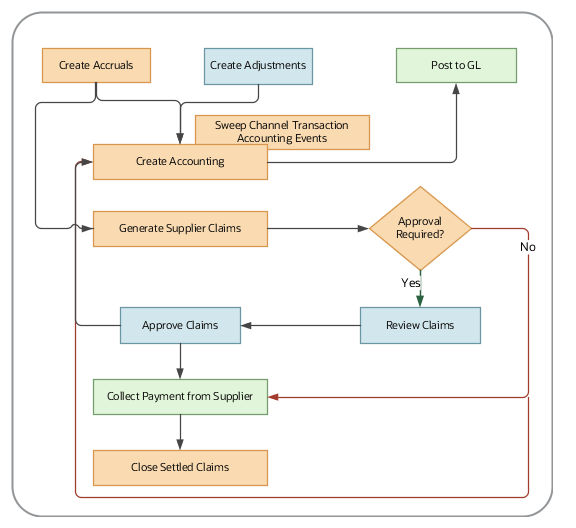

How Supplier Accruals are Accounted

Here you understand how supplier activity is accounted in Channel Revenue Management.

Accrue Earned Supplier Discounts

-

Supplier Rebate: After receiving transactions are loaded into Channel Revenue Management and supplier invoices are received, eligible program discounts can be captured using the Create Accruals for Channel Batch process.

Supplier Ship and Debit: When an order is created in an order capture application, eligible program discounts are calculated and applied as channel incentives on an order line. After the order is invoiced, it's eligible to be brought into Channel Revenue Management as a channel accrual.

-

A supply chain application administrator can create these accruals on demand or schedule it as a batch process on a periodic basis.

-

Accruals that were missed or needs correction can be added as manual adjustments.

-

After a channel accrual is earned based on its program rules, it's eligible to be posted to the general ledger.

-

A general accounting manager can post earned accruals to the general ledger on demand, or schedule it as a batch process on a periodic basis. The integration to General Ledger supports the Subledger Accounting architecture to derive the accounting.

Relieve Supplier Accruals

-

You can create claims against the accruals using the Generate Supplier Claims process.

-

After a claim is created (or approved) and is pending settlement, it's eligible to relieve its accruals by posting to the general ledger.

-

A general accounting manager can post relief of accruals to the general ledger on demand or schedule it as a batch process on a periodic basis. The integration to General Ledger supports the Subledger Accounting architecture to derive the accounting.

-

Sweep the unprocessed channel journal entries from closed accounting periods to open or future enterable periods using the Sweep Channel Transaction Accounting Events process. Run the Create Accounting process to post these to GL.

-

After payment, close the settled claims using the Close Settled Claims process.