Expiring Tax Loss/Credit

When you set an expiration rule for an account, the available amount in the carry forward account will be offset automatically for current year and below years. Automatic expiration takes place only when consolidating last period of the financial year that is, P12.

Automatic expiration takes place after automatic deferral or utilization for the current entity, scenario, year and period has completed. You can set up rules for the system to automatically expire losses that will no longer be available for utilization after the current period.

The Tax Losses form shows the expired losses in the Expiration Automated (TRCS_TLCExpirationAutomated) column for the account.

The Temporary Differences form shows the expired amount for each carry forward account under the Other Adjustments (Deferred Only) column for the current year and period.

The expiration logic aims to expire all available amounts that have a year of expiration that is less than or equal to the current year for a specified account. Losses whose year of expiration is the current year will only be expired in the last period the year, that is, P12.

The system determines the loss amount to be expired based on the TRCS_TLCAvailable column in the Tax Losses form for the year of expiration at the account.

Note:

The process is the same for Credits expiration.Note:

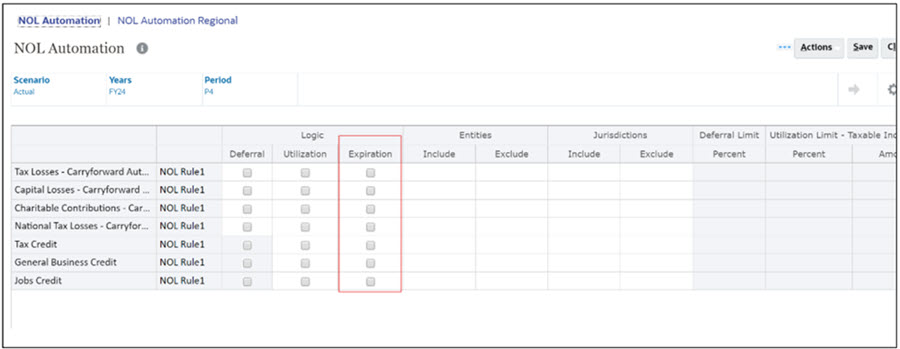

The Expiration column is selectable for all periods, but the actual calculations will only take place in P12. This allows you to copy NOL automation rules from period to period.

Related Topics: