2.2.1 Consent Capture

OBDX/ OBAPI support APIs as well as UX for Payment Service User (PSU) consent capture for a request from Third Party provider (TPP)

Prerequisite: TPP has registered with the ASPSP as a client to avail UK Open Banking services.

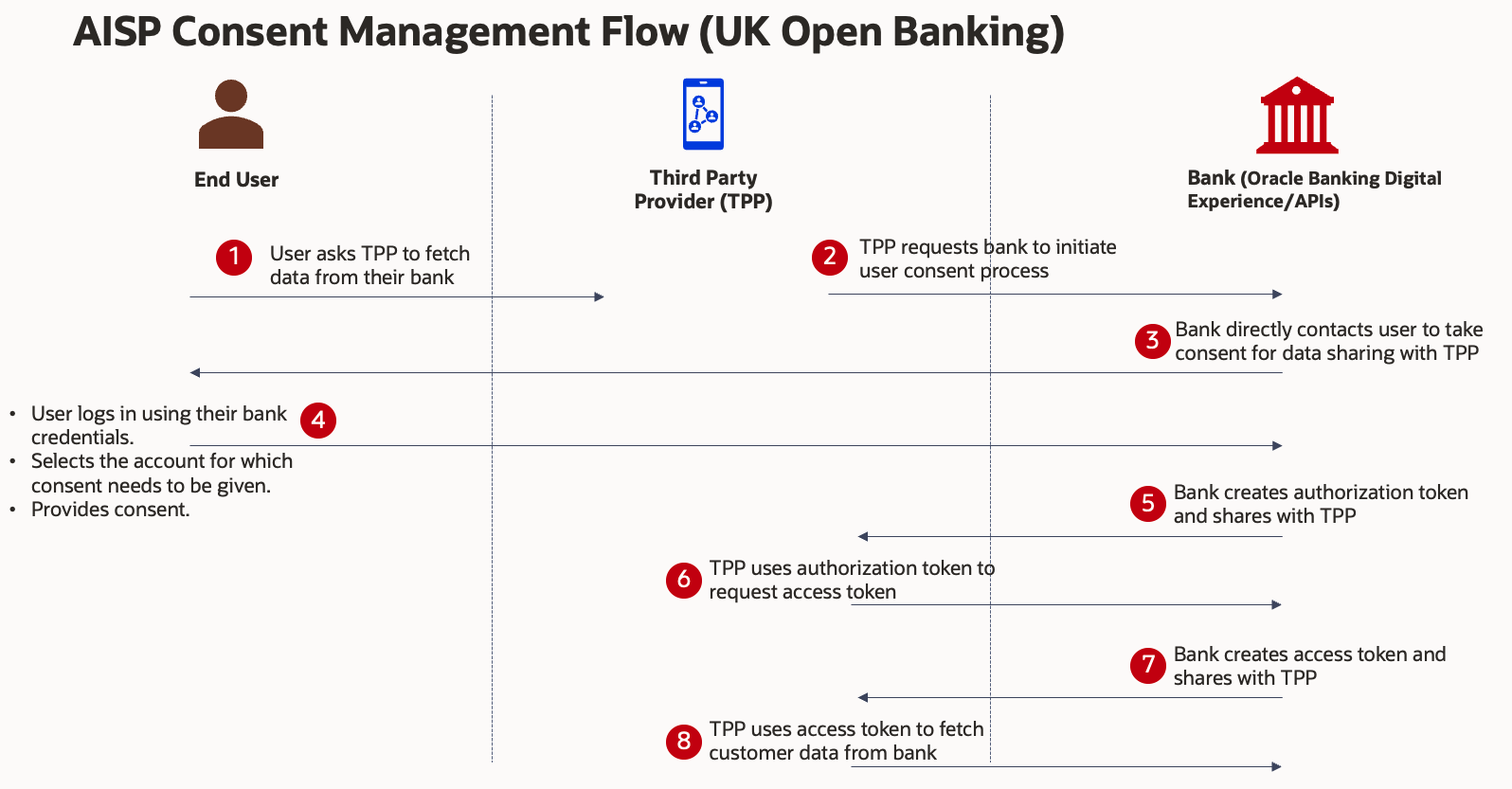

AISP Flow:

- During data request, TPP contacts ASPSP with their credentials

- ASPSP then directly contacts PSU to acquire consent for sharing the data with the TPP

- During this process, PSU sees the list of accounts that they have with the ASPSP and then selects the account for which the consent needs to be given

- Once consent is given by the PSU to ASPSP, ASPSP generates an authorisation token and shares the same with the TPP

- TPP uses this authorisation token and gets the access token from the ASPSP

- TPP can use this access token to access customer’s data for the specified time

Note:

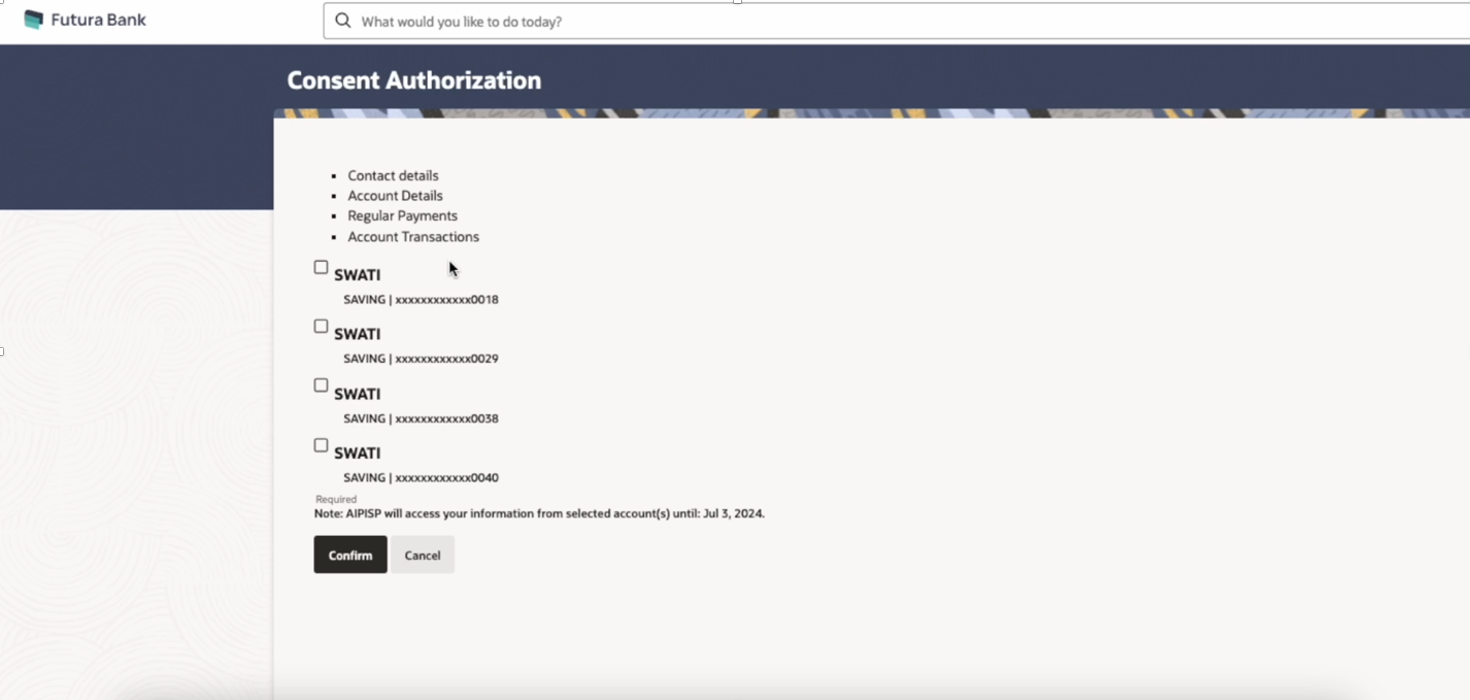

In UK Open Banking an Account is identified using the Sort Code and Account number combination.Figure 2-2 AISP Consent Capture Screen - UK Open Banking

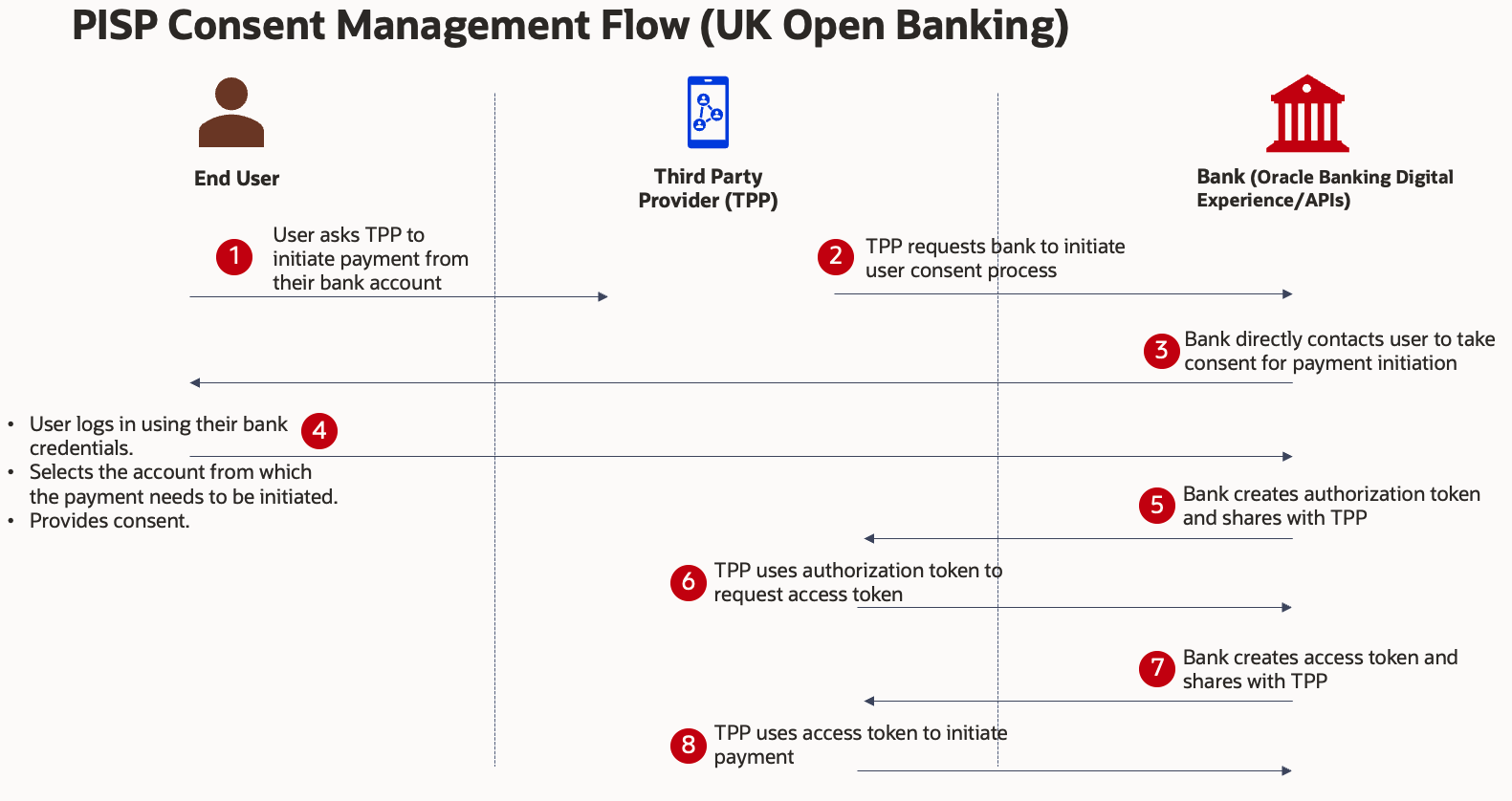

PISP Flow:

- During payment initiation request, TPP contacts ASPSP with their credentials and payment details

- ASPSP then directly contacts PSU to acquire consent for allowing payment initiation from their accounts.

- During this process, the PSU sees the list of accounts that they have with the ASPSP and then selects the account from which the payment needs to be initiated.

- Once consent is given by the PSU to ASPSP, ASPSP generates an authorisation token and shares the same with the TPP

- TPP uses this authorisation token and gets the access token from the ASPSP

- TPP uses this access token to initiate the payment

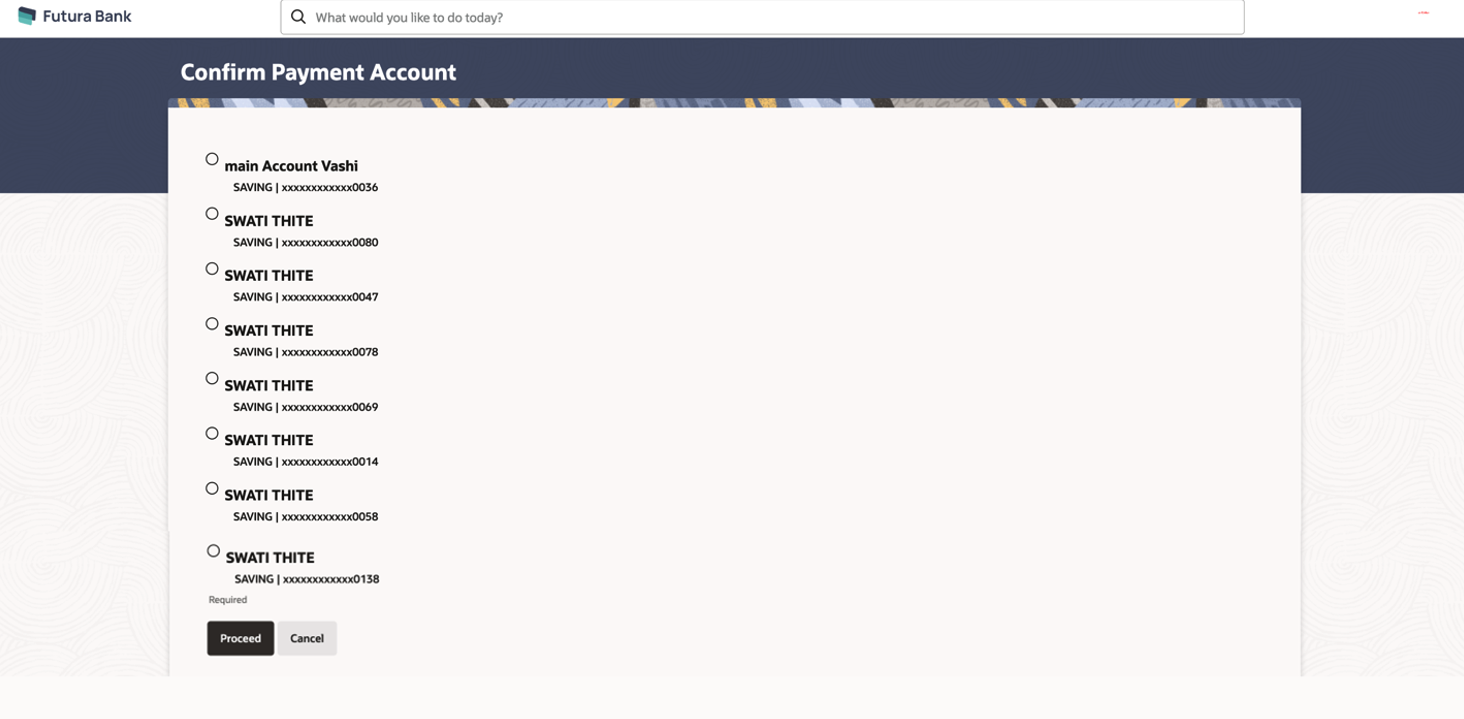

Figure 2-4 PISP Consent Capture Screen with Account Selection - UK Open Banking)

Parent topic: Consent Management