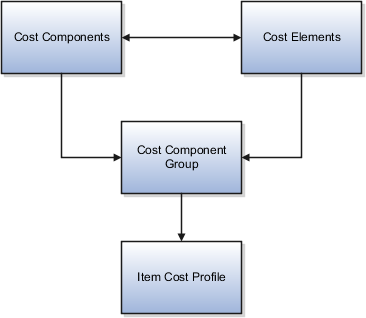

How Cost Components, Cost Elements, and Cost Component Groups Work Together

Cost components are user-defined or come from external sources, and are mapped to cost elements which the costing application uses to track the cost of items.

Use cost component groups to map cost components to cost elements, and to map source cost elements to destination cost elements when items are transferred from one inventory organization to another.

This figure illustrates the relationship between cost components, cost elements, cost component groups, and cost profiles.

Cost Components

Cost components are the most granular representation of item costs. Examples of cost components are purchase order item price, material, freight, tax, and overhead. Cost Components come from different sources:

-

Predefined costs from external sources such as Purchasing, Accounts Payable, and Inventory Management

-

Landed cost charges from Oracle Fusion Landed Cost Management.

Cost Elements

A cost element is the level where the costs of an item are tracked through the inventory accounting life cycle. Cost components are mapped to cost elements, which enables you to calculate item costs at different granularity levels for different business needs. For example, you may want more granularity for high-value than for low-value items.

You can define cost elements for four types of costs:

-

Material cost element type for incoming material cost components.

-

Overhead cost element type for costs that are calculated by the cost processor based on user-defined overhead rules.

-

Profit in Inventory cost element type for tracking of internal margins when items are transferred from one inventory organization to another, including global procurement and drop shipment flows. For cost elements of this type, indicate the Profit in Inventory organization that incurs the gain or loss due to the transfer of goods.

-

Adjustment cost element type for separate tracking of cost adjustments, which provides a more detailed view of item costs and profit margins.

Cost elements are defined at the set level and thereby have the advantages of set-level definitions for sharing and segregation. A Profit in Inventory cost element must be assigned to the Common cost element set so that it can be shared across cost organizations.

The following table gives examples of cost element definitions:

|

Cost Element Set |

Cost Element |

Cost Element Type |

Inventory Organization |

|---|---|---|---|

|

Country 1 |

Metals Material |

Material |

Not Applicable |

|

Country 1 |

Plastic Material |

Material |

Not Applicable |

|

Country 1 |

Miscellaneous Material |

Material |

Not Applicable |

|

Country 1 |

Miscellaneous Material |

Adjustment |

Not Applicable |

|

Country 1 |

Plant Depreciation |

Overhead |

Not Applicable |

|

Country 1 |

Equipment Depreciation |

Overhead |

Not Applicable |

|

Country 1 |

Freight Charges |

Overhead |

Not Applicable |

|

Common |

Internal Margin |

Profit in Inventory |

Seattle |

|

Country 2 |

Dairy Material |

Material |

Not Applicable |

|

Country 2 |

Miscellaneous Material |

Material |

Not Applicable |

|

Country 2 |

Dairy Material |

Adjustment |

Not Applicable |

Cost Component Groups

Use cost component groups to define mappings of cost components from external sources to cost elements in the costing application. These mappings provide flexibility in the granularity level where you track costs. You can map one cost component to one cost element for a detailed cost breakdown, or several cost components to one cost element for a less granular view of costs. For cost components and cost elements that are related to landed cost charges, you can choose to capitalize them into inventory value, or expense them. All other costs are automatically capitalized.

You can also map source cost elements to destination cost elements when transferring items from one inventory organization to another. This helps to maintain visibility of the item cost structure from the source application and across the supply chain.

You can specify a default cost component mapping to cost element to be used in cases where the source cost element doesn't have a matching destination cost element. The default cost component mapping is helpful when:

-

The detailed mapping of a cost component to cost element isn't required, and you want to map it to a single cost element.

-

The designated mapping for a cost component is missing. If the mapping is missing, the transaction automatically picks up the default cost component mapping.

Cost component groups are one of the attributes of cost profiles, which the cost processor uses to determine how to calculate item costs. Cost component groups are defined at the set level and thereby have the advantages of set-level definitions for sharing and segregation. Cost component groups and cost profiles are both set enabled; therefore, only those cost component groups belonging to the same set as the cost profile are available to that cost profile.

Example 1: The following table describes mapping of one cost component to one cost element.

|

Mapping Group |

Cost Component |

Cost Element |

|---|---|---|

|

MG1 |

PO Item Price |

Material |

|

MG1 |

PO Tax |

Tax |

|

MG1 |

Profit in Inventory |

PII |

|

MG1 |

Interorganization Freight |

Freight Charges |

|

MG1 |

Invoice Price Variance |

IPV |

|

MG1 |

Exchange Rate Variance |

ERV |

|

MG1 |

Tax Invoice Price Variance |

TIPV |

Example 2: The following table describes mapping of cost components to one or more cost elements.

|

Mapping Group |

Cost Component |

Cost Element |

|---|---|---|

|

MG2 |

PO Item Price PO Tax NR Tax Invoice Price Variance Exchange Rate Variance Tax Invoice Price Variance |

Material |

|

MG2 |

Interorganization Freight |

Freight Charges |

|

MG2 |

Profit in Inventory |

PII |

Example 3: The following table describes mapping of source cost elements to destination cost elements in an interorganization transfer.

|

Mapping Group |

Source Cost Element Set |

Source Cost Element |

Destination Cost Element Set |

Destination Cost Element |

|---|---|---|---|---|

|

MG3 |

Country 1 |

Material Tax |

Country 2 |

Material |

|

MG3 |

Country 1 |

Freight Charges |

Country 2 |

Freight Charges |

|

MG3 |

Country 1 |

Other |

Country 2 |

Other |

You have flexibility in how you map cost component groups to items:

-

Different items in a cost organization and book combination can have the same or different cost component group mappings if they use different cost profiles.

-

One item can have different cost component group mappings in different cost books.

-

Several cost organizations can share the same cost component group mappings if they belong to the same set, or if they're defined the same way in different sets.

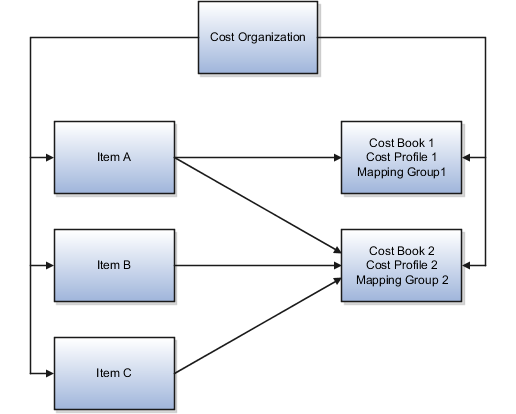

The following figure illustrates different mappings of cost component groups to items. That is, in a cost organization, Item A maps to two cost groups, and item B and Item C maps to only one cost group.