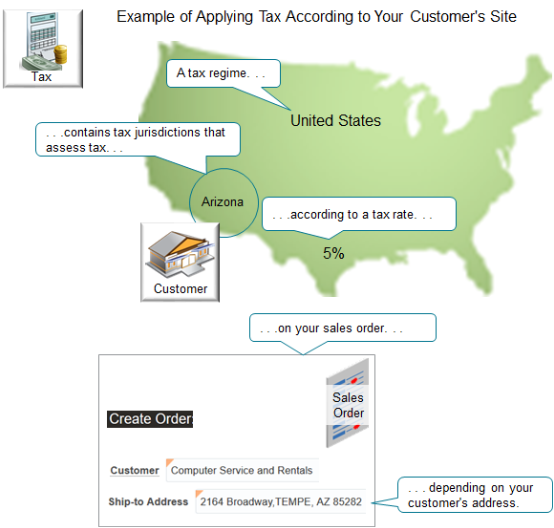

Apply Tax According to Customer Site

Set up tax so Order Management can add tax to a sales order according to your customer's physical site. This is the way you set up the default tax that Order Management applies on a sales order for most customers.

Here's an example of how you can set up tax.

Note

-

A tax regime, such as the United States, contains tax jurisdictions, such as the Arizona Department of Revenue.

-

The tax jurisdiction assess a tax on your sales according to its tax rate, and depending on your customer's address.

-

For example, if the tax rate in the Arizona tax jurisdiction is 5%, and if the net price on the sales order is $100, then the tax is $5.

You have a wide range of choices when setting up tax, depending on your supply chain's tax requirements. For example, you can specify tax according to the tax jurisdiction that applies at the ship-to site, the bill-to site, or a range of other locations.

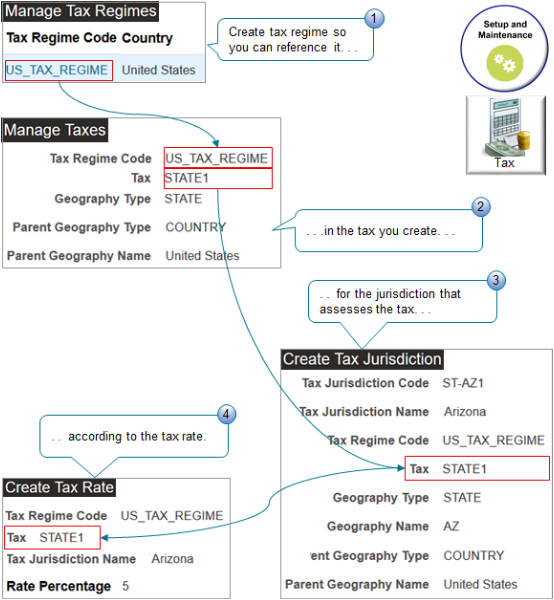

Here's the flow that you use to set up the example in this topic.

Here are the tasks you use.

|

Task |

Description |

|---|---|

|

1. Manage Tax Regimes |

Create a tax regime named USA_TAX_REGIME for the United States. |

|

2. Manage Taxes |

Create a tax named STATE1 at the state level for Arizona. |

|

3. Create Tax Jurisdiction |

Create a tax jurisdiction for the state of Arizona. |

|

4. Create Tax Rate |

Create the 5% tax rate to apply for the STATE1 tax. |

Each task maintains the tax hierarchy. For example:

-

The tax rate is in the USA_TAX_REGIME and the Arizona jurisdiction.

-

The Arizona jurisdiction and the STATE1 tax are in the USA_TAX_REGIME.

You create a relationship between your customer's site and the tax regime.

Summary of the Set Up

-

Create the tax regime.

-

Create the tax.

-

Create the tax status.

-

Create the tax jurisdiction.

-

Add the customer site.

-

Verify geography and collect data.

-

Test your set up.

For this example, assume.

-

You are in the Vision Operations business unit.

-

Your sales order must calculate tax according to the ship-to address on the sales order.

-

You set up tax for site 1036 of your Computer Service and Rentals customer, and their ship-to address is 2164 Broadway Tempe, AZ 85282.

-

The tax jurisdiction in Tempe charges a 5% tax.

For background details about how to set up tax, see Administering Tax Reporting on Oracle Help Center.

For other technical details, including lots of helpful screen prints, see Order Management Tax Best Practices and General Questions (Doc ID 2619517.1).

Create the Tax Regime

-

Go to the Setup and Maintenance work area, then go to the task:

-

Offering: Financials

-

Functional Area: Transaction Tax

-

Task: Manage Tax Regimes

-

-

On the Manage Tax Regimes page, click Actions > Create.

-

On the Create Tax Regimes page, set the values.

Attribute

Value

Tax Regime Code

US_TAX_REGIME

Tax Regime Name

US_TAX_REGIME

Regime Level

Country

Country

United States

Tax Currency

USD

Minimum Accountable Unit

0.01

Tax Precision

2

Tax Inclusion Method

Standard Noninclusive Handling

Allow Tax Rounding Override

Contains a check mark.

Allow Override and Entry of Inclusive Tax Lines

Contains a check mark.

Enable this option so the Order Entry Specialist can override inclusive tax on the order line.

-

In the Configuration Options and Service Subscriptions area, on the Configuration Options tab, set values, then click Save and Close > Done.

Attribute

Value

Party Name

FUSION_AP

You must set up your party before you do this procedure.

Party Type

First Party Legal Entity

Country

United States

Configuration for Taxes and Rules

Common Configuration with Party Overrides

Configuration for Product Exceptions

Common Configuration

Create the Tax

-

On the setup page, go to the task.

-

Offering: Financials

-

Functional Area: Transaction Tax

-

Task: Manage Taxes

-

-

On the Manage Taxes page, click Actions > Create.

-

On the Create Tax page, set the values.

Attribute

Value

Tax Regime Code

US_TAX_REGIME

Configuration Owner

Global Configuration Owner

Tax

STATE1

Tax Name

STATE1

Geography Type

State

Parent Geography Type

Country

Parent Geography Name

United States

Override Geography Type

US_STATE_ZONE_TYPE_101

Tax Currency

USD

Tax Minimum Accountable Unit

0.01

Tax Precision

2

Conversion Rate Type

Corporate

Rounding Rule

Down

-

In the Controls and Defaults area, set the values.

Attribute

Value

Tax Inclusion Method

Standard Noninclusive Handling

Allow override and entry of inclusive tax lines

Allow tax rounding override

Allow override of calculated tax lines

Allow entry of manual tax lines

Make sure each of these options contain a check mark. They allow Order Management to modify tax at run time.

Allow creation of multiple jurisdictions

Contains a check mark.

Allow tax exceptions

Contains a check mark.

Allow tax exemptions

Contains a check mark.

-

Click Tax Rule Defaults, then set the values.

Attribute

Value

Place of Supply

Ship to, Use Bill to If Not Found.

You're setting tax according to the tax rate in the tax jurisdiction of the ship-to address. If Order Management can't find the ship-to address at run time, then it will use the tax rate that the tax jurisdiction applies at the bill-to address.

Tax Applicability

Applicable

Tax Registration

Ship-to Party

Tax Calculation Formula

STANDARD_TC

TC means tax calculation.

Taxable Basis Formula

STANDARD_TB

TB means taxable basis.

-

In the Indirect Defaults area, set the values.

Attribute

Value

Tax Jurisdiction

ST-AZ1

ST means state.

AZ means Arizona.

Tax Status

STANDARD

Tax Rate

STD

Create the Tax Status

-

On the setup page, go to the task.

-

Offering: Financials

-

Functional Area: Transaction Tax

-

Task: Manage Tax Statuses

-

-

On the Manage Tax Statuses page, click Actions > Create.

-

On the Create Tax Status page, set the values, then click Save and Close > Done.

Attribute

Value

Tax Regime Code

US_TAX_REGIME

Configuration Owner

Global Configuration Owner

Tax

STATE1

Tax Status Code

STANDARD

Tax Status Name

STANDARD

Set as Default Tax Status

Allow tax exceptions

Allow tax exemptions

Allow tax rate override

Contains a check mark.

Parent Geography Name

United States

Create the Tax Jurisdiction

-

On the setup page, go to the task.

-

Offering: Financials

-

Functional Area: Transaction Tax

-

Task: Manage Tax Jurisdictions

-

-

On the Manage Tax Jurisdictions page, click Actions > Create.

-

On the Create Tax Jurisdiction page, set the values.

Attribute

Value

Tax Jurisdiction Code

ST-AZ1

Tax Jurisdiction Name

Arizona

Tax Regime Code

US_TAX_REGIME

Tax

STATE1

Geography Type

STATE

Geography Name

AZ

Parent Geography Type

COUNTRY

Parent Geography Name

United States

Set as Default Jurisdiction

Contains a check mark.

-

Click Save.

You must click save before you do the next step.

-

On the Associated Jurisdiction Tax Rate Periods tab, click Create.

-

On the Create Tax Rate page, set values.

Attribute

Value

Configuration Owner

Global Configuration Owner

Tax Status Code

STANDARD

Tax Rate Code

STD-DEFAULT

Tax Rate Type

Percentage

Order to Cash

Procure to Pay

Expenses

Contains a check mark.

-

In the Rate Periods area, set the values, then click Save and Close.

Attribute

Value

Rate Percentage

5

Set as Default Rate

Contains a check mark.

-

On the Edit Tax Jurisdiction page, notice that the Associated Jurisdiction Tax Rate Periods contains the STD-DEFAULT rate you just created, then click Save and Close > Done.

Create the Standard Tax Rate

-

On the setup page, go to the task.

-

Offering: Financials

-

Functional Area: Transaction Tax

-

Task: Manage Tax Rates and Tax Recovery Rates

-

-

On the Manage Tax Rates and Tax Recovery Rates page, click Actions > Create.

-

On the Create Tax Rate page, set values.

Attribute

Value

Tax Regime Code

US_TAX_REGIME

Configuration Owner

Global Configuration Owner

Tax

STATE1

Tax Status Code

STANDARD

Tax Jurisdiction Code

ST-AZ1

Tax Rate Code

STD

STD means standard.

Tax Rate Type

Percentage

Order to Cash

Procure to Pay

Expenses

Contains a check mark.

-

In the Rate Periods area, set the values, then click Save and Close > Done.

Attribute

Value

Rate Percentage

10

Set as Default Rate

Doesn't contain a check mark.

Add the Customer Site

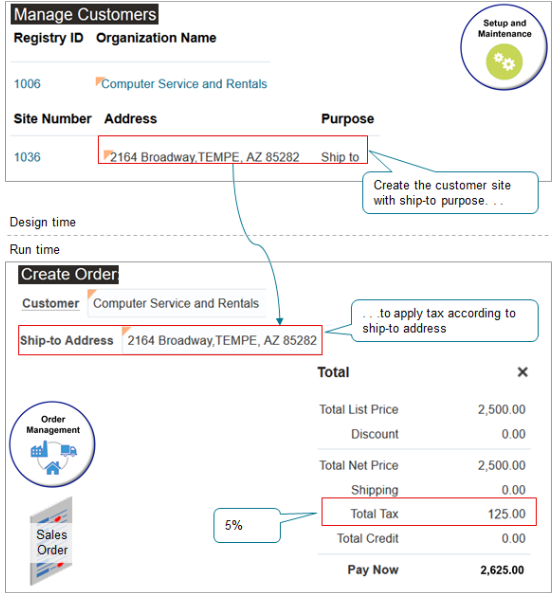

Use the Manage Customers task to create a site for your Computer Service and Rentals customer. You specify the purpose as ship-to so you can use the ship-to address on the sales order to determine the tax to apply.

Try it.

-

On the setup page, go to the task.

-

Offering: Financials

-

Functional Area: Customers

-

Task: Manage Customers

-

-

On the Manage Customers page, search for the value.

Attribute

Value

Organization Name

Computer Service and Rentals

-

In the search results, in the Sites area, click Actions > Create.

-

On the Create Account Site page, set the values.

Attribute

Value

Account Address Set

Vision Operations Set

Country

United States

Site Number

1036

Address Line 1

2164 Broadway

City

TEMPE

State

AZ

Postal Code

85282

-

In the Address Purposes area, click Actions > Add Row, set the values, then click Save and Close > Done.

Attribute

Value

Purpose

Ship To

Verify Geography and Collect Data

-

On the setup page, go to the task.

-

Offering: Financials

-

Functional Area: Enterprise Profile

-

Task: Manage Geographies

-

-

On the Manage Geographies page, search for the value.

Attribute

Value

Country Name

United States

-

In the search results, click the row that has United States in the Country Name column, then click Actions > Manage Geography Validation.

-

On the Manage Geography Validation page, in the Geography Mapping and Validation area, verify the values for the State.

Geography Type

Map to Attribute

Tax Validation

State

State

Contains a check mark.

Collect Data

-

Go to the Plan Inputs work area.

Don't use the Plan Inputs task that's available in the Setup and Maintenance work area. Use the Plan Inputs work area instead.

-

In the Plan Inputs work area, click Tasks > Collect Planning Data.

-

In the Collect Planning Data dialog, set your source system, then move reference entities to selected entities.

-

Customer

-

Geographies

-

Organizations

-

-

Click Submit.

For details, see Collect Planning Data for Order Management.

Test Your Set Up

-

Go to the Order Management work area and create a sales order.

Attribute

Value

Customer

Computer Service and Rentals

Business Unit

Vision Operations

Ship-to Address

2164 Broadway, Tempe, AZ, 85282

-

Add an order line.

Attribute

Value

Item

AS54888

Quantity

1

Amount

2,500

-

Click Actions > Reprice Order.

-

Click the total at the top of the sales order, then verify that the tax rate is 5%, which is the STD-DEFAULT rate you set up according to the ship-to address.

Attribute

Value

Total List Price

2,500.00

Discount

0.00

Total Net Price

2,500.00

Shipping

0.00

Total Tax

125.00

125 is 5% of 2,500, so this rate is correct.

Total Credit

0.00

Pay Now

2,625.00

-

Change the ship-to address to any other value, then click Actions > Reprice Order.

-

Click the total at the top of the sales order, then verify that the tax rate is 10%, which is the STD rate you set up to apply when the ship-to address isn't 2164 Broadway, Tempe, AZ, 85282.

Attribute

Value

Total List Price

2,500.00

Discount

0.00

Total Net Price

2,500.00

Shipping

0.00

Total Tax

250.00

250 is 10% of 2,500, so this rate is correct.

Total Credit

0.00

Pay Now

2,750.00