Cost Adjustments and Cost Distributions

You can adjust the cost of items to manage obsolescence, or to mark down inventory to address "lower of cost or market requirements", price changes, and variances.

You can make adjustments to the perpetual average cost of items, purchase order and miscellaneous receipt costs, and layer inventory cost.

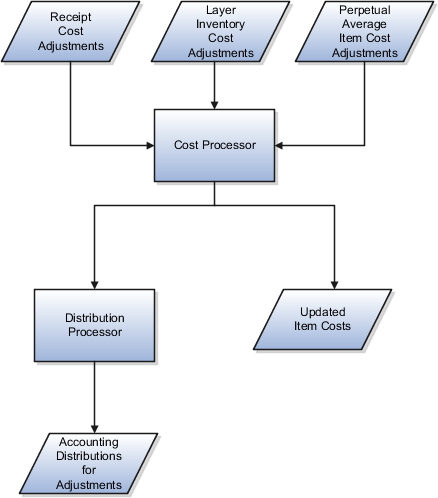

This figure illustrates the process for making cost adjustments, processing them, and viewing results.

The costing application enables you to adjust costs, process them, and create the corresponding cost accounting distributions.

Entering Cost Adjustments

Adjust the cost of items on the Create Cost Adjustments page. You can make three kinds of adjustments for combinations of a cost organization, cost book, valuation unit, and cost element.

If you want to track the adjustment through the supply chain, use a cost element of type Adjustment:

-

Perpetual average item cost. Enter the new average unit cost. The processor will automatically adjust the overall average cost for the quantity on hand.

-

Receipt cost. The receipt cost is adjusted by an update from purchasing or accounts payable, or you can manually enter new receipt costs, PO receipts, interorganization receipts, miscellaneous receipts, or RMA receipts. The processor will automatically adjust the cost of the remaining receipt quantity.

-

Layer inventory cost. You can adjust the unit cost of items that use the actual cost method. The processor will automatically adjust the value of the on-hand receipt layer quantity.

You can bundle multiple records, such as multiple receipts or valuation units, into a single adjustment transaction, and when submitted, they are assigned an adjustment number. Optionally, you can also specify a reason code.

Save the adjustment and review the impact to inventory valuations based on the quantity on hand at the time of adjustment. Do this prior to final submission for cost processing, so that you can revise as necessary. After final review and submission, you can still void the adjustment, provided it is not yet processed by the cost processor. However, the adjustment cannot be reversed once processed. Accordingly, the adjustment status code is automatically set to: S for submitted, C for voided, or P for pending processing.

Processing Adjustments

When you review and submit a cost adjustment, the cost processor creates a new adjustment transaction:

-

For a perpetual average item cost adjustment, the processor updates the perpetual average cost of the item in that combination of cost organization, cost book, item, and valuation unit. The processor then applies the perpetual average item cost adjustment against inventory valuation at the rate of quantity on hand times the change in cost.

If you create multiple perpetual average cost adjustments with the same cost organization, cost book, item, valuation unit, and adjustment date combination, then the cost processor will only process the adjustment with the maximum adjustment number. The cost processor will ignore the remaining adjustments and mark them as excluded.

-

For a receipt cost adjustment, the processor updates the receipt cost for the portion of the receipt that is part of the current on-hand balance. The portion of the adjustment attributable to what is no longer part of the on-hand balance will be accounted for with a write off distribution. However, if the cost profile of the item has cost propagation enabled, the processor revalues the issue transactions that were consumed out of the receipt.

-

For a layer inventory cost adjustment, the processor updates the unit cost of the item in that combination of cost organization, cost book and valuation unit. The processor then updates inventory valuation at the rate of quantity on hand times the change in cost.

Example 1: Assume a receipt of 8 units, all of which are currently on hand. The valuation unit has a total of 10 units on hand. You adjust the cost of the receipt from $10 to $11 per unit. The processor adjusts the average cost by $0.80 (that is, 8/ (Division symbol) 10 * (Multiplication symbol) $1).

Example 2: Assume a receipt of 8 units, of which 6 units are currently on hand, and 2 units have been depleted. The valuation unit has a total of 10 units on hand. You manually adjust the cost of the receipt from $10 to $11 per unit. The processor adjusts the receipt cost by $6 (that is, 6 *(Multiplication symbol) $1), and creates a write off accounting distribution of $2 (that is, 2 * (Multiplication symbol) $1).

Example 3: Assume a valuation unit has a total of 7 units on hand, valued at $10 per unit. You manually adjust the unit cost to $12 per unit. The processor adjusts inventory value by $14 (that is, 7 * (Multiplication symbol) $2).

Reviewing Cost Adjustment Results

After running the cost processors, check processing results, including warning and error messages, on the Review Cost Accounting Processes page.

Review the accounting entries resulting from the cost adjustments on the Review Cost Distributions page.

Review the updated perpetual average cost or actual cost of items on the Review Item Costs page.