Tax Losses DTNR: Use Case Example

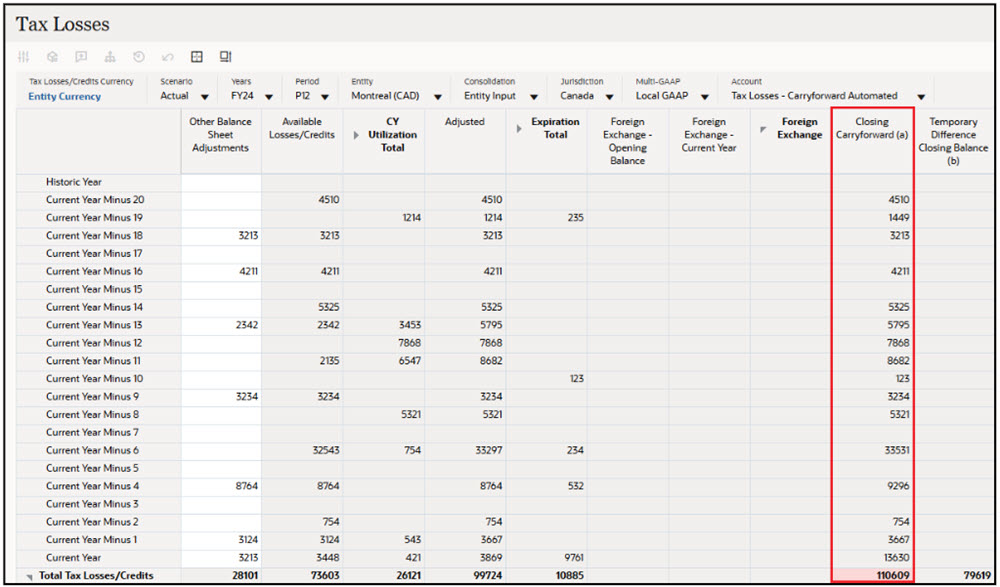

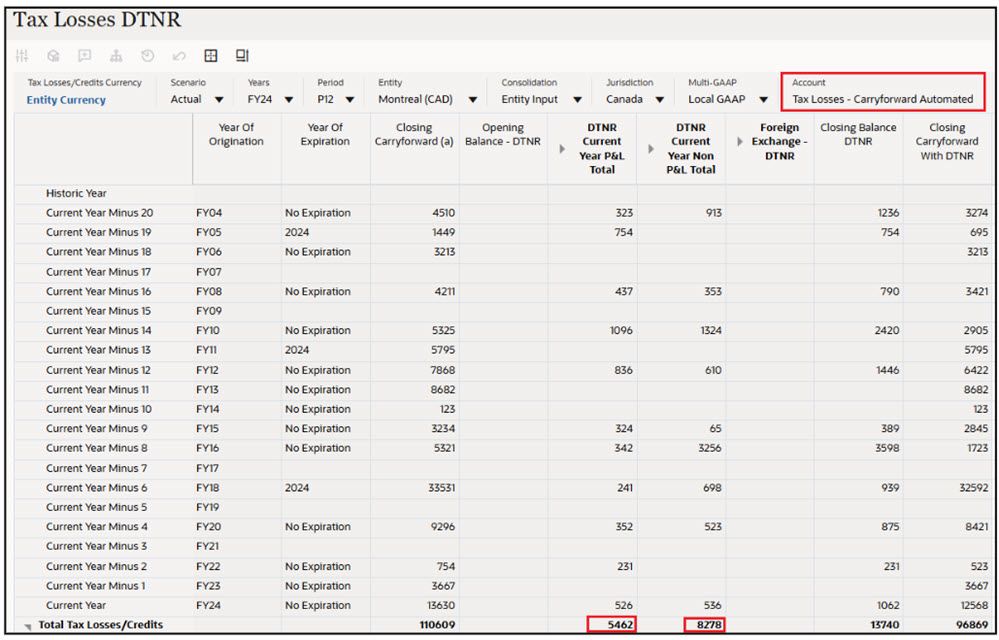

Consider the following values for Closing Carryforward (a) in Tax Losses form for the account Tax Losses - Carryforward Automated.

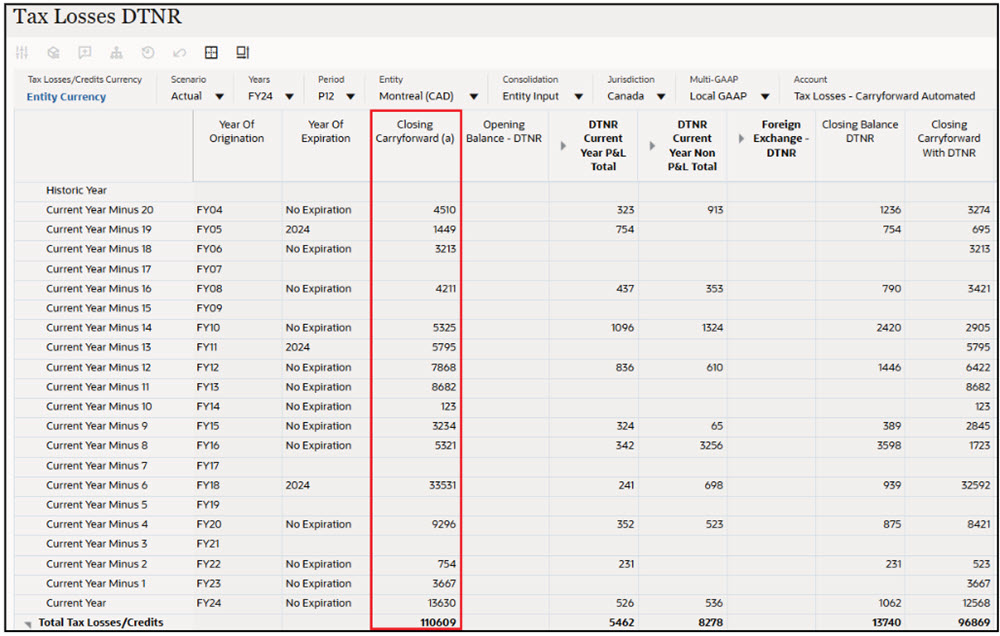

Closing Carryforward (a) values are populated in Tax Losses DTNR form.

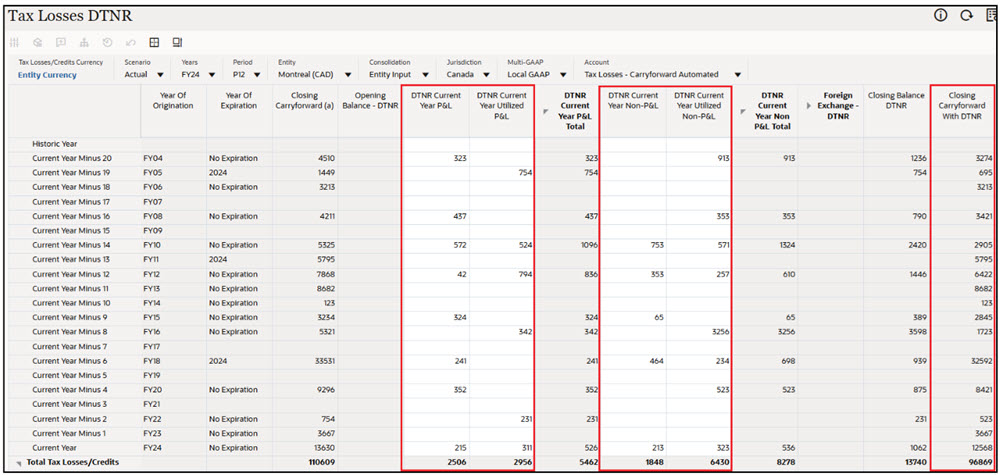

You can derecognize P&L and Non P&L amounts from any year using the DTNR Current Year P&L, DTNR Current Year Utilized P&L, DTNR Current Year Non-P&L and DTNR Current Year Utilized Non-P&L columns.

For example, for Year FY24, refer the screenshot below. The values for DTNR Current Year P&L is 215, DTNR Current Year Utilized P&L is 311, DTNR Current Year Non-P&L is 213 and DTNR Current Year Utilized Non-P&L is 323.

Closing CarryForward with DTNR column holds the Closing Carryforward with the derecognized amounts.

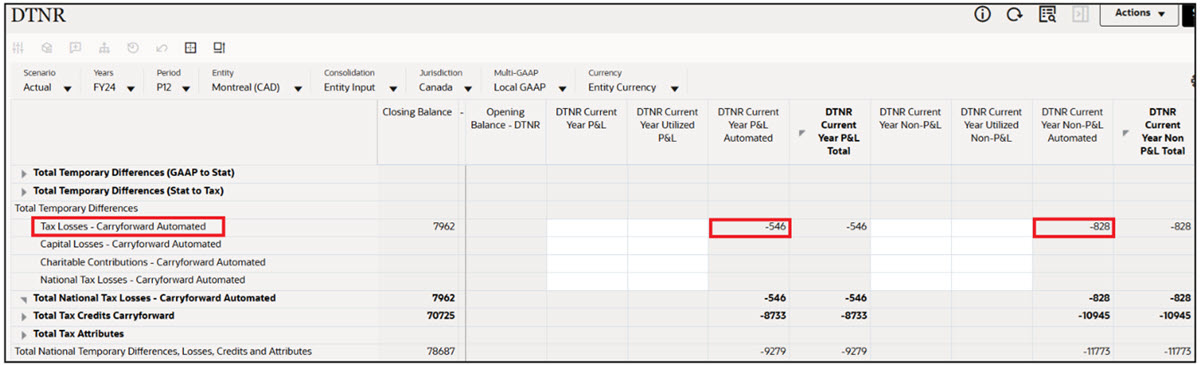

Post Consolidating FY24 P12, the values are populated in the DTNR form as follows:

- DTNR Current Year P&L Automated = - DTNR Current Year P&L Total (5462) * Closing Tax Rate (10% in this use case)

- DTNR Current Year Non-P&L Automated = - DTNR Current Year Non-P&L Total (8278) * Closing Tax Rate (10% in this use case)

Note:

If configured, Override Tax Rate Closing will be used for calculations instead of Closing Tax Rate.

Post consolidation, DTNR Current Year P&L Automated and the DTNR Current Year Non-P&L Automated values are populated as below:

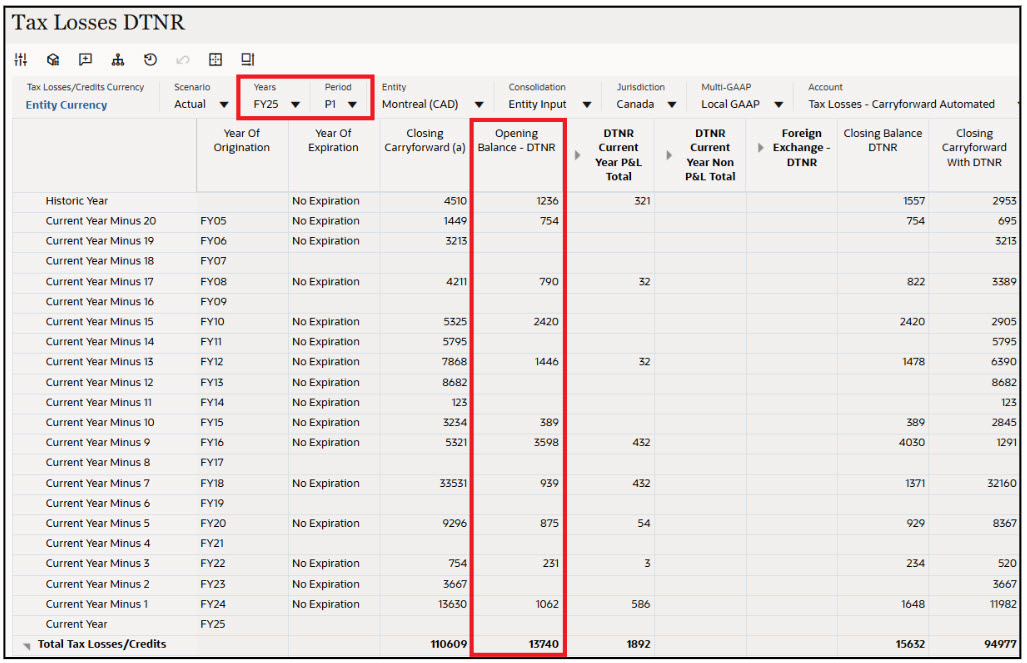

Post consolidating FY25, P1, in Tax Losses DTNR, the values from Closing Balance DTNR flows to Opening Balance - DTNR column.