UBL-2.1-PEPPOL-Invoice-In

The data mapping and sample payload for UBL-2.1-PEPPOL-Invoice-In message definition are outlined in this section.

You must create the following list of domain value maps before you can exchange UBL PEPPOL messages. Populate each domain value map with values from the code lists.

| DVM Name | Code Lists |

|---|---|

|

CURRENCY_CODE |

|

|

INVOICE_TYPE_CODE |

https://docs.peppol.eu/poacc/billing/3.0/codelist/UNCL1001-inv/ |

|

INVOICE_TRX_TYPE_CODE |

https://docs.peppol.eu/poacc/billing/3.0/codelist/UNCL1001-inv/ |

|

EAS_CODE |

|

|

ICD_CODE |

|

|

CHARGE_REASON_CODE |

|

|

UOM_CODE |

https://docs.peppol.eu/poacc/billing/3.0/codelist/UNECERec20/ |

|

COUNTRY_CODE |

|

|

PAYMENT_METHOD |

|

|

TAX_CATEGORY_CODE |

|

|

PAYMENT_TERMS |

Data Mapping

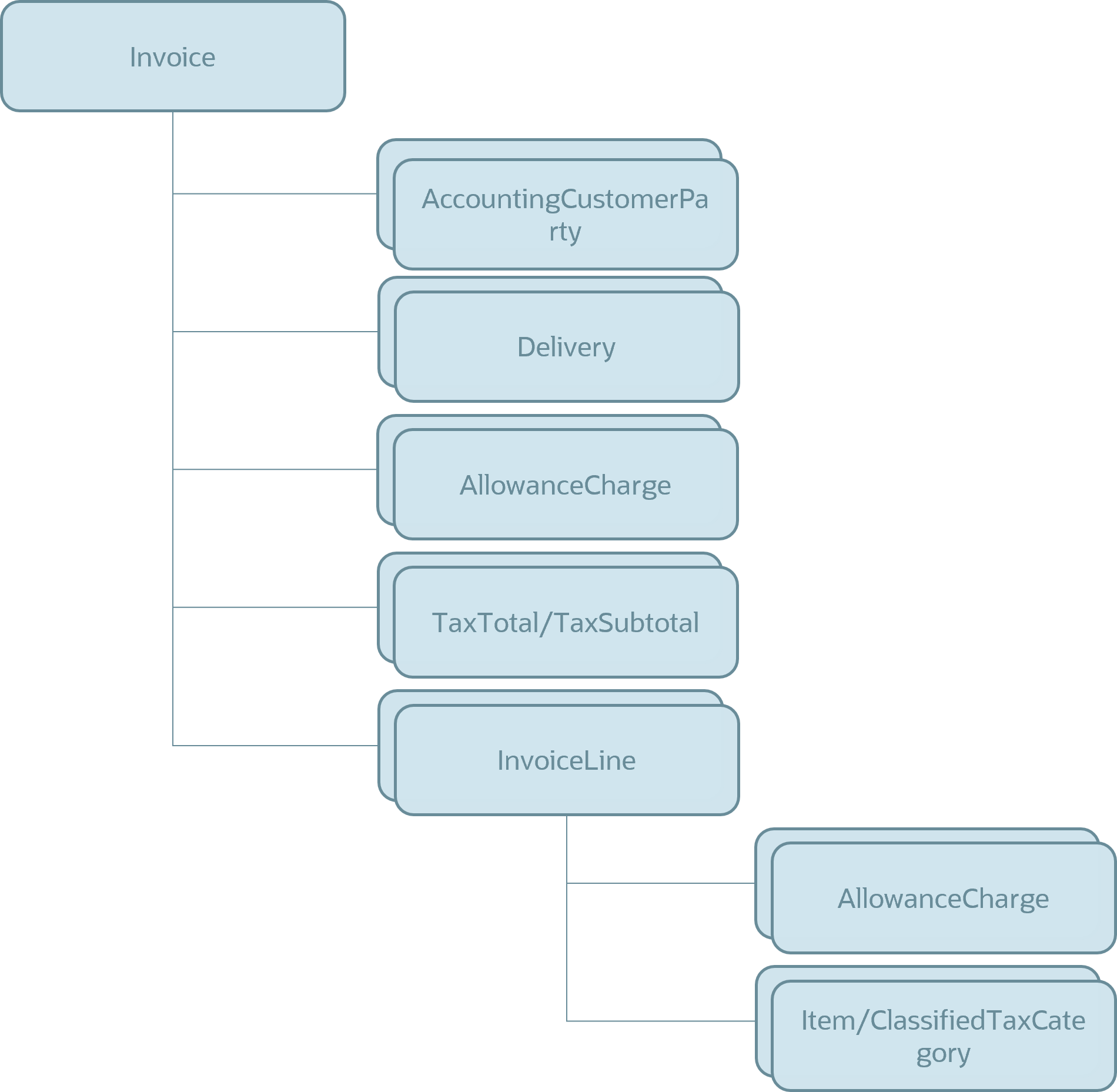

This diagram shows the structure of the inbound payload that's received from the inbound UBL-2.1-PEPPOL-Invoice-In message.

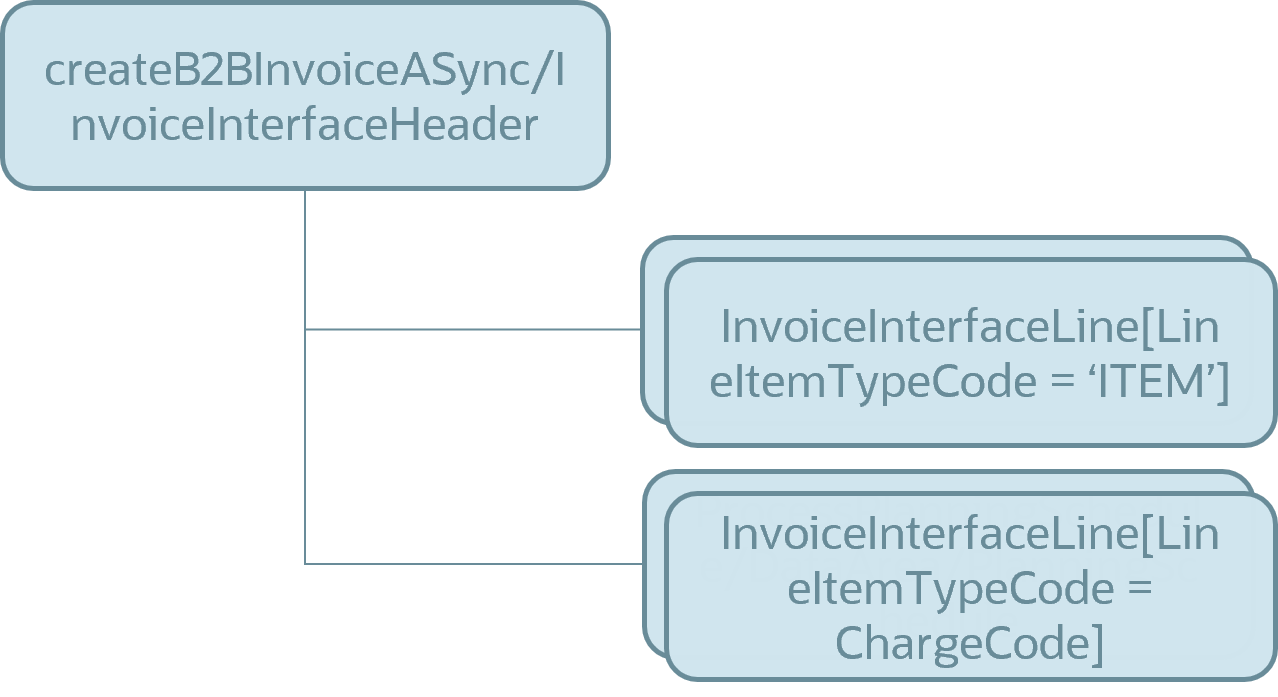

This diagram shows the structure of the payload that's passed to the application server for the UBL-2.1-PEPPOL-Invoice-In message.

This table shows where the data received in the predefined UBL-2.1-PEPPOL-Invoice-In message definition is mapped to in the application service.

|

Source: UBL-2.1-PEPPOL-Invoice-In |

Target: InvoiceInterfaceService |

|---|---|

|

../ProcessingConfiguration/PartnerKey1 |

VendorId |

|

../ProcessingConfiguration/PartnerKey2 |

VendorSiteId |

|

../ProcessingConfiguration/ProcActionCode |

B2BSiteCode |

|

../ProcessingConfiguration/SoldToLE |

LegalEntityId |

|

AccountingCustomerParty/Party/PartyLegalEntity/RegistrationName |

LegalEntityName |

|

AccountingSupplierParty/Party/PartyName/Name |

VendorName |

|

AccountingSupplierParty/SellerContact/ElectronicMail |

VendorEmailAddress |

|

AdditionalDocumentReference[DocumentType = '130']/ID |

ExternalDocumentReference |

|

AllowanceCharge [ where ChargeIndicator = 'true' and Amount != ''] |

InvoiceInterfaceLine |

|

AllowanceChargeReason |

Description |

|

AllowanceChargeReasonCode |

LineTypeLookupCode

Note: If a value is

provided for AllowanceChargeReasonCode, then the DVM

CHARGE_REASON_CODE is used to derive this value otherwise if

there is no value provided for AllowanceChargeReasonCode

then LineTypeLookupCode is then set to

MISCELLANEOUS. |

|

Amount |

Amount: If InvoiceTypeLookupCode = STANDARD, this value is set to the Amount received in the payload. If InvoiceTypeLookupCode = CREDIT and the Amount received in the payload is negative, then this value is set to that amount, otherwise if the Amount in the payload is positive, this value is set to negative. |

|

DocumentCurrencyCode |

InvoiceCurrencyCode |

|

ID |

InvoiceNumber |

|

InvoicedQuantity |

InvoicedQuantity Note: If InvoiceTypeLookupCode = STANDARD then InvoicedQuantity is

mapped.If InvoiceTypeLookupCode = CREDIT and the InvoicedQuantity

received in the payload is negative, then this value is set

to that, otherwise if the InvoicedQuantity in the payload is

positive, this value is set to the negative of it.

|

|

InvoicedQuantity/@unitCode |

UnitOfMeasLookupCode Note: DVM UOM_CODE associated with this field.

|

| InvoiceLine | InvoiceInterfaceLineAn InvoiceInterfaceLine[LineTypeLookupCode = 'ITEM'] is created for each InvoiceLine. |

|

InvoiceTypeCode |

InvoiceTypeLookupCode Note: If LegalMonetaryTotal/PayableAmount is a negative then this

value is set to CREDIT.If InvoiceTypeCode = 'CREDIT' or 'Credit' or '381' then this

value is set to CREDIT.If InvoiceTypeCode = 'STANDARD' or '380' or '388' then this

value is set to STANDARD.If InvoiceTypeCode does not have a value then the value for

InvoiceTypeLookupCode is derived from the DVM

INVOICE_TYPE_CODE .

|

|

IssueDate |

InvoiceDate |

|

Item/Name |

ItemDescription |

|

Item/SellersItemIdentification/ID |

VendorItemNumber |

|

LegalMonetaryTotal/PayableAmount |

InvoiceAmount: If InvoiceTypeLookupCode = STANDARD then InvoiceAmount is set to LegalMonetaryTotal/PayableAmount. If InvoiceTypeLookupCode = CREDIT then InvoiceAmount is set to LegalMonetaryTotal/PayableAmount expressed as a negative number. |

|

LineExtensionAmount |

Amount: If InvoiceTypeLookupCode = STANDARD then LineExtensionAmount is mapped. If InvoiceTypeLookupCode = CREDIT and LineExtensionAmount is positive then it is mapped as negative. |

|

Note |

Description |

|

Note |

Description |

|

OrderLineReference[1]/LineID |

POLineNumber |

|

OrderLineReference[1]/OrderReference/ID |

PONumber |

|

OrderReference/ID |

PONumber: If OrderReference/ID is provided it is mapped or if OrderReference/ID is blank then InvoiceLine[1]/OrderLineReference[1]/OrderReference/cbc:ID is mapped. |

|

PaymentTerms/Note |

TermsName Note: By default, this value is derived using

the DVM PAYMENT_TERMS. If you don't want to map PaymentTerms,

update the variable mapPaymentTerms in the XSL file.

|

|

Price/PriceAmount |

UnitPrice |

|

TaxTotal/TaxAmount |

ControlAmount: If the InvoiceTypeLookupCode = STANDARD then ControlAmount is set as the sum of the TaxAmounts. If the InvoiceTypeLookupCode = CREDIT then the ControlAmount is set to the sum of the TaxAmounts expressed as a negative number. |

|

Source: Set to B2B XML INVOICE. |

|

|

B2BProgramName: This value is set to AP_INV_B2B_SOA. |

|

|

LineGroupNumber: This is set to the instance of InvoiceLine. |

|

|

LineTypeLookupCode: When InvoiceInterfaceLine represents the InvoiceLine, LineTypeLookupCode is set to ITEM. |

Sample Payload

<?xml version="1.0" encoding="UTF-8"?>

<ubl:Invoice xmlns:cac="urn:oasis:names:specification:ubl:schema:xsd:CommonAggregateComponents-2" xmlns:cbc="urn:oasis:names:specification:ubl:schema:xsd:CommonBasicComponents-2" xmlns:cmk="http://xmlns.oracle.com/apps/scm/cmk" xmlns:ubl="urn:oasis:names:specification:ubl:schema:xsd:Invoice-2">

<cbc:UBLVersionID>2.1</cbc:UBLVersionID>

<cbc:CustomizationID>urn:cen.eu:en16931:2017#compliant#urn:fdc:peppol.eu:2017:poacc:billing:3.0</cbc:CustomizationID>

<cbc:ProfileID>urn:fdc:peppol.eu:2017:poacc:billing:01:1.0</cbc:ProfileID>

<cbc:ID>2810005248</cbc:ID>

<cbc:IssueDate>2020-09-07</cbc:IssueDate>

<cbc:InvoiceTypeCode>380</cbc:InvoiceTypeCode> <!-- INVOICE_TYPE_CODE -->

<cbc:DocumentCurrencyCode>EUR</cbc:DocumentCurrencyCode> <!-- CURRENCY_CODE -->

<cac:OrderReference>

<cbc:ID>PO123456789</cbc:ID>

</cac:OrderReference>

<cac:AccountingSupplierParty>

<cac:Party>

<cbc:EndpointID schemeID="NL">NL001830041B01</cbc:EndpointID>

<cac:PartyIdentification>

<cbc:ID schemeID="NL">NL001830041B01</cbc:ID>

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>MyLegal Name</cbc:Name>

</cac:PartyName>

<cac:PostalAddress>

<cbc:StreetName>123 Main Steet</cbc:StreetName>

<cbc:AdditionalStreetName>Line 2</cbc:AdditionalStreetName>

<cbc:CityName>AnyCity</cbc:CityName>

<cbc:PostalZone>1082 MS</cbc:PostalZone>

<cbc:CountrySubentity>Region 2</cbc:CountrySubentity>

<cac:AddressLine>

<cbc:Line>123 Main Steet</cbc:Line>

</cac:AddressLine>

<cac:Country>

<cbc:IdentificationCode>NL</cbc:IdentificationCode>

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID>NL001830041B01</cbc:CompanyID>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>MyLegal Name</cbc:RegistrationName>

<cbc:CompanyID>09036504</cbc:CompanyID>

</cac:PartyLegalEntity>

</cac:Party>

</cac:AccountingSupplierParty>

<cac:AccountingCustomerParty>

<cac:Party>

<cbc:EndpointID schemeID="NL">CustomerTaxRegNumber</cbc:EndpointID>

<cac:PartyIdentification>

<cbc:ID schemeID="NL">CustomerTaxRegNumber</cbc:ID>

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>BillToPartyName</cbc:Name>

</cac:PartyName>

<cac:PostalAddress>

<cbc:StreetName>Main Street 2</cbc:StreetName>

<cbc:AdditionalStreetName>Line 2</cbc:AdditionalStreetName>

<cbc:CityName>MyCity</cbc:CityName>

<cbc:PostalZone>3526 LA</cbc:PostalZone>

<cac:AddressLine>

<cbc:Line>Main Street 2</cbc:Line>

</cac:AddressLine>

<cac:Country>

<cbc:IdentificationCode>NL</cbc:IdentificationCode>

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID>CustomerTaxRegNumber</cbc:CompanyID>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>BillToPartyName</cbc:RegistrationName>

<cbc:CompanyID schemeID="NL">CustomerTaxRegNumber</cbc:CompanyID>

</cac:PartyLegalEntity>

</cac:Party>

</cac:AccountingCustomerParty>

<cac:Delivery>

<cac:DeliveryLocation>

<cbc:ID schemeID="NL">12345</cbc:ID>

<cac:Address>

<cbc:StreetName>Griffioenlaan 2</cbc:StreetName>

<cbc:AdditionalStreetName>Line 2</cbc:AdditionalStreetName>

<cbc:CityName>MyCity-ShipTo</cbc:CityName>

<cbc:PostalZone>3526 LA</cbc:PostalZone>

<cac:AddressLine>

<cbc:Line>Griffioenlaan 2</cbc:Line>

</cac:AddressLine>

<cac:Country>

<cbc:IdentificationCode>NL</cbc:IdentificationCode>

</cac:Country>

</cac:Address>

</cac:DeliveryLocation>

</cac:Delivery>

<cac:PaymentMeans>

<cbc:PaymentMeansCode>PO</cbc:PaymentMeansCode>

<cac:PayeeFinancialAccount>

<cbc:ID>NL85RABO0112295037</cbc:ID>

</cac:PayeeFinancialAccount>

</cac:PaymentMeans>

<cac:PaymentTerms>

<cbc:Note>30 days</cbc:Note> <!-- PAYMENT_TERMS -->

</cac:PaymentTerms>

<cac:AllowanceCharge>

<cbc:ChargeIndicator>true</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>FREIGHT</cbc:AllowanceChargeReasonCode> <!-- CHARGE_REASON_CODE -->

<cbc:AllowanceChargeReason>FREIGHT</cbc:AllowanceChargeReason>

<cbc:Amount currencyID="EUR">10.00</cbc:Amount>

<cac:TaxCategory>

<cbc:ID>E</cbc:ID>

<cbc:Percent>0</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:AllowanceCharge>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="EUR">420</cbc:TaxAmount>

<cac:TaxSubtotal>

<cbc:TaxableAmount currencyID="EUR">5010</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="EUR">0</cbc:TaxAmount>

<cac:TaxCategory>

<cbc:ID>E</cbc:ID>

<cbc:Percent>0</cbc:Percent>

<cbc:TaxExemptionReason>Exempt</cbc:TaxExemptionReason>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

<cac:TaxSubtotal>

<cbc:TaxableAmount currencyID="EUR">2000</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="EUR">420</cbc:TaxAmount>

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>21</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

</cac:TaxTotal>

<cac:LegalMonetaryTotal>

<cbc:LineExtensionAmount currencyID="EUR">7000</cbc:LineExtensionAmount>

<cbc:TaxExclusiveAmount currencyID="EUR">7015</cbc:TaxExclusiveAmount>

<cbc:TaxInclusiveAmount currencyID="EUR">7435</cbc:TaxInclusiveAmount>

<cbc:AllowanceTotalAmount currencyID="EUR">0</cbc:AllowanceTotalAmount>

<cbc:ChargeTotalAmount currencyID="EUR">10</cbc:ChargeTotalAmount>

<cbc:PayableAmount currencyID="EUR">7435</cbc:PayableAmount>

</cac:LegalMonetaryTotal>

<cac:InvoiceLine>

<cbc:ID>1</cbc:ID>

<cbc:Note>test line 1</cbc:Note>

<cbc:InvoicedQuantity unitCode="10">1</cbc:InvoicedQuantity> <!-- UOM_CODE -->

<cbc:LineExtensionAmount currencyID="EUR">2000</cbc:LineExtensionAmount>

<cac:AllowanceCharge> <!-- Inbound xsl does not map these -->

<cbc:ChargeIndicator>true</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>FREIGHT</cbc:AllowanceChargeReasonCode> <!-- CHARGE_REASON_CODE -->

<cbc:AllowanceChargeReason>FREIGHT</cbc:AllowanceChargeReason>

<cbc:Amount currencyID="EUR">10.00</cbc:Amount>

</cac:AllowanceCharge>

<cac:AllowanceCharge>

<cbc:ChargeIndicator>true</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>MISC</cbc:AllowanceChargeReasonCode> <!-- CHARGE_REASON_CODE -->

<cbc:AllowanceChargeReason>MISC</cbc:AllowanceChargeReason>

<cbc:Amount currencyID="EUR">5.00</cbc:Amount>

</cac:AllowanceCharge>

<cac:Item>

<cbc:Description>Item Description</cbc:Description>

<cbc:Name>Item Description</cbc:Name>

<cac:SellersItemIdentification>

<cbc:ID>Item</cbc:ID>

</cac:SellersItemIdentification>

<cac:ClassifiedTaxCategory>

<cbc:ID/>

<cbc:Percent>21</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

</cac:Item>

<cac:Price>

<cbc:PriceAmount currencyID="EUR">2000</cbc:PriceAmount>

</cac:Price>

</cac:InvoiceLine>

</ubl:Invoice>