How Customer Claims Are Processed

Here you'll understand how customer claims are processed in Channel Revenue Management.

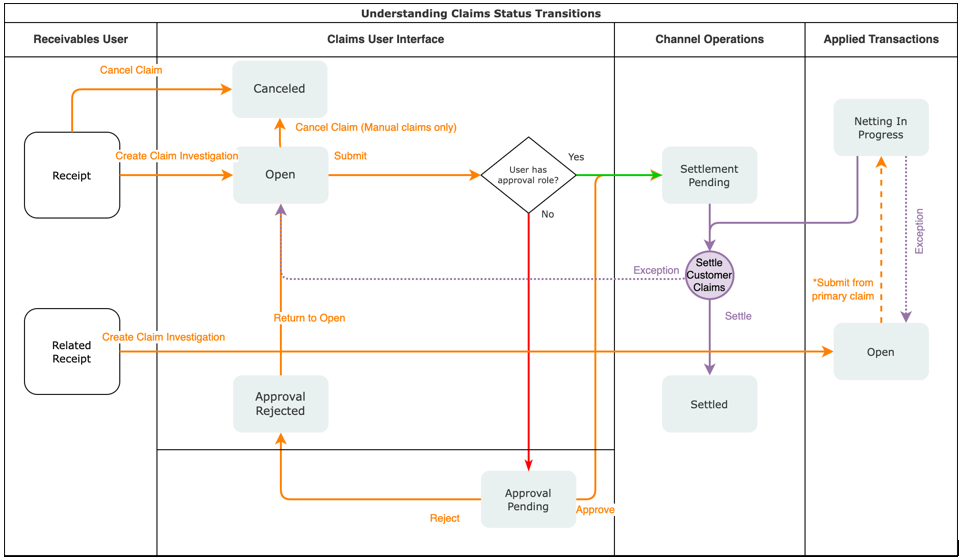

There are 4 stages in the life cycle of a customer claim.

-

Creation

Claims can be created by the following methods:

-

A claim investigation activity, initiated in Receivables by a receivables manager, creates a claim in Channel Revenue Management.

-

Deduction claim: From short payments in a receipt

-

Overpayment claim: From over payments in a receipt

-

-

A channel revenue claim, initiated in Receivables by a receivables manager against an invoice application line of a receipt creates a claim in Channel Revenue Management.

-

Invoice Deduction claim: From short payments against the invoice

-

Invoice Overpayment claim: From over payments against the invoice

-

-

Claims can be created through Receivables lockbox.

-

A manual claim can be created directly in Deductions and Settlement.

-

A manual claim initiated by a 3rd party application can be created through a REST service.

Once created, the claim is assigned to a claim owner. A claim owner can be assigned at various levels: business unit, customer, account, or bill site. The deductions analyst assigned to the claim will investigate and resolve the claim.

Note:Multiple non-invoice related claim investigation applications can be performed per receipt, as long as the sum of application amounts is equal to the receipt amount.

-

-

Resolution

This table lists the available settlement methods for each claim source and the action that created the claim.

Receivables Action

Claim Source

Settlement Method

Apply Open Transactions

Create Claim Investigation

Deduction

Credit Memo - On Account

Manual Write-off

Auto Write-off

Open Credit Memos

Open Overpayments

Create Claim Investigation

Overpayment

Invoice

Open Deductions

Create Channel Revenue Claim

Invoice Deduction

Credit Memo on Account

Credit Memo on Invoice

Chargeback

Manual Write-off

Auto Write-off

Open Credit Memos

Open Overpayments

Create Channel Revenue Claim

Invoice Overpayment

Invoice

Open Deductions

N/A

Manual Claim

Credit Memo on Account

Custom Settlement Method

Check (AP)

Payables Default Payment (AP)

None

-

A deduction can be resolved by creating a credit memo on account or invoice, or by applying existing credit memos or overpayments.

-

An overpayment can be resolved by creating an invoice or by applying existing deductions.

-

When existing deductions or overpayments are applied, these claims are reserved so that they can't be accidentally applied again.

-

-

Submission

After resolving the claim, the analyst submits it for approval and settlement.

-

If the analyst has been assigned the approval role, then the claim goes straight to Settlement Pending status, awaiting processing by the Settle Customer Claims scheduled process.

-

If the analyst doesn't have the approval role, then the claim will move to Approval Pending status, awaiting approval. The approver can either approve or reject the claim.

-

Rejection puts the claim in Approval Rejected status, and the deductions analyst can move it back to Open status to correct the claim. Only a Receivables analyst can cancel the claim, from the receipt.

-

-

Settlement

On a periodic basis, you can schedule the Settle Customer Claims process, which performs the creation of the resolution artifacts or settlement methods in Receivables, and then applies them to the appropriate receipt. These credit memos and invoices will have the transaction source as Channel Revenue Management.

In addition you can also use the Settle Customer Claims scheduled process to settle your manual claims in Payables.

-

If applicable, taxes are calculated and applied to the claim.

-

If there is any remaining unsettled amount which is below the set threshold, it's written off.

-

If there is any remaining unsettled amount and write-offs don't apply, a child claim is automatically created and applied to the receipt.

-

The original claim investigation is reversed in the receipt.

If an invoice deduction claim is settled with a settlement method other than Credit Memo - On Invoice, the following happens during settlement:

-

Unapplies the invoice application on the receipt and reapplies the invoice application on the receipt for the original application amount plus the amount settled.

-

Applies the Receivables transaction created as the settlement document to the receipt.

-

The dispute on the invoice is removed to the extent of the settlement amount.

-