Tax Accounting for Receipt Transactions

To comply with tax regulations, calculate taxes and generate tax distributions for all receipt transactions. You can capture item prices, inclusive and exclusive taxes on your purchases. Receipt costs are adjusted to account inclusive taxes that were included in the item purchase price. Inclusive taxes are booked to a tax liability or recovery account.

You configure the tax point basis and tax point date in Oracle Fusion Cloud Financials. Based on this configuration, taxes are calculated either on delivery or invoice generation. For more information about configuring and calculating taxes, see the Oracle Fusion Cloud Financials Using Tax guide available on the Oracle Help Center.

Prerequisites

You must assigned a role with the privileges listed here:

-

Create Tax Processing Options (ZX_CREATE_TAX_PROCESSING_OPTIONS_PRIV)

This allows creation of configuration owner tax options to differentiate setup from the predefined event class setup.

-

Update Tax Processing Options (ZX_UPDATE_TAX_PROCESSING_OPTIONS_PRIV)

This allows update of configuration owner tax options to differentiate setup from the predefined event class setup.

-

Verify Tax Configuration (ZX_VERIFY_TAX_CONFIGURATION_PRIV)

This allows verification of tax configuration for taxes that are enabled for transactions or for simulation by simulating real-time transactions.

Configure the following to automatically calculate and account taxes.

-

In the Offerings work area, enable the Tax Calculation on Receipt Accounting Distributions feature at the Financials offering level.

-

Enable delivery-based tax calculation for invoices:

-

In the Setup and Maintenance work area, go to the following:

-

Offering: Financials

-

Functional Area: Transaction Tax

-

Task: Manage Configuration Owner Tax

-

-

From the Configuration Owner drop-down list, select the relevant business unit.

-

From the Application Name drop-down list, select Payables.

-

From the Event Class drop-down list, select Standard Invoices.

-

From the Tax Point Basis drop-down list, select Invoice.

-

From the Tax Point Date drop-down list, select Receipt Date.

For more information about configuring and calculating taxes, see the Oracle Fusion Cloud Financials Using Tax guide available on the Oracle Help Center.

-

-

Configure the application to automatically calculate taxes for trade receipt accrual:

-

In the Setup and Maintenance work area, go to the following:

-

Offering: Manufacturing and Supply Chain Materials Management

-

Functional Area: Supply Chain Financial Flows

-

Task: Manage Supply Chain Financial Orchestration System Options

-

-

Select Calculate tax for trade receipt accrual.

-

-

Configure the application to automatically calculate and account nonrecoverable taxes on intercompany invoices:

-

Navigate to the Financial Orchestration work area.

-

In the Tasks pane, click Manage Documentation and Accounting Rules.

-

Click the required documentation and accounting rule.

-

Under Required Tasks, select Intercompany Invoices.

-

How Taxes are Calculated and Accounted

Here's how taxes are calculated and accounted for different combinations of tax point basis and tax point dates:

|

Tax Point Basis |

Tax Point Date |

Tax Calculation |

Tax Accounting |

Variance Calculation and Accounting |

|---|---|---|---|---|

|

Delivery |

Receipt Date |

Taxes are calculated on goods receipt |

Recoverable and nonrecoverable taxes are accounted on goods receipt |

Not Applicable |

|

Invoice |

Receipt Date |

Taxes are calculated on goods receipt |

|

Not Applicable |

|

Invoice |

Invoice Date |

Taxes are calculated on invoice generation |

Recoverable and nonrecoverable taxes are accounted on invoice generation |

Tax variance is calculated and accounted for difference in the taxes estimated on purchase order and final tax calculated on invoice |

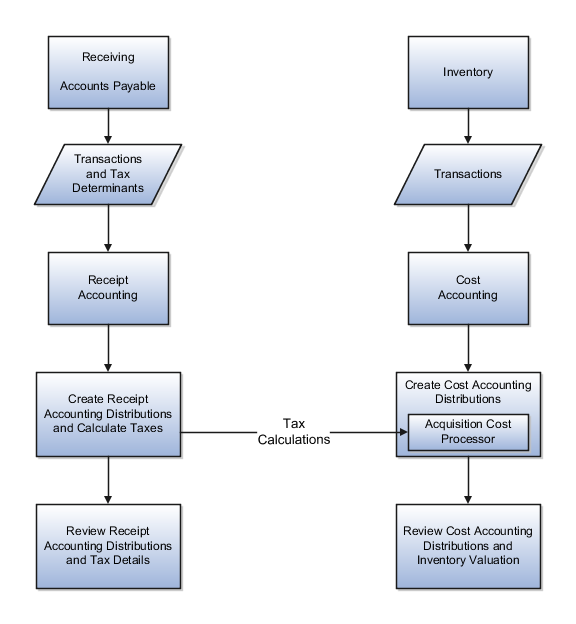

Oracle Receipt Accounting receives transactions and related tax determinants from outside sources such as Oracle Receiving, Oracle Inventory Inventory, and Oracle Accounts Payable. The following discusses:

-

Import of tax determinants into Receipt Accounting

-

Tax distributions created by Receipt Accounting

-

Tax distributions by Oracle Cost Accounting

-

Review of tax distributions

Import Tax Determinants

Here's how you can import transactions and related tax determinants from outside sources on the Scheduled Processes page in the Scheduled Processes work area.

-

Select the Transfer Transactions from Receiving to Receipt Accounting process to import receipt transactions into Receipt Accounting.

-

Select the Transfer Costs to Cost Management process to import accounts payable transactions into Receipt Accounting and Cost Accounting.

Tax Distributions by Receipt Accounting

The Receipt Accounting Processor calls the Tax Application Programming Interface to calculate transaction taxes based on imported tax determinants. The processor also generates tax distributions for receipt transactions.

Run the Receipt Accounting Processor on the Create Receipt Accounting Distributions page in the Receipt Accounting work area.

Tax Distributions by Cost Accounting

The Cost Accounting Processor uses tax results generated by Receipt Accounting to calculate inventory acquisition costs including nonrecoverable taxes.

Run the Cost Accounting Processor on the Create Cost Accounting Distributions page in the Cost Accounting work area.

Review Tax Distributions

On the Review Receipt Accounting Distributions page in the Receipt Accounting work area view results of the Receipt Accounting Processor:

-

Distributions and journal entries for receipt transactions

-

Tax determinants accessed by clicking the links in the Tax Determinants column

-

Transaction taxes accessed by clicking the Transaction Unit Cost links in the Cost Information tab

On the Review Cost Accounting Distributions page in the Cost Accounting work area view results of the Cost Accounting Processor:

-

Distributions and journal entries for inventory transactions

-

Inventory unit costs including taxes in the Cost Information tab

- Example of Tax Accounting for a Simple Procurement Transaction

- Example of Tax Accounting for a Consigned Inventory Transaction

- Example of Tax Accounting for a Purchase Order Retroactive Price Change

- Example of Tax Accounting for Interorganization Transfers Across Business Units

- Example of Tax Accounting for Internal Drop Shipments