- Teller User Guide

- Customer Transactions

- F23C Tax Payment by Cash

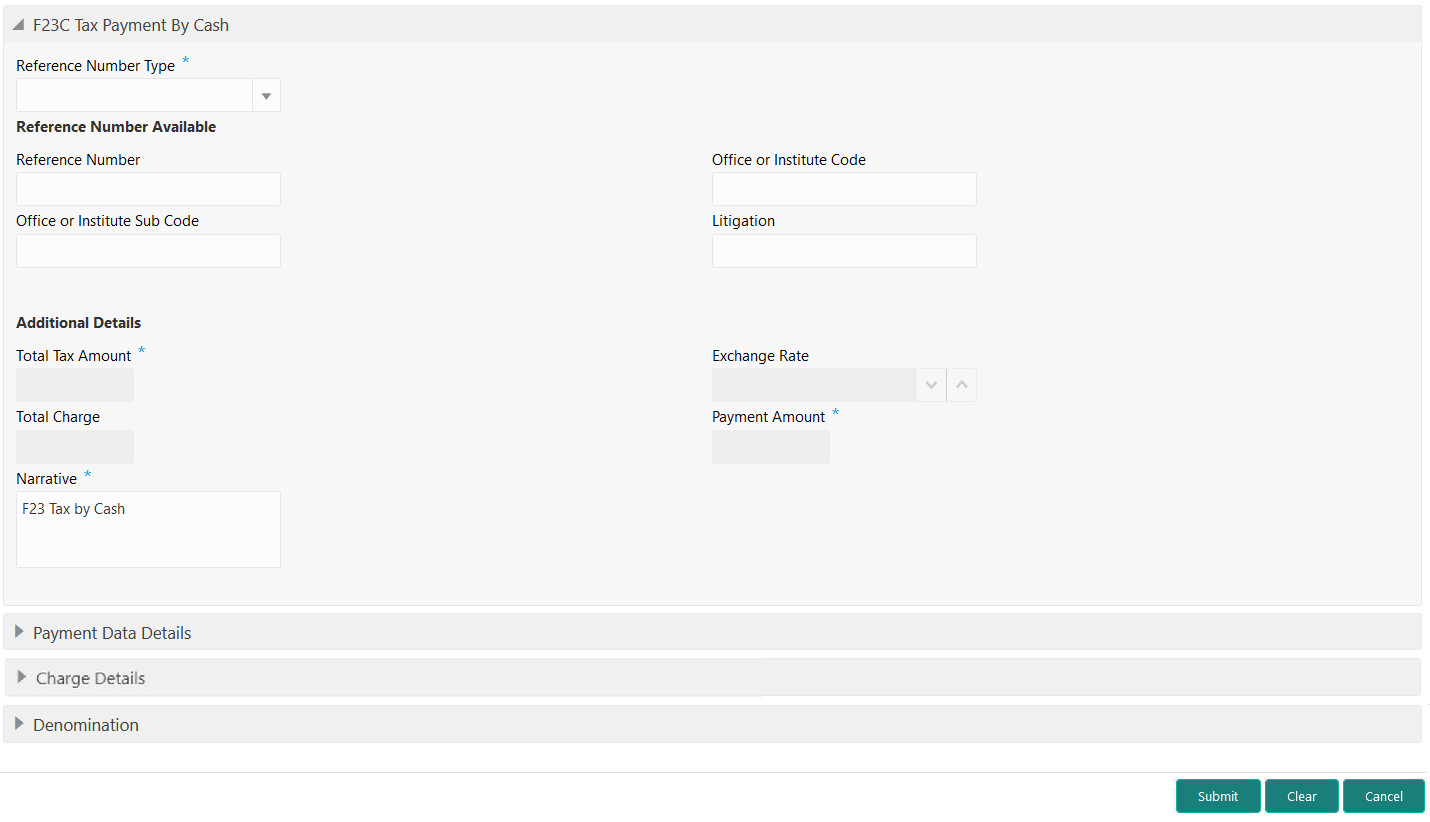

4.12 F23C Tax Payment by Cash

The F23C Tax Payment By Cash screen is used to capture data related to the F23C tax document for a customer and collect the corresponding tax by cash from the customer.

- On the Homepage, from Teller mega menu, under

Customer Transaction, click F23C Tax

Payment - Cash or specify F23C Tax Payment -

Cash in the search icon bar and select the screen.The F23C Tax Payment By Cash screen is displayed.

- On the F23C Tax Payment By Cash screen, specify the

fields. For more information on fields, refer to the field description

table.

Note:

The fields, which are marked with an asterisk, are mandatory.Table 4-17 F23C Tax Payment By Cash Screen - Field Description

Field Description Reference Number Type

Select the reference number types from the drop-down list. The drop-down list shows the following values:

-

Reference Number Available

-

Reference Number Not Available

Reference Number

Specify the reference number of the payment provided by the Public Authority.

Office or Institute Code

Specify the office or institute code that receives the payment.

Office or Institute Sub code

Specify the office or institute subcode that receives the payment.

Litigation

Specify the kind of litigation.

For a Total Amount

Displays the total tax amount.

Total Charge

Displays the total charge amount, which is computed by the system in the local currency of the branch.

Exchange Rate

Displays the exchange rate based on the Account Currency and Offset Account Currency.

Payment Amount

Displays the amount paid by the customer.Note:

The currency of the amount paid defaults from the received currency.Narrative

Displays the default narrative as F23 Tax by Cash, and it can be modified.

-

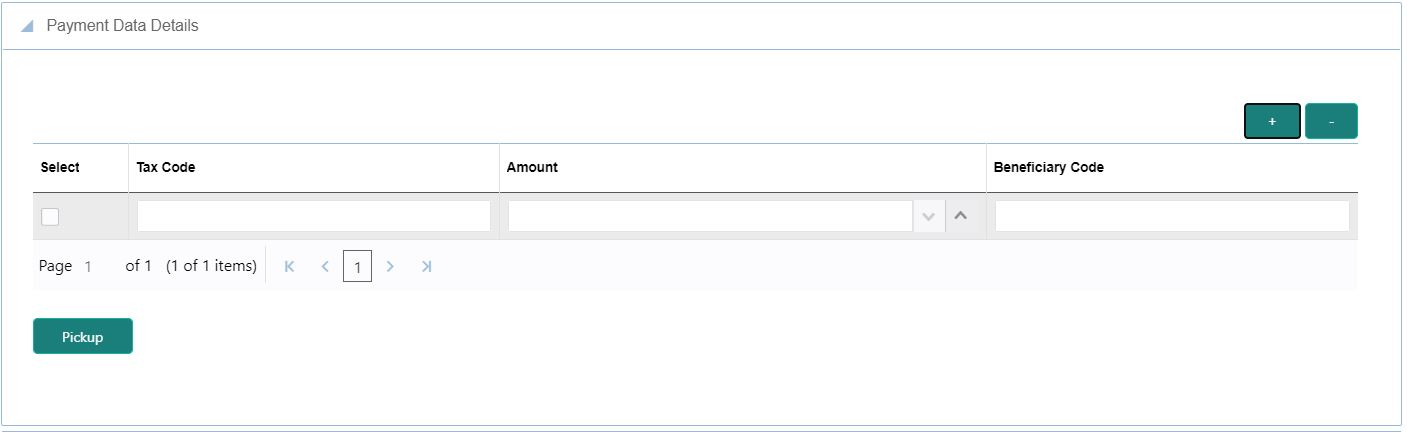

- Click on the Payment Data Details data segment.The Payment Data Details data segment is displayed.

- On the Payment Data Details data segment, specify the

fields. For more information on fields, refer to the field description

table.

Table 4-18 Payment Data Details - Field Description

Field Description Tax Code

Specify the Tax Code.

Amount

Specify the tax amount.

Beneficiary Code

Specify the beneficiary institute code.

- Specify the charge details. For information on the fields in the Charge Details segment, refer to Add Charge Details.

- Specify the denomination details. For information on the fields in the Denomination segment, refer to Add Denomination Details.

- After you specify the Reference Number, click

Pickup.

The system defaults the Elaboration Date in the section Reference Number Available with the current system date. In case you do not specify the Reference Number, then the Principal Fiscal Code needs to be specified. After which the system defaults the Elaboration Date in the section Reference Number Not Available with the current system date. It then adds up the Amounts in the Payment Data Details block and defaults the sum in the For a total Amount field.

The system posts the following accounting entries on save and authorization of the record:

Table 4-19 Accounting Entries Posted for Payment Amount

Dr/Cr Description Amount Dr

Cash Account

For a Total Amount

Cr

Account maintained in ARC of the associated product

For a Total Amount

Table 4-20 Accounting Entries Posted for Charge Amount

Dr/Cr Description Amount Dr

Cash Account

Charges amount computed as per ARC maintenance

Cr

Account maintained in ARC of the associated product

Charges amount computed as per ARC maintenance

The following validations are performed by the system:

- The system allows you to maintain a minimum of one row and a maximum of eight rows in the Payment Data Details multi-entry block. If you do not maintain the minimum row or exceed the maximum row, then the system displays an appropriate error message.

- If the Principal Fiscal Code and Secondary Fiscal Code fields have a value of 16 characters that is for non-individual customers the system validates the last character in the value as per the checksum algorithm for Fiscal Code. If the validation fails, then the system displays an appropriate error message. In the case of individual customers, where the Principal Fiscal Code and Secondary Fiscal Code field has a value of 11 characters, the system validates the last character in the value as per the checksum algorithm for a VAT number. If the validation fails, then the system displays an appropriate error message.

- The system validates only the data format of the fields specified.

- If the computed value for Payment Amount field value is less than or equal to 0, on pickup, the system displays an appropriate error message.

- Once Pickup is completed, click Submit.A teller sequence number is generated, and the Transaction Completed Successfully information message is displayed.

Note:

The transaction is moved to authorization in case of any approval warning raised when the transaction saves. On transaction submission, the deposit of tax amount is completed successfully.

Parent topic: Customer Transactions