Reviewing Payment Configuration Options

Use the tables below to provide all feature configuration inputs to your Oracle Utilities Delivery Team as a request using My Oracle Support.

Note: You can use the Opower Configuration Tool to implement certain configurations for Digital Self Service - Transactions. This can include user experience configurations, interface messages and formats, branding configurations, and other configurations relevant to Digital Self Service - Transactions. To review if any configurations listed below are available with the Opower Configuration Tool, access the tool at https://configuration.opower.com/ and review the available options for the pages and widgets included in your Digital Self Service - Transactions web portal.

General Payment Configuration Options

Use the table below to review the payment configuration options that apply broadly to the user experiences for interacting with payments.

| Image Number | Configuration Option |

|---|---|

| Not Depicted |

Enable Restrictions for Cash-Only Accounts Payment options can be restricted and hidden for cash-only accounts to prevent customers with cash-only accounts from attempting to submit payments. This general restriction support can be enabled by requesting the update using My Oracle Support. If you request to enable restrictions on cash-only accounts, you can also enable restrictions on the following features by using the Opower Configuration Tool. The Opower Configuration Tool allows you to make the following configuration choices directly:

Default: Disable restrictions for cash-only accounts |

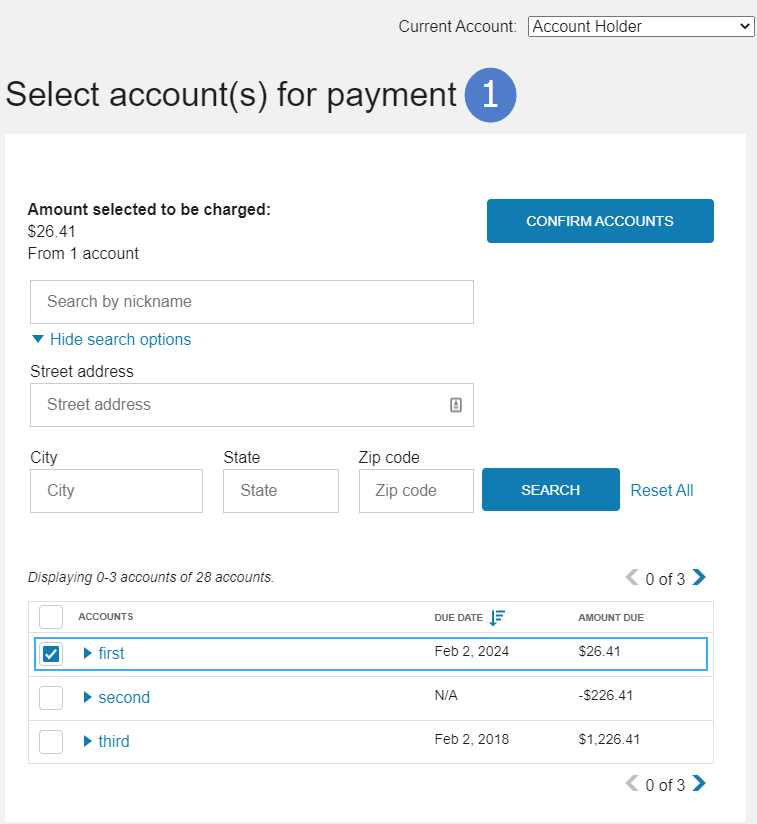

Select Accounts Configuration Options

The following image shows a standard example of selecting accounts for one-time payments and indicates the primary configuration option.

Use the table below to review all available configuration options.

| Image Number | Configuration Option |

|---|---|

| 1 |

Title Default: Select account(s) for payment |

| Not Depicted |

Offer One-Time Payments One-time payments can be hidden if the utility does not want to offer this feature to customers. Default: Enable one-time payments |

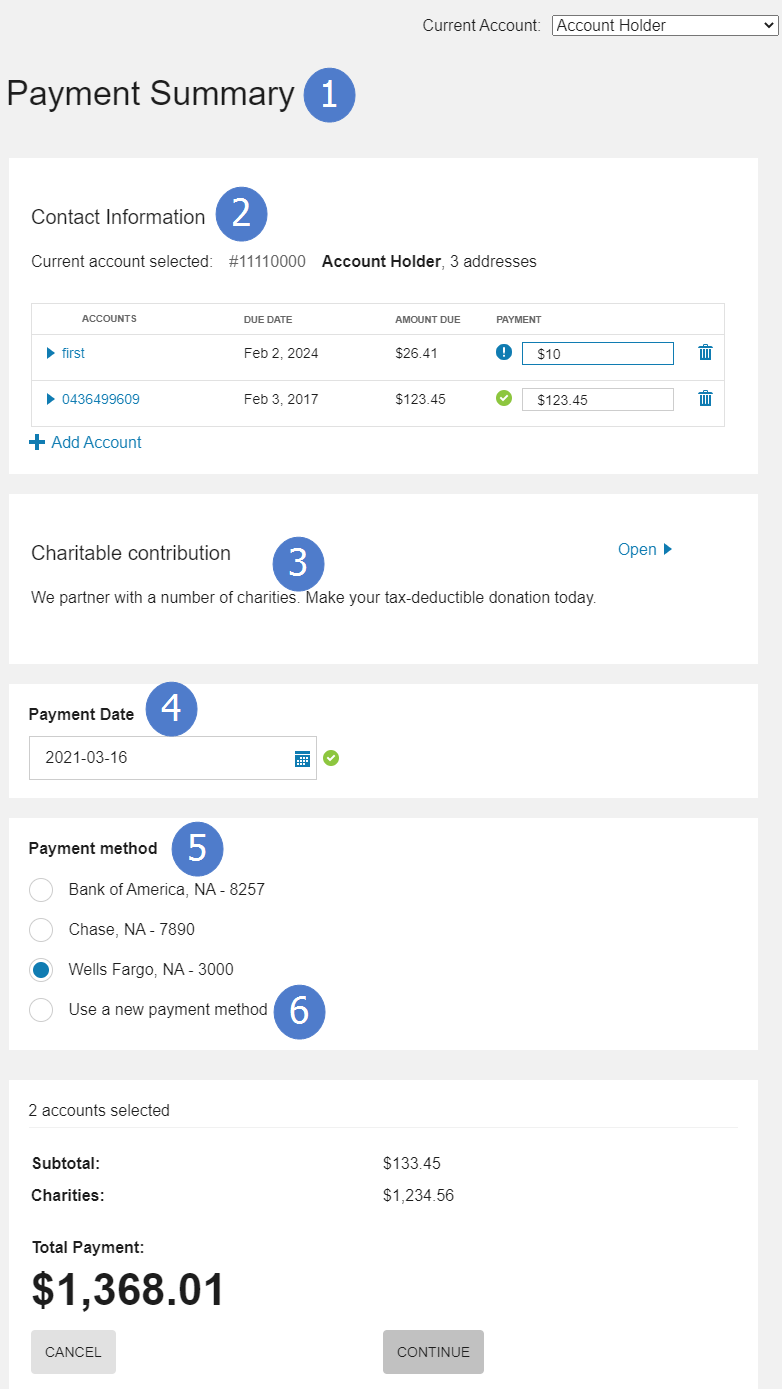

Payment Summary Configuration Options

The following images show a standard example of payment summary.

Use the table below to review all available configuration options.

| Image Number | Configuration Option |

|---|---|

| 1 |

Title Default: Payment Summary |

| 2 |

Payment Information Section Title Default: Contact Information |

| 3 |

Charitable Contributions Section Title Default: Charitable Contribution |

| 3 |

Charitable Contributions Section Explanation Default: We partner with a number of charities. Make your tax-deductible donation today. |

| 4 | Payment Date Section Title

Default: Payment Date |

| 5 | Payment Methods Section Title

Default: Payment Method |

| 6 |

Enable Customers to Save Payment Methods The utility can determine if they want to allow customers to save their payment methods. Default: Enable payment method saving |

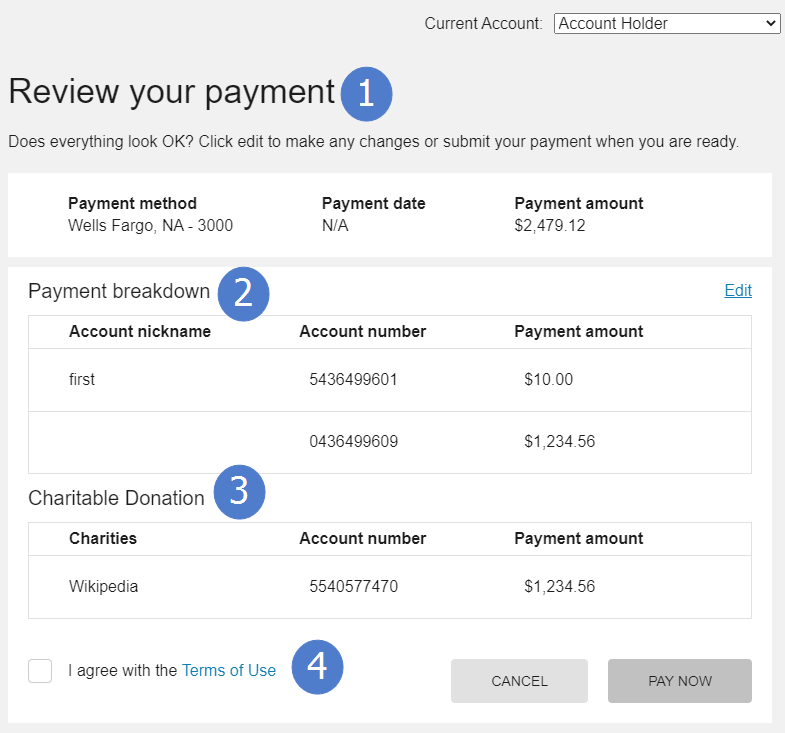

Payment Review Configuration Options

The following images show a standard example of payment review.

Use the table below to review all available configuration options.

| Image Number | Configuration Option |

|---|---|

| 1 |

Review Title Default: Review your payment |

| 2 |

Payment Breakdown Section Title Default: Payment breakdown |

| 3 |

Charitable Donations Label Default: Charitable Donation |

| 4 |

Terms of Use Clearing house payment terms of use can be included during payment review, which requires customers to accept the terms of use before submitting payment. If this option is enabled, an applicable terms of use message must also be provided. Default: Disabled |

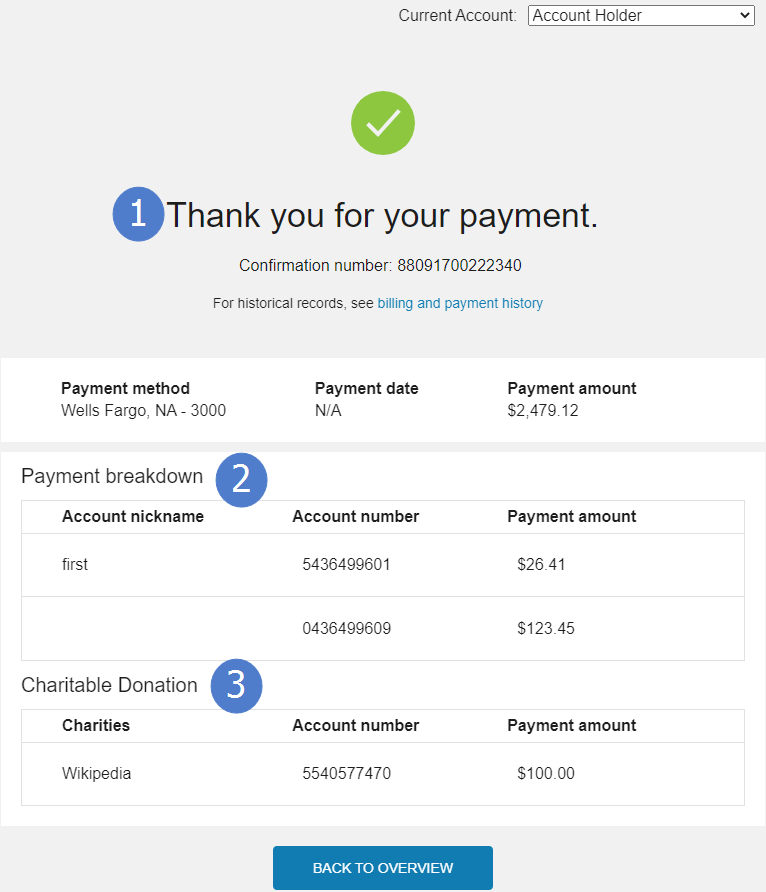

Payment Confirmation Configuration Options

The following images show a standard example of payment confirmation.

Use the table below to review all available configuration options.

| Image Number | Configuration Option |

|---|---|

| 1 |

Confirmation Title Default: Thank you for your payment |

| 2 |

Payment Breakdown Section Title Default: Payment breakdown |

| 3 |

Charitable Donations Label Default: Charitable Donation |

| Not Depicted |

Email Confirmation Message A message that informs the customer that an email confirmation of the payment will also be sent to the customer. If enabled, this email must be configured and supported by the utility and the default confirmation message displayed on the interface can be reviewed below. Default: Do not show the email confirmation message Default Confirmation Message: We will email you a confirmation when your payment has processed |

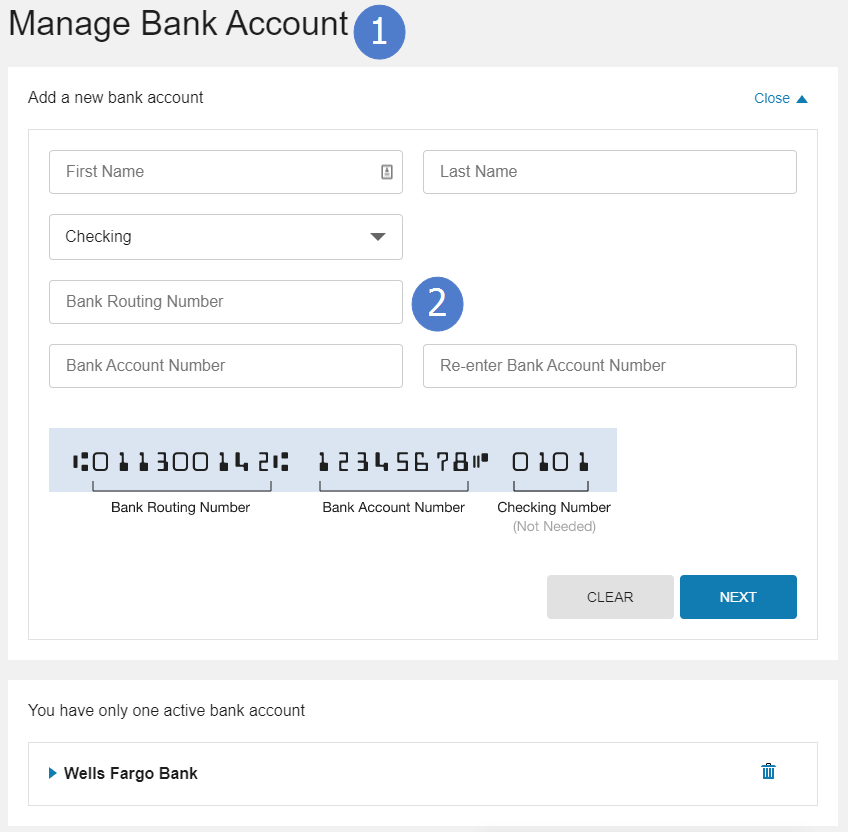

Manage Bank Accounts Configuration Options

The following images show a standard example of manage back accounts.

Use the table below to review all available configuration options.

| Image Number | Configuration Option |

|---|---|

| 1 |

Manage Bank Account Title Default: Manage Bank Account |

| 2 |

Routing Number Verification Customers must enter a routing number to add a new bank account. The number a customer enters is verified that it only includes numbers, and uses a default of nine digits. Default: Verify routing number format and require nine digits. |

| 2 |

Account Number Requirements Customers must enter an account number to add a new bank account. The number a customer enters is verified that it only includes numbers, and meets minimum and maximum lengths. Default: Enforce account number format and require a minimum of six digits and a maximum of 17 digits. |

User Experience Variations

The user experience varies for customers depending upon their service types, available data, costs, and locale. Note that the following list indicates the primary user experience variations, not all possible variations.

- Credit Card Payments: Credit card payments are not supported for one-time payments for multiple accounts. Customers can use the single account payments to pay by a credit card if the utility has set up the required third-party payment vendor.

- Cash-Only Accounts: The ability to submit payments can be restricted for cash-only accounts. If these restrictions are enabled, messages are displayed to replace payment options for cash-only accounts. Refer to the configuration inputs listed in to enable restrictions for cash-only accounts.