Rate Calculation

Tax Rate Schedule

A Tax Rate Schedule is the first step in implementing rate calculations and defines the tax components (State tax, City tax) that are applicable at various instances in time for related resources (materials, labor, equipment, and other). The tax rate can be defined on a resource type but this can be overridden for specific storerooms if necessary..

Tax Components, Characteristic Type, and Characteristic Type Values

Each tax component should be set up as a Characteristic Type and include several associated values. For example, if the Characteristic Type is State, the associated values could include Alaska, Alabama, Arkansas, Arizona, and so on. You will also need to define the list of portals that this Characteristic Type is relevant for. (Only ones that have a Tax Information zone would really be valid) Taxes and tax rates are subject to change over time so each tax component would reference a factor that captures the effective-dated tax percentage.

Factors and Factor Values

Factors are used to calculate tax values related to anything which incurs costs that must be taxed for your organization, such as purchases and resources used to complete activities. For example, you might define different factors for city tax, state tax, and federal tax.

Factor definition references a Factor Characteristic Type and includes only those Characteristic Values that are appropriate. Factor definition also captures an Effective Date/Time and Factor Value which is used to calculate the tax and is able to be edited. The factor is then referenced on a Tax Rate Schedule.

Extending the Data Area

Each jurisdiction has its own applicable taxes so implementations will need to extend the system to add the taxes that are applicable for them. One way to extend the system is to use the Data Area (DA) Extension to extend the base Business Object (BO).

• You will need one DA for each business object you want to extend and the element name for every type of tax must match across all the DAs.

◦ Find the Data Area that needs to be extended for the BO.

◦ Drill into the Maintenance Object to discover the table the Characteristic would reside on.

◦ Navigate back to the business object's Schema tab and copy the Data Area for the Tax Information zone.

◦ Create a new custom Data Area and indicate what data it is extending (Prefix your element names with "cm" to avoid upgrade issues).

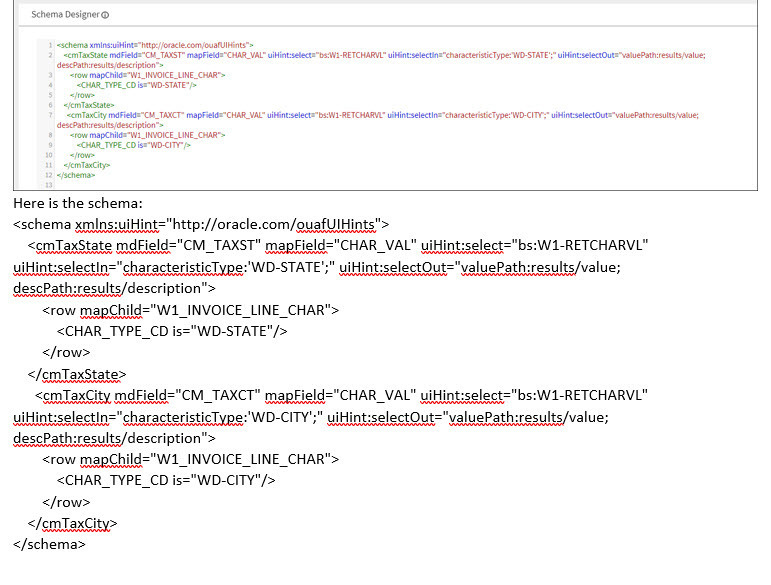

◦ Return to the Schema tab and enter the schema to match your Fields and Factors.

◦ Here is an example Schema:

Please see the Framework section of this guide for more information on Data Areas.

Parent topic