Overview of Cost Accounting

The Manage Cost Accounting business process is used by cost accountants to calculate inventory transaction costs, maintain inventory valuation, generate accounting distributions for inventory transactions, analyze product costs, analyze usage of working capital for inventory, and analyze gross margins.

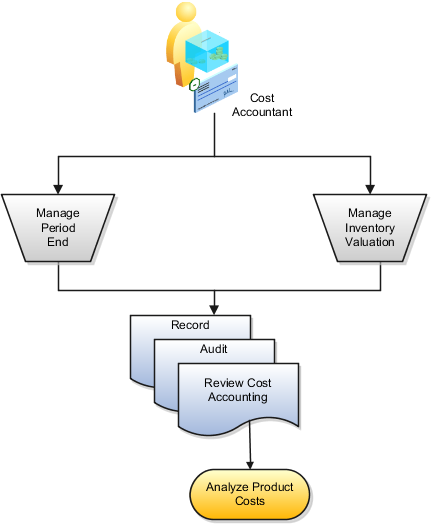

The following image lists the Cost Accounting tasks.

-

Manage Period End. Manage the timing of transaction processing, and perform validations in preparation for accounting period close.

-

Manage Inventory Valuation. Adjust the cost of items to address inventory obsolescence, price changes, and other variances.

-

Record, Audit, and Review Cost Accounting. Create cost accounting distributions for transaction data that's received from external sources, view and address any processing exceptions, and review results.

-

Analyze Product Costs: View the perpetual average cost, actual cost, and standard cost details of an item, chart its cost trend, compare costs across items, analyze usage of working capital and gross margins.