- Teller User Guide

- Customer Transactions

- Close Out Withdrawal by Multi-Mode

4.9 Close Out Withdrawal by Multi-Mode

The Close Out Withdrawal by Multi Mode screen is used to close the CASA account by multi-mode payout options, which include cash, account transfer, and BC. This screen can be used only when the closeout withdrawal needs to be done in multiple payout modes.

The balance amount displayed is only the available balance from FLEXCUBE Universal Banking and Oracle Banking Branch does not consider the closeout withdrawal charges configured in FLEXCUBE Universal Banking. In case charges are required to be displayed in Oracle Banking Branch, Oracle Banking Branch also supports charges which can be configured.

To close the CASA account by multi-mode payout options:

- On the Homepage, from Teller mega menu, under

Customer Transaction, click Close Out

Withdrawal by Multi Mode or specify Close Out

Withdrawal by Multi Mode in the search icon bar and select the

screen.The Close Out Withdrawal by Multi Mode screen is displayed.

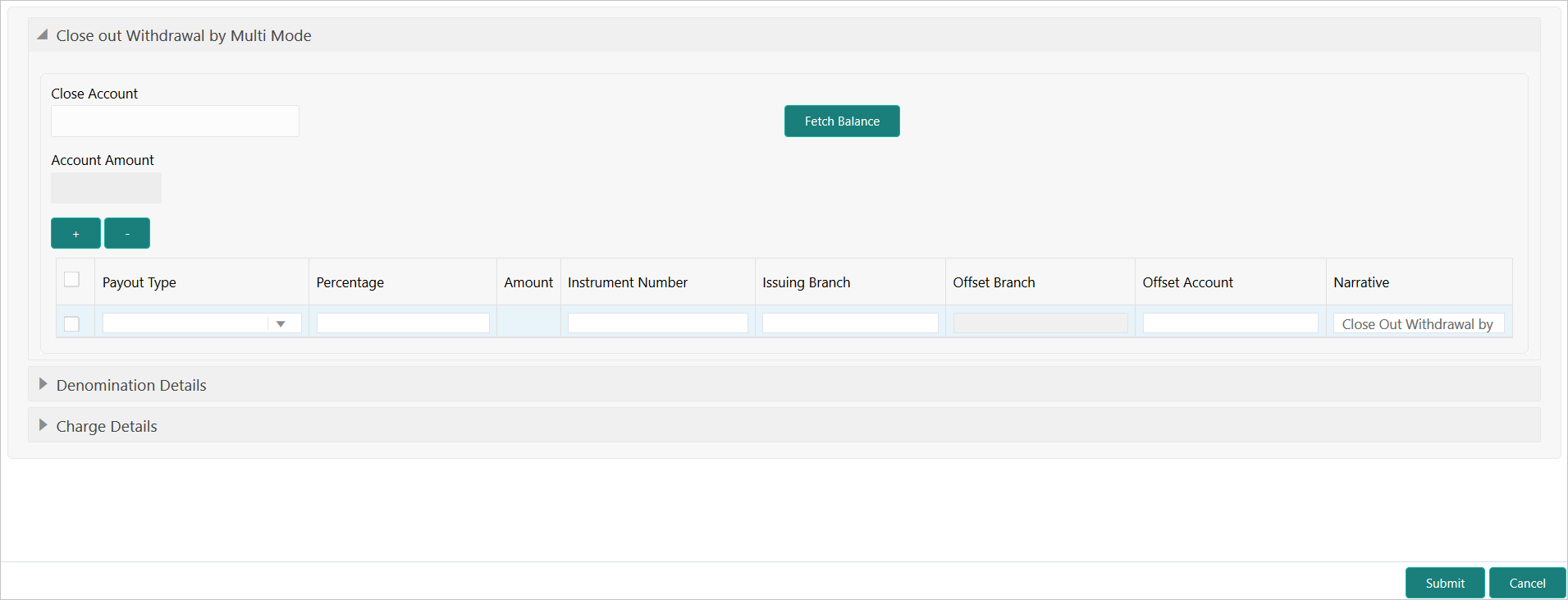

Figure 4-14 Close Out Withdrawal by Multi Mode

- On the Close Out Withdrawal by Multi Mode screen,

specify the fields. For more information on fields, refer to the field description

table.

Table 4-14 Close Out Withdrawal by Multi Mode - Field Description

Field Description Close Account

Specify the account number, which needs to be closed.

Note:

The system displays an override or error message on the tab out of Account Number based on the account dormancy parameters.Fetch Balance

Click Fetch Balance to fetch and display the account amount.

Account Amount

Displays the account amount.

Payout Type

Select the payout type from the following drop-down values:

-

Account– If this option is selected, the user needs to specify the Offset Account, to which the transfer is to be made. Based on the specified offset account number, the system will default the Offset Branch and Offset Currency fields. -

Cash– If this option is selected, the user needs to disburse the cash in the account currency. -

Bankers Cheque- If this option is selected, either the field Instrument Number is populated or the teller can input the value. On submission, the system will validate the instrument number if inputted or derive the instrument number in case of a null value. In addition, the user needs to capture the BC-related details in the Bankers Cheque Details data segment. This data segment is mandatory only if the Payout Type is selected as Bankers Cheque.

Percentage

Specify the amount of redemption for the payout type selected.Note:

Based on the percentage input, the system will derive the amount to be paid out.Amount

Specify the amount that needs to be withdrawn in the payout type selected.

Instrument Number

Specify the BC number.Note:

This field is applicable only if the Payout Type is selected asBankers Cheque.Issuing Branch

Displays the branch code of the specified account number.

Offset Account

Specify the account number to which the payout amount needs to be transferred.Note:

This field is applicable only if the Payout Type is selected asAccount.Offset Branch

Displays the branch of the specified offset account number.Note:

This field is applicable only if the Payout Type is selected asAccount.Offset Currency

Displays the currency of the specified offset account number.Note:

This field is applicable only if the Payout Type is selected asAccount.Narrative

Displays the default narrative as Close Out Withdrawal by Multimode, and it can be modified. -

- Specify the denomination details. For information on the fields in the Denomination Details segment, refer to Add Denomination Details.

- Specify the charge details. For information on the fields in the Charge Details segment, refer to Add Charge Details.

- Click Submit.A teller sequence number is generated, and the Transaction Completed Successfully information message is displayed.

Note:

The transaction is moved to authorization in case of any approval warning raised when the transaction saves. On transaction submission, the transaction details are handed off to the CASA module in the FLEXCUBE Universal Banking for the account closure process.

If the account balance is credited to an intermediary bridge GL, the transaction status will be changed from

PendingtoCompleted.Based on the payout options, the corresponding transaction will be completed successfully.

Parent topic: Customer Transactions