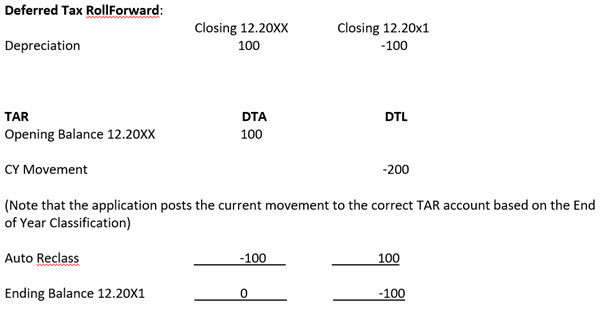

Use Case Example: Deferred Tax Asset to Deferred Tax Liability Reclassification

The Deferred Tax Asset/Deferred Tax Liability (DTA/DTL) classification for the Deferred Tax Rollforward is configurable. The Tax Account RollForward (TAR) mirror the Deferred Tax Rollforward classification (see also: Working with Tax Account RollForward (TAR). By using the automated reclassification for example, if you have configured the classification based on an account level and it went from DTA to DTL from the beginning of the year versus the end of the year, then, the TAR reclassification would automatically reclassify the beginning balance to a DTL.

For example:

For information on how to set up DTA/DTL classification, see: Classifying Deferred Tax Assets and Liabilities