Customer Subject Areas

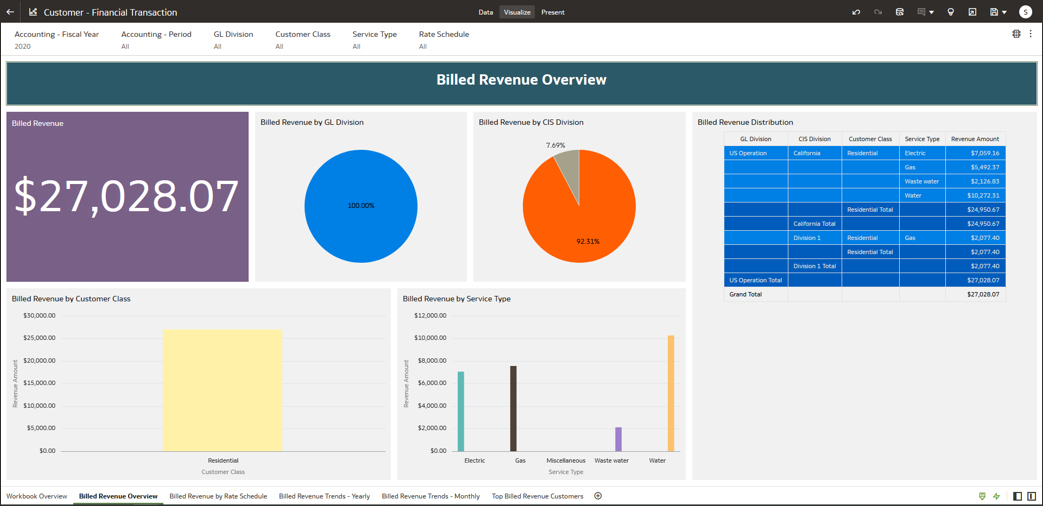

The customer subject areas are based on customer data objects available in Oracle Utilities Customer Cloud Service, such as billed usage, financial transactions, and service agreement arrears. The image below is an example of how data could look in the Financial Transactions subject area.

On this page:

Customer - Adjustment

The Adjustment subject area can be used to analyze count and current amount of adjustment data by adjustment status, cancel reason, and adjustment type.

Answer questions like these:

- Which adjustments are not yet finalized and therefore have not impacted a customer’s account balance (e.g., not frozen)?

- What is the trend (e.g., volume, current amount) and current status of created adjustments over the past 12 months?

- What is the trend (e.g., volume, current amount) and current status of created adjustments over the past 31 days?

- What are the main reasons adjustments have been cancelled?

- What is the distribution of created adjustments by adjustment type over the past 12 months?

- Which adjustments are still waiting to be approved by a business user?

Customer - Billed Usage

The Billed Usage subject area can be used to visualize, review, and analyze billed usage information.

Answer questions like these:

- What are the billed amounts and billed quantities by Customer Class?

- What is the month by month comparison of billed amounts and billed quantities over a period of time?

- What were the highest billed amounts and billed quantities by Rate?

Customer - Billing Overview

The Billing Overview subject area can be used to visualize, review, and analyze billing information.

Answer questions like these:

- What is the number of pending and completed bills within a period of time?

- What are the trends in bill completions and bill amounts over a period of time?

- How many pending bills are without exceptions?

Customer - Cases

The Cases subject area can be used to analyze case data by attributes of Account, Case Type, Person, Premise, and User.

Answer questions like these:

- What is the distribution of open cases across customer classes and case types?

- Which business users have the most number of open cases and what state are these cases in?

- Which persons / addresses have had the most number of cases opened against them?

- What is the trend (e.g., volume) and case condition of created cases over the past 12 months?

- What is the trend (e.g., volume) and case condition of created cases over the past 31 days?

- For a specific case type, how long were cases in the previous state for?

- For a specific case type, what is the distribution across the final states the cases ended up in?

- For a specific case type, what was the average case completion duration?

Customer - Collectible Process

The Collectible Process subject area can be used to review and analyze collectible processes. A collectible process is a collection process and the severance processes it initiates.

A collection process is a series of events meant to encourage a customer to make payments for overdue debt for an account. A severance process is a more encouraging series of events to get a customer to make payments for overdue debt for a service agreement which may lead to a disconnection of service.

Answer questions like these:

- How many accounts are there, and what is the overall overdue debt under collectible and collection processing?

- What are the trends in the creation of collectible processes?

- Which Collection Process Templates were the most commonly and least commonly used?

- How effective were collectible processes in reducing a customer’s overdue debt?

- Which customers have the highest levels of debt under collectible processing?

Customer - Collection Process

The Collection Process subject area can be used to analyze the count and arrears amount of collection process data by collection status, collection status reason, collection process template, and attributes of account.

Note: The Collection Process subject area is superseded by the Collectible Process subject area, which may be used to review and analyze collection processes.

Answer questions like these:

- How are currently active collection processes, by count and initiated arrears amounts, distributed across customer classes and collection process templates?

- What is the distribution of active collection processes by initiated arrears amount and process age?

- Over the past 12 months, what is the current status of created collection processes by volume and initiated arrears amounts?

- Over the past 12 months, what is the distribution across Collection Status Reasons why collection processes were made inactive by volume and initiated arrears amounts?

- Based on Collection Status Reason, what were the most and least effective collection process templates that encouraged customers to make payment?

- Which accounts have had the most number of collection processes initiated against them over the past 12 months?

Customer - Customer Contacts

The Customer Contacts subject area can be used to analyze customer contact data by attributes of Account, Person, Premise, and User.

Answer questions like these:

- How are customer contacts distributed across Customer Contact Classes and Customer Contact Types?

- What is the monthly trend for customer contacts?

- What is the daily trend for customer contacts?

Customer - Deposit Control

The Deposit Control subject area can be analyzed to find unexpected anomalies with their ending balance. For example, this model can be used to find whether there are balanced deposit controls with a non-zero ending balance, or if deposit controls created in the past have still not been balanced.

Answer questions like these:

- Which deposit controls are unbalanced?

- What are the Ending Balances for balanced deposit controls?

Customer - Financial Transaction

The Financial Transaction subject area can be used to visualize, review, and analyze financial transaction information. You can configure a batch process to aggregate this data by month.

Answer questions like these:

- What is the billed revenue by Customer Class and General Ledger Division?

- What is the billed revenue by Rate?

- What is the yearly and monthly trend in billed revenue?

Customer - Financial Transaction General Ledger

The Financial Transaction General Ledger subject area can be used to visualize, review, and analyze financial transaction general ledger information. You can configure a batch process to aggregate this data by month.

Answer questions like these:

- What is the billed revenue and tax amount by General Ledger Division?

- What is the general ledger accounts summary over a period of time?

Customer - Payment Header

This subject area can be used to analyze the count and payment amount of payment header data by payment status, pay cancel reason, and customer class.

Answer questions like these:

- What is the extent of payments not yet finalized and therefore have not yet impacted a customer’s account balance (e.g., not frozen)?

- What is the age distribution for payments that have not yet been finalized based on payment date?

- What is the trend (e.g., volume, payment amount) and payment status of created payments over the past 12 months?

- What is the trend (e.g., volume, payment amount) and payment status of created payments over the past 31 days?

Customer - Payment Tender

This subject area can be used to analyze count and tender amount of payment tender data by tender status, tender type, cancel reason and customer class.

Answer questions like these:

- What is the trend (e.g., volume, tender amount) and tender status of created payment tenders (i.e., how payments were made) over the past 12 months?

- What is the trend (e.g., volume, tender amount) and tender status of created payment tenders (i.e., how payments were made) over the past 31 days?

- Over the past 12 months, what is the distribution of payments across how payments were made (e.g., check, cash, etc.)?

- Which accounts had the most number of payment cancellations due to non-sufficient funds?

Customer - Service Agreement Arrears

The Service Agreement Arrears subject area can be used to review and analyze arrears (outstanding debt). You can configure a batch process to take monthly snapshots of this information.

Answer questions like these:

- What is the distribution of outstanding debt by age (for example, by 30, 60, or 90 days)? This can be further analyzed by Customer Class, Service Type, and Service Agreement Type.

- What is the trend over the past 15 months of outstanding debt by age (for example, by 30, 60, or 90 days)?

- Who are the top 100 customers with the highest amount of outstanding debt older than 30 days?

Customer - Severance Process

The Severance Process subject area can be used to analyze the count and arrears amount of severance process data by customer class, service type, and attributes of account and service agreement.

Answer questions like these:

- What are the trends in the creation of severance processes?

- Which Severance Process Templates were the most-commonly used and least-commonly used?

- What is the trend in service disconnections and reconnections?

- How effective were severance processes in reducing a customer’s overdue debt?

- Which customers have the highest levels of debt under severance processing?

Customer - Tender Control

This subject area can be used to analyze the starting and ending balances of balanced and open tender controls by batch control, deposit control, tender source, and user.

Answer questions like these:

- Which tender controls are unbalanced?

- What are the Ending Balances for balanced tender controls?

Customer - Write-Off Process

The Write-Off Process subject area can be used to review and analyze outstanding debt associated with write-off processes.

Answer questions like these:

- How many active write-off processes exist, and what amount of outstanding debt initiated these processes?

- What is the trend in the effectiveness of write-off processes collecting outstanding debt over time?

- How many write-off processes are being created over time?

- What is the trend in the amount of outstanding debt initiating write-off processes (active and inactive) over time?

- Has the amount of outstanding debt to be written off been increasing or decreasing over time?

- Has the time it takes to complete or cancel a write-off process (debt written off / debt collected) been increasing or decreasing over time?