Overview of Supply Chain Financial Orchestration

Oracle Supply Chain Financial Orchestration enables you to run financial orchestration flows and define business rules for financial orchestration. Using Supply Chain Financial Orchestration, you can:

-

Manage intercompany transactions and intracompany flows. Intracompany flows are present when a financial orchestration exists between two different profit center business units that belong to the same legal entity. You can separate the physical part of this transaction from the financial part of the transaction.

-

Support complex global structures without compromising supply chain efficiency.

-

Model your corporate tax structures in a global environment efficiently without impacting the physical movement of goods. You can deliver goods and services to your customers as quickly as possible, and lower your total supply chain costs at the same time.

-

Optimize operational efficiency by centralizing sourcing and order management functions.

-

Reduce implementation costs and cycle time.

-

React effectively to corporate reorganizations or acquisitions.

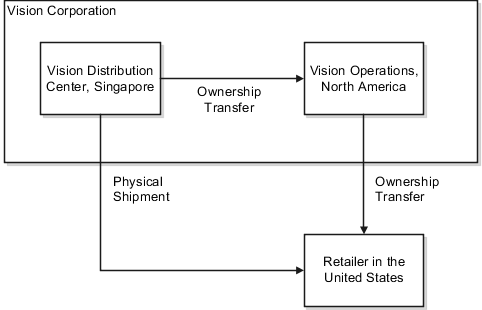

The following figure illustrates an example of an intercompany transaction for the Vision Corporation.

In this example, a financial orchestration flow exists between the Vision Distribution Center, located in Singapore, and Vision Operations, located in North America. The Vision Distribution Center sends the physical product that's involved in the transaction to retailers. It also sends the financial information and transfers ownership of the product in the financial books for the transaction to Vision Operations in North America. Each organization is a separate legal entity in Vision Corporation. However, these organizations are located in different countries. They require separate accounting and tax reporting. You can use Supply Chain Financial Orchestration to capture, process, and perform an accounting of the events. The events occur during an intercompany transaction in an enterprise that's similar to Vision Corporation. For example, you can use it to do the following:

-

Create documentation and accounting rules that specify the type of accounting documentation to create. For example, whether or not to create an intercompany invoice, to track profits in inventory, or to track trade distributions.

-

Create transfer pricing rules that specify whether to use the transaction cost, a purchase order price, or the sales order price as the basis to calculate the intercompany transfer price between the seller and the buyer. You can create transfer pricing rules that apply a markup or markdown percentage on the internal sale.

-

Create intercompany buyer profiles and intercompany seller profiles that Financial Orchestration uses to create the intercompany invoice. You can specify the business units that provide the following:

-

Procurement and payables invoicing for the profit center business unit.

-

Business unit that provides receipt accounting information.

-

Bill-to business unit and bill-to locations.

-

Procurement business unit.

-

-

Create financial orchestration qualifiers that specify when to run a financial orchestration flow. For example, you can create a rule to run an orchestration flow only if a particular supplier is involved in the transaction.

-

Create financial orchestration flows. You can specify the following:

-

Legal entities and business units that are involved in a flow.

-

Financial orchestration qualifiers that control when to use the flow.

-

Financial routes to use for the flow.

-

Transfer pricing rules and documentation accounting rules.

-

Date when the flow goes into effect.

-

-

Specify a priority among different flows.

In general, the term financial orchestration is used to describe the Financial Orchestration work area and the related tasks. This work area is part of the Manufacturing and Supply Chain Materials Management offering. For more information about implementing supply chain financial orchestration, see the Implementing Manufacturing and Supply Chain Materials Management guide.