Manage Tolerances Using the Redwood Experience

Fiscal document tolerances determine whether holds are placed on fiscal documents for variances between fiscal documents and the source documents you match them to. This helps you to effectively capture the incoming fiscal documents. When you import the fiscal documents or run the fiscal document validation process, the process checks if the matching is within the defined tolerances. For example, if the fiscal document price of an item exceeds a tolerance, a hold is placed on the fiscal document. You can't capture the fiscal document until the hold is released.

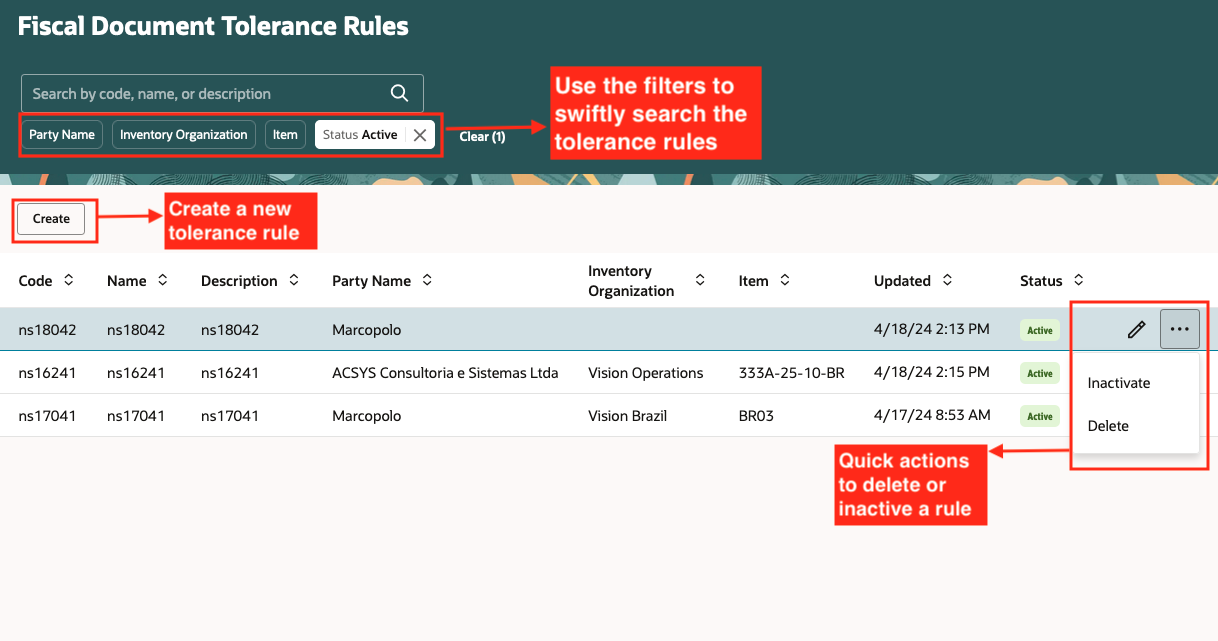

You can now swiftly search for these fiscal document tolerances, create, edit, or mark them as inactive as a response to your changed business needs on this redesigned page.

You can also define tolerances based on any of these parameters:

- at party level

- at inventory organization level

- at item level

- or a combination of above parameters

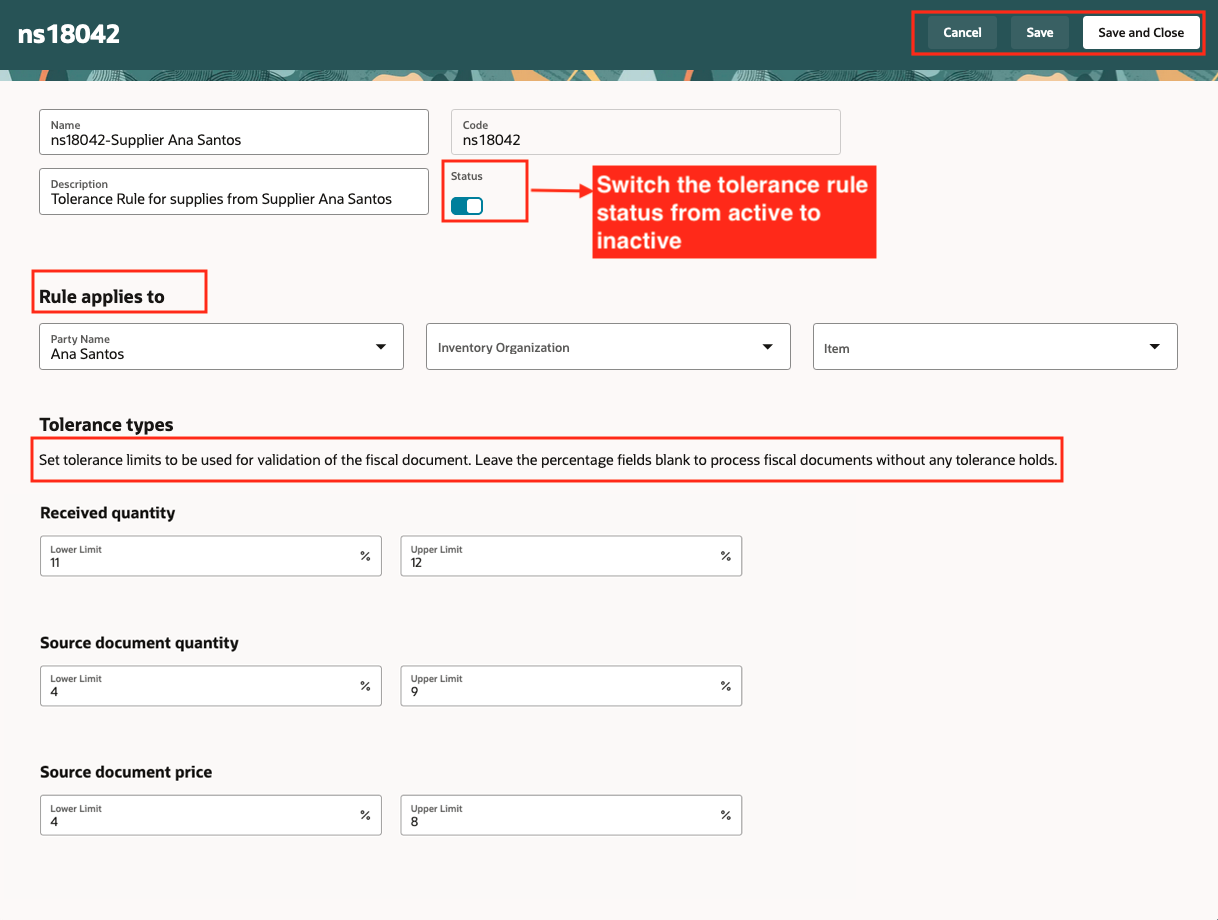

For each type of tolerance, you can either specify percentages for the lower limit, or upper limit, or both.

You can also set up an exception tolerance rule by leaving the percentage fields for lower or upper limits blank. This processes the fiscal documents without any tolerance holds.

You can set up these tolerance types:

- Received quantity: Tolerance applies to the variance between the fiscal document quantity and the quantity confirmed using the Confirm Item Deliveries action.

- Source document quantity: Tolerance applies to the variance between the fiscal document quantity and the allocated quantity from the matched source document.

- Source document price: Tolerance applies to the variance between the price on the fiscal document line and the price from the matched source document.

Using the new Fiscal Document Tolerances page, you can:

- Search the fiscal document tolerance rules by their status as active or inactive.

- Search the fiscal document tolerance rules by party name, inventory organization, and item.

- Create, edit, or delete a fiscal document tolerance rule.

- Define the rule applicability, tolerance types, and tolerance limits for a tolerance rule.

Fiscal Document Tolerance Rules Search page

New Tolerance Rule page

This feature lets you manage your fiscal document tolerance rules in a modern and responsive layout with improved search capabilities.

Steps to Enable

Enable the ORA_CMF_TOLERANCE_RULES_REDWOOD_ENABLED profile option:

- In the Setup and Maintenance work area, go to the following:

- Offering: Manufacturing and Supply Chain Management

- Task: Manage Administrator Profile Values

- On the Manage Administrator Profile Values page, enable the new ORA_CMF_TOLERANCE_RULES_REDWOOD_ENABLED profile option at Site or Product or User level.

- Select Yes for the Redwood page for Fiscal Document Tolerance Rules Enabled option.

Tips And Considerations

- If fiscal document tolerance rules were created in an earlier version of the UI with the Allow Discrepancy action, then when you view them on the new Redwood page, the limit value is shown as null.

- Fiscal document tolerance rules created with upper or lower limits on the Redwood page are processed as an error action, and a hold is placed on fiscal documents with deviations.

Key Resources

- Oracle Supply Chain Management Cloud: Using Fiscal Document Capture guide, available on the Oracle Help Center.

Access Requirements

Users who are assigned a configured job role that contains these privileges can access this feature:

- Set Up Fiscal Document Tolerances (CMF_FISCAL_DOC_TOLERANCES)

- Manage Fiscal Document Tolerances by Web Service (CMF_FISCAL_DOC_TOLERANCE_WEB_SERVICE)