- Teller User Guide

- Remittances

- Banker's Cheque

- Multi BC Issuance

- Multi BC Issuance Against Account

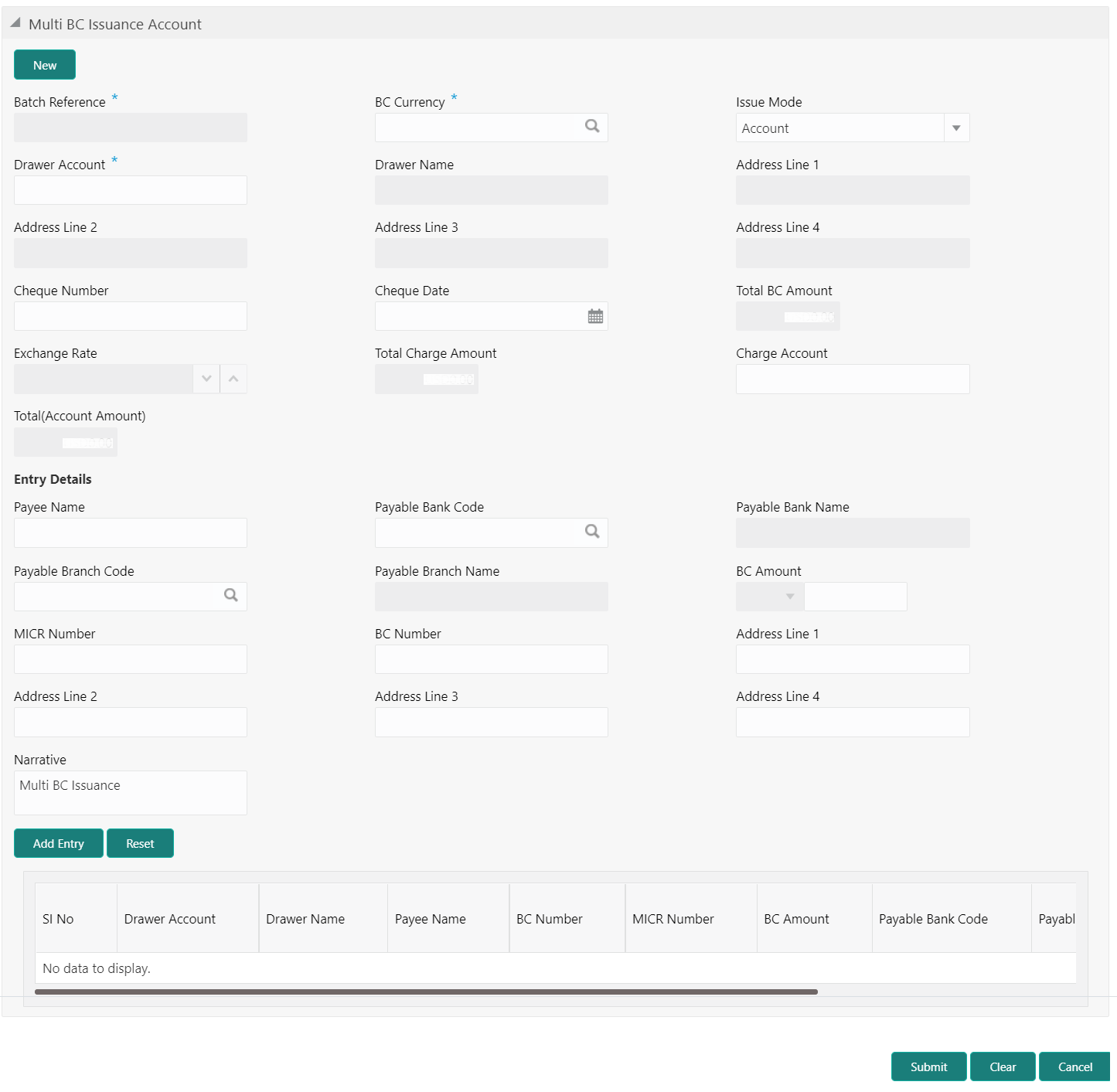

8.1.6.1 Multi BC Issuance Against Account

The Teller can use the Multi BC Issuance screen to issue BCs against multiple beneficiaries for a single remitter account.

- On the Homepage, from Teller mega menu, under

Remittances, click Multi BC

Issuance or specify Multi BC Issuance in

the search icon bar and select the screen.The Multi BC Issuance Account screen is displayed.

- On the Multi BC Issuance Account screen, specify the

fields. For more information on fields, refer to the field description

table.

Note:

The fields, which are marked with an asterisk, are mandatory.Table 8-21 Multi BC Issuance Account - Field Description

Field Description New

Click New to generate a batch reference number.

Batch Reference

Displays the auto-generated batch reference number.

BC Currency

Select the BC currency from the LOV.

Issue Mode

Select the issue mode as Account from the drop-down values.

Drawer Account

Specify the remitter account number. When you press the Tab key, the Account Description, Remitter Name, and Address of the remitter account will be populated.

Drawer Name

Displays the name of the specified remitter account number.

Address Line 1 to Address Line 4

Displays the address of the specified remitter account number.

Cheque Number

Specify the cheque number.

Note:

The system validates the status of the cheque and prompts an error message if incase of a Used or Stopped or Invalid cheque.Cheque Date

Specify the issue date of the cheque.

Total BC Amount

Displays the total sum of the multiple BC amount inputs, which is computed by the system.

Exchange Rate

Displays the exchange rate, and it can be modified.Note:

If the transaction currency is the same as the account currency, the system will display the exchange rate as 1. This field is displayed only ifMulti-Currency Configurationat the Function Code Indicator level is set as Y.Total Charges

Displays the total charge amount.Note:

This field is displayed only ifTotal Charges Configurationat the Function Code Indicator level is set as Y.Charge Account

Specify the charge account number.Note:

By default, the drawer account number will be displayed as a charge account, and it can be modified.Total (Account Amount)

Displays the total amount available in the specified charge account.

Entry Details

Specify the fields.

Payee Name

Specify the name of the payee.

Payable Bank Code

Select the payable bank code from the list of values.

Payable Bank Name

Displays the bank name of the specified payable bank code.

Payable Branch Code

Select the payable branch code from the list of values.

Payable Branch Name

Displays the bank name of the specified payable branch code.

BC Amount

Specify the BC amount.

MICR Number

Specify the MICR number.

BC Number

Specify the BC number.

Address Line 1 to Address Line 4

Specify the address of the payee.

Narrative

Displays the default narrative as Multi BC Issuance, and it can be modified.

Add Entry

After filling the necessary fields, click Add Entry to add a new entry.

Reset

Click Reset to reset the added entries.

- Click Submit.

A teller sequence number is generated, and the Transaction Completed Successfully information message is displayed.

Note:

The transaction is moved to authorization in case of any warning raised when the transaction saves.On transaction submission, the system creates an individual BC transaction and hand-off individual BC issue requests to Oracle Banking Payments system. Once the individual BC transaction is created in Oracle Banking Payments, the system will hand off the consolidated accounting to FLEXCUBE Universal Banking by debiting Customer Account/Cash GL for the total consolidated amount and crediting the intermediary bridge GL. In case of any rejection from Oracle Banking Payments, the system will not consider the transaction for accounting to FLEXCUBE Universal Banking during console entry.

Parent topic: Multi BC Issuance