Deductions and Settlement

Deductions originally started in consumer goods where powerful retailers would short pay invoices based on their understanding of the trade terms or agreements.

This has spread across all industries, and deductions are a common practice not only for collecting promotions, but also for any kind of dispute or misunderstanding, whether it's a pricing error, transportation related, damages, and so on. This is also the hardest challenge for the receivables departments to resolve because of the need for approval from outside receivables, like sales or shipping. The customer may short pay based on their own policies and procedures. It's up to you to resolve these claims.

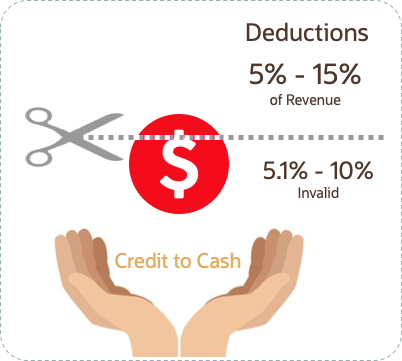

According to market surveys, deductions can represent 5 to 15 percentage of revenue, depending on the industry. Of that number, 5.1 to 10 percent are invalid or unauthorized. In some industries it can be a lot higher.

Deductions and Settlement in Channel Revenue Management enables you to take back control, and provides:

-

Centralized deductions directly from Receivables.

-

Accurate and fast resolution of customer short pays.

-

Resolution with accountability and transparency, which enables root cause analyses.

-

Settlement of deductions in Receivables.