How Channel Accounting Works for Sell Side

Here's how channel accounting works for the sell side.

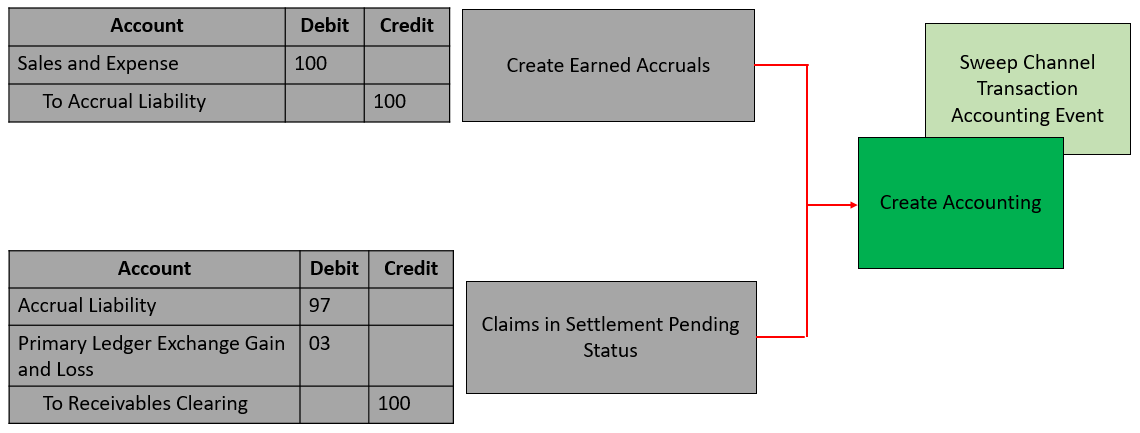

Accrue Customer Rebates

- Customer Rebate: After sales orders and invoices are loaded into Channel Revenue Management, eligible program discounts can be captured using the Create Accruals for Batch process.

- A supply chain application administrator can create these accruals on demand or schedule it as a batch process on a periodic basis.

- After a channel accrual is earned based on its program rules, it's eligible to be posted to the general ledger.

- A general accounting manager can post earned accruals to the general ledger on demand, or schedule it as a batch process on a periodic basis. The integration to General Ledger supports the Subledger Accounting architecture to derive the accounting.

Relieve Accruals

- After a claim is approved, it is in settlement pending status, and its then eligible to be relieved its accruals by posting to the general ledger.

- A general accounting manager can post relief of accruals to the general ledger on demand or schedule it as a batch process on a periodic basis. The integration to General Ledger supports the Subledger Accounting architecture to derive the accounting.