1.1 Supported Features

- Amount BlockAn amount block is the part of the customer account balance reserved for a specific purpose. Amount blocks are placed on an account either on the directions of the customer or at the behest of the bank. When an amount block is set for an account, the balance available for withdrawal is the current balance of the account minus the blocked amount. On expiry of the period for which the amount block is defined, the system automatically updates the amount block. The different types of blocks are as follows.

- Cheque - User can place an amount block on an account with the cheque number. It has to be a valid non-utilized cheque number issued to the account

- Referral - System checks the available balance while performing the referral checks for all transactions involving the account. If a transaction involving the account results in the account moving to overdraft, the account and transaction details will be sent to the Referral Queue. Transactions in Referral Queue must be approved for the transaction to be successful.

- RTL - An RTL can be used to request an Amount block or Credit.

- ELCM - Limits maintained for the customer can be used for transactions in the customer account. ELCM limits get updated on limit utilization.

- ECA block - An ECA block is placed for debit transactions initiated from external product processors. We can create, modify, release or rollback ECA blocks.

- Legal block - A Legal or Lien block is placed for debit transactions initiated within OBA with force post as True. We can create, release or rollback Legal/Lien blocks.

- Accounting

Accounting posting to customer accounts in OBA can either happen directly or from an external system. External systems can trigger accounting entries in OBA via the external accounting interface. All validations are performed and the transactions are posted to the account. Accounting entries can be posted directly to the account - External Accounting (EA), or External Credit Approval (ECA) block followed by External Accounting. We have a facility to create, delete, authorize or delete an EA. Accounting entries are posted directly from OBA as well.

- L2 Caching

L2 caching enables faster transaction processing by caching the data (like currency, branch, source code preferences, transaction code, override configuration, account details, customer details, and so on) which are used frequently for transaction processing. We can enable, disable account and customer caching whenever not required. Any modification to the above cached data (except for customer details, branch and currency), triggers an event to evict the cached data. The UI is used to refresh all the data in the cache manually.

- Coherence Post Processing and WritebackAs part of transaction processing, the balance update is handled online. Post the online balance update, transaction is completed in two logical steps called the Coherence Post Processing and the Database Post Processing or Writeback and is carried out in a sequence.

- Coherence Post Processing is performed for authorized transactions. The list of activities are as follows.

- Current balance updates

- Turnover updates

- Dormancy updates

- Value dated balance updates

- Updates for uncollected processing

- Accounting Entries hand-off to statement domain

- Database Post Processing or Writeback is the process executed after Coherence Post Processing. ECA transactions which are fully utilized/closed/canceled and authorized EA after post processing are written back to the database. Update of Value dated balance, Book dated balance, Turnover balance happens here. The technology of this is explained in detail.

- Delete or Purge of Coherence Cache.

- EA Transaction Cache deletion for completed transactions.

- Coherence Post Processing is performed for authorized transactions. The list of activities are as follows.

- Batch configuration in batch server

Batch services are defined in the OBA batch services and the Batch service is required to invoke these batches during EOD.

- Reval Transaction Posting

Revaluation reinstates the Local Currency Balance for FCY accounts and the difference is booked as revaluation profit/loss. Accounting entries are framed and handed over to the GL system.

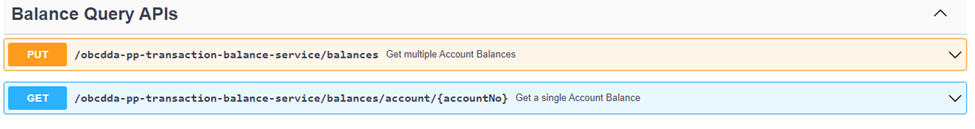

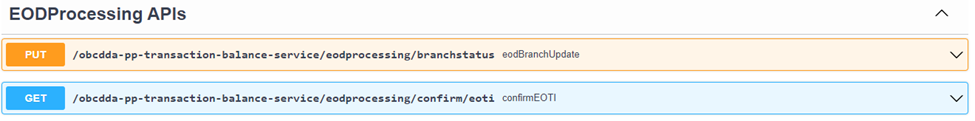

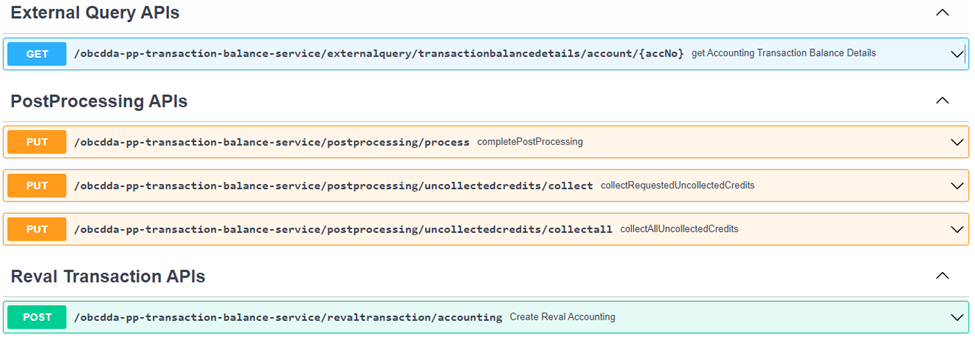

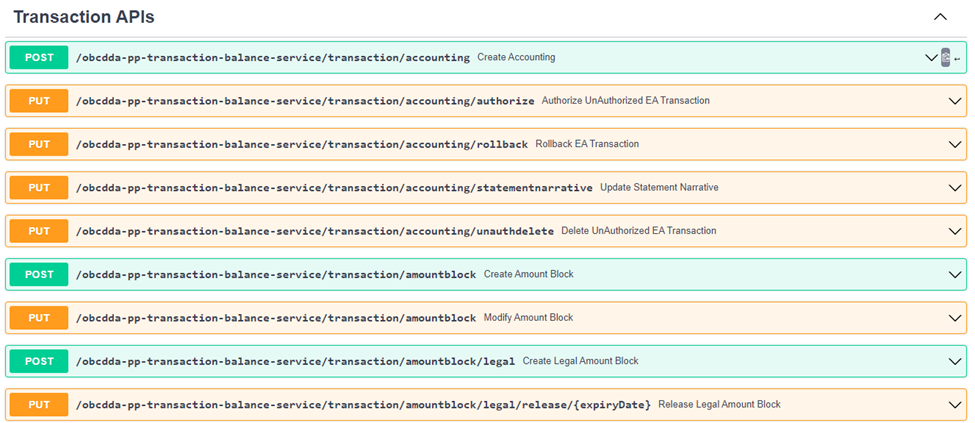

- Balance / Accounting / Amount Block Query API'sOBA supports APIs for various operations such as balance fetch, ECA block, EA posting and various queries as listed below.

Figure 1-1 Balance Query APIs

Figure 1-2 EOD Processing APIs

Figure 1-3 External Query, Post Processing and Reval Transaction APIs

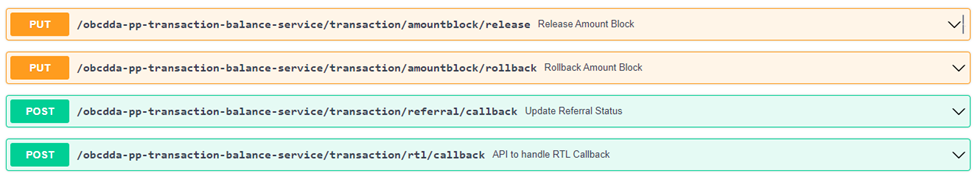

Figure 1-4 Transaction APIs

Figure 1-5 Transaction APIs (contd.)

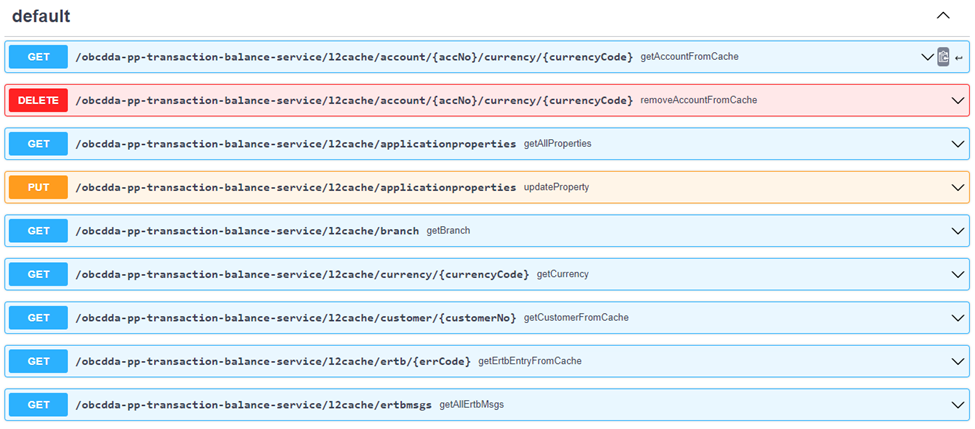

Figure 1-6 Default APIs

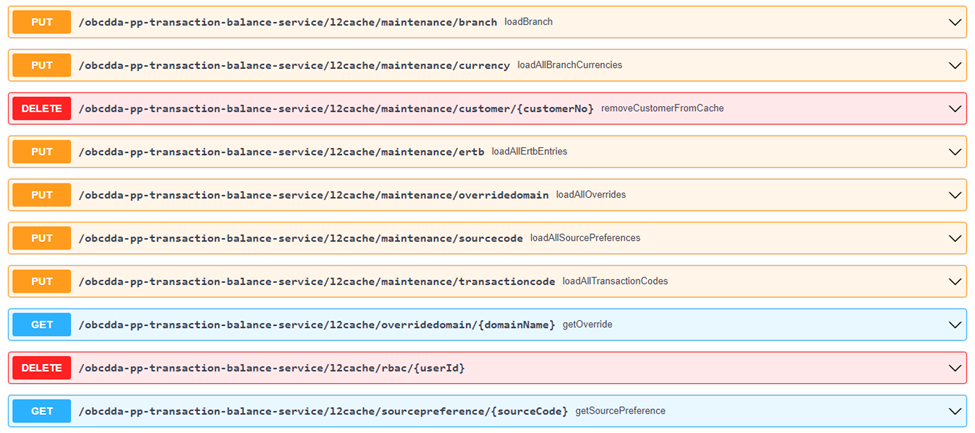

Figure 1-7 Default APIs (contd.)

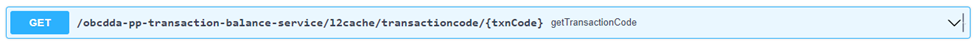

Figure 1-8 Default APIs (contd.)

- EOD flow, Configuration and Invocation

As part of the End of Day (EOD) process, OBA allows the user to execute several functions every day on a routine basis. These functions are run at various stages of the EOD process.

Refer to the EOD Configuration User Guide for the EOD flow, Configuration and Invocation.

- Referral functionality and APIs properties

TBS checks the available balance (not the current balance) while performing the referral checks for all transactions involving the account. If a transaction involving the account results in the account moving to overdraft, then the account and transaction details are sent to the Referral Queue.

Overrides, errors and information codes that occur as part of EAC/ECA/EA are maintained and used by Transaction Balance Service while processing the transaction. These error codes are mapped to different exception categories like Account validation exceptions, Balance exceptions, Limit exceptions and are used in ECA/EA processing.

When a transaction request is processed, different exceptions occur. Each error code which is mapped to one of the exception queues, is subject to approval processing according to the severity level. In the Referral Queue, all the exceptions are grouped by queue type and the user can approve any transaction by drilling down to the transaction and by checking the balance and exceptions. Adjacent to every queue name, the number of transactions in the specific exception queue pending for approval is displayed. Subsequently, transactions in the referral queue are approved or rejected.

- Interest and Charges (IC) functionality

Interest is computed and applied on accounts with balances. Interest component is set up once, and by using it, the system calculates and applies interest on accounts. The system automatically computes and applies interest on all the balance type accounts. Interest is calculated using the interest rules defined. The user can define interest rules to suit the particular requirements of the bank.

Refer to the Interest and Charges User Guide for the Interest Configurations.

Parent topic: Transaction Balance Service