Example Use Case

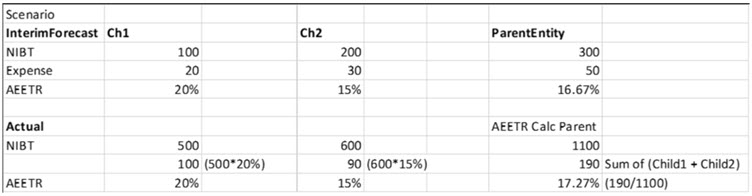

The Interim provision forecast is always pre loss data exclusion and Actual is always post loss data exclusion. See the example below:

Actual scenario will be using 36.68% AEETR rate to calculate Consolidated AEETR Adjustment for all the Entities.

Note:

Calgary is a loss entity hence there is no pre-tax net income is calculated.Sample Calculation at Parent Entity

The example below shows how the data is calculated in the Interim scenario as well as in Actual scenario.