- Interest and Charges User Guide

- Interest Product

- Create Interest Product

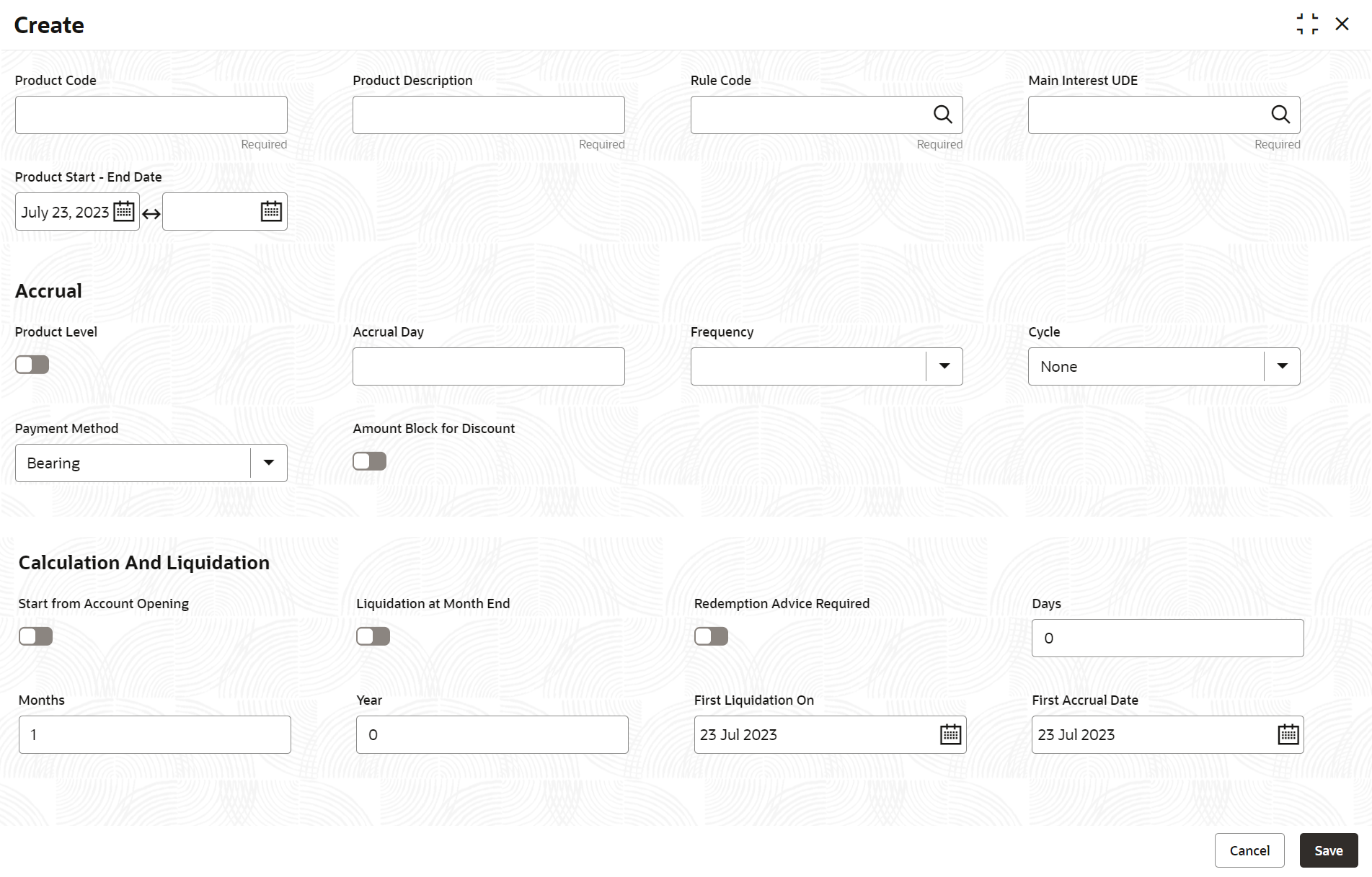

6.1 Create Interest Product

This topic describes the systematic instructions to configure the interest in Interest Product maintenance.

- On Home screen, click Retail Deposits. Under Retail Deposits, click Configurations. Under Configurations, click Interest and Charges.

- Under Interest and Charges, click Interest

Product. Under Interest Product, click

Create.The Create screen displays.

- Specify the fields on Create screen.

For more information on fields, refer to the field description table.

Table 6-1 Create Interest Product - Field Description

Field Description Product Code Displays the code of the product to define the preferences. Product Description Specify the appropriate description for the defined Product Code. Rule Code Click Search icon and select the rule created in the IC Rule Maintenance screen. Main Interest UDE Specify the interest rate for the product. Click Search icon and the list displays all the IC rule linked to the product. User can choose the appropriate one. Product Start - End Date Specify the date range when the product can be used. The start and end dates should be kept handy while defining a product for a scheme which is open for a specific period. The user cannot use a product beyond the specified expiry date. If the user have attached the expired product at the account level, on save, the system displays the override message as, The product has expired.

Accrual While building a formula (for the rule to link the product), the interest amount will be accrued for all the accounts linked to the product if the interest is indicated as the result of the formula. While defining the preferences for this product, the user can choose to pass the accrual entries in the following manner:- Pass an accrual entry for each account

- Consolidate the interest to be accrued (for individual accounts) and track it against the product.

If the user choose the latter option, the cumulative value of all the accruals (for accounts linked to the product) will be passed as a single accounting entry.

Product Level Select this toggle to accrue interest at the ‘Product Level’, the accrued interest for all the accounts linked to the product will be consolidated and a single entry posted for the product. If the user choose to accrue the interest for each account linked to the product, an accrual entry will be posted for each account individually. The account for which the accrual entry is passed will be shown when the user retrieve information about an entry. The details of accruals for each account will be available in the Accrual Control Journal, a report generated whenever accruals are performed as part of end-of-cycle processing. Accrual day Specify the day of the month on which the accruals have to be carried out for a non-daily accrual frequency. For example, If the Accrual Day is specified as 25, the automatic accrual will be on the 25th day of the months, as per the frequency. Frequency Select the frequency with which the interest accured for the defined account classes. The available options are:- Daily

- Monthly

- Quarterly

- Semi Annual

- Annual

- On liquidation (accrues only when the interest liquidates)

Let us recall the operations relating to accruals that the user have performed so far. When the user build an interest rule, the user defines whether the result of a formula is to be accrued. While defining the product (to which the rule linked), the user would:- Identify the GL/SL to which the interest accrued is posted (Product Accounting Role Definition screen), and

- Specify the event ‘accrual’ occurs to post the entry to the identified GL/SL (Events Definition screen).

Cycle Specify the accrual cycle in the months. If the frequency is selected as- Quarterly

- Semi Annual

- Annual

For example, a quarterly cycle may be March, June, September and December, indicating that the accrual should take place in these months. For a half-yearly cycle, the user would specify June and December.

Payment Method In case of Term deposits, user has to specify whether the payment method for the main interest is to be Bearing or Discounted. This cannot be changed at the time of processing a deposit. - Bearing - In case user choose bearing product as the payment method, the system books the term deposit without liquidating the interest for the account.

- Discounted - For discounted

products, the payment of interest is upfront and no

interest liquidation on maturity date. In case of

true discounted, the payment method is calculated

based on the formula maintained in the IC rule

definition and the interest is calculated based on

the formula defined at the rule level.

Note:

The rule user define for true discounted products is applied exclusively for the discounted products.

Amount Block for Discount Enable this option, if user wish to create amount block on the term deposit account. Start from Account Opening Select the toggle to liquidate the interest periodically for accounts according to a frequency determined in the Account Opening Date. Instead of giving a First Liquidation Date and bringing all the accounts linked to the product to the same liquidation cycle. The periodic liquidations can also be fixed to begin on a particular date (First Liquidation Date) and happen at a definite frequency.

Liquidation at Month End Select the toggle to liquidate the interest at the last working day of the month. For a liquidation frequency in months or multiples of a month (for example: quarterly, half yearly, every two months, etc.,), the user can select that liquidation has to be carried out as of the last working day of the month. In this case, the user should specify the Liquidation Start Date as the last date of the month from which you would begin liquidation.

Redemption Advice Required Enable this option, if redemption advice is required. Days, Months and Year Specify the liquidation frequency for the Interest product. The user can specify the liquidation frequency in - Days - Example: If the user wants to liquidate interest every 15 days, enter ‘15’.

- Months - Example: If the user wants to liquidate interest every quarter, enter ‘03’.

- Years - Example: If the user wants to liquidate interest every year, enter ‘01’

First Liquidation On Select the First Liquidation Date once the liquidation frequency has been defined. The frequency and the date will be used to arrive at the first and subsequent dates of liquidation for the accounts linked to the product. For example, the quarterly liquidation cycle may be March, June, September and December, and the liquidation is on the month-end. For such a cycle, the user should indicate 31 March as the date of first liquidation during the year. The subsequent dates will be automatically fixed by the system based on the frequency and the first liquidation date. - Click Save to save the details.

Parent topic: Interest Product