Setting Safe Harbor Automation

- Navigate to Configuration card.

- Click on Safe Harbor Automation.

Note:

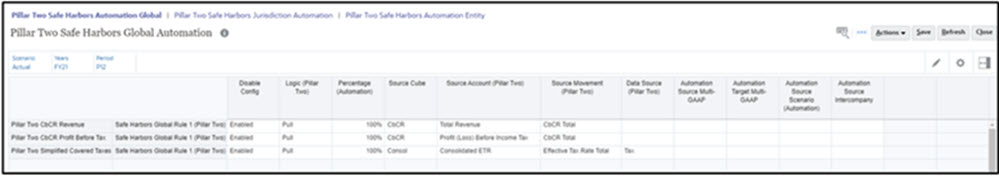

- Safe Harbors automation allows automating the data from Tax Provision (Consol Cube) and or from CbCR (CbCR Cube)

- Pillar Two Simplified Covered Taxes is setup to pull total tax from Consolidated ETR

- In the example below, setup is pulling Pillar Two CbCR Revenue and

Pillar Two CbCR Profit Before Tax from CbCR cube

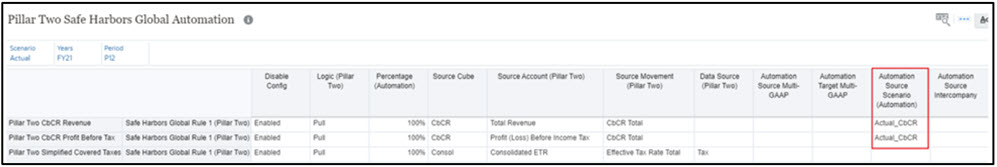

Note:

- If a separate CbCR scenario is created, then configure source scenario in the

automation rule.

- When selecting CbCR Scenario (that is, Actual_CbCR), then you must select Source Cube as CbCR, otherwise data will not be pulled as valid source movement member.

- If Source Cube column is not selected, system will assume Source Cube to be "Consol" cube.

- The source movement is needed as CBCR Total when selecting source cube as "CbCR".

How it works: The Global rules when set are copied to the Jurisdiction and Entity level upon save. Global Rules can be disabled at the Jurisdiction or Entity level and then a new Jurisdiction or Entity Rule can be created to have an alternative calculation. The only detail that is allowed to be changed at the Jurisdiction or Entity level for a Global Rule is the Enabled/Disabled column.

Jurisdiction Rules can be disabled at the Entity level and then a new Entity Rule can be created to have an alternative calculation. The only detail that is allowed to be changed at the Entity level for a Jurisdiction Rule is the Enabled/Disabled column.

You can save the new Entity Rules at the Entity level. You can see the type of rule (that is, Global, Jurisdiction, and Entity) by looking at the rule name. You can also add additional rules to the metadata as needed.