Learning About Net Operating Losses (NOL)/Credits

NOL Automation is used to configure rules to automate the process of deferring current year tax losses and utilizing and expiring tax losses and credits carry forward.

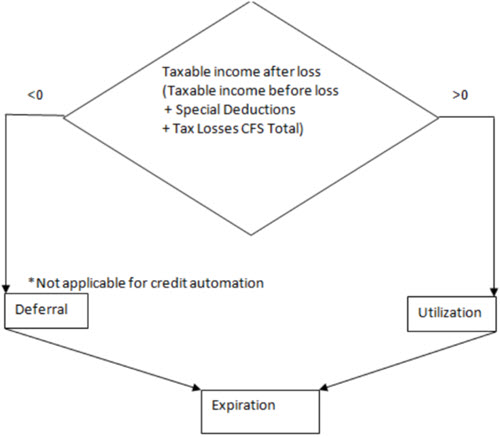

Tax losses are incurred when the total of taxable income (TaxableIncomeAfterLoss) in the current period is less than 0. Tax losses incurred in the current period can be deferred so that they can be utilized in future periods/years.

When the total of Taxable Income (TaxableIncomeAfterLoss) in the current period results in a positive amount, tax losses originating in prior years can be utilized. Deferred losses (losses originating in prior periods or years) can be utilized either fully or partially in the current period.

Carried forward losses can be assigned a year of expiration or no expiration by default, if nothing is entered. Tax Losses or credits expiring in current year can be automatically written off.

Note that NOL automation supports parent tax calculation entities only when the tax losses and credits are accounted for on the parent tax calculation enabled entity.

Note:

Net Operating Loss Automation rules apply to both National and Regional tax calculation.