- Retail Accounts User Guide

- Operations

- Limits

- Unsecured Overdraft Limits

3.9.1 Unsecured Overdraft Limits

This topic provides systematic instructions to create an unsecured limit for an account and to update, modify, or delete the existing unsecured limits on the account.

To create or update unsecured limit for an account:

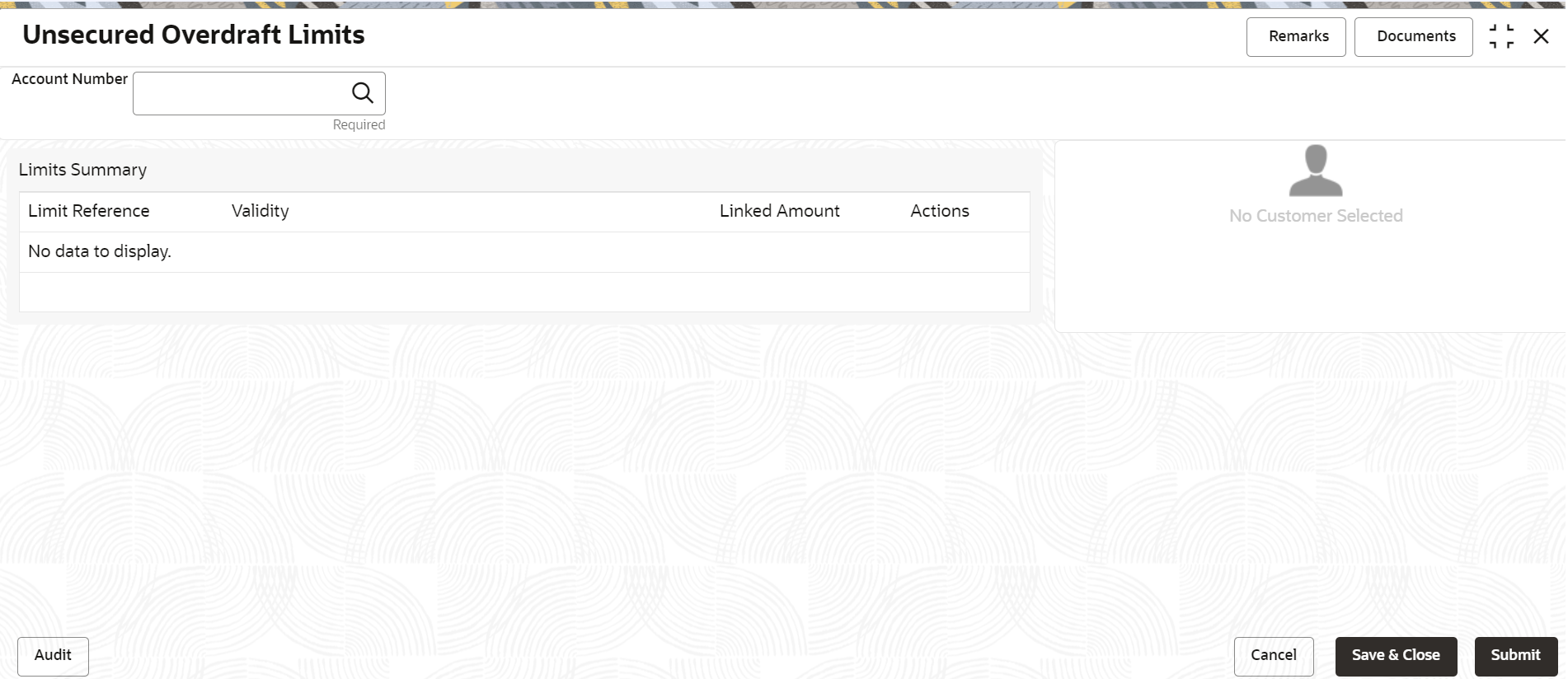

- On the Home screen, from Retail Account

Services, under Limits, click

Unsecured Overdraft Limits, or specify the

Unsecured Overdraft Limits in the Search icon

bar.The Unsecured Overdraft Limits screen is displayed.

- On Unsecured Overdraft Limits screen, specify the

fields. For more information on fields, refer to the field

description table below.

Table 3-27 Unsecured Overdraft Limits - Field Description

Field Description Account Number Enter the Account Number or click the search icon to view the Account Number pop-up window. By default, this window lists all the Account Numbers present in the system. You can search for a specific Account Number by providing Customer ID, Account Number, or Account Name and clicking on the Fetch button. Note:

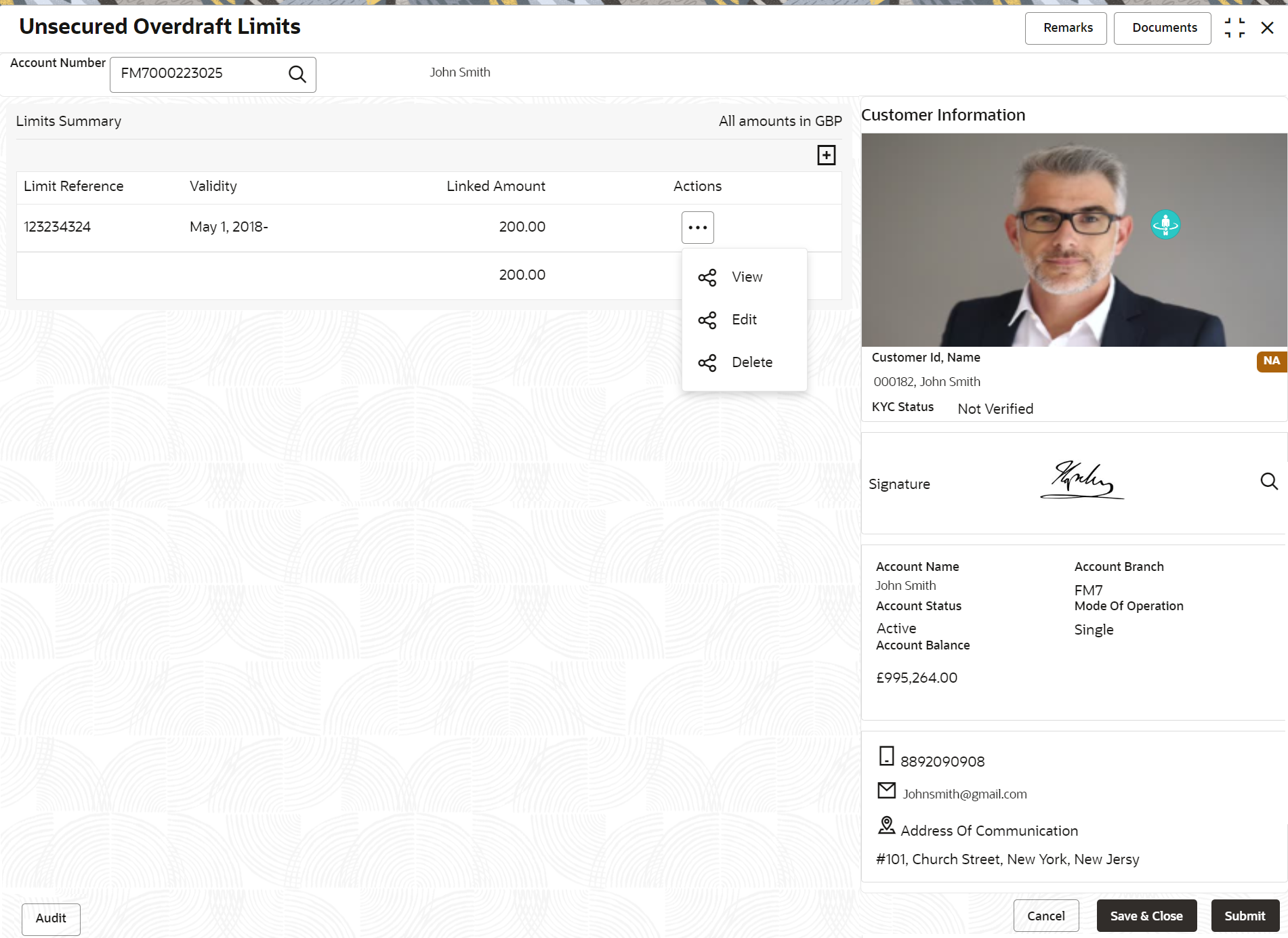

As you specify or select the account number:- The account name is displayed adjacent to the Account Number field.

- The customer information is displayed in a widget, to the right of the screen.

Customer Information and Limits Summary is displayed for the selected Account Number with existing records.Figure 3-49 Customer Information - Unsecured Overdraft Limits

Description of "Figure 3-49 Customer Information - Unsecured Overdraft Limits" - On Unsecured Overdraft Limits screen, under

Limits Summary, click the

Action icon.The system displays the following options:

- View

- Edit

- Delete

- Click the View or Delete option

to view or delete the existing unsecured limits record.The non- editable Unsecured Limits window is displayed.

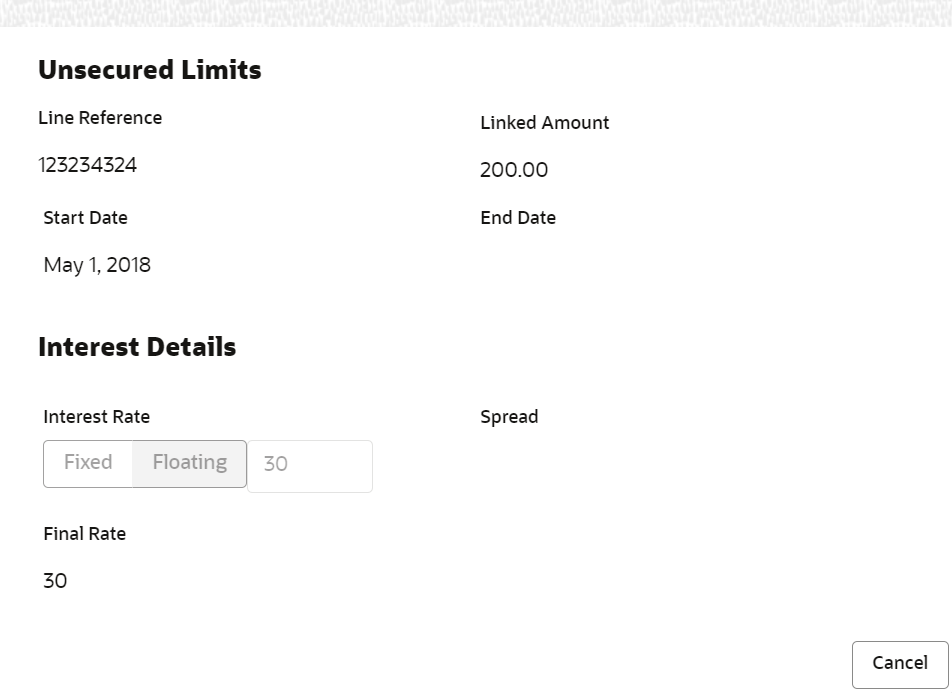

Figure 3-50 Unsecured Limits - View or Delete

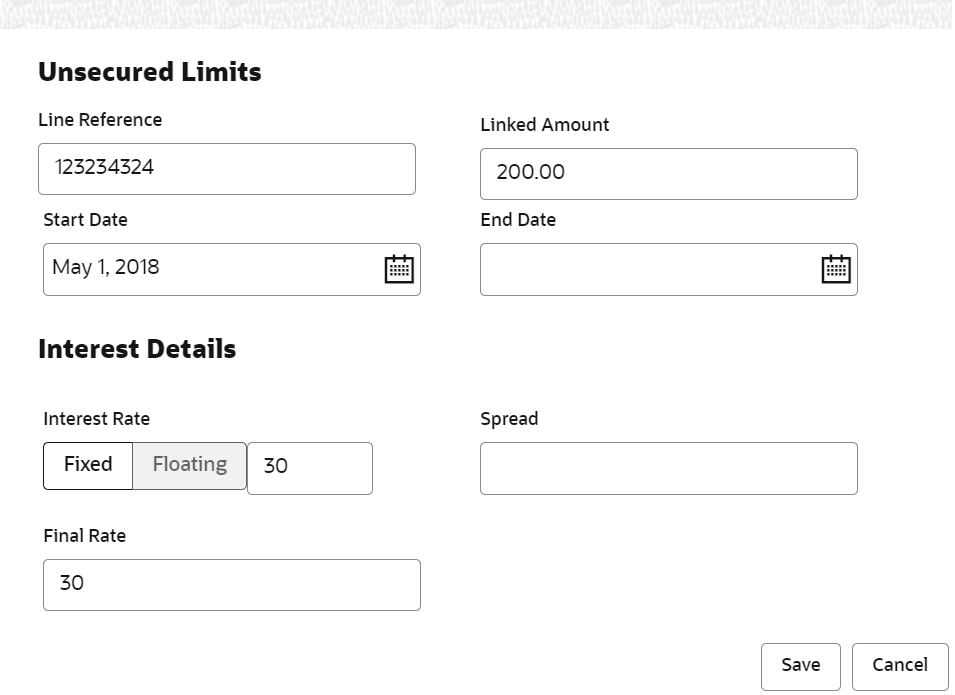

Description of "Figure 3-50 Unsecured Limits - View or Delete" - Click the Edit option to modify the existing unsecured

limits record.The editable Unsecured Limits window is displayed.

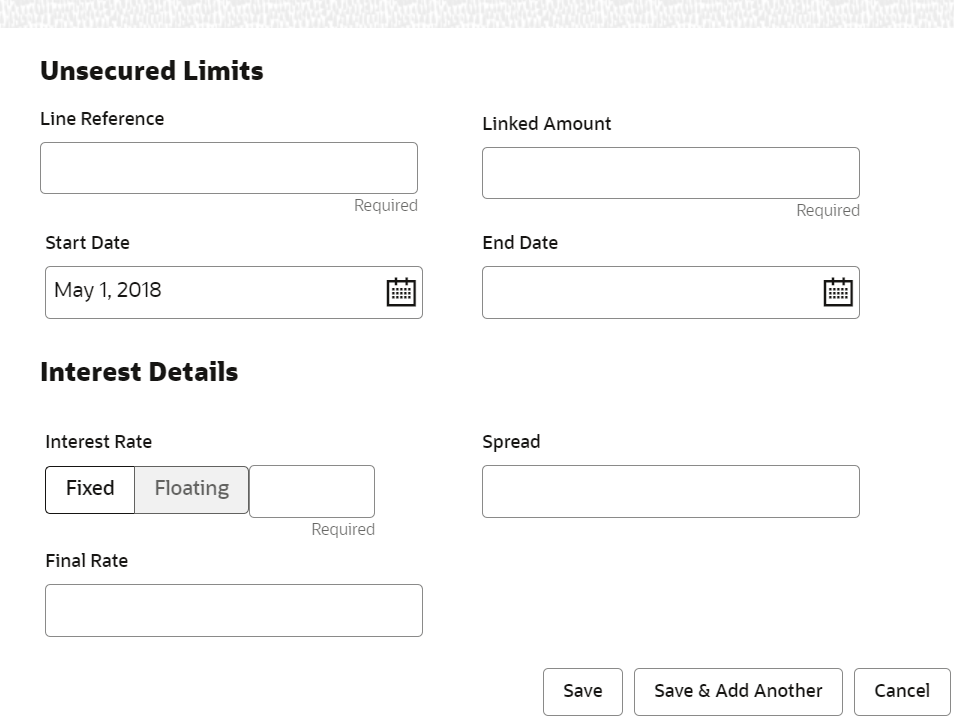

- To add new unsecured limits, click the Add icon.Unsecured Limits window is displayed.

- On Unsecured Limits window, specify the fields. For more information on fields, refer to the field

description table below.

Table 3-28 Unsecured Limits - Field Description

Field Description Line Reference Enter any reference number to identify the clean unsecured limit being granted to the account holder. Linked Amount Enter the amount of unsecured limit being granted to the customer. Start Date The system defaults the Start date as the current branch date. You can modify the Start Date to any future date using the adjoining calendar button. Note:

The Start Date cannot be backdated.End Date Click on the adjoining calendar icon and specify the End Date of the unsecured limit. Interest Rate Displays the interest rate as Fixed. Note:

Interest Rate Type and actual Interest Rates defaults from the account class level if defined. In such cases, the Interest Rate Type and Interest Rates automatically defaults in these fields.Spread This is an optional field and can be Positive Spread or Negative Spread. Final Rate The system defaults the Final Rate by adding the Interest rate. Note:

The additional of interest rate can be +/- spread.On clicking Save button, newly added unsecured limit is displayed in the Limits Summary.

Parent topic: Limits