Excluding Loss Entities from Interim Provision

Interim Tax Provisioning applies to both Tax Provision National and Regional. The Annualized Estimated Effective Tax Rate (AEETR) is taken from the Consolidated Rate Reconciliation, and takes into account the Regional Tax and Federal Benefit of Regional Taxes, where appropriate. All entities participate in the calculation; however, there may be instances when you need to exclude Loss Entities from the Effective Tax Rate calculation.

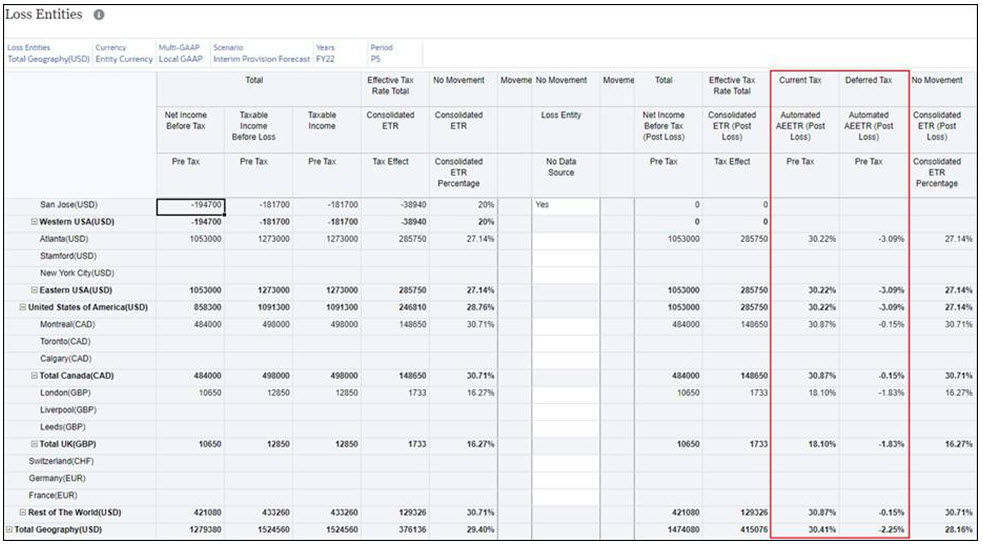

You use the Loss Entities Forecast form to mark the loss entities that are to be excluded, and then consolidate the form. The results can be checked on the Interim Provision form, and then use the Rollover form to copy the exclusion forward.

The following considerations apply:

- The Interim Provision feature must be enabled during the initial creation of the application, or using the Enable Features option. See Creating the Application.

- The Loss Entities form and Rollover of Loss Entities considers only the Interim Forecast Scenario.

To exclude loss entities from Interim Provision:

- From the Home page, click Tax Provision Interim, then click

Package Forecast, and then Loss Entities

Forecast. The Pre Tax and post Tax values for Net Income Before Tax,

Consolidated ETR and Consolidated ETR Percentage are the same on both sides of the

form.

- For the Entity that you want to exclude from the calculation, under Loss Entity, select Yes from the drop-down list.

Note:

You can only set the loss entity on the Base Entity. - Under Actions, select Consolidate. When the consolidation is complete, view the Post Loss values for Net Income Before Tax, Consolidated ETR and Consolidated ETR Percentage.

- Click the Interim icon, and then Interim Total to review the Interim Total form. Post Loss, the Automated AEETR row is blank because it was set to a Loss Entity.

- From the Home page, click Applications, then Configuration, and then select Rollover.

- On the Rollover screen, click the selection icon

to select the Scenario, Year

and Period to which the Loss Entity applies.

to select the Scenario, Year

and Period to which the Loss Entity applies.

- Under Select Task, select Loss Entities, and then click Run. Under Status, a message indicates when the action has been completed. Only data from the selected Scenario, Year, and Period is copied and rolled over.

Note:

- Consolidation using AEETR rule allows you to consolidate the Interim Total and/or Interim Detail web forms with the latest AEETR while ignoring the Data Status (for example, OK). One benefit of this rule is that it avoids manually impacting entities to get the latest AEETR.

- This specific rule is not available in the Rules card but is available in the Interim Total and Interim Detail web forms via a right click.