Example of Accounting of Global Procurement Trade Transactions into Inventory

Most large enterprises use a global procurement approach to their purchasing needs, wherein a central buying organization buys goods from suppliers on behalf of the internal organizations.

Oracle Receipt Accounting and Oracle Cost Accounting process transactions for these global procurement trade events and generate subledger journal entries.

The following is an example of accounting performed by Cost Accounting and Receipt Accounting for a global procurement flow into inventory. It illustrates:

-

Transactions that are captured in Oracle Supply Chain Financial Orchestration and interfaced to Receipt Accounting and Cost Accounting.

-

Accounting entries that Receipt Accounting and Cost Accounting generate for the forward flow of a shipment from the supplier, through the intermediary distributor, to the final receiving organization.

-

Accounting entries that Receipt Accounting and Cost Accounting generate for the return flow from the receiving organization to the supplier.

Scenario

China Supplier ships the goods to US Inc. through the intermediary distributor, China Ltd.

Transactions from Supply Chain Financial Orchestration

The global procurement trade agreement, accounting rule sets, and associated purchase orders are set up in Supply Chain Financial Orchestration, and the transactions flow into Receipt Accounting and Cost Accounting based on this setup:

-

Purchase Order (PO) price from China Supplier to China Ltd. is USD 50.

-

Intercompany transfer price from China Ltd. to US Inc. is USD 100.

-

Intercompany invoicing is set to Yes.

-

Profit tracking is set to Yes.

-

Overhead rule is configured in Cost Accounting for transaction type Trade in-Transit Receipt in Cost Organization CO1.

-

China Ltd books a profit of USD 40 (USD 100 transfer price - USD 50 PO price - USD 10 overhead).

Analysis

Receipt Accounting and Cost Accounting create accounting distributions for the forward and return shipment of goods.

Accounting Entries

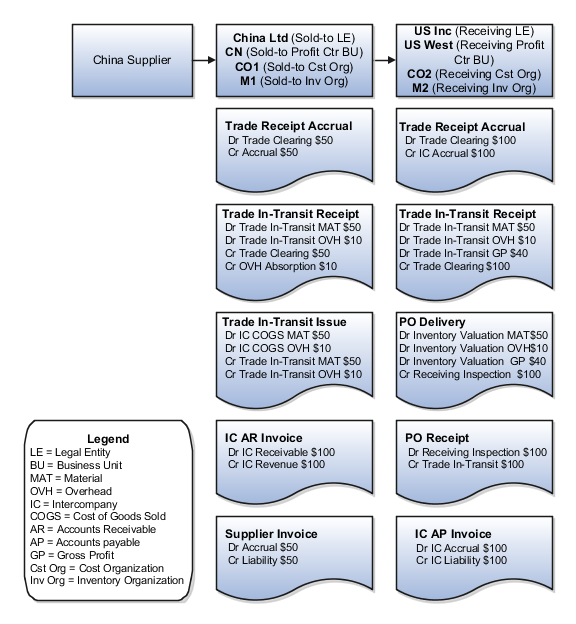

The following figure illustrates accounting entries for the forward flow from legal entity China Ltd. to legal entity US Inc.

Receipt Accounting generates distributions under business unit CN and inventory organization M1. Cost Accounting generates distributions under cost organization CO1 and inventory organization M1.

The following table describes those distributions.

|

Subledger |

Event Type |

Accounting Line Type |

Amount in Functional Currency +Dr/-Cr |

Functional Currency |

Cost Element |

Basis of Amount |

|---|---|---|---|---|---|---|

|

Receipt Accounting |

Trade Receipt Accrual |

Trade Clearing |

50 |

USD |

Not Applicable |

PO Price |

|

Receipt Accounting |

Trade Receipt Accrual |

Accrual |

-50 |

USD |

Not Applicable |

PO Price |

|

Cost Accounting |

Trade In-Transit Receipt |

Trade In-Transit |

50 |

USD |

Material |

PO Price |

|

Cost Accounting |

Trade In-Transit Receipt |

Trade Clearing |

-50 |

USD |

Material |

PO Price |

|

Cost Accounting |

Trade In-Transit Receipt |

Expense |

10 |

USD |

Overhead |

Overhead Rate |

|

Cost Accounting |

Trade In-Transit Receipt |

Overhead Absorption |

-10 |

USD |

Overhead |

Overhead Rate |

|

Cost Accounting |

Trade In-Transit Issue |

Intercompany COGS |

50 |

USD |

Material |

PO Price |

|

Cost Accounting |

Trade In-Transit Issue |

Trade In-Transit |

-50 |

USD |

Material |

PO Price |

|

Accounts Receivable |

Intercompany Accounts Receivable Invoice |

Intercompany Receivable |

100 |

USD |

Not Applicable |

Transfer Price |

|

Accounts Receivable |

Intercompany Accounts Receivable Invoice |

Intercompany Revenue |

-100 |

USD |

Not Applicable |

Transfer Price |

|

Receipt Accounting |

Supplier Invoice |

Accrual |

50 |

USD |

Not Applicable |

PO Price |

|

Receipt Accounting |

Supplier Invoice |

Liability |

-50 |

USD |

Not Applicable |

PO Price |

Receipt Accounting generates distributions under business unit US West and inventory organization M2. Cost Accounting generates distributions under cost organization CO2 and inventory organization M2.

The following table describes those distributions.

|

Subledger |

Event Type |

Accounting Line Type |

Amount in Functional Currency +Dr/-Cr |

Functional Currency |

Cost Element |

Basis of Amount |

|---|---|---|---|---|---|---|

|

Receipt Accounting |

Trade Receipt Accrual |

Trade Clearing |

100 |

USD |

Not Applicable |

Transfer Price |

|

Receipt Accounting |

Trade Receipt Accrual |

Intercompany Accrual |

-100 |

USD |

Not Applicable |

Transfer Price |

|

Cost Accounting |

Trade In-Transit Receipt |

Trade In-Transit |

50 |

USD |

Material |

Sending Organization Cost |

|

Cost Accounting |

Trade In-Transit Receipt |

Trade In-Transit |

10 |

USD |

Overhead |

Sending Organization Cost |

|

Cost Accounting |

Trade In-Transit Receipt |

Trade In-Transit |

40 |

USD |

Profit in Inventory |

Internal Markup |

|

Cost Accounting |

Trade In-Transit Receipt |

Trade Clearing |

-100 |

USD |

Material |

Transfer Price |

|

Accounts Payable |

Intercompany Accounts Payable Invoice |

Intercompany Accrual |

100 |

USD |

Not Applicable |

Transfer Price |

|

Accounts Payable |

Intercompany Accounts Payable Invoice |

Intercompany Liability |

-100 |

USD |

Not Applicable |

Transfer Price |

|

Receipt Accounting |

PO Receipt |

Receiving Inspection |

100 |

USD |

Not Applicable |

Transfer Price |

|

Receipt Accounting |

PO Receipt |

Trade In-Transit |

-100 |

USD |

Not Applicable |

Transfer Price |

|

Cost Accounting |

PO Delivery |

Inventory Valuation |

50 |

USD |

Material |

Sending Organization Cost |

|

Cost Accounting |

PO Delivery |

Inventory Valuation |

10 |

USD |

Overhead |

Sending Organization Cost |

|

Cost Accounting |

PO Delivery |

Inventory Valuation |

40 |

USD |

Profit in Inventory |

Internal Markup |

|

Cost Accounting |

PO Delivery |

Receiving Inspection |

-100 |

USD |

Not Applicable |

Transfer Price |

US Inc returns goods directly to China Supplier.

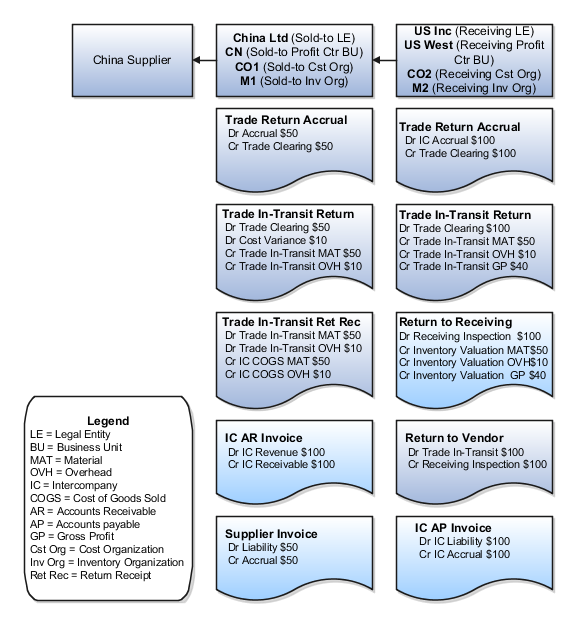

The following figure illustrates accounting entries for the return flow from legal entity US Inc to legal entity China Ltd.

Receipt Accounting generates distributions under business unit US West and inventory organization M2. Cost Accounting generates distributions under cost organization CO2 and inventory organization M2.

The following table describes those distributions.

|

Subledger |

Event Type |

Accounting Line Type |

Amount in Functional Currency +Dr/-Cr |

Functional Currency |

Cost Element |

Basis of Amount |

|---|---|---|---|---|---|---|

|

Receipt Accounting |

Trade Return Accrual |

Intercompany Accrual |

100 |

USD |

Not Applicable |

Transfer Price |

|

Receipt Accounting |

Trade Return Accrual |

Trade Clearing |

-100 |

USD |

Not Applicable |

Transfer Price |

|

Cost Accounting |

Trade In-Transit Return |

Trade Clearing |

100 |

USD |

Material |

Transfer Price |

|

Cost Accounting |

Trade In-Transit Return |

Trade In-Transit |

-50 |

USD |

Material |

Sending Organization Cost |

|

Cost Accounting |

Trade In-Transit Return |

Trade In-Transit |

-10 |

USD |

Overhead |

Sending Organization Cost |

|

Cost Accounting |

Trade In-Transit Return |

Trade In-Transit |

-40 |

USD |

Profit in Inventory |

Internal Markup |

|

Cost Accounting |

Return to Receiving |

Receiving Inspection |

100 |

USD |

Material, Overhead, and Profit in Inventory |

Transfer Price |

|

Cost Accounting |

Return to Receiving |

Inventory Valuation |

-50 |

USD |

Material |

Sending Organization Cost |

|

Cost Accounting |

Return to Receiving |

Inventory Valuation |

-10 |

USD |

Overhead |

Sending Organization Cost |

|

Cost Accounting |

Return to Receiving |

Inventory Valuation |

-40 |

USD |

Profit in Inventory |

Internal Markup |

|

Receipt Accounting |

Return to Supplier |

Trade In-Transit |

100 |

USD |

Not Applicable |

Transfer Price |

|

Receipt Accounting |

Return to Supplier |

Receiving Inspection |

-100 |

USD |

Not Applicable |

Transfer Price |

|

Receipt Accounting |

Intercompany AP Invoice |

Intercompany Liability |

100 |

USD |

Not Applicable |

Transfer Price |

|

Receipt Accounting |

Intercompany AP Invoice |

Intercompany Accrual |

-100 |

USD |

Not Applicable |

Transfer Price |

Receipt Accounting generates distributions under business unit CN and inventory organization M1. Cost Accounting generates distributions under cost organization CO1 and inventory organization M1.

The following table describes those distributions.

|

Subledger |

Event Type |

Accounting Line Type |

Amount in Functional Currency +Dr/-Cr |

Functional Currency |

Cost Element |

Basis of Amount |

|---|---|---|---|---|---|---|

|

Receipt Accounting |

Trade Return Accrual |

Accrual |

50 |

USD |

Not Applicable |

PO Price |

|

Receipt Accounting |

Trade Return Accrual |

Trade Clearing |

-50 |

USD |

Not Applicable |

PO Price |

|

Cost Accounting |

Trade In-Transit Return |

Trade Clearing |

50 |

USD |

Material |

PO Price |

|

Cost Accounting |

Trade In-Transit Return |

Cost Variance* |

10 |

USD |

Not Applicable |

Inventory is depleted at the current cost, and the difference between transfer price and cost is booked as cost variance |

|

Cost Accounting |

Trade In-Transit Return |

Trade In-Transit |

-50 |

USD |

Material |

PO Price |

|

Cost Accounting |

Trade In-Transit Return |

Trade In-Transit |

-10 |

USD |

Overhead |

Overhead Rate |

|

Cost Accounting |

Trade In-Transit Return Receipt |

Trade In-Transit |

50 |

USD |

Material |

PO Price |

|

Cost Accounting |

Trade In-Transit Return Receipt |

Trade In-Transit |

10 |

USD |

Overhead |

Overhead Rate |

|

Cost Accounting |

Trade In-Transit Return Receipt |

Intercompany COGS |

-50 |

USD |

Material |

PO Price |

|

Cost Accounting |

Trade In-Transit Return Receipt |

Intercompany COGS |

-10 |

USD |

Overhead |

Overhead Rate |

|

Accounts Receivable |

Intercompany Accounts Receivable Invoice |

Intercompany Revenue |

100 |

USD |

Not Applicable |

Transfer Price |

|

Accounts Receivable |

Intercompany Accounts Receivable Invoice |

Intercompany Receivable |

-100 |

USD |

Not Applicable |

Transfer Price |

|

Receipt Accounting |

Supplier Invoice |

Liability |

50 |

USD |

Not Applicable |

PO Price |

|

Receipt Accounting |

Supplier Invoice |

Accrual |

-50 |

USD |

Not Applicable |

PO Price |

*Inventory is depleted at the current cost, and the difference between transfer price and cost is booked as cost variance.