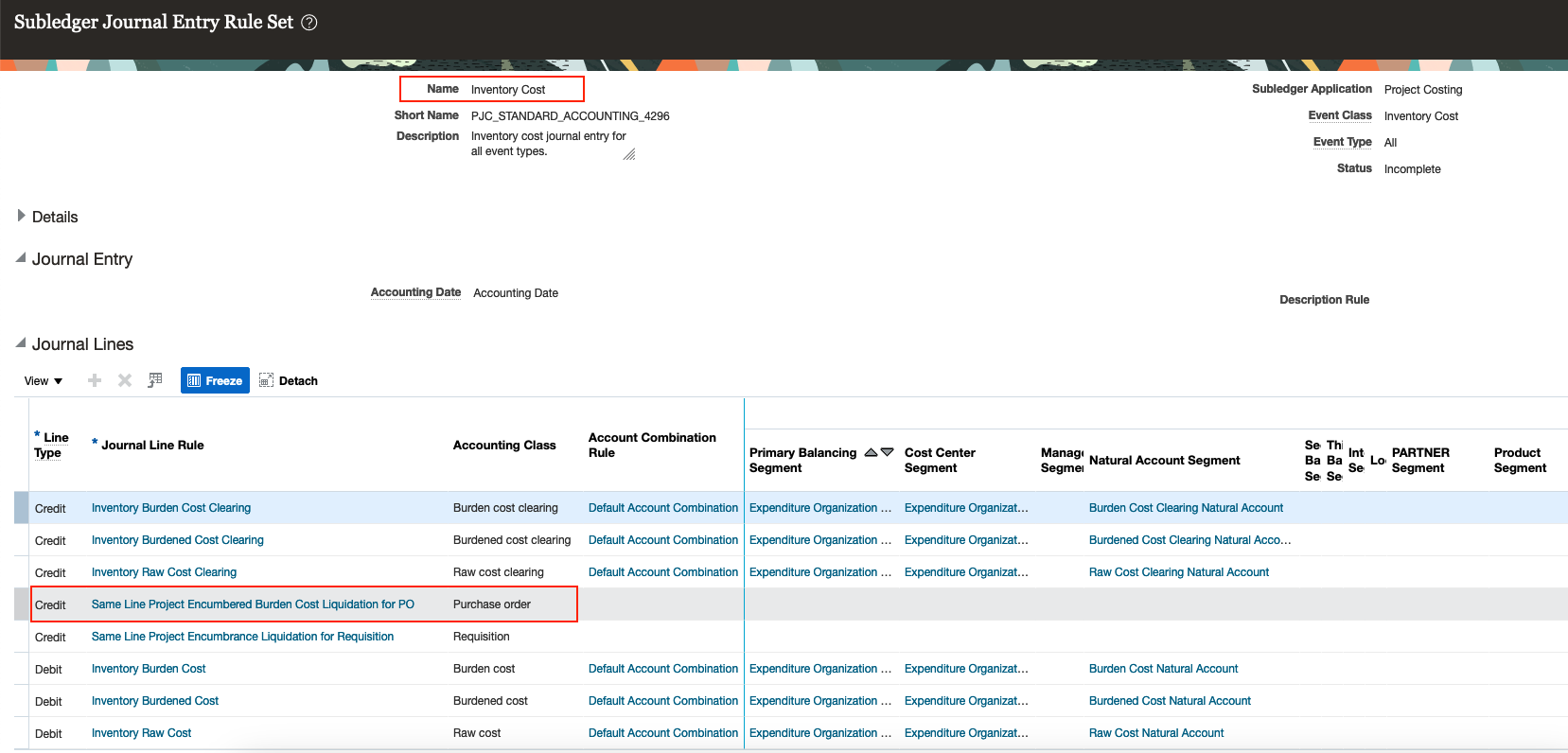

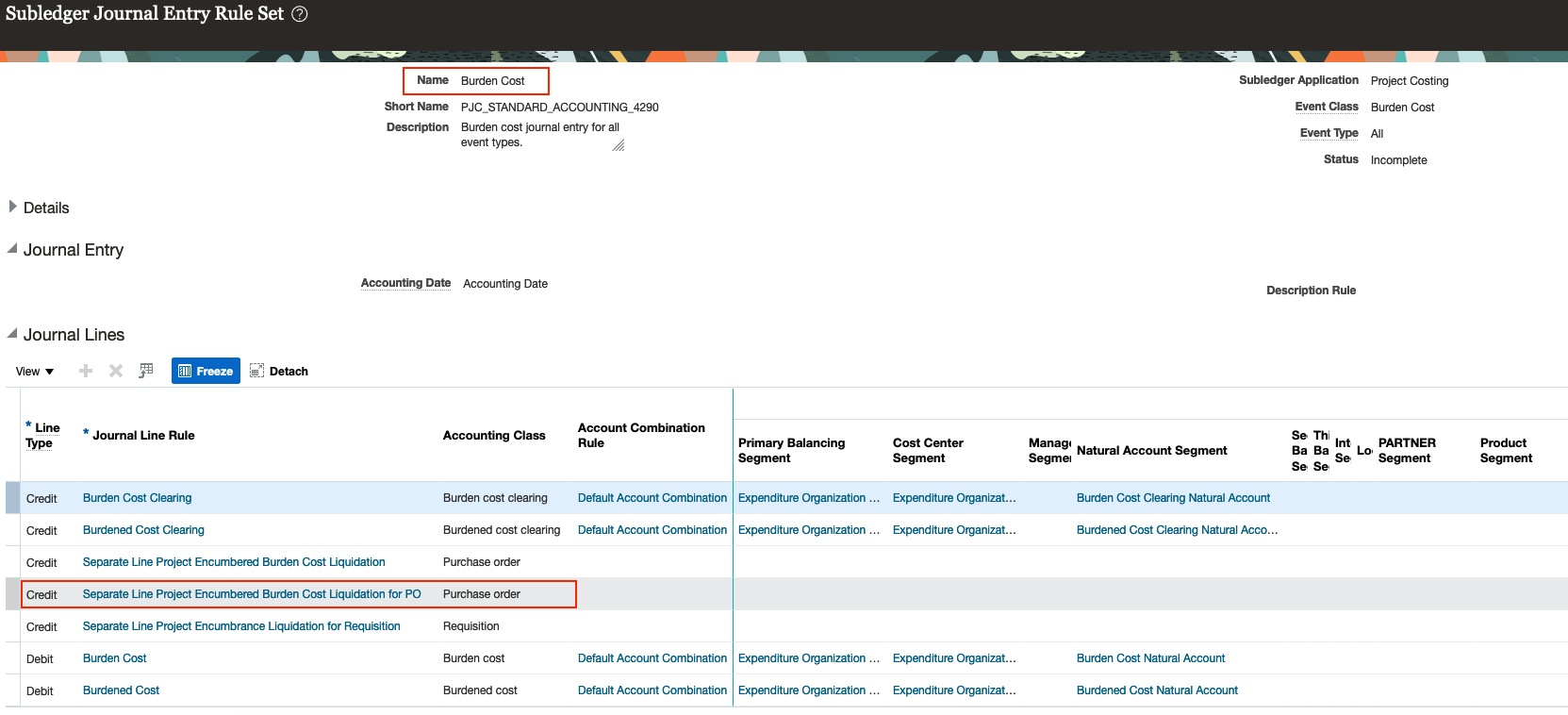

- This feature also makes available two new journal line rules for encumbrance accounting in Project Costing. 'Same Line Project Encumbered Burden Cost Liquidation for PO' for same line burdening enabled projects, and 'Separate Line Project Encumbered Burden Cost Liquidation for PO' for separate line burdening enabled projects. They are already available in the ‘Inventory Cost’ and ‘Burden Cost’ seeded journal entry rule sets.

New Project Costing Journal Entry Rules for Liquidation of Encumbered Burden Cost for Same Line Project

New Project Costing Journal Entry Rules for Liquidation of Encumbered Burden Cost for Separate Line Project

- If your ledger is assigned with a user-defined subledger accounting method, then add these new journal line rules to your rule sets and recompile your subledger accounting method for encumbrances to be accounted successfully for project-specific procurements to an inventory or work order destination.

Tips And Considerations

Budgetary Control:

- The new transaction subtypes that are introduced to support budgetary control and account encumbrances for a project-specific procurement to an inventory or a work order destination and back-to-back orders will be enabled by default for newly created business units and ledgers that are enabled for budgetary control. New business units and ledgers refers to those created on or after release 24A. The new transaction subtypes will remain disabled for existing business units and ledgers that are enabled for budgetary control. They will have to be manually enabled if you would like to have budgetary control and account encumbrances for project-specific procurement to an inventory or work order destination and back-to-back orders.

- To successfully budgetary control and account encumbrances for a project-specific procurement that involves use of both requisitions and purchase orders to an inventory or a work order destination and back-to-back orders, you must enable the new transaction subtypes for BOTH the Requisitioning and Procurement business functions. Failure to enable the new subtypes for both the business functions will result in funds being reserved or liquidated incorrectly.

Requisitions:

- Project-specific requisitions for inventory or work order destination as well as back-to-back requisitions created before enabling budgetary control or encumbrance accounting for requisition transaction subtypes, will remain as not applicable for budgetary control and encumbrance accounting. Once you enable the new transaction subtypes for the requisitioning business function, only new requisitions will be subject to budgetary control and encumbrance accounting.

Purchase Orders:

- Project-specific purchase orders for inventory or work order destination, as well as back-to-back purchase orders created before budgetary control is enabled for these transaction subtypes, will continue being excluded from budgetary control and encumbrance accounting throughout their fulfillment cycle. Once budgetary control for these transaction types is enabled for existing inventory or work order destination purchase orders, the changes listed below will trigger budgetary control and encumbrance accounting.

- Changes to account, project, or budget date

- Addition of new back-to-back or project-specific lines, schedules, or distributions

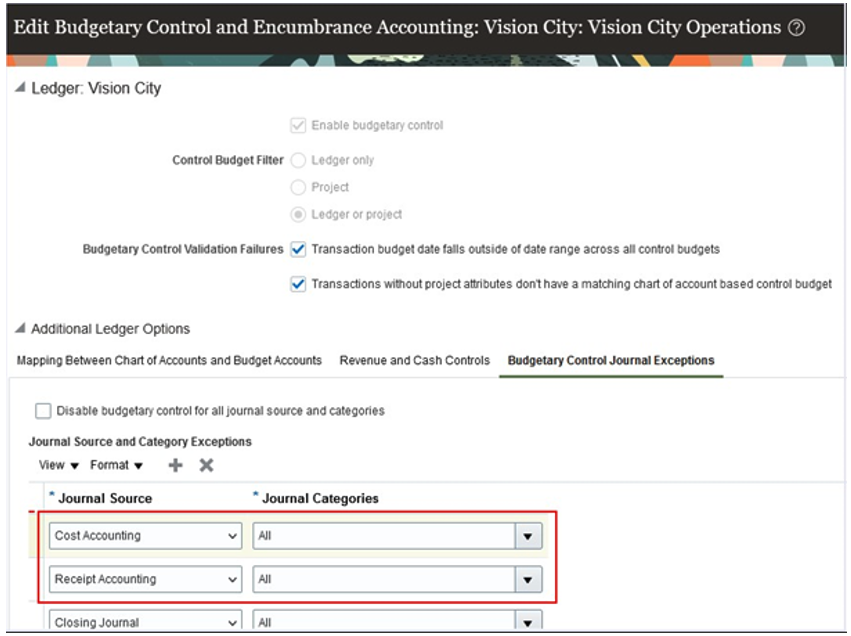

Receipt Accounting and Cost Management:

- Verify that the journal sources for cost accounting and receipt accounting are displayed in the Budgetary Control Journal Exceptions section, under the Ledger Options region in the Edit Budgetary Control and Encumbrance Accounting page. Add these sources if they have not been previously included.

Journal Source and Category Exceptions for Cost Accounting and Receipt Accounting

- The encumbrance liquidation of raw (purchase order) costs will be done by the Receipt Accounting subledger using the following transaction types:

|

Transaction Flow |

Transaction Type |

|---|---|

|

Delivery of Receipt into Inventory |

Delivery to Inventory Destination |

|

Delivery of Receipt into Work Order |

Delivery to Work Order Destination |

|

Correction to Delivery Event |

Correction to Deliver for Inventory |

|

Correction to Deliver for Work Order |

|

|

Return to Receiving |

Return to Receiving for Inventory |

|

Return to Receiving for Work Order |

|

|

Price update on Inventory Purchase Order |

Cost Adjustment - PO Price Update for Inventory Destination |

|

Price update on Work Order Purchase Order |

Cost Adjustment - PO Price Update for Work Order Destination |

- Encumbrance liquidation of raw costs due to price update to a purchase order is done only for the un-invoiced receipt quantities in Receipt Accounting using the transaction types ‘Cost Adjustment - PO Price Update for Inventory Destination’ and ‘Cost Adjustment - PO Price Update for Work Order Destination.’

- To successfully reserve funds for invoice variance costs in projects for project-specific purchase orders to an inventory and work order destination, disable the profile option to Exclude Invoice Variances from Cost Management if enabled.

- For description-based purchase orders without item reference and to a work order destination, the encumbrance liquidation and budgetary check will be done directly in receipt accounting using the transaction type ‘Delivery to Expense’.

Projects:

- Project-specific purchase orders to an inventory or work order destination and back-to-back orders that were created prior to enabling the new transaction subtypes may exist. This can also include inventory receipts and returns. If these project costs are imported into the Project Costing subledger after enabling the new transaction subtypes, they will be subject to budgetary control in Project Costing. Funds reservation will happen in Project Costing for such scenarios irrespective of whether funds were originally reserved at the time of creating the purchase order or not. It is recommended you review and adjust your control budgets to allow for these reservations.

- Budgetary control, when enabled for this feature, is successful only for projects with project types that have not been enabled for exclusion from cost collection in the Manage Project Type Cost Exclusions task.

- The encumbrance liquidation of the purchase order raw costs will be done by Receipt Accounting and that of burden costs associated to the purchase order by Project Costing. It is recommended you run the relevant create distributions and accounting processes for each application without delay to ensure the encumbrances are accounted promptly.

Payables:

- Before this feature, for budgetary control enabled ledgers, Payables reserved funds for invoice price variances in the applicable control budgets when the invoice was matched to project-specific purchase orders to an inventory destination. With this feature, Payables will stop reserving funds for invoice price variances and the reservation will instead be done by Project Costing. It is recommended to review your existing user-defined business flows that could be impacted by this change.

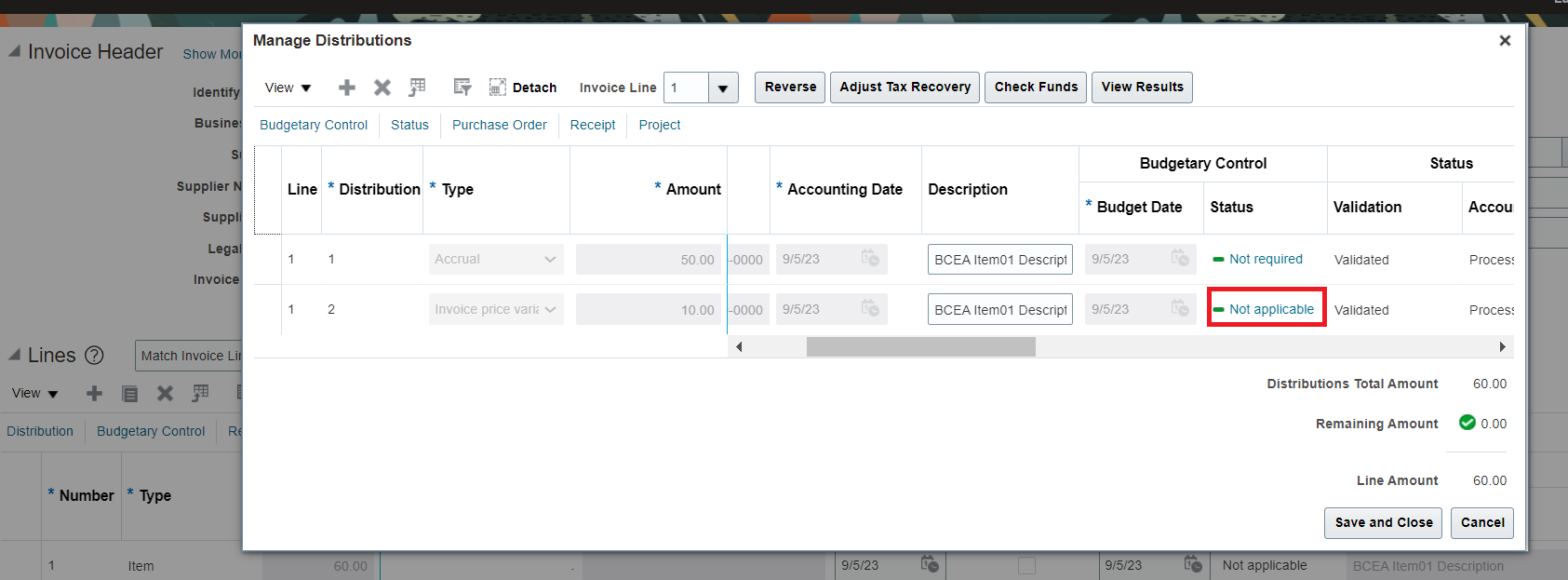

- When invoice price variances exist for project-specific purchase orders to an Inventory and Work Order destination, the funds status for such distributions will show as not applicable. These distribution lines are also not subject to further funds reservation at General Ledger.

Budgetary Control Status of Invoice Price Variance in Payables

- Before this feature, for capital projects or construction-in-process (CIP) projects, there was a possibility of capitalization or asset lines being created twice, once in Payables and again in Projects, if the accrual account is also an asset clearing account. With the project details being captured at Payables, this will no longer occur. It is recommended to review your existing user-defined business flows, if any, that could be impacted due to this change.

- View and report project details on payables invoice lines and distributions, available in the OTBI Subject Area: “Payables Invoices — Transactions Real Time”.

Other:

- Budgetary control for purchase orders related to outside processing services or contract manufacturing is not supported at this time.

- Budgetary control and encumbrance accounting is not supported for project-specific internal material transfer requisitions to an inventory destination.

Key Resources

For more information on budgetary control and encumbrance accounting, refer to the following topics:

- Overview of Budgetary Control and Encumbrance Accounting in the Using Financials for the Public Sector manual in the Financials Cloud Applications documentation.

- Overview of Project-Driven Supply Chain topic in the Using Project Costing manual.

- Budgetary Control topic in the Defining and Managing Financial Projects manual.

- Direct Procurement of Materials for Work Orders topic under Manage Production in the Using Manufacturing manual.

Access Requirements

No new access requirements.