- Teller User Guide

- Remittances

- Banker's Cheque

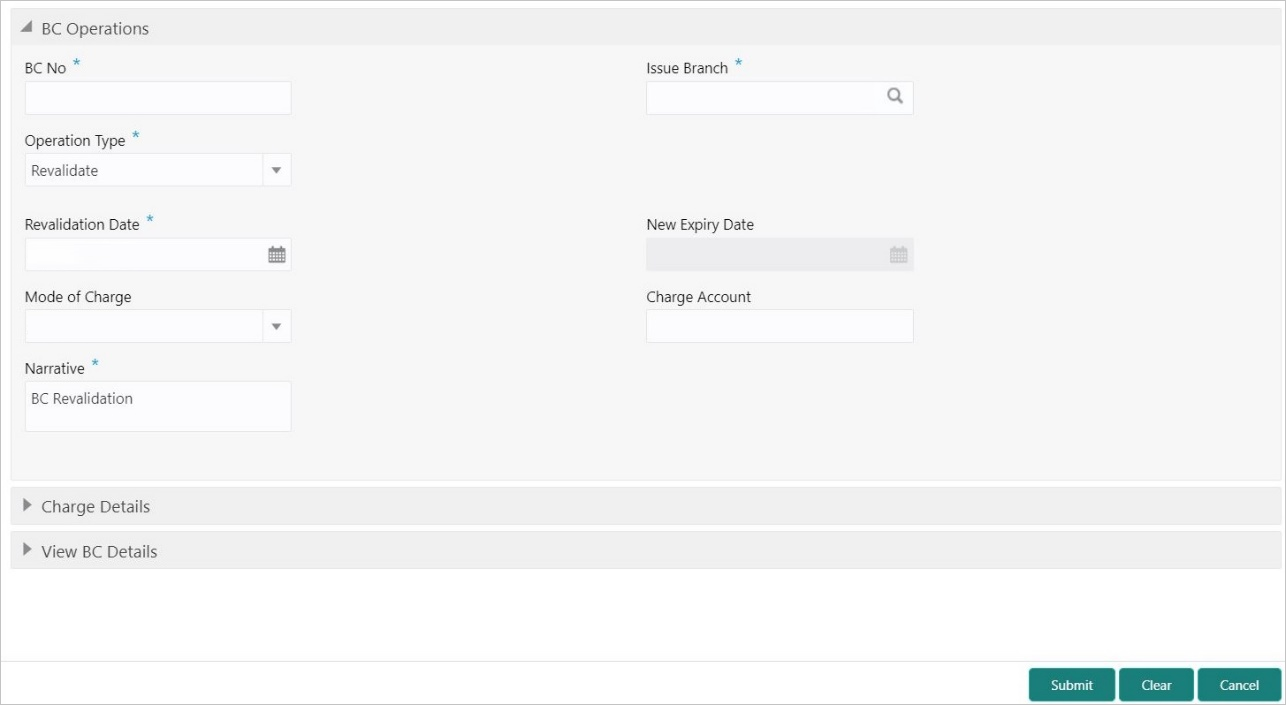

- BC Operations

- BC Revalidation by Account

BC Revalidation by Account

The Teller can use the BC Operations screen to revalidate an instrument that is in expired status.

-

Revalidation is allowed at the Instrument type level

-

The instrument is not liquidated, canceled, or refunded

-

The instrument is issued, revalidated, or duplicate issued but not liquidated/refunded/canceled

-

Rule based authorization is not supported for revalidation

To revalidate an instrument:

- On the Homepage, from Teller mega menu, under

Remittances, click BC

Operations or specify BC Operations in

the search icon bar and select the screen.The BC Operations screen is displayed.

- On the BC Operations screen, specify the fields. For more information on fields, refer to the field description

table.

Note:

The fields, which are marked with an asterisk, are mandatory.Table 8-11 BC Operations (Revalidate) - Field Description

Field Description Operation Type

Select the type Revalidate from the drop-down list.

BC No

Specify the BC number of the instrument.

Issue Branch

Select the branch code where the instrument is issued from the LOV.

Revalidation Details

Specify the details under this segment.

Beneficiary Account

Displays the beneficiary account number.

Revalidation Date

Select the revalidation date.Note:

By default, the system date is displayed as the revalidation date.New Expiry Date

Displays the new expiry date based on the specified revalidation date.

Mode of Charge

Select the mode of charge from the drop-down values (Account or Cash).

Charge Account

Specify the charge account number. The following conditions apply based on the value selected for Mode of Charge:

-

If the Mode of Charge is selected as Account, the user needs to capture the account from which the charges are to be deducted.

Note:

If the Mode of Charge is selected as Account, the system displays the Drawer Account by default. Else, this field is kept blank and the user can input the valid account number. -

If Mode of Charge is selected as Cash, the user needs to capture Charge Currency, and denomination details to be picked up based on the charge currency specified.

Narrative

Displays the default narrative as BC Revalidation, and it can be modified.

-

- Specify the charge details. For information on the fields in the Charge Details segment, refer to Add Charge Details.

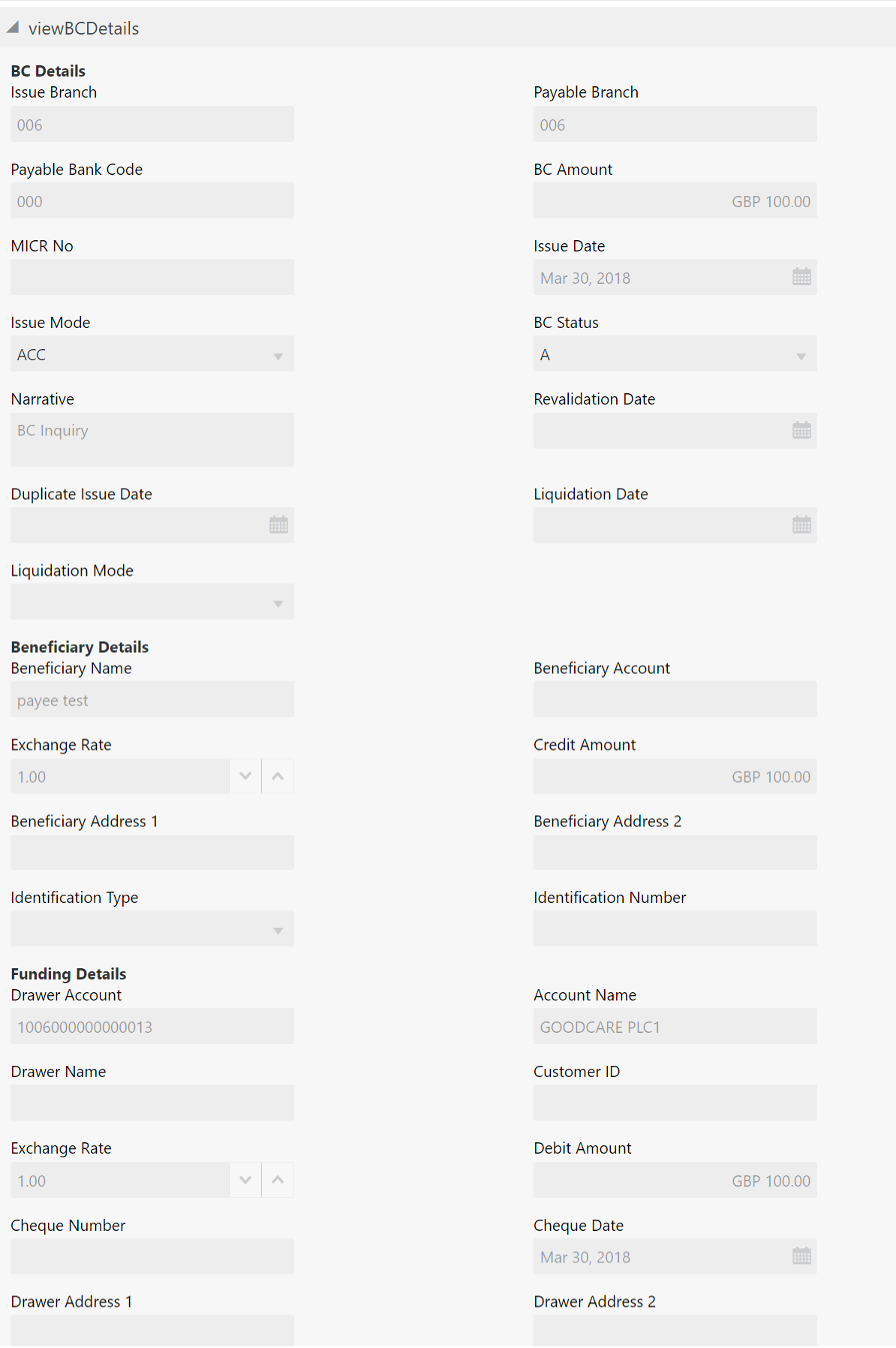

- Click on the View BC Details data segment to view the additional details of the BC when the issue mode as account.

Figure 8-12 View BC Details (Revalidate BC Issued by Account)

- On the View BC Details screen, view the fields. For more information on fields, refer to the field description

table.

Table 8-12 View BC Details (Revalidate BC Issued by Account) - Field Description

Field Description BC Details

Displays the details of BC under this segment.

Issue Branch

Displays the logged-in branch code.

Payable Branch

Displays the payable branch for the BC.

Payable Bank Code

Displays the payable bank code.

BC Amount

Displays the BC currency and the BC amount.

MICR No

Displays the MICR number.

Issue Date

Displays the issue date mentioned in the BC.

Issue Mode

Displays the issue mode as Account.

BC Status

Displays the status of the BC.

Narrative

Displays the default narrative as BC Inquiry, and it can be modified.

Revalidation Date

Displays the date of BC revalidation.

Duplicate Issue Date

Displays the duplicate issue date of BC.

Liquidation Date

Displays the liquidation date of BC.

Liquidation Mode

Displays the liquidation mode of BC.

Beneficiary Details

Specify the fields.

Beneficiary Name

Displays the beneficiary's name.

Beneficiary Account

Displays the beneficiary account number.

Exchange Rate

Displays the exchange rate, and it can be modified.Note:

If the transaction currency is the same as the account currency, the system will display the exchange rate as 1.Credit Amount

Displays the credit amount.

Beneficiary Address 1 and Beneficiary Address 2

Displays the address of the beneficiary.

Identification Type

Displays the identification type of the beneficiary.

Identification Number

Displays the identification number of the beneficiary.

Funding Details

Funding details are displayed under this segment.

Drawer Account Displays the account number of the drawer. Account Name Displays the drawer name.

Drawer Name

Displays the drawer name.

Customer ID

Displays the customer ID of the drawer.

Exchange Rate

Displays the exchange rate.

Debit Amount

Displays the amount that needs to be debited from the drawer account.

Cheque Number

Displays the cheque number.

Cheque Date

Displays the date mentioned in the cheque.

Drawer Address 1 and Drawer Address 2

Displays the address of the drawer.

- Click Submit.

A teller sequence number is generated, and the Transaction Completed Successfully information message is displayed.

Note:

The transaction is moved to authorization in case of any warning raised when the transaction saves.On transaction submission, the system will hand off the details to the payments product processor (Oracle Banking Payments) for processing. When you get a success notification from Oracle Banking Payments, the system will update the transaction status as Success and mark for charges accounting handoff. The transaction accounting is not applicable for the transaction. In case of reject notification from the Oracle Banking Payments, the system will discard the transaction.

Parent topic: BC Operations