Use Case Example: Tax Automation Regional

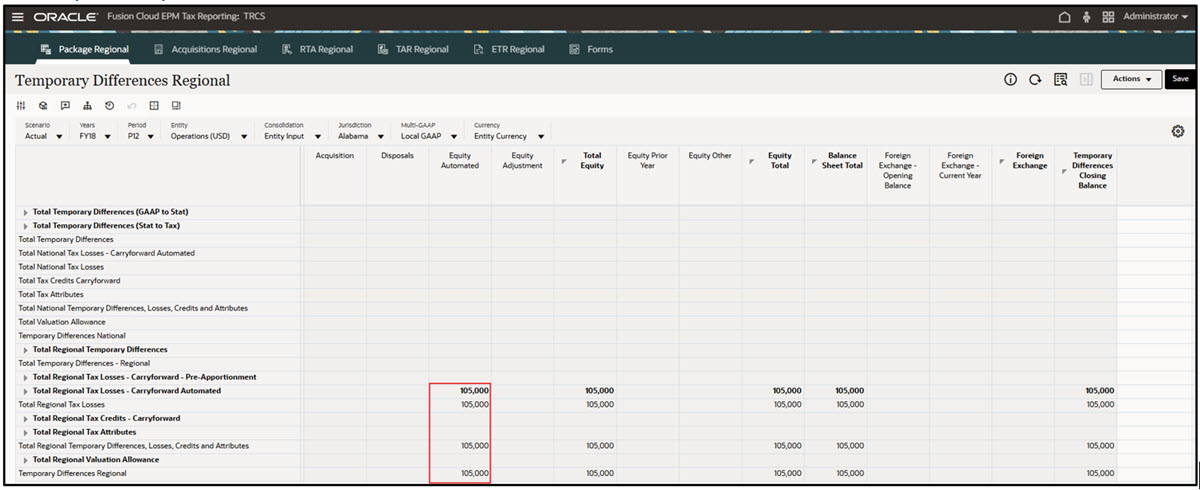

If you have configured a Tax Automation Regional Rule, then the value from the Tax Automation Rule is aggregated with the value of Other Balance Sheet Adjustments from Tax Losses Regional to Equity Automated in Temporary Differences Regional form.

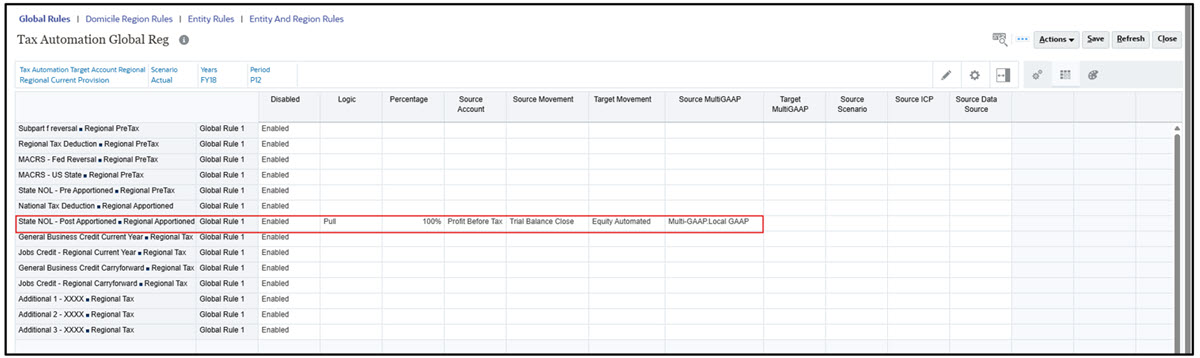

- Set up the Tax Automation Global Reg Rule (see: Working with Regional Tax Automation in Administering Tax Reporting).

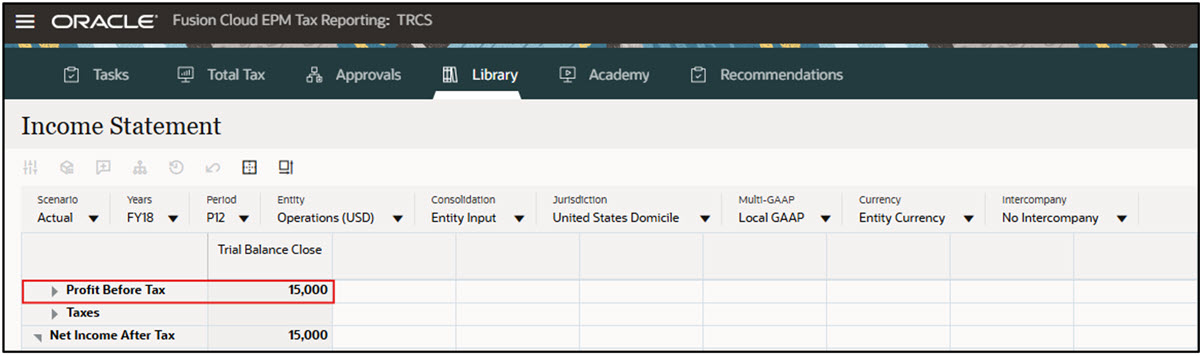

- Enter values for the POV used above in the Income Statement form, for example 15,000

as mentioned in the screenshot below.

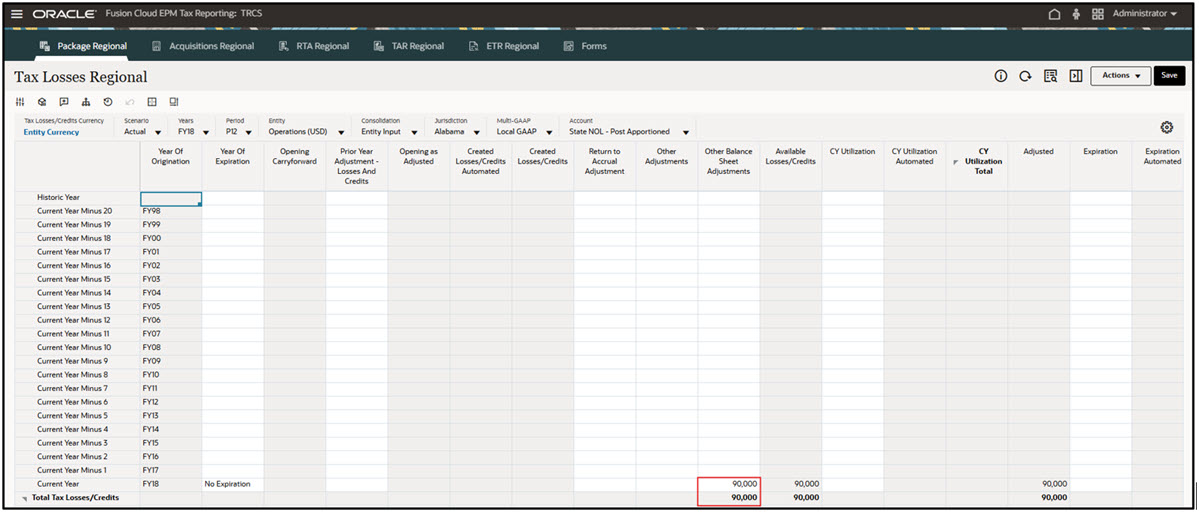

- Add values in Other Balance Sheet Adjustments in the Tax Losses Regional form, for

example 90,000 as mentioned in the example screenshot below.

- Run Consolidation. Note that post consolidation, the Equity Automated of the

Temporary Differences Regional form has the aggregated value of Tax Automation rule

and Other Balance Sheet Adjustments. For example: Equity Automated (105,000) = Other

Balance Sheet Adjustments (90,000) + Tax Automation Rule value (15,000)