- Account Configurations User Guide

- Branch Parameters

- Configure Branch Parameters

1.1 Configure Branch Parameters

This topic describes the systematic instructions to configure branch parameters.

- On Home screen, click Account Configurations. Under Account Configurations, click Branch Parameters.

- Under Branch Parameters, click Configure.The Configure screen displays.

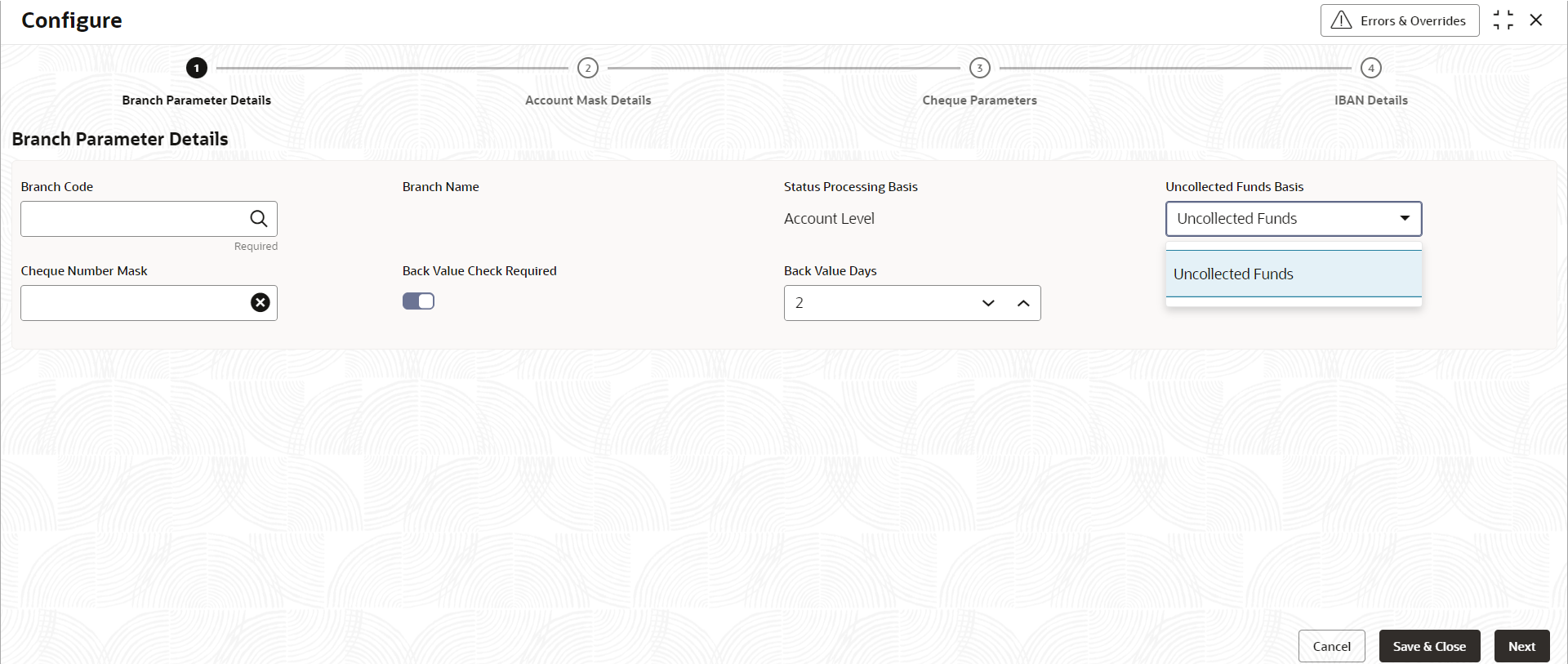

Figure 1-1 Configure Branch Parameter Details

- On Branch Parameter Details tab, specify the fields.

For more information on fields, refer to the field description table below.

Table 1-1 Branch Parameter Details - Field Description

Field Description Branch Code Specify the branch code. Branch Name Specify the description for the branch. Status Processing Basis Status Processing is done at the Account level → 'A' (Default). Each account status is assigned according to the status processing parameters in effect for that account. Uncollected Funds Basis Specify how the system must enforce an amount of uncollected funds (on an account) that can be withdrawn within one business day. Set a limit on the amount of uncollected funds that can be withdrawn (Uncollected Funds Limit) for each account. You can also specify whether the system considers uncollected funds that are allowed to be withdrawn on a particular business day, as follows:

- The funds yet to be released on the current date (today), OR,

- The total uncollected funds available in accounts subject to the Uncollected Funds limit.

The following details are displayed in the drop-down list –

- Uncollected Funds → 'U' (Default) - If selected, an amount equal to or lesser than the uncollected funds limit defined for the account can be withdrawn by the account on any business day.

Cheque Number Mask Specify the mask of the cheque number. If the cheque mask is not maintained at the Branch level, the system checks for the maintenance at the Bank level. Cheque Stale Days Specify the number of days after which the cheque must be considered stale. Back Value Check Required Specify whether a check is to be performed for back-valued transaction. The default value is No. Back Value Days Specify the number of days up to which back-valued transactions can be allowed. This field is enabled when Back Value Check Required is set to Yes.

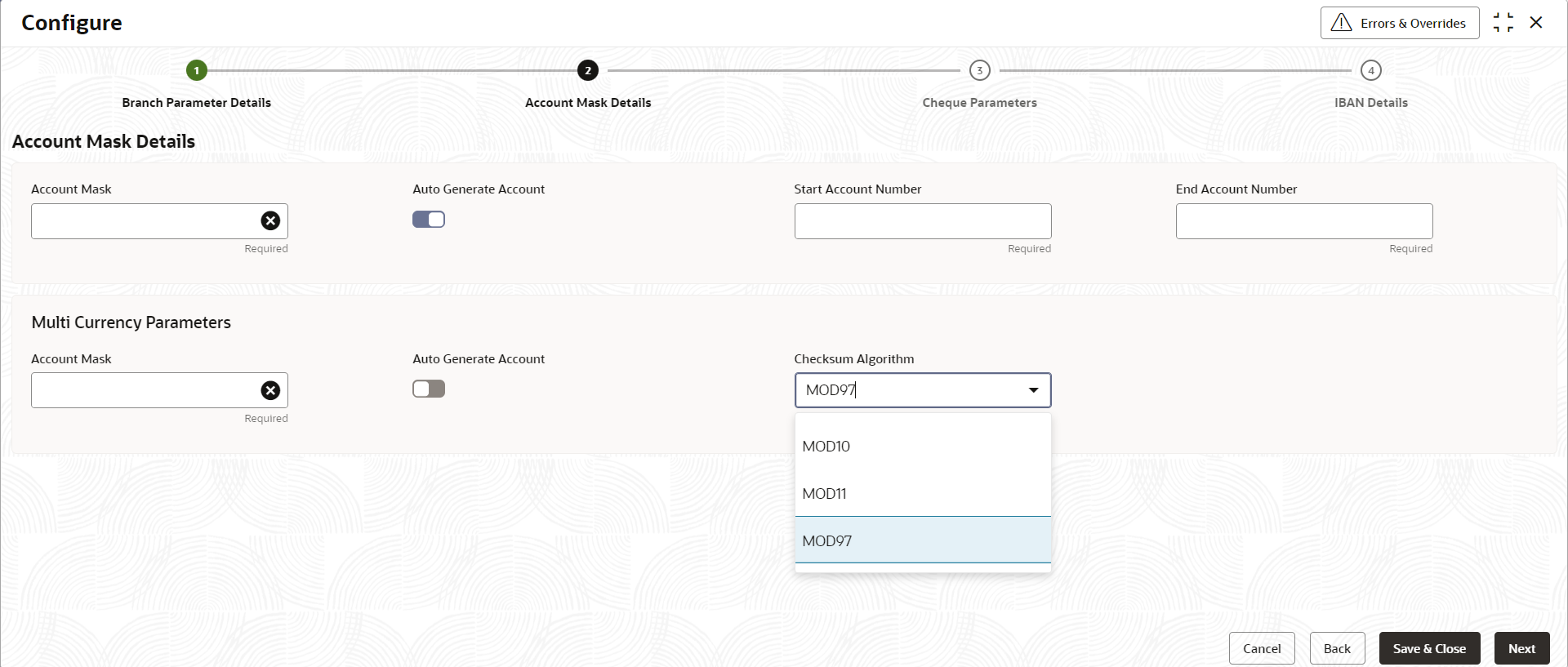

- After specifying the information in the fields, click Next to continue the configuration.The Account Mask Details tab displays.

- On Account Mask Details tab, specify the fields.

For more information on fields, refer to the field description table below.

Table 1-2 Account Mask Details - Field Description

Field Description Account Mask This drop-down list displays the account mask value. The list of values is – - L - Account class

- T - Account code

- a – Alphabet

- B - Branch code

- D – Check digit

- $ - Currency code

- C - Customer number

- n - Numeric value

Auto Generate Account Select this check box to generate the account number automatically. The customer account mask contains only number or combination of Branch Code and number.

Note:

This flag will be ‘automatic’ - if the Auto Generate Account flag is Yes and ‘manual’ - if Auto Generate Account flag is No.Checksum Algorithm This drop-down list displays the checksum algorithm to be used for an account. The following items are available in the list.

- Modulo 10

- Modulo 11

- Modulo 97

Note:

Mod 97 supports only Numeric mask.Start Account Number This field appears if Auto Generate Account is enabled. Specify the start account number. End Account Number This field appears if Auto Generate Account is enabled. Specify the end account number. The above fields are repeated for Multicurrency Parameters.

Account MaskWhen you open Account Mask, the left pane displays a list of items that are part of the account mask. Click and select from the left pane to view the fields. Fields that accept 'n' characters or numbers will have a text box where you can enter the number of times you want this value to repeat. Click Add to enter values in the Account Mask screen.

The following characters are supported in Account Mask.

Table 1-3 Account Mask

Field Mask Character Mask Length Account Class L 6 Account Code T 4 Alphabet (User Input) a User defined Branch Code B 3 Check Digit D 2 Currency Code $ 3 Customer Number C 9 Numeric Value (User Input) n User defined There is no restriction to the number of characters when maximum length is not provided. However, the total length including the check digit must not exceed a maximum of 20 characters.

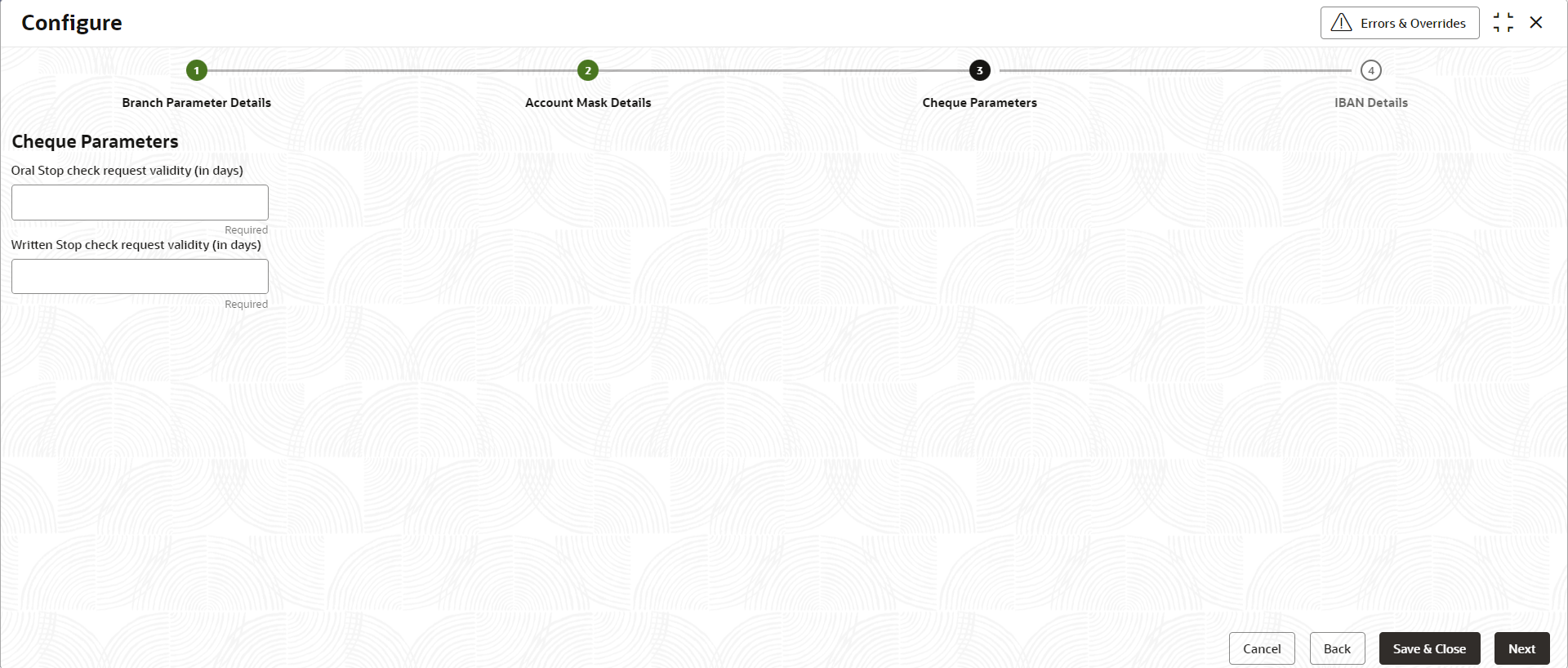

- After specifying the fields, click Next to continue with the configuration.The Cheque Parameters tab displays.

- On Cheque Parameters tab, specify the fields.

For more information on fields, refer to the field description table below.

Table 1-4 Cheque Parameters - Field Description

Field Description Oral Stop check request validity (in days) Specify the value to determine the validity of a stop check request when the request is originated 'orally' from the customer. In this case, for example, if this value is 3 and the stop check request is given orally by the customer on January 01, then the stop payment instruction for the check will be auto-revoked automatically on January 03.

Written Stop check request validity (in days) Specify the value to determine the validity of a stop check request when the request is originated in writing from the customer. In this case, for example, if this value is 3 and the stop check request is given in written by the customer on January 01, then the stop payment instruction for the check will be auto-revoked automatically on January 03.

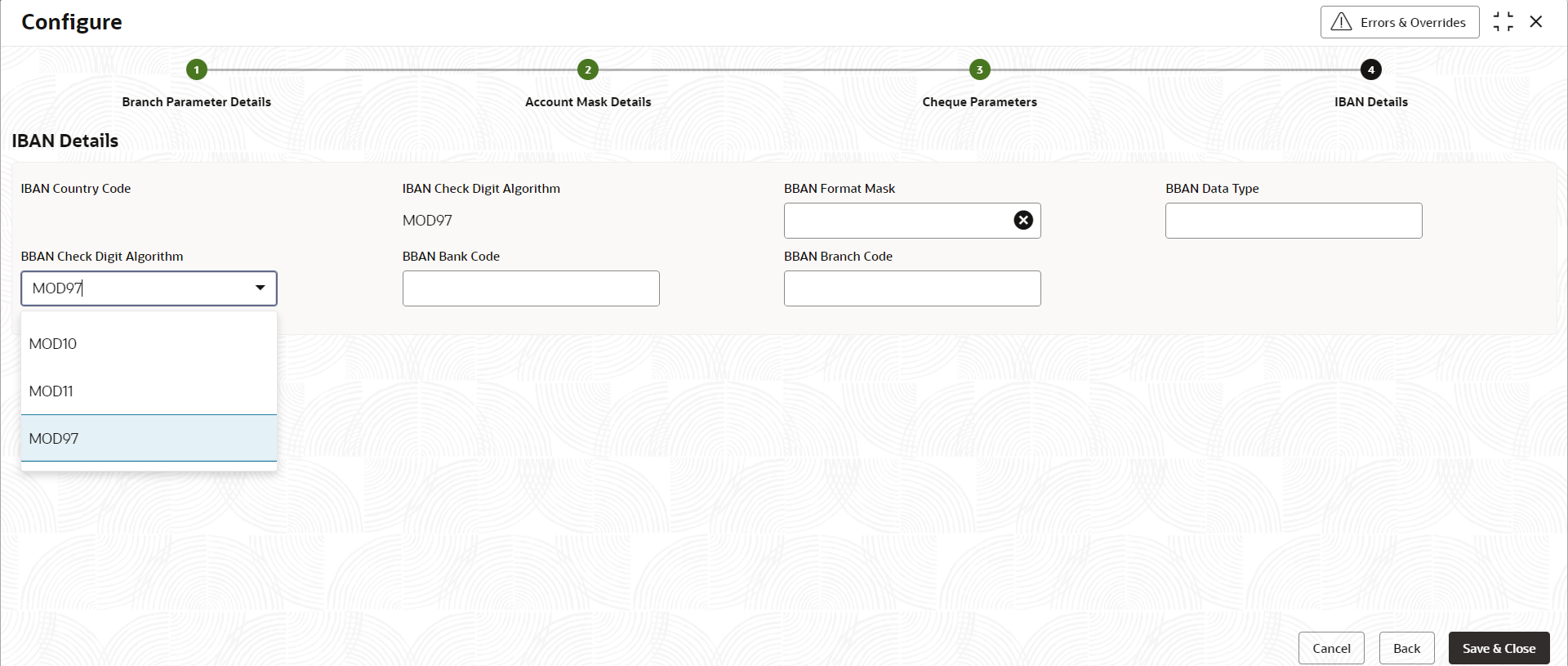

- After specifying the information in the fields, click Next to continue with the configuration.The IBAN Details tab displays.

- On IBAN Details tab, specify the fields.International Bank Account Number (IBAN) allows the user to identify bank accounts across national borders. IBAN comprises of the country code, check digits followed by a country specific Basic Bank Account Number (BBAN).

For more information on fields, refer to the field description table below.

Table 1-5 IBAN Details - Field Description

Field Description IBAN Country Code The system defaults the country code of the branch. The maximum allowed characters for IBAN country code are 2. IBAN Country Code is mandatory. IBAN Check Digit Algorithm The system defaults MOD97 as IBAN check digit algorithm. BBAN Format Mask Specify the mask for BBAN. Refer to the table below. BBAN Data Type Specify the data type of the BBAN mask characters. It can have only a (alphabet), n (number) and c (alphanumeric) as values. BBAN Check Digit Algorithm Select the BBAN check digit algorithm from the drop-down list. The elements are as listed below – - MOD10

- MOD11

- MOD97

BBAN Bank Code Specify the BBAN bank code which will be replaced for bank code in the BBAN account mask. BBAN Branch Code Specify the BBAN branch code which will be replaced for branch code in the BBAN account mask. BBAN Format Mask

Table 1-6 BBAN Format Mask - Field Description

Field Character Mask Length Account Number z User defined Account Type T User defined BBAN Bank Code b User defined BBAN Branch Code s User defined Check Digit d User defined National Identifier i User defined Number of Account Holders h The value is defaulted to 1 Note:

The maximum characters allowed for BBAN account mask is 30. - Click Back to navigate to previous tabs or click Save & Close to complete the steps. Click Cancel to exit without saving.

Parent topic: Branch Parameters