Overview of Setting Up Credit Check

Use credit check in Order Management to minimize the financial risk that your organization assumes during day-to-day operations. Validate each sales order and verify your customer has credit available that's sufficient to cover the cost of purchase.

For example:

-

Screen each sales order for customer credit at order submit.

-

Do credit check according to order type.

-

Automatically release credit hold after the credit check issue resolves and proceed to fulfillment.

-

Check credit before shipment during a long fulfillment cycle. Credit status might change during fulfillment.

-

Allow only some users to manually release a credit check hold.

Order Management can do a credit check on each sales order or on each order line, and can hold an order line that doesn't pass credit check.

Note

-

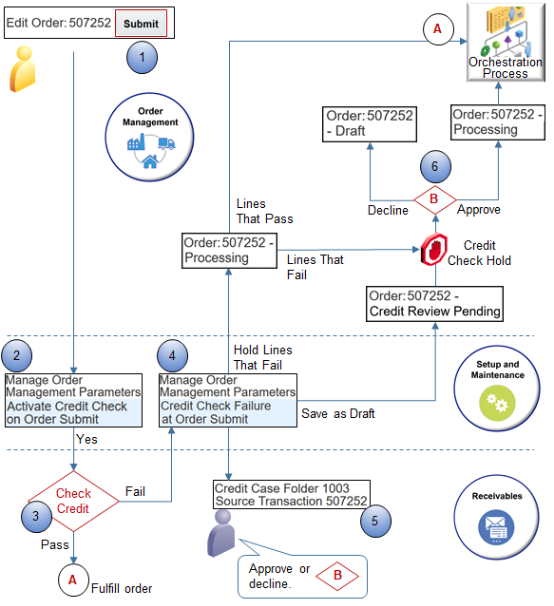

The Order Entry Specialist creates a sales order in Order Management, adds order lines, sets payment terms, payment method, and Bill-to Customer, then clicks Submit.

-

If you set the Activate Credit Check on Order Submit parameter to:

-

Yes.. Order Management calls the credit check service in Receivables.

-

No. Order Management orchestrates fulfillment.

For details, see Manage Order Management Parameters.

-

-

Do credit check.

-

Receivables does credit check. If credit check.

-

Passes. Receivables sends the result to Order Management, and Order Management orchestrates fulfillment.

-

Fails. Credit check continues.

-

-

-

Order Management processes the sales order depending on how you set the value of the Credit Check Failure at Order Submit parameter.

Value

Description

Save Order in Draft Status

Save the sales order in Draft status and don't proceed to fulfillment. Wait for the credit analyst to approve or decline.

Submit the Order with Hold on Lines That Failed Credit Check

Save the sales order in Processing status, place a hold on each order line that fails credit check, then send order lines that aren't on hold to fulfillment.

For details, see the Handle Credit Check Failure section later in this topic.

-

Receivables creates a case folder for the credit request and determines credit status.

Status

Description

Open

Receivables authorizes credit and sets Authorization Status to Open.

Failed

Receivables sends the credit check result to Order Management, including credit authorization number, credit authorization amount, and credit expiration date.

The credit analyst uses the Credit Reviews page in the Receivables work area to examine the case folder, then approves or declines the credit request. Receivables sends the result of the credit review to Order Management.

-

If the credit analyst.

-

Approves. Receivables sends the authorization ID, date, Bill To, and release reason to Order Management. Order Management sets the status to Processing and orchestrates fulfillment for the entire sales order.

-

Declines. Order Management sets the status to Draft and doesn't send any part of the sales order to fulfillment. The Order Entry Specialist must revise the sales order.

-

Note

-

Credit check establishes a credit line only for a single currency, and only for the customer account.

-

Order Management runs credit check when the user submits the sales order, and immediately before running approval. If credit check succeeds, and if approval fails, then Order Management removes authorization for the authorization number, then gets a new authorization number after the user resubmits the sales order.

-

If the Order Entry Specialist modifies an attribute that affects payment sometime after Order Management runs credit check, then Order Management runs credit check again. Bill-To Customer is an example of an attribute that affects payment.

-

If the Order Entry Specialist cancels a sales order before fulfillment finishes, then Order Management communicates with Credit Management in Receivables to reverse the credit amount of the sales order. It reverses this amount in the customer account in Oracle Financials.

Calculate Available Credit

Here's the equation that Receivables uses when it calculates available credit.

-

Credit limit, minus the open balance, minus total outstanding authorization, equals available credit.

Receivables also does this.

-

Uses invoice details to determine the open balance

-

Sums the amounts of an authorization to determine the total outstanding authorization

For example, assume a customer account contains these values.

-

Credit limit is $2,000

-

Open balance is $0

-

Outstanding authorization is $500

-

Customer orders an item that costs $1,000

Receivables does these calculations.

-

$2,000 credit limit, minus $0 open balance, minus $500 outstanding authorization, equals $1,500 available credit.

-

$1,500 available credit exceeds the $1,000 item cost, so Receivables authorizes the purchase, and then sends an authorization number, expiration date, authorization amount of $1,000, and available credit to Order Management. Receivables uses the same currency that the sales order uses.

You can use the Receivables work area to define a different formula, such as modifying credit limit, including shipping charges and taxes, and so on. For details, see Using Receivables Credit to Cash.

Handle Credit Check Failure

Order Management processes credit check differently depending on the value you set for the Credit Check Failure at Order Submit parameter.

Save Order in Draft Status

This section assumes you enable the Credit Management feature in Receivables.

If any order line fails credit check, then the entire sales order fails during order submit.

Order Management processes the sales order.

-

Saves the sales order in status Credit Review Pending.

-

Doesn't submit the sales order to order fulfillment.

-

Doesn't apply a credit check hold on any order line.

-

Receivables opens a case folder for the sales order in Credit Reviews.

-

The credit analyst sets the recommendation and closes the case folder in Credit Management.

-

Order Management does these steps.

-

Updates the Credit Authorization Number attribute and the Expiration Date attribute on the sales order.

-

Displays a message for the fulfillment lines. The message contains case folder details, such as Closure Date, Status, and Closed By. For details, see Release Holds for Order Lines That Fail Credit Check.

-

Changes order status and continues processing depending on how the credit analyst sets the recommendation.

Credit Analyst's Recommendation

Result in Order Management

Approve Source Transaction Credit Request

Depends on whether you implement trade compliance check or order approval.

-

Don't implement. Changes order status to Processing, automatically removes credit hold, and proceeds to order fulfillment.

-

Do implement. Sets status according to the state of compliance check or order approval, then proceeds to compliance check or order approval.

Decline Source Transaction Credit Request

Change order status to Draft.

The Order Entry Specialist must revise and resubmit the sales order.

-

-

Submit Order with Hold on Lines that Failed Credit Check

This section assumes you enable the Credit Management feature in the Receivables work area.

Order Management does these steps.

-

Submits the sales order to order fulfillment even if credit check fails.

-

Applies a credit check hold on each order line that fails credit check.

-

Holds the lines that fail credit check on the first step of the orchestration process.

-

Opens a case folder for the sales order in Credit Management.

-

Sends fulfillment lines that pass credit check to the next step in the orchestration process.

-

The credit analyst sets the recommendation and closes the case folder in Credit Management.

-

Order Management does these steps.

-

Updates attributes and displays a message. This behavior is similar to the behavior that happens when you use Save Order in Draft Status.

-

Changes order status depending on how the credit analyst sets the recommendation when closing the case folder.

Recommendation

Result in Order Management

Approve Source Transaction Credit Request

Release credit check hold on fulfillment lines and send them to order fulfillment.

Decline Source Transaction Credit Request

Doesn't release credit check hold on fulfillment lines. These lines remain on hold, and Order Management doesn't send them to order fulfillment.

The Order Entry Specialist can query or cancel failed lines, but can't revise them.

-

Revising Sales Orders

Note

-

If a revision fails credit check, then Order Management sets the status to Credit Review Pending regardless of how you set the parameter.

-

If the sales order or order revision is in the Credit Review Pending status, then the Order Entry Specialist can't make any changes. The Order Entry Specialist must use the Revert to Draft action, and then make changes.

-

If you enable or don't enable the Credit Management feature.

-

Enable. Order Management waits for the credit analyst to close the case folder before submitting failed lines to order fulfillment.

-

Don't enable. The Order Entry Specialist must manually revise the revision to a draft, modify the sales order, such as delete lines that failed credit check, reduce quantity so the sales order total doesn't exceed credit limit, and so on, and then resubmit.

-

-

The revision must successfully pass credit check so Order Management can merge the Draft sales order into the Processing instance of the same sales order that's currently running in order fulfillment.

Behavior When You Don't Enable Credit Management

This section assumes you don't enable the Credit Management feature in Receivables, and credit check fails during order submit.

-

Order Management takes action depending on the value of the Credit Check Failure at Order Submit parameter.

Value

Result

Save Order in Draft Status

Set order status to Credit Review Pending.

Wait for the credit analyst to resolve the issue and close the case folder.

Don't submit any order lines to order fulfillment.

Submit Order with Hold on Lines that Failed Credit Check

Set order status to Processing.

Place each order line that fails credit check on credit check hold.

Submit all order lines, including order lines that fail credit check, to order fulfillment.

-

Credit analyst resolves the issue and closes the case folder.

-

Order Entry Specialist must revise the sales order, then resubmit it.