Working with Transitional Safe Harbor Rules

The Safe Harbor rules are designed as a short-term measure that effectively excludes a multi-national company’s operations in certain lower-risk jurisdictions from the scope of GloBE. The safe harbor allows a multi-national company to avoid GloBE calculations in respect of a Jurisdiction if, based on its qualifying CbCR and financial accounting data:

- that jurisdiction has revenue and income below the de minimis threshold (the de minimis test)

- an ETR that equals or exceeds an agreed rate (the Simplified ETR (effective tax rate) test)

- has no excess profits after excluding routine profits (the routine profits test)

See, Example Tests

Note:

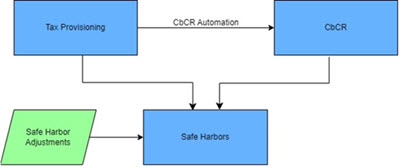

All entities must translate to EUR to apply Safe Harbor rules.Here’s the workflow:

- Tax provisioning

- CbCR Calculations

- Safe Harbors

- Pillar Two